A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

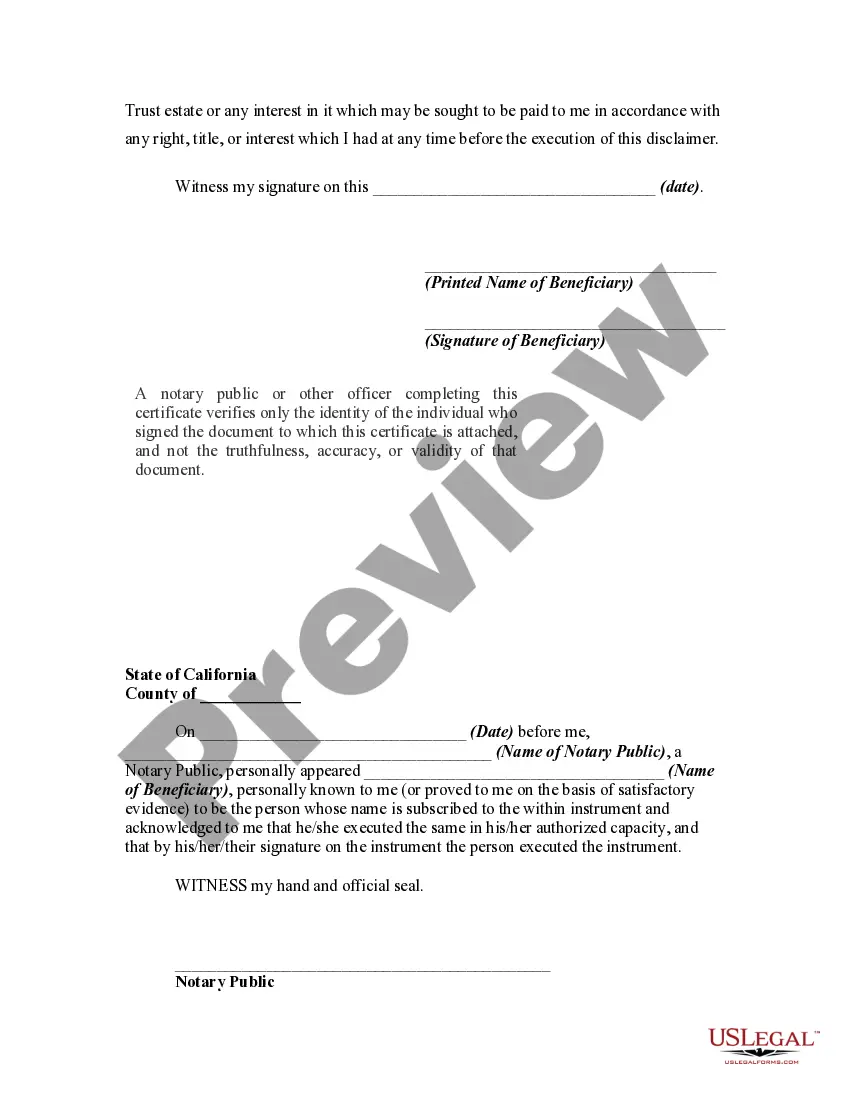

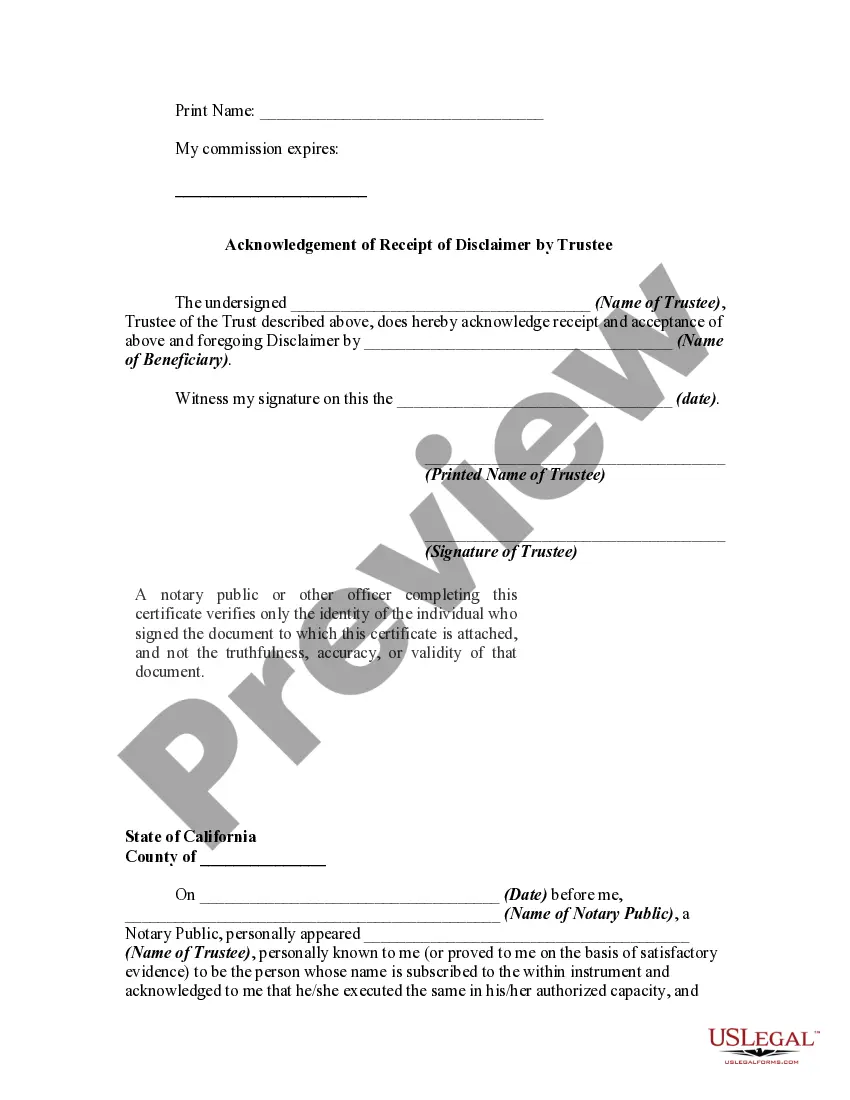

Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the disclaiming of rights by a beneficiary under a trust. It is important to note that I am an AI language model and not a legal professional, so it's always advisable to consult a legal expert for accurate information and assistance regarding this matter. In Simi Valley, California, a beneficiary of a trust may choose to disclaim or renounce all their rights and interests in the trust. This disclaimer can be done to avoid potential tax liabilities, to pass on assets to other beneficiaries, or for other personal reasons. The Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document is an essential legal instrument in such cases. Key elements that may be included in the Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee are as follows: 1. Identification of Parties: The document will identify the involved parties, including the beneficiary disclaiming their rights and the trustee accepting the disclaimer. 2. Description of Trust: A detailed description of the trust and its provisions will be included, such as the assets held, the terms of distribution, and any applicable restrictions. 3. Beneficiary's Disclaimer: The beneficiary will explicitly state their intention to disclaim all their rights, interests, and benefits under the trust. This may include renouncing any claims to property, income, or control over the trust assets. 4. Trustee's Acceptance of Disclaimer: The trustee will acknowledge the beneficiary's disclaimer and accept it as valid. This acceptance signifies that the trustee will distribute the disclaimed rights and assets according to the terms of the trust. Different types of Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee may exist depending on the specific circumstances, trust provisions, and legal requirements. Some possible variations of disclaimers within Simi Valley, California, include: 1. General Disclaimer: A beneficiary may choose to disclaim all rights and interests under the trust without any conditions or limitations. 2. Partial Disclaimer: In some cases, a beneficiary may wish to disclaim only specific assets or portions of their rights under the trust, rather than renouncing all benefits completely. 3. Qualified Disclaimer: This type of disclaimer must meet specific legal requirements to be recognized by the Internal Revenue Service (IRS) and other relevant authorities. It allows the disclaiming beneficiary to redirect the assets to an alternate beneficiary without incurring tax liabilities. It is crucial to consult with an attorney or legal expert familiar with state and federal laws, as well as the specific trust in question, to ensure the proper execution of a Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This document can have significant legal and financial implications, making professional guidance essential to protect the interests of all parties involved.Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is a legal document that outlines the disclaiming of rights by a beneficiary under a trust. It is important to note that I am an AI language model and not a legal professional, so it's always advisable to consult a legal expert for accurate information and assistance regarding this matter. In Simi Valley, California, a beneficiary of a trust may choose to disclaim or renounce all their rights and interests in the trust. This disclaimer can be done to avoid potential tax liabilities, to pass on assets to other beneficiaries, or for other personal reasons. The Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee document is an essential legal instrument in such cases. Key elements that may be included in the Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee are as follows: 1. Identification of Parties: The document will identify the involved parties, including the beneficiary disclaiming their rights and the trustee accepting the disclaimer. 2. Description of Trust: A detailed description of the trust and its provisions will be included, such as the assets held, the terms of distribution, and any applicable restrictions. 3. Beneficiary's Disclaimer: The beneficiary will explicitly state their intention to disclaim all their rights, interests, and benefits under the trust. This may include renouncing any claims to property, income, or control over the trust assets. 4. Trustee's Acceptance of Disclaimer: The trustee will acknowledge the beneficiary's disclaimer and accept it as valid. This acceptance signifies that the trustee will distribute the disclaimed rights and assets according to the terms of the trust. Different types of Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee may exist depending on the specific circumstances, trust provisions, and legal requirements. Some possible variations of disclaimers within Simi Valley, California, include: 1. General Disclaimer: A beneficiary may choose to disclaim all rights and interests under the trust without any conditions or limitations. 2. Partial Disclaimer: In some cases, a beneficiary may wish to disclaim only specific assets or portions of their rights under the trust, rather than renouncing all benefits completely. 3. Qualified Disclaimer: This type of disclaimer must meet specific legal requirements to be recognized by the Internal Revenue Service (IRS) and other relevant authorities. It allows the disclaiming beneficiary to redirect the assets to an alternate beneficiary without incurring tax liabilities. It is crucial to consult with an attorney or legal expert familiar with state and federal laws, as well as the specific trust in question, to ensure the proper execution of a Simi Valley California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This document can have significant legal and financial implications, making professional guidance essential to protect the interests of all parties involved.