A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

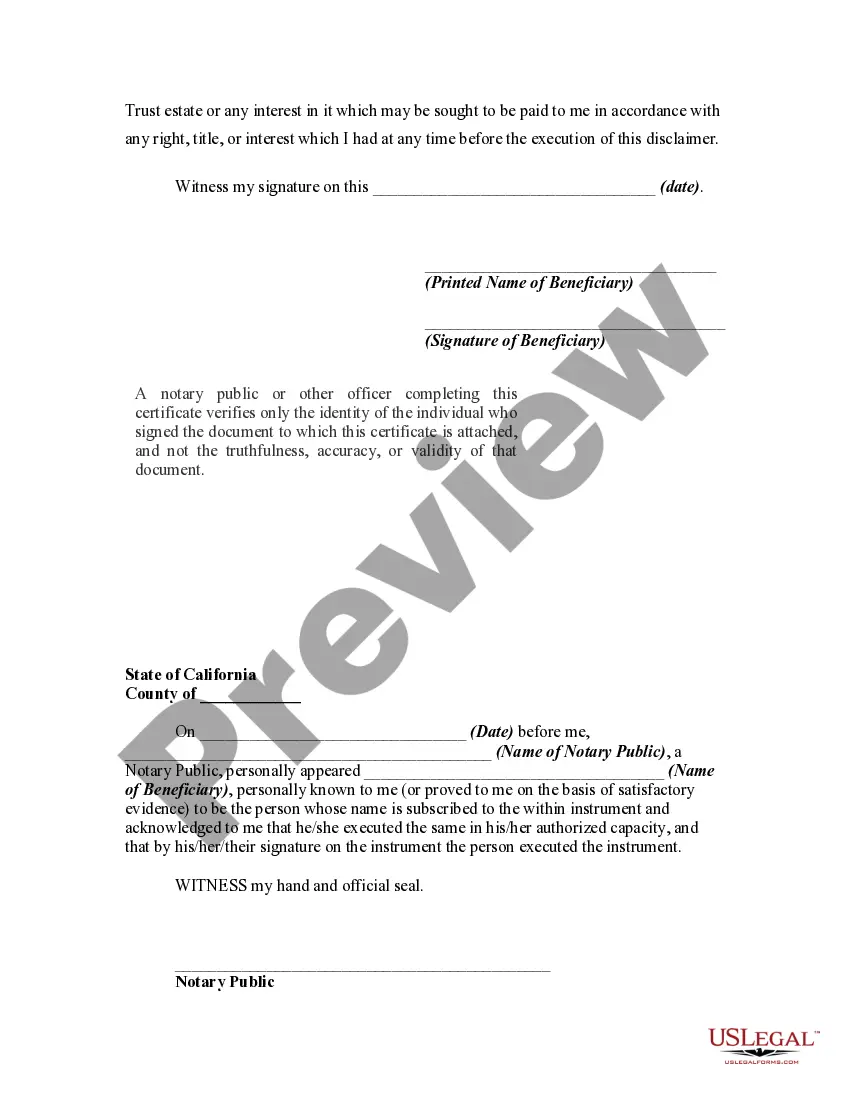

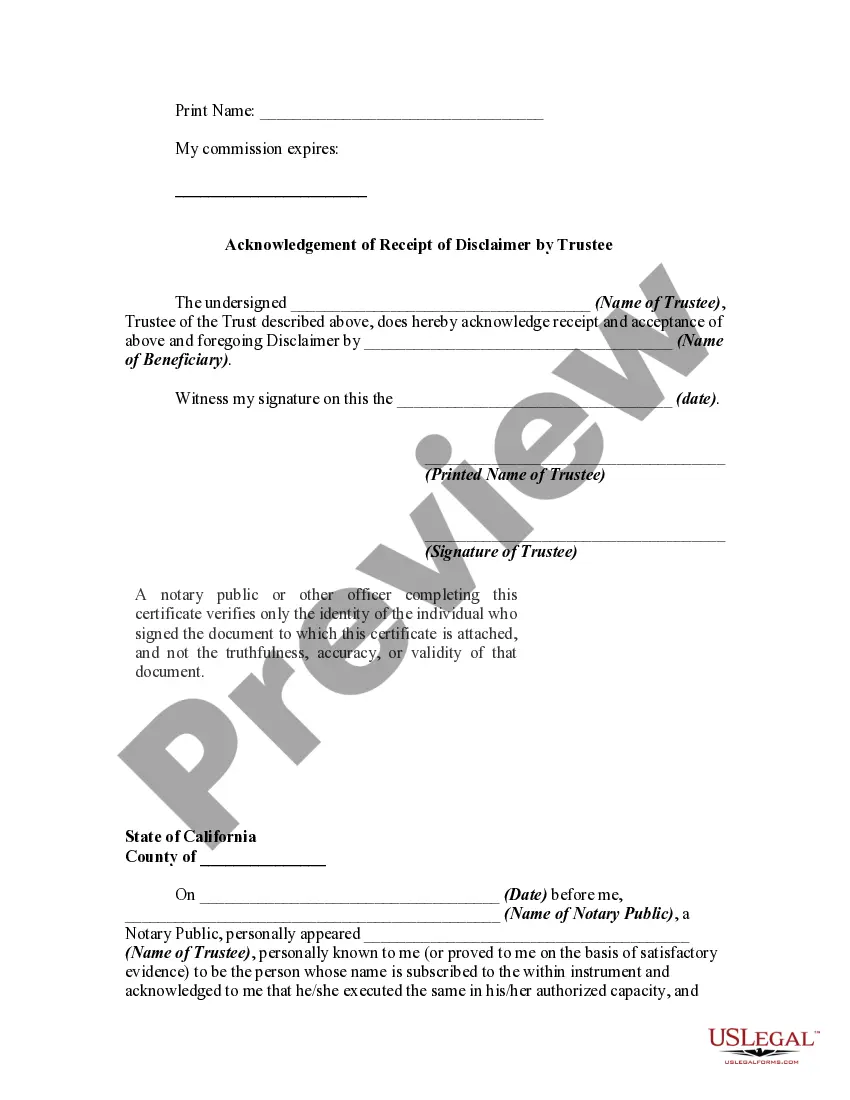

Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legally binding document that establishes the agreement between a beneficiary and a trustee regarding the beneficiary's decision to disclaim any rights or interest in a trust. This document works to clarify the beneficiary's intention to renounce any rights they might have in relation to the trust, while simultaneously acknowledging the trustee's acceptance of this disclaimer. In Sacramento California, there are two primary types of disclaimers that can be executed by a beneficiary under a trust: a qualified disclaimer and an unqualified disclaimer. 1. Qualified Disclaimer: A qualified disclaimer refers to the intentional and formal refusal by a beneficiary to accept any rights or interests in a trust. By disclaiming the benefits, assets, or rights they would otherwise be entitled to, the beneficiary effectively redirects these resources to the contingent or alternate beneficiaries named within the trust agreement. It is important to note that this type of disclaimer must meet specific legal requirements to be valid in Sacramento California. 2. Unqualified Disclaimer: An unqualified disclaimer, on the other hand, refers to a complete and unconditional renouncement of any rights, benefits, or assets under the trust without specifying alternate beneficiaries. By making an unqualified disclaimer, the beneficiary relinquishes any claim to the trust assets, and the assets will generally be treated as if the beneficiary predeceased the creator of the trust. However, it is crucial to consult legal professionals in Sacramento California for guidance as specific laws and regulations may apply. The Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document typically includes the following key elements: 1. Identification: The document starts by identifying the trust involved, including the creator (also known as the granter or settler) of the trust, the beneficiary making the disclaimer, and the trustee of the trust. 2. Beneficiary Disclaimer: The beneficiary explicitly states that they are disclaiming any rights, interests, benefits, or assets under the trust. It is important to include specific details about the disclaimed property or rights to ensure clarity. 3. Acknowledgment by Trustee: The trustee acknowledges and accepts the beneficiary's disclaimer, affirming their understanding of the beneficiary's decision and their agreement to handle the trust assets according to the terms of the disclaimer. 4. Legal Consideration: This section emphasizes that the beneficiary's disclaimer is voluntary and made without any coercion or undue influence from any party. 5. Effective Date: The document should clearly state the effective date of the disclaimer, as well as the date of its execution by both the beneficiary and the trustee to ensure a legally binding agreement. By executing the Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document, the beneficiary formally disclaims their rights, interests, and assets under the trust, while the trustee accepts and acknowledges this disclaimer, enabling the smooth administration and distribution of trust assets according to the trust's terms and conditions. It is recommended to consult with an attorney experienced in trust and estate planning to ensure the legal validity and compliance with Sacramento California laws.Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legally binding document that establishes the agreement between a beneficiary and a trustee regarding the beneficiary's decision to disclaim any rights or interest in a trust. This document works to clarify the beneficiary's intention to renounce any rights they might have in relation to the trust, while simultaneously acknowledging the trustee's acceptance of this disclaimer. In Sacramento California, there are two primary types of disclaimers that can be executed by a beneficiary under a trust: a qualified disclaimer and an unqualified disclaimer. 1. Qualified Disclaimer: A qualified disclaimer refers to the intentional and formal refusal by a beneficiary to accept any rights or interests in a trust. By disclaiming the benefits, assets, or rights they would otherwise be entitled to, the beneficiary effectively redirects these resources to the contingent or alternate beneficiaries named within the trust agreement. It is important to note that this type of disclaimer must meet specific legal requirements to be valid in Sacramento California. 2. Unqualified Disclaimer: An unqualified disclaimer, on the other hand, refers to a complete and unconditional renouncement of any rights, benefits, or assets under the trust without specifying alternate beneficiaries. By making an unqualified disclaimer, the beneficiary relinquishes any claim to the trust assets, and the assets will generally be treated as if the beneficiary predeceased the creator of the trust. However, it is crucial to consult legal professionals in Sacramento California for guidance as specific laws and regulations may apply. The Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document typically includes the following key elements: 1. Identification: The document starts by identifying the trust involved, including the creator (also known as the granter or settler) of the trust, the beneficiary making the disclaimer, and the trustee of the trust. 2. Beneficiary Disclaimer: The beneficiary explicitly states that they are disclaiming any rights, interests, benefits, or assets under the trust. It is important to include specific details about the disclaimed property or rights to ensure clarity. 3. Acknowledgment by Trustee: The trustee acknowledges and accepts the beneficiary's disclaimer, affirming their understanding of the beneficiary's decision and their agreement to handle the trust assets according to the terms of the disclaimer. 4. Legal Consideration: This section emphasizes that the beneficiary's disclaimer is voluntary and made without any coercion or undue influence from any party. 5. Effective Date: The document should clearly state the effective date of the disclaimer, as well as the date of its execution by both the beneficiary and the trustee to ensure a legally binding agreement. By executing the Sacramento California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document, the beneficiary formally disclaims their rights, interests, and assets under the trust, while the trustee accepts and acknowledges this disclaimer, enabling the smooth administration and distribution of trust assets according to the trust's terms and conditions. It is recommended to consult with an attorney experienced in trust and estate planning to ensure the legal validity and compliance with Sacramento California laws.