A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the beneficiary of a trust is disclaiming any rights he/she has in the trust.

Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

How to fill out California Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Are you searching for a trustworthy and budget-friendly provider of legal documents to purchase the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee? US Legal Forms is your ideal resource.

Whether you need a straightforward agreement to set rules for living together with your partner or a collection of papers to facilitate your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All the templates we provide are not generic and are tailored to meet the regulations of particular states and counties.

To obtain the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please note that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can set up an account in just a few minutes, but before doing so, ensure that you complete the following.

Now you can create your account. Next, choose the subscription plan and move forward to payment. Once the payment is finalized, download the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee in any available format. You are welcome to revisit the website anytime and redownload the form at no additional cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and free yourself from spending hours researching legal forms online once and for all.

- Verify if the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee adheres to your state and local regulations.

- Review the form’s description (if available) to understand whom and what the form serves.

- Restart the search if the form doesn’t meet your legal needs.

Form popularity

FAQ

A beneficiary may choose to disclaim property to avoid tax liabilities or to help ensure that the assets are passed on to the next heirs. By executing a Vallejo California Disclaimer by Beneficiary of all Rights under Trust and the subsequent Acceptance of Disclaimer by Trustee, they can strategically navigate financial implications. Additionally, some beneficiaries may not have the capacity to manage or want the responsibilities tied to the property. Using the uslegalforms platform can provide valuable assistance in these situations.

In California, a trustee is generally expected to distribute assets to beneficiaries within a reasonable time after the trust has been settled, usually within 12 months of the trustor's death. This timeline can vary based on the trust's complexity and any potential disputes. Efficient asset distribution is vital for maintaining trust, especially concerning the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Trustees can benefit from using USLegalForms to facilitate this process smoothly.

Beneficiaries in California should expect to be notified within 60 days after the trustee’s acceptance of the trust or the death of the trustor, whichever is applicable. This notification is fundamental, allowing beneficiaries to understand their role concerning the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. It's essential for the trustee to adhere to these timelines to ensure clarity and avoid potential disputes.

A trustee in California must notify beneficiaries within 60 days after accepting their role or after the trust becomes irrevocable. This timely communication is crucial for beneficiaries to understand their rights and obligations, particularly regarding the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. Utilizing platforms like USLegalForms can help streamline this notification process for trustees.

In California, a trustee has a legal obligation to keep beneficiaries informed about the trust's administration. This includes providing information on the trust's terms, assets, and any actions taken on behalf of the trust. By ensuring clear communication, the trustee supports the beneficiaries' understanding of the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee. This transparency helps to maintain trust between the trustee and beneficiaries.

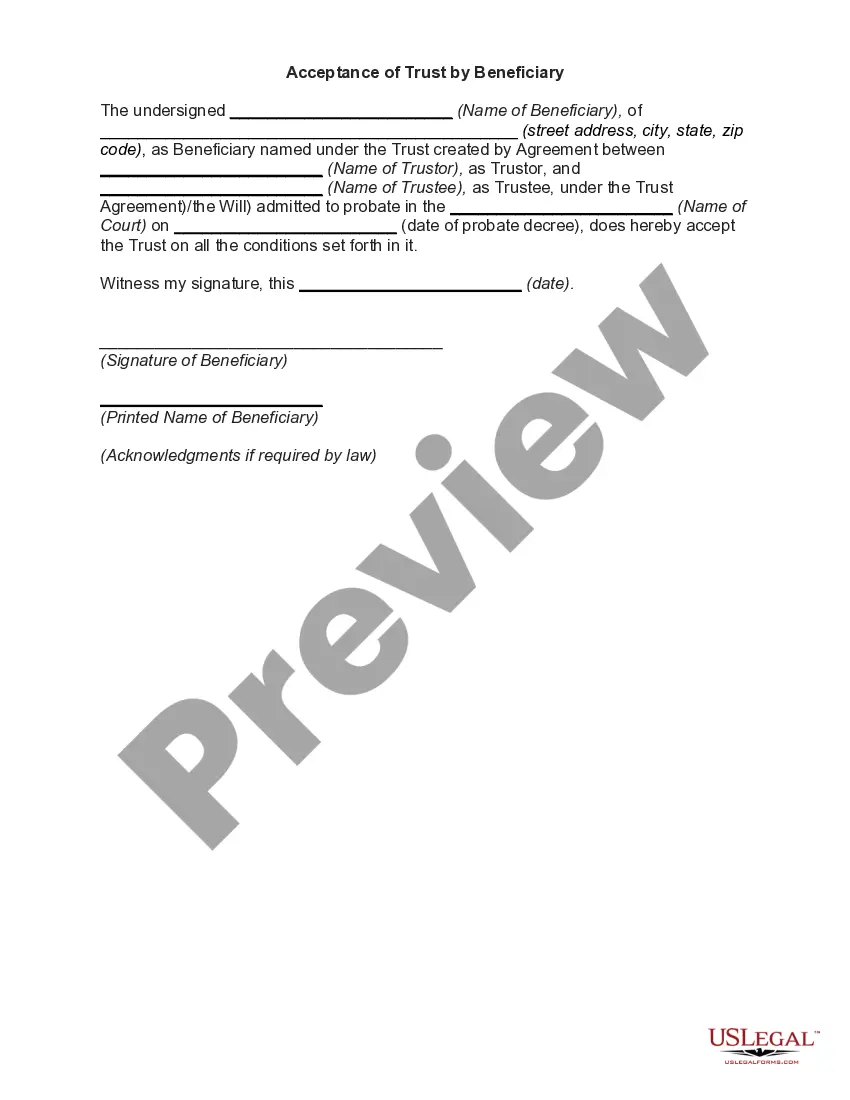

An example of a disclaimer trust involves a situation where a beneficiary chooses to reject their inheritance from a trust, allowing it to pass to the next eligible beneficiary. For instance, if a grandparent creates a trust and the designated grandchild disclaims their share, that share would then go to the grandchild's sibling. This act embodies the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, making it essential for understanding how to navigate trust decisions.

Someone might disclaim a trust if they want to avoid tax implications or if they believe the inheritance will negatively affect their financial situation. Disclaiming can also occur if the beneficiary feels unqualified to manage trust assets effectively. This decision reflects the principles of the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, creating opportunities for more suitable financial arrangements.

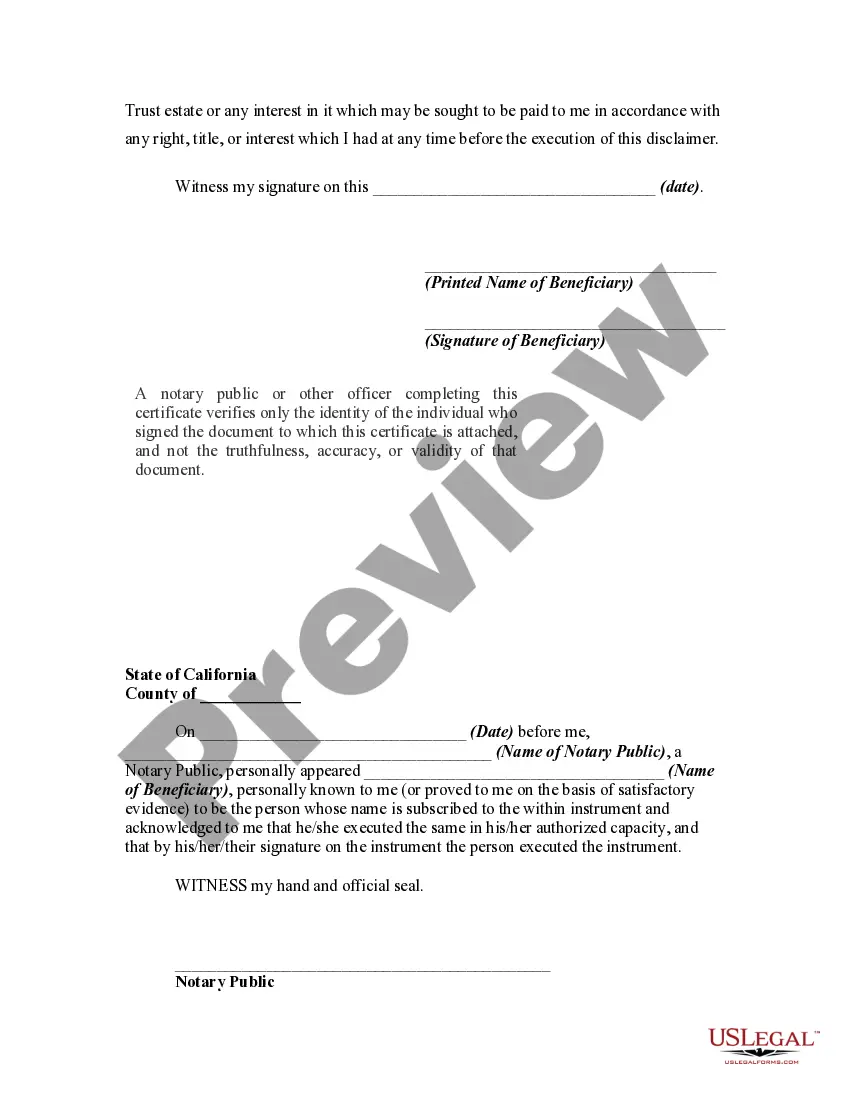

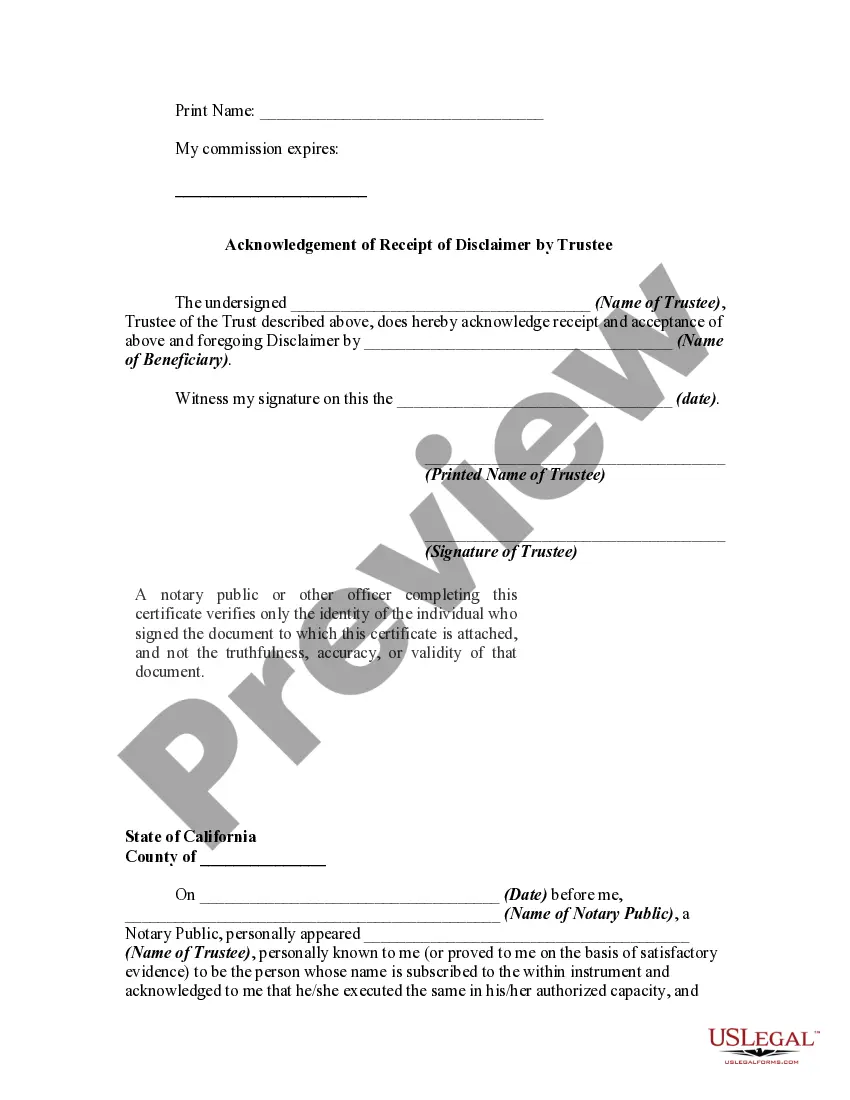

To write a disclaimer for an inheritance, you should start by clearly stating your intent to disclaim the inheritance. Include details about the trust or estate from which you are disclaiming, and make sure your disclaimer is in writing and signed. It's beneficial to consult a legal professional or use resources like USLegalForms to ensure compliance with the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.

A qualified disclaimer trust allows beneficiaries to refuse a gift or inheritance while still adhering to IRS requirements. By executing a qualified disclaimer, you avoid tax liabilities on the disclaimed assets. This process aligns with the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, ensuring that disclaiming does not adversely affect your estate planning.

A common example of a trust clause might include instructions on how to distribute assets among beneficiaries after your passing. For instance, a clause may state that the trustee must distribute specified funds to each beneficiary on their 25th birthday. This clarity helps prevent disputes and aligns with the concepts in the Vallejo California Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee.