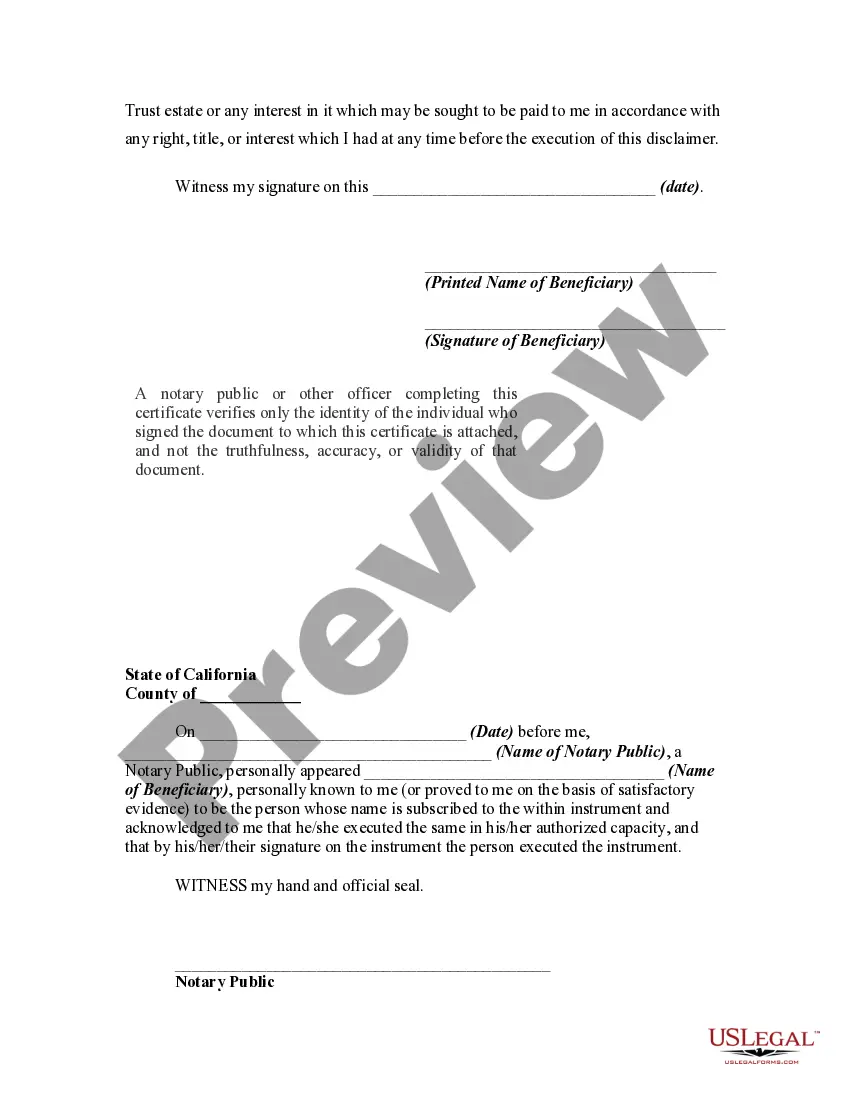

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

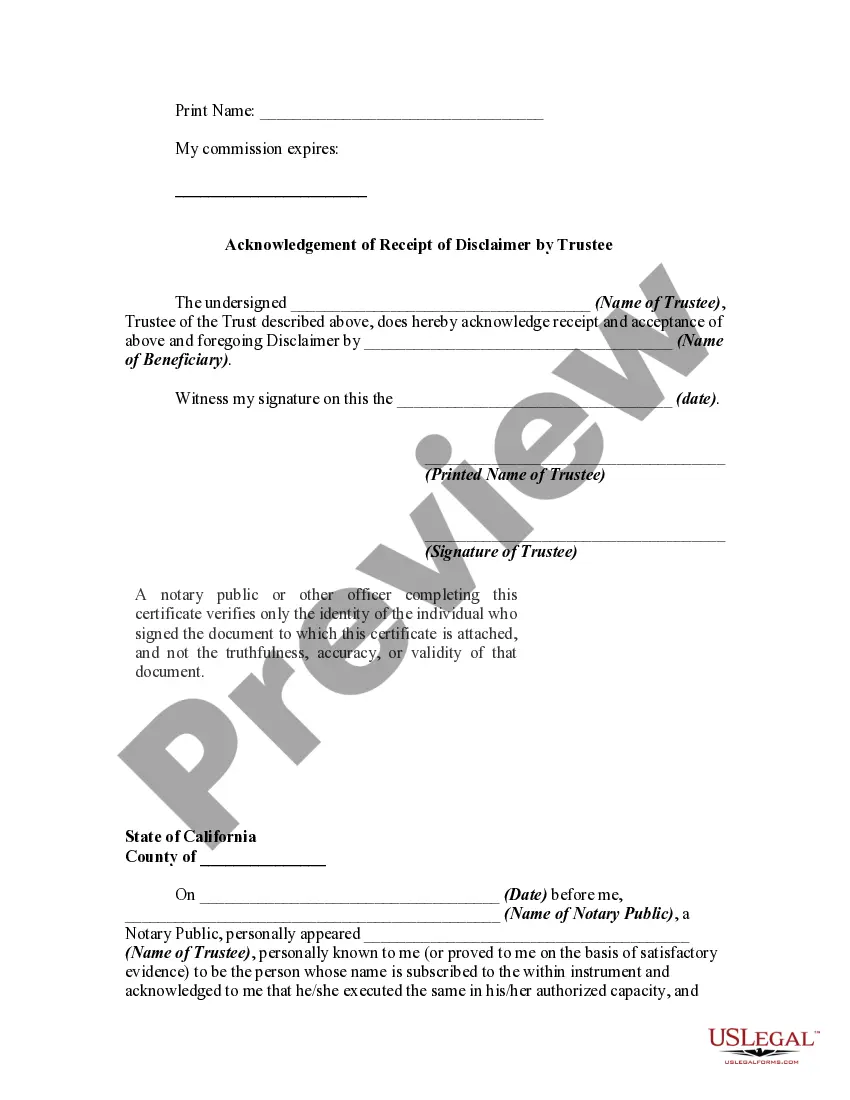

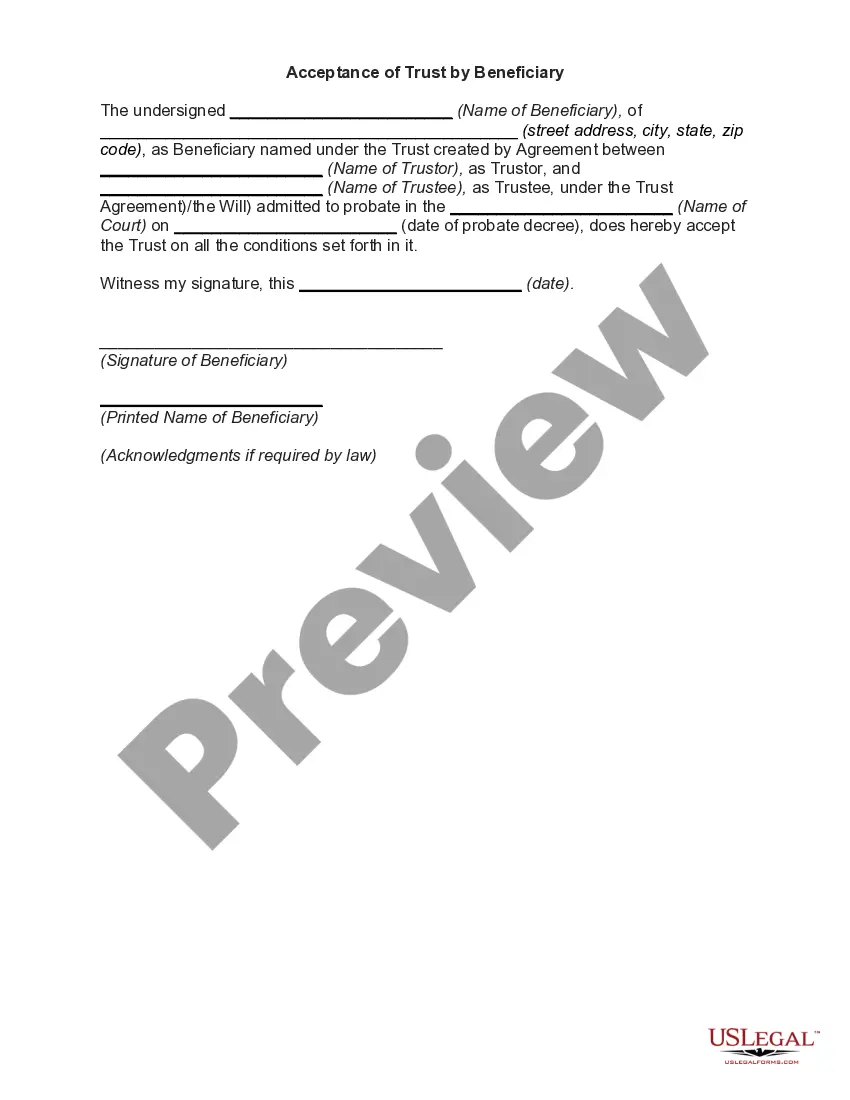

Title: Understanding the Oxnard California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee Introduction: In Oxnard, California, the legal concept of a Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee plays a crucial role in estate planning and trust administration. This article aims to provide a detailed description of this concept, outlining its significance, purpose, and potential variations that may exist. Keywords: Oxnard California, Disclaimer by Beneficiary, Trust, Acceptance, Trustee 1. Overview of the Oxnard California Disclaimer by Beneficiary: The Oxnard California Disclaimer by Beneficiary refers to a legal instrument that allows a beneficiary to renounce or disclaim their rights or interest in a trust. This disclaimer enables beneficiaries to opt-out of inheriting specific assets or property held within the trust. 2. Purpose of the Disclaimer by Beneficiary: The primary purpose of a Disclaimer by Beneficiary is to grant individuals the flexibility to decline assets received through a trust. This can be due to various reasons, including tax planning, avoiding creditors, or preserving government benefits. 3. Rights Under Trust: When a beneficiary disclaims their rights under a trust, they essentially forfeit any claim to the assets or property within it. This disclaimer must be explicit, in writing, and made within a specific timeframe after becoming aware of the trust's existence. 4. Acceptance of Disclaimer by Trustee: The Trustee plays a crucial role in accepting the beneficiary's disclaimer. Acceptance occurs when the Trustee agrees to treat the disclaimed assets as if the beneficiary never had any interest in them. It is important to note that the Trustee's acceptance is irrevocable, and they must follow specific legal requirements when handling the disclaimed assets. 5. Different Types of Oxnard California Disclaimer by Beneficiary: While the core concept remains the same, the Oxnard California Disclaimer by Beneficiary may have some variations, depending on specific circumstances. Some potential types of disclaimers include: — Partial Disclaimer: In this scenario, a beneficiary may disclaim only a portion of their interest in the trust, allowing them to retain certain assets while renouncing others. — Disclaimer of Future Interests: A beneficiary may choose to disclaim any rights or interests that may arise in the future, providing them with flexibility if the trust assets change or evolve. Conclusion: The Oxnard California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is an essential legal tool that grants beneficiaries the option to renounce their rights or interests in a trust. This flexibility provides individuals with the ability to strategically manage their inheritance and estate planning goals. Proper understanding and adherence to the legal requirements surrounding this concept are crucial when navigating trust administration in Oxnard, California. Keywords: Oxnard California, Disclaimer by Beneficiary, Trust, Acceptance, Trustee, estate planning, flexibility, tax planning, creditors, government benefits, rights under trust, partial disclaimer, disclaimer of future interests