This form is an agreement between an independent investment agent (or consultant) and a corporation whereby the investment agent actually holds the investments as well as makes them for the client. We are assuming that the investment agent is duly licensed to perform this activity and will make any necessary filings with the state of California and the United States.

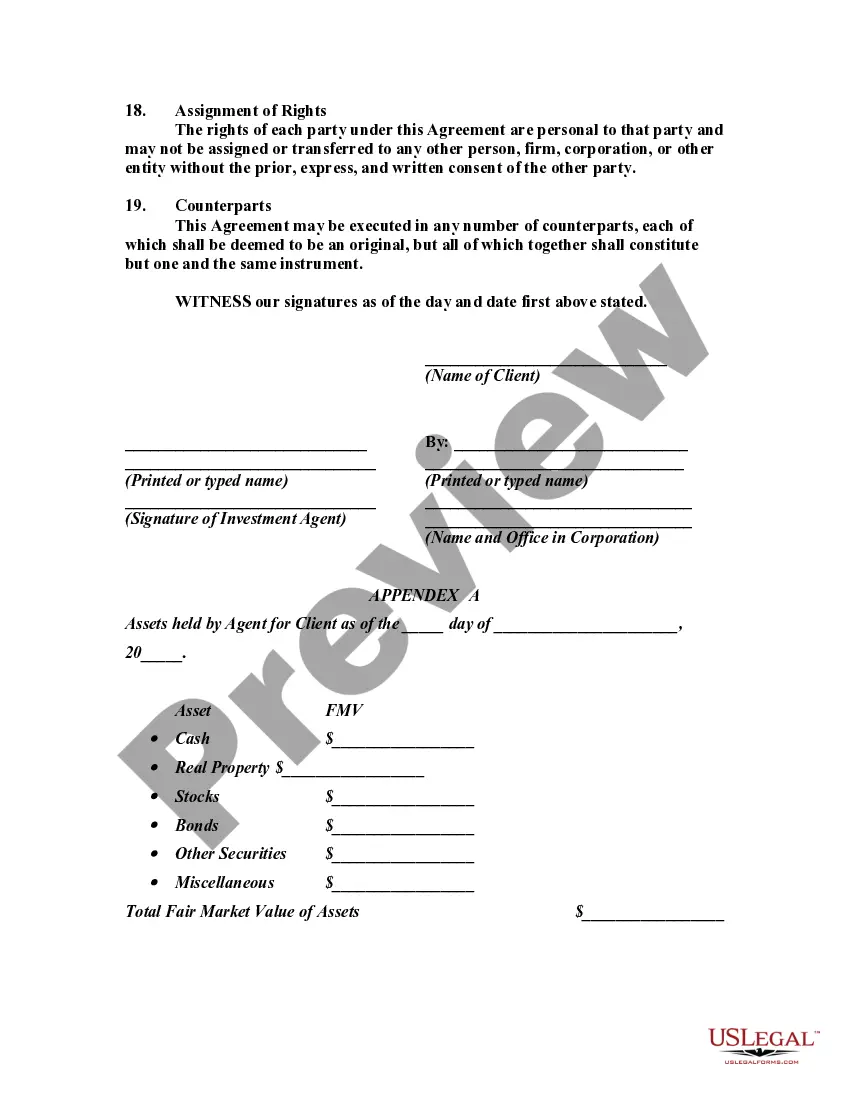

The Fullerton California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a comprehensive agreement that outlines the terms and conditions between an investment agent and their client. This agreement establishes a legal framework for the agent to act on behalf of the client in the purchase and sale of investments. Under this agreement, the investment agent is entrusted with the responsibility of executing investment transactions on behalf of the client. The agent is expected to possess the necessary knowledge, skills, and experience in the field of investments to make sound decisions that will benefit the client's financial portfolio. The agreement includes specific clauses that define the scope of services provided by the investment agent. It outlines the agent's authority to act on behalf of the client, specifying the types of investments that can be purchased or sold. The agreement may encompass a wide range of investment types such as stocks, bonds, mutual funds, real estate investments, and other securities, depending on the needs and preferences of the client. In addition, the agreement establishes the obligations and responsibilities of both parties. It outlines the agent's duty to act in the best interest of the client and to exercise due diligence in investment decision-making. It may also include provisions regarding the agent's compensation structure, performance benchmarks, and any applicable fees or commissions. To ensure transparency and accountability, the agreement may require the agent to report regularly to the client on the status of investments, providing updates on performance, changes in market conditions, and any suggested modifications to the investment strategy. It is important to note that there may be different variations or types of the Fullerton California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client, depending on specific circumstances or the nature of the client's investment objectives. For example, there may be customized agreements for high-net-worth individuals, institutional investors, or clients seeking specific investment strategies such as socially responsible investing or impact investing. Keywords: Fullerton California, Agreement for Services, Investment Agent, Agent to Purchase, Sell Investments, Benefit of Client, comprehensive agreement, legal framework, investment transactions, financial portfolio, investment types, stocks, bonds, mutual funds, real estate investments, securities, obligations, responsibilities, due diligence, compensation structure, performance benchmarks, fees, commissions, transparency, accountability, market conditions, investment strategy, customized agreements, high-net-worth individuals, institutional investors, socially responsible investing, impact investing.The Fullerton California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a comprehensive agreement that outlines the terms and conditions between an investment agent and their client. This agreement establishes a legal framework for the agent to act on behalf of the client in the purchase and sale of investments. Under this agreement, the investment agent is entrusted with the responsibility of executing investment transactions on behalf of the client. The agent is expected to possess the necessary knowledge, skills, and experience in the field of investments to make sound decisions that will benefit the client's financial portfolio. The agreement includes specific clauses that define the scope of services provided by the investment agent. It outlines the agent's authority to act on behalf of the client, specifying the types of investments that can be purchased or sold. The agreement may encompass a wide range of investment types such as stocks, bonds, mutual funds, real estate investments, and other securities, depending on the needs and preferences of the client. In addition, the agreement establishes the obligations and responsibilities of both parties. It outlines the agent's duty to act in the best interest of the client and to exercise due diligence in investment decision-making. It may also include provisions regarding the agent's compensation structure, performance benchmarks, and any applicable fees or commissions. To ensure transparency and accountability, the agreement may require the agent to report regularly to the client on the status of investments, providing updates on performance, changes in market conditions, and any suggested modifications to the investment strategy. It is important to note that there may be different variations or types of the Fullerton California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client, depending on specific circumstances or the nature of the client's investment objectives. For example, there may be customized agreements for high-net-worth individuals, institutional investors, or clients seeking specific investment strategies such as socially responsible investing or impact investing. Keywords: Fullerton California, Agreement for Services, Investment Agent, Agent to Purchase, Sell Investments, Benefit of Client, comprehensive agreement, legal framework, investment transactions, financial portfolio, investment types, stocks, bonds, mutual funds, real estate investments, securities, obligations, responsibilities, due diligence, compensation structure, performance benchmarks, fees, commissions, transparency, accountability, market conditions, investment strategy, customized agreements, high-net-worth individuals, institutional investors, socially responsible investing, impact investing.