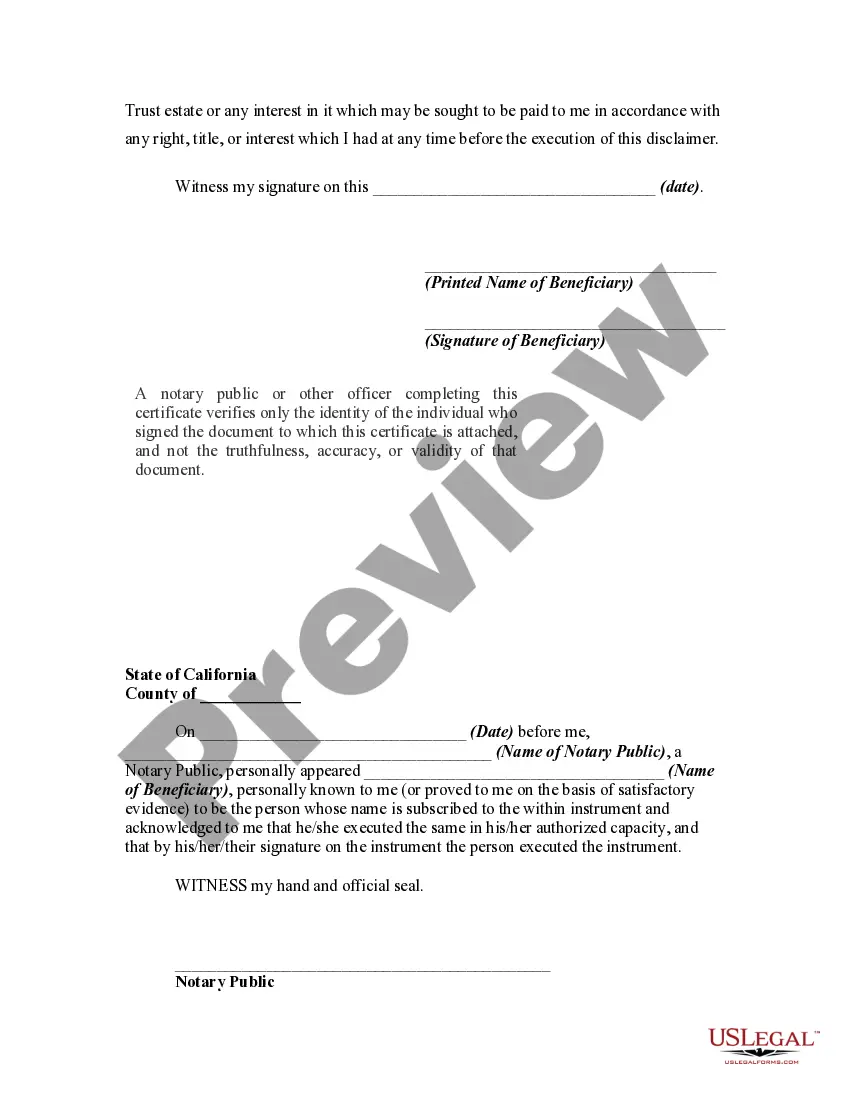

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

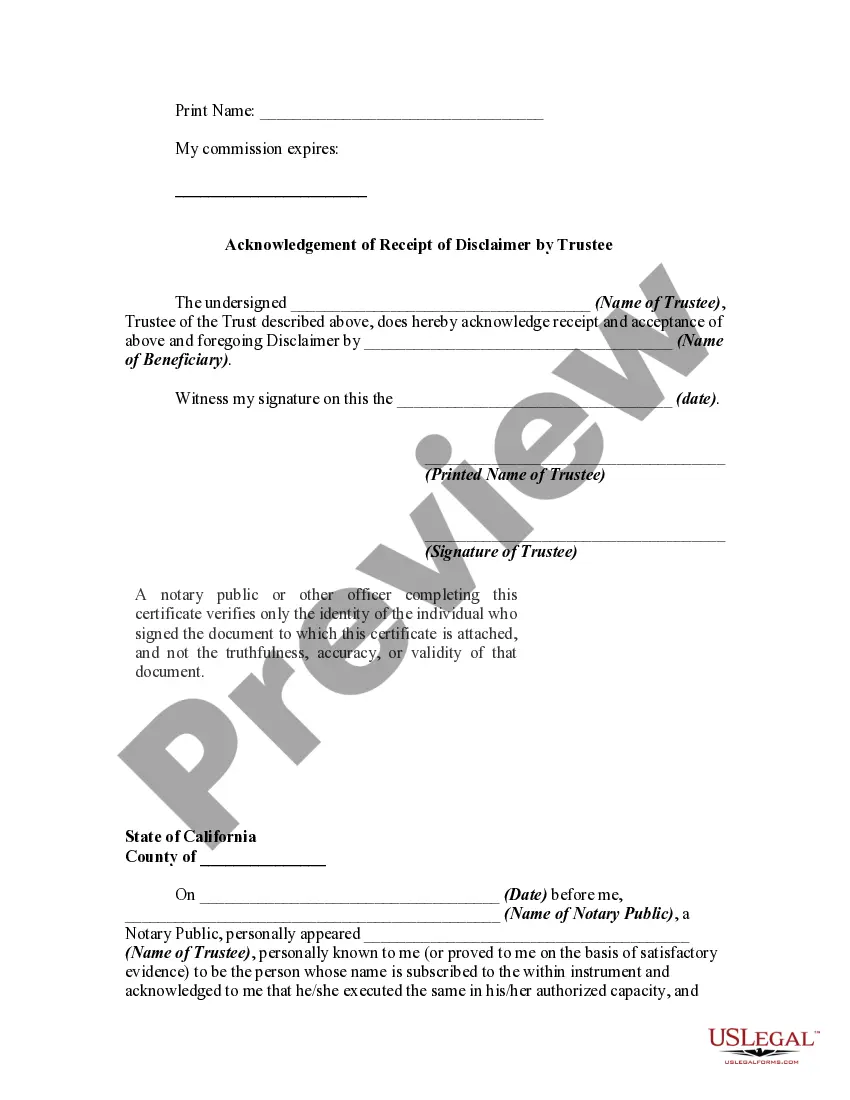

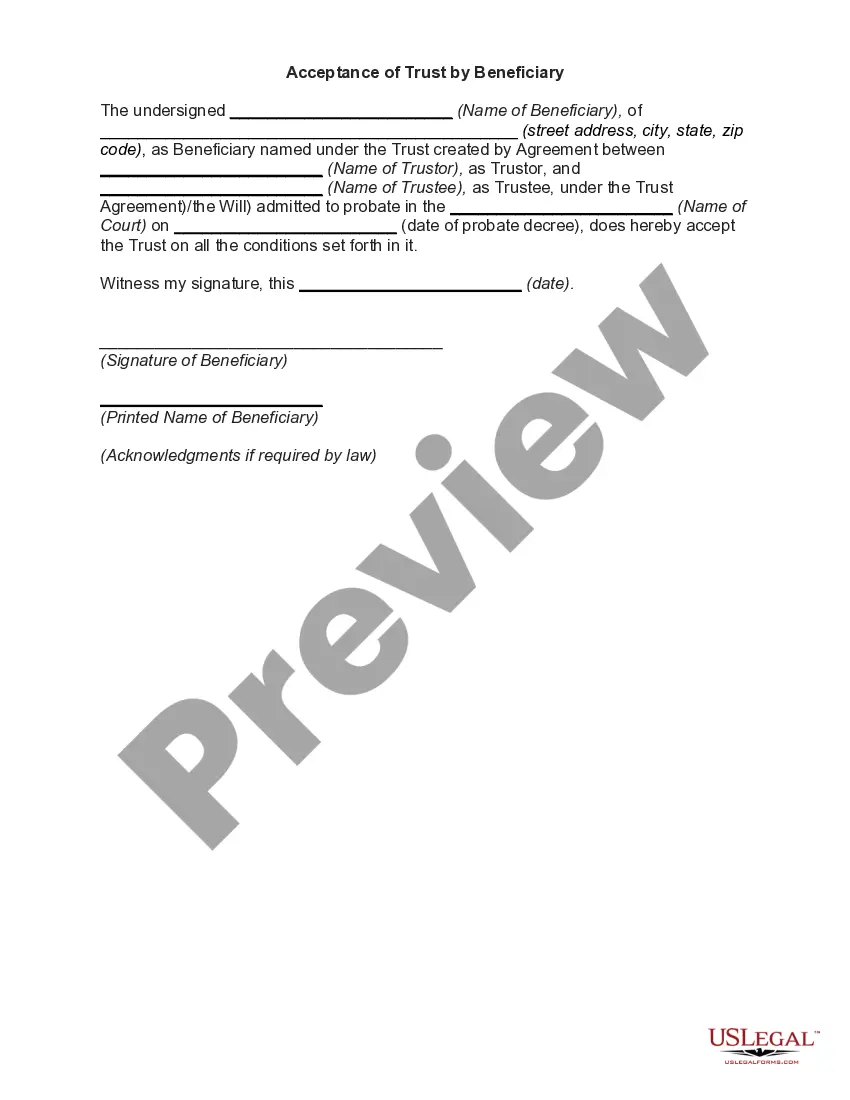

Title: Salinas California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: A Comprehensive Guide Introduction: A Salinas California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal instrument used to disclaim, renounce, or refuse a beneficiary's interests, rights, or assets under a trust in Salinas, California. This article provides a detailed description of this disclaimer, its purpose, and the types of disclaimers commonly employed. Key Concepts: 1. Salinas, California: Located in Monterey County, Salinas is a city known for its agriculture, beautiful landscapes, and rich cultural heritage. 2. Trust: Refers to a legal arrangement where assets are held and managed by a trustee for the benefit of one or more beneficiaries. 3. Beneficiary: An individual or entity who is entitled to receive benefits, assets, or income from a trust. 4. Disclaimer: A formal refusal or renouncement of one's interest, rights, or assets to be transferred or assigned under a legal instrument like a trust. 5. Trustee: A person or entity appointed to manage and administer a trust on behalf of the beneficiaries. Detailed Description: 1. Purpose of a Salinas California Disclaimer: — A beneficiary may choose to disclaim their interests under a trust due to various reasons, such as tax planning, preserving eligibility for government benefits, or personal financial strategies. — The disclaimer allows beneficiaries to forego their rights to receive assets or income, thereby redirecting them to alternate beneficiaries or contingent provisions within the trust. 2. Beneficiary's Disclaimer of Rights under Trust: — This type of disclaimer is typically executed by a beneficiary and formalizes their decision to renounce specific rights, interests, or assets that would otherwise be allocated to them under a trust. — By disclaiming, the beneficiary effectively relinquishes their claim, directing those assets or rights to alternative beneficiaries or following the trust's contingency plan. — This disclaimer must conform to specific legal requirements to be valid and enforceable. 3. Trustee's Acceptance of Disclaimer: — Once a beneficiary disclaims their rights, the trustee, who manages the trust, must accept the disclaimer through a legally binding acceptance. — Trustees may either accept or decline the beneficiary's disclaimer, depending on the trust document's provisions and applicable laws. — The trustee's acceptance legally releases them from their obligations towards the disclaimed assets or rights and allows them to distribute them accordingly. 4. Potential benefits of using a Salinas California Disclaimer: — Reducing estate taxes: By disclaiming their interests, beneficiaries can potentially decrease the overall estate tax liability for both the original beneficiary and the intended recipient of the disclaimed assets. — Asset protection: Disclaiming can be an effective strategy for safeguarding assets from creditors or legal claims. — Medicaid and government benefits eligibility: Beneficiaries disclaiming assets can ensure they remain eligible for need-based benefits, such as Medicaid or government assistance programs. Conclusion: The Salinas California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee offers a legal pathway for beneficiaries to renounce their rights, interests, or assets under a trust. By disclaiming, beneficiaries retain control over the distribution of their inheritance, while potentially gaining various tax and asset protection advantages. It is essential to consult with an experienced attorney to ensure compliance with legal requirements and maximize the benefits of disclaiming in Salinas, California.