This form is an agreement between an independent investment agent (or consultant) and a corporation whereby the investment agent actually holds the investments as well as makes them for the client. We are assuming that the investment agent is duly licensed to perform this activity and will make any necessary filings with the state of California and the United States.

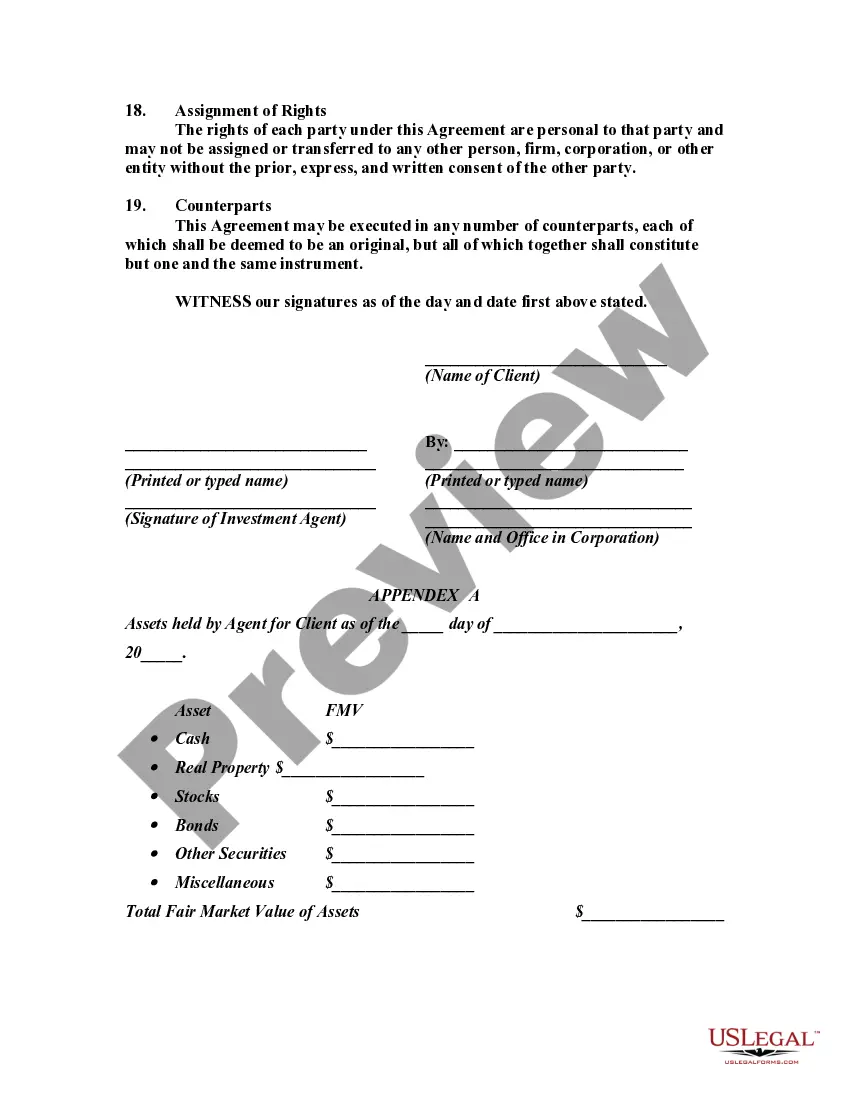

The Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legal document that outlines the terms and conditions under which an investment agent is authorized to act on behalf of a client in purchasing and selling investments. This agreement establishes a professional relationship between the investment agent and the client, providing a clear framework for conducting investment transactions and protecting the interests of both parties. Keywords: Oxnard California Agreement, Services of Investment Agent, Purchase and Sell Investments, Benefit of Client. This agreement typically includes the following key elements: 1. Parties Involved: The agreement identifies the client and the investment agent, making it clear who is the principal and who is acting as the agent. 2. Scope of Services: The agreement outlines the specific services the investment agent will provide, such as researching investment opportunities, executing trades, managing investment portfolios, and providing regular updates to the client. 3. Investment Objectives: The agreement defines the investment objectives and risk tolerance of the client, ensuring that the investment agent makes informed decisions aligned with the client's goals. 4. Compensation: The agreement details the fee structure and payment terms for the investment agent's services, including any commissions, management fees, or performance-based incentives. 5. Investment Authority: The agreement specifies the level of authority granted to the investment agent, such as discretionary authority to make investment decisions without prior consent from the client or limited authority requiring approval for each transaction. 6. Confidentiality and Privacy: The agreement emphasizes the importance of maintaining the confidentiality of the client's financial information and sets forth provisions for handling sensitive data in compliance with applicable privacy laws. 7. Dispute Resolution: The agreement incorporates a dispute resolution mechanism, outlining the steps to be taken in case of any conflicts or disputes between the client and the investment agent. Different Types of Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client: 1. Standard Agreement: This is the most common type of agreement used in Oxnard, California, for engaging an investment agent to purchase and sell investments on behalf of a client. It covers the basic terms and conditions that apply to the investment agent's services. 2. Limited Authority Agreement: In some cases, clients may prefer to retain more control over their investment decisions and grant limited authority to the investment agent. This type of agreement specifies the scope of the agent's authority and requires the client's approval for certain transactions. 3. Comprehensive Portfolio Management Agreement: For clients seeking a comprehensive approach to investment management, this type of agreement includes additional provisions regarding asset allocation, risk management, and investment planning services provided by the investment agent. In conclusion, the Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a crucial legal document that establishes the responsibilities, rights, and expectations of both the investment agent and the client. It ensures transparency, defines the scope of services, and safeguards the client's interests in investment transactions.The Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a legal document that outlines the terms and conditions under which an investment agent is authorized to act on behalf of a client in purchasing and selling investments. This agreement establishes a professional relationship between the investment agent and the client, providing a clear framework for conducting investment transactions and protecting the interests of both parties. Keywords: Oxnard California Agreement, Services of Investment Agent, Purchase and Sell Investments, Benefit of Client. This agreement typically includes the following key elements: 1. Parties Involved: The agreement identifies the client and the investment agent, making it clear who is the principal and who is acting as the agent. 2. Scope of Services: The agreement outlines the specific services the investment agent will provide, such as researching investment opportunities, executing trades, managing investment portfolios, and providing regular updates to the client. 3. Investment Objectives: The agreement defines the investment objectives and risk tolerance of the client, ensuring that the investment agent makes informed decisions aligned with the client's goals. 4. Compensation: The agreement details the fee structure and payment terms for the investment agent's services, including any commissions, management fees, or performance-based incentives. 5. Investment Authority: The agreement specifies the level of authority granted to the investment agent, such as discretionary authority to make investment decisions without prior consent from the client or limited authority requiring approval for each transaction. 6. Confidentiality and Privacy: The agreement emphasizes the importance of maintaining the confidentiality of the client's financial information and sets forth provisions for handling sensitive data in compliance with applicable privacy laws. 7. Dispute Resolution: The agreement incorporates a dispute resolution mechanism, outlining the steps to be taken in case of any conflicts or disputes between the client and the investment agent. Different Types of Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client: 1. Standard Agreement: This is the most common type of agreement used in Oxnard, California, for engaging an investment agent to purchase and sell investments on behalf of a client. It covers the basic terms and conditions that apply to the investment agent's services. 2. Limited Authority Agreement: In some cases, clients may prefer to retain more control over their investment decisions and grant limited authority to the investment agent. This type of agreement specifies the scope of the agent's authority and requires the client's approval for certain transactions. 3. Comprehensive Portfolio Management Agreement: For clients seeking a comprehensive approach to investment management, this type of agreement includes additional provisions regarding asset allocation, risk management, and investment planning services provided by the investment agent. In conclusion, the Oxnard California Agreement for Services of Investment Agent with Agent to Purchase and Sell Investments for the Benefit of Client is a crucial legal document that establishes the responsibilities, rights, and expectations of both the investment agent and the client. It ensures transparency, defines the scope of services, and safeguards the client's interests in investment transactions.