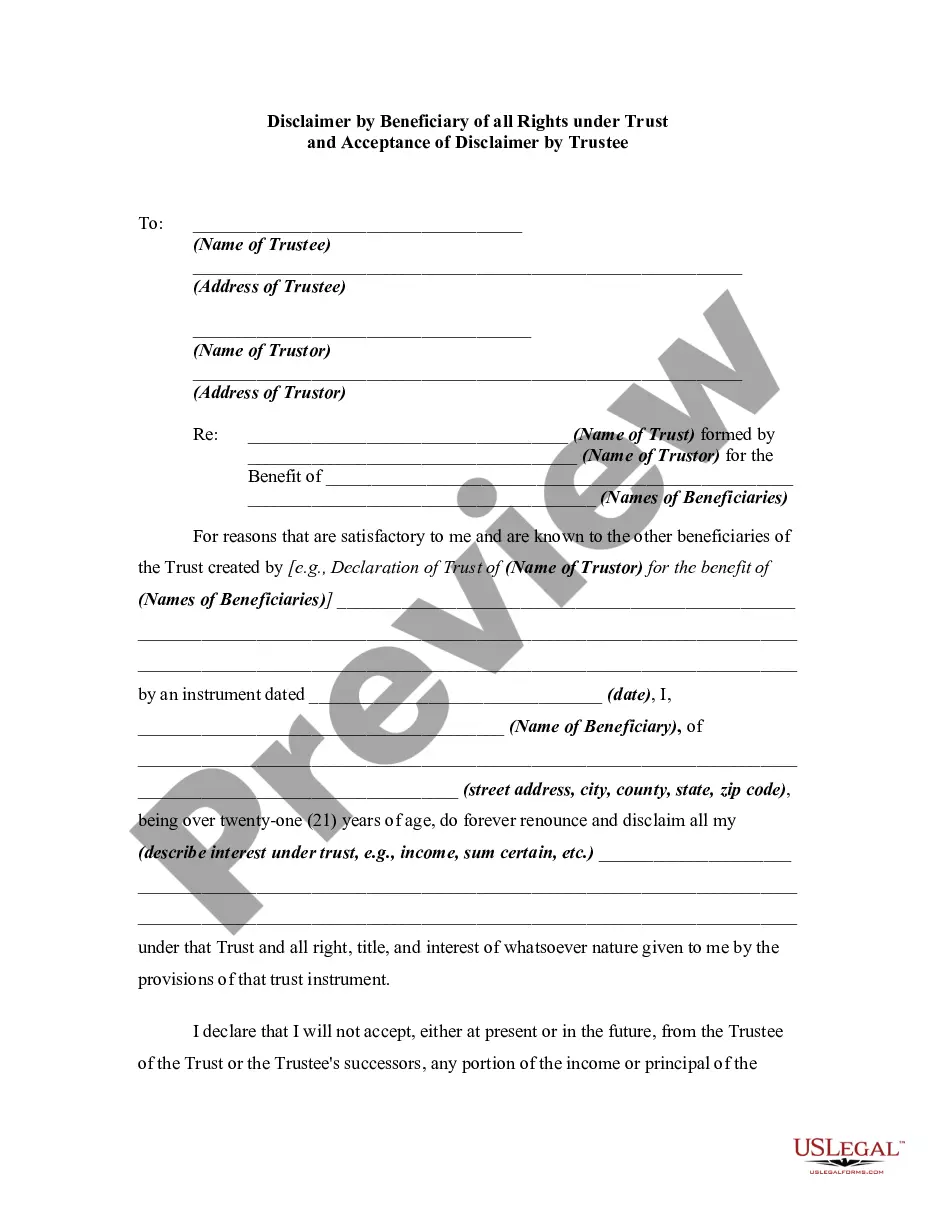

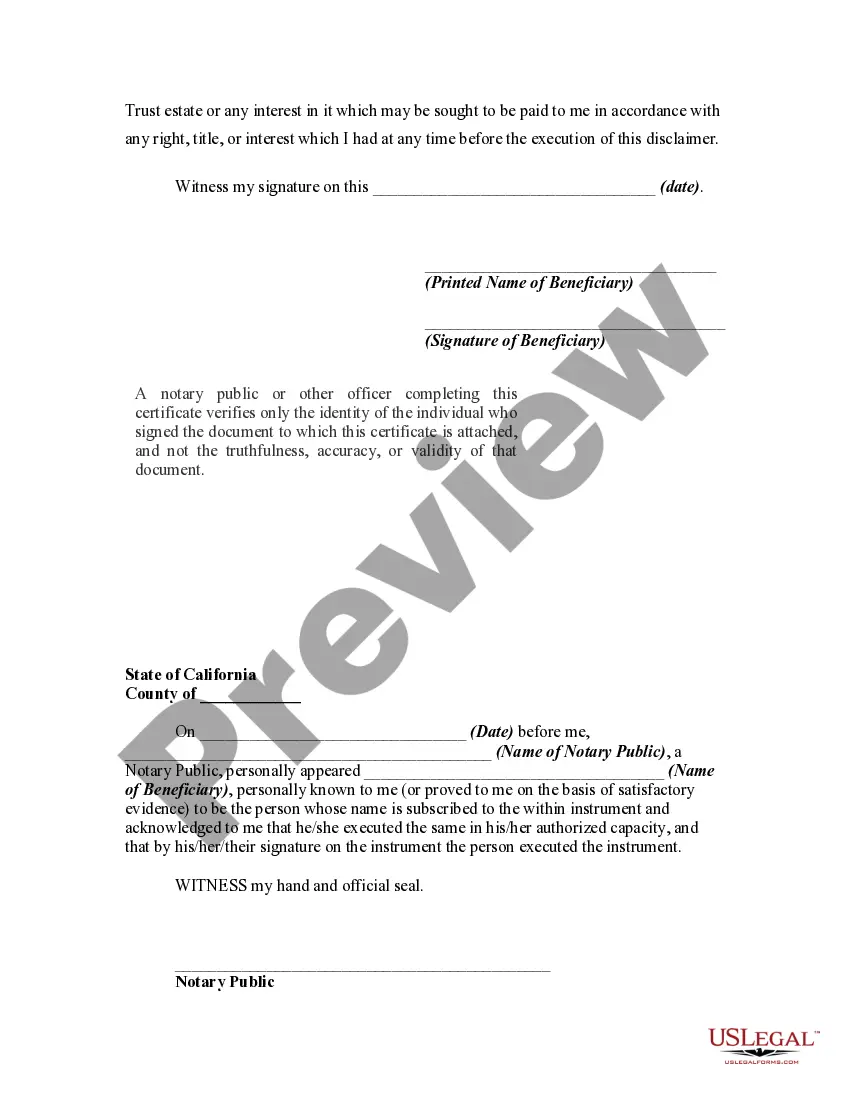

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

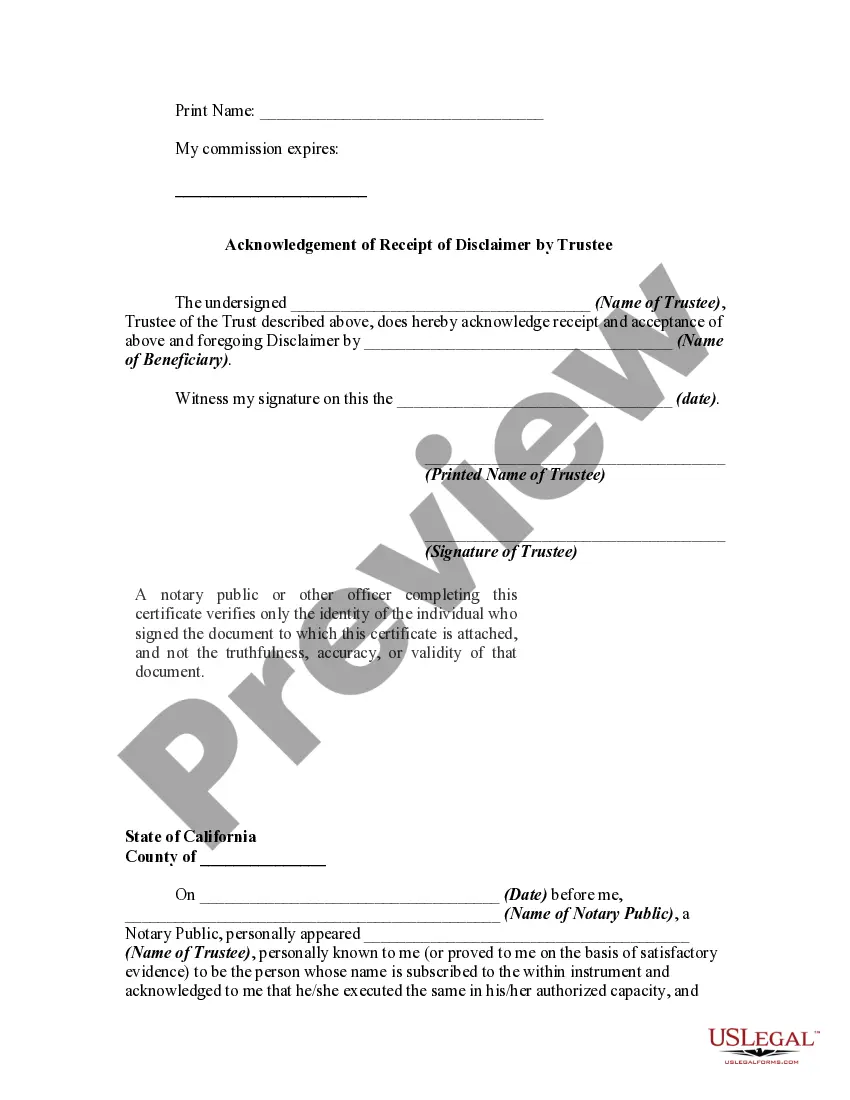

Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights by a beneficiary of a trust in the city of Santa Maria, California. This disclaimer is executed voluntarily by the beneficiary to disclaim any interest or rights they may have in the assets held within the trust. The purpose of the Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is to provide a legal framework for beneficiaries who wish to abdicate their rights and interests in the assets of a trust. By signing this document, the beneficiary acknowledges their understanding of the trust's terms and conditions and agrees to waive any rights they may have regarding the trust's assets. This disclaimer is generally utilized in situations where the beneficiary does not wish to be involved in the management or distribution of the trust assets. It allows the trustee to have sole control over the trust property and make decisions without interference from the beneficiary. The Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can be of various types, depending on the specific circumstances and terms of the trust. Some common types include: 1. Full Disclaimer: In this type, the beneficiary completely disclaims any interest or rights in the trust assets. They relinquish all claims to the property held within the trust and expressly state that they do not wish to be considered a beneficiary. 2. Partial Disclaimer: This type of disclaimer allows the beneficiary to disclaim only a portion of their rights or interests in the trust assets. They may choose to disclaim specific properties or a percentage share of the assets, while still retaining some benefits or rights associated with the trust. 3. Qualified Disclaimer: A qualified disclaimer refers to the disclaimer made by a beneficiary that meets certain conditions set forth by applicable tax laws. By qualifying the disclaimer, the beneficiary can avoid tax implications and ensure that the assets pass to other designated individuals or entities as intended by the trust. It is important to note that the Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee should be drafted and executed with the assistance of a qualified attorney to comply with the legal requirements of the state and ensure its enforceability. The specific terms and conditions of the trust will also dictate the appropriate type of disclaimer to be utilized.Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the relinquishment of rights by a beneficiary of a trust in the city of Santa Maria, California. This disclaimer is executed voluntarily by the beneficiary to disclaim any interest or rights they may have in the assets held within the trust. The purpose of the Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is to provide a legal framework for beneficiaries who wish to abdicate their rights and interests in the assets of a trust. By signing this document, the beneficiary acknowledges their understanding of the trust's terms and conditions and agrees to waive any rights they may have regarding the trust's assets. This disclaimer is generally utilized in situations where the beneficiary does not wish to be involved in the management or distribution of the trust assets. It allows the trustee to have sole control over the trust property and make decisions without interference from the beneficiary. The Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee can be of various types, depending on the specific circumstances and terms of the trust. Some common types include: 1. Full Disclaimer: In this type, the beneficiary completely disclaims any interest or rights in the trust assets. They relinquish all claims to the property held within the trust and expressly state that they do not wish to be considered a beneficiary. 2. Partial Disclaimer: This type of disclaimer allows the beneficiary to disclaim only a portion of their rights or interests in the trust assets. They may choose to disclaim specific properties or a percentage share of the assets, while still retaining some benefits or rights associated with the trust. 3. Qualified Disclaimer: A qualified disclaimer refers to the disclaimer made by a beneficiary that meets certain conditions set forth by applicable tax laws. By qualifying the disclaimer, the beneficiary can avoid tax implications and ensure that the assets pass to other designated individuals or entities as intended by the trust. It is important to note that the Santa Maria California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee should be drafted and executed with the assistance of a qualified attorney to comply with the legal requirements of the state and ensure its enforceability. The specific terms and conditions of the trust will also dictate the appropriate type of disclaimer to be utilized.