This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out California Quitclaim Deed From Husband And Wife To Husband And Wife?

Acquiring validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s a digital repository of over 85,000 legal documents catering to both individual and business requirements across various real-life situations.

All the paperwork is accurately categorized by usage area and jurisdiction, making it straightforward to find the Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife.

Maintaining organized paperwork that complies with legal standards is of great significance. Leverage the US Legal Forms library to consistently have essential document templates readily available for any requirement!

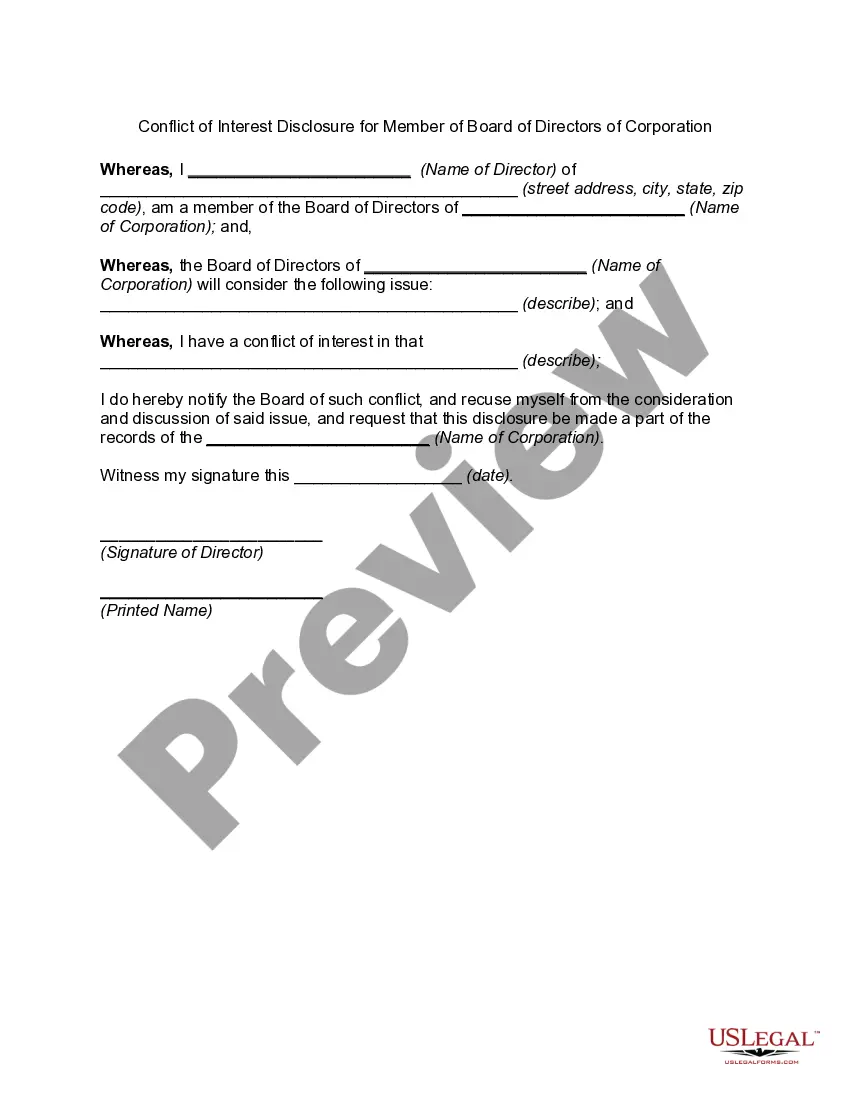

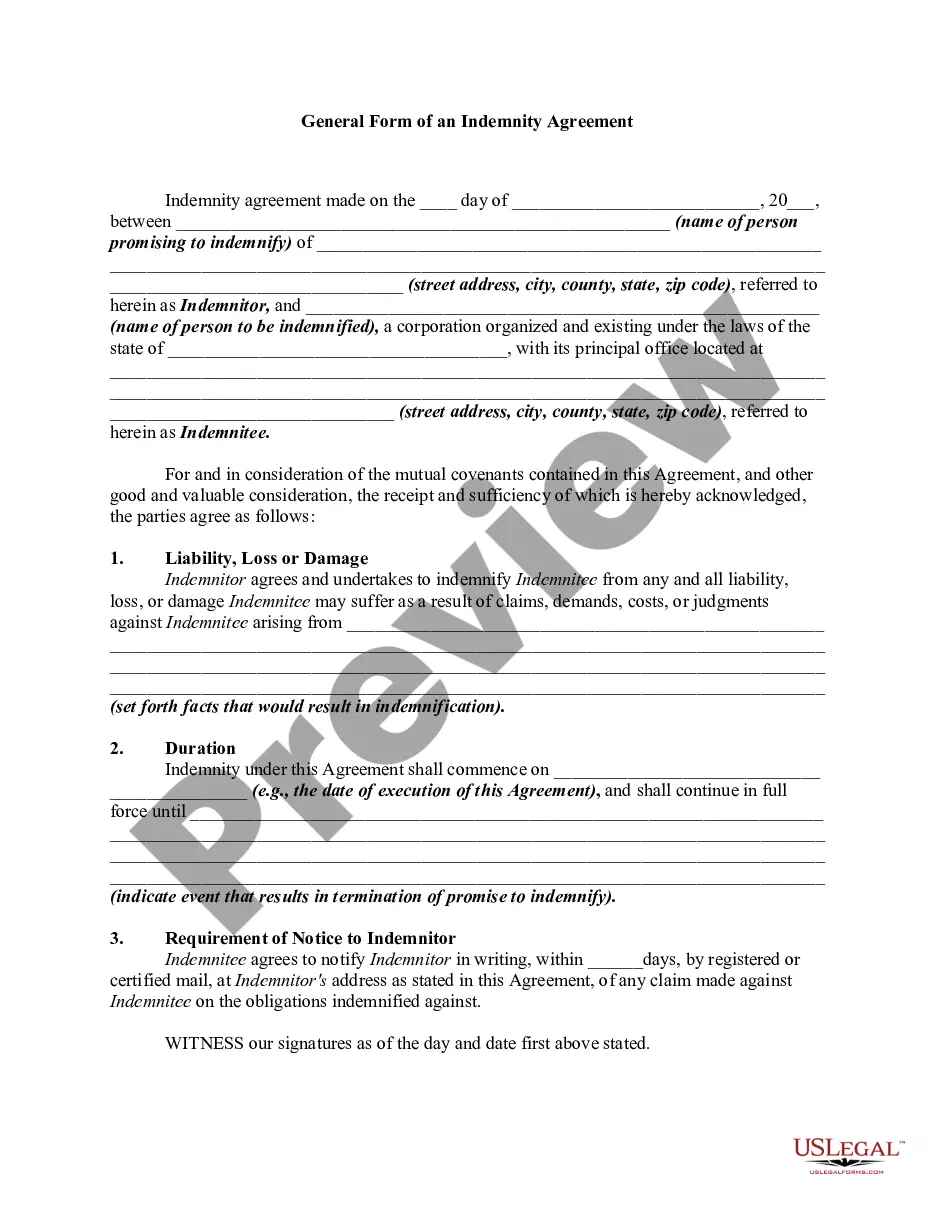

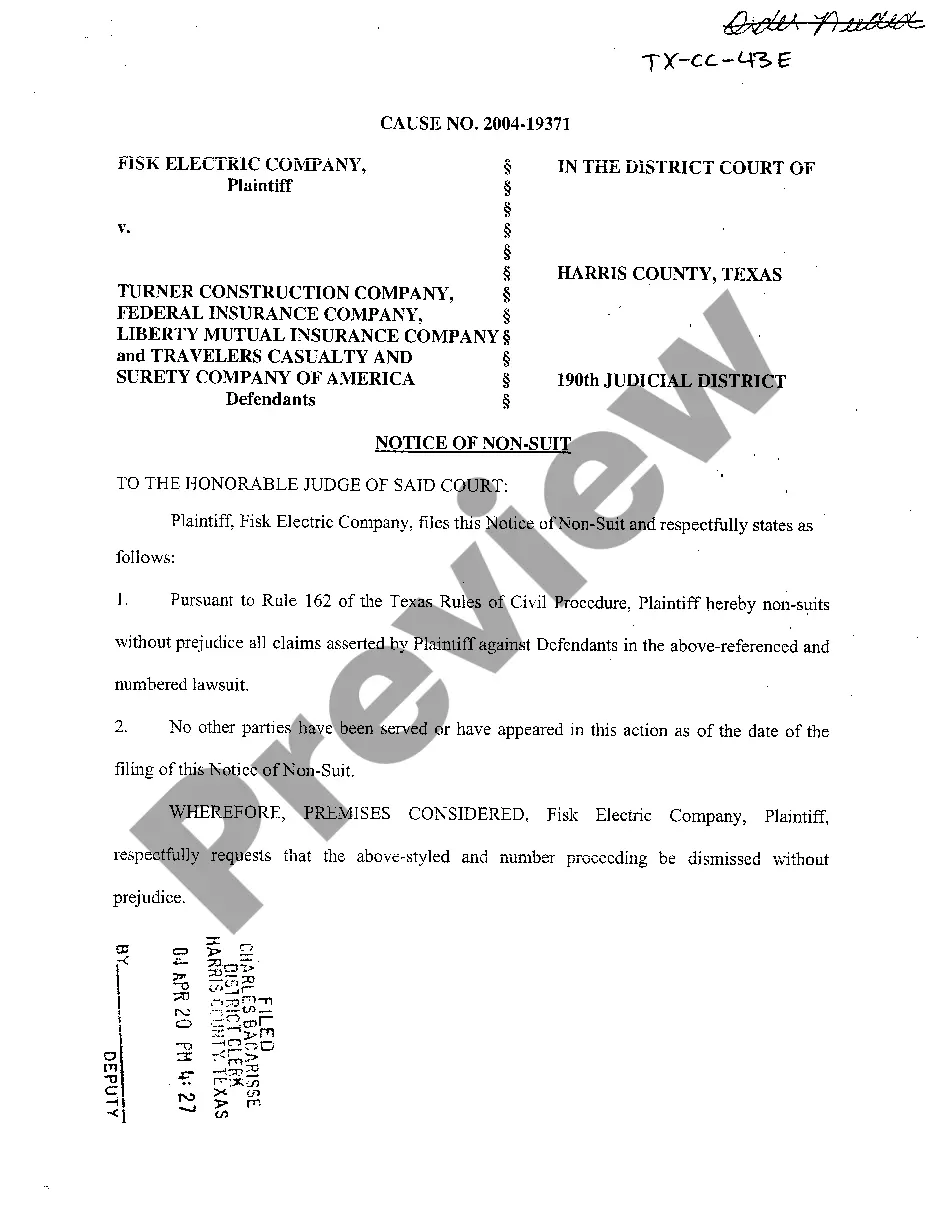

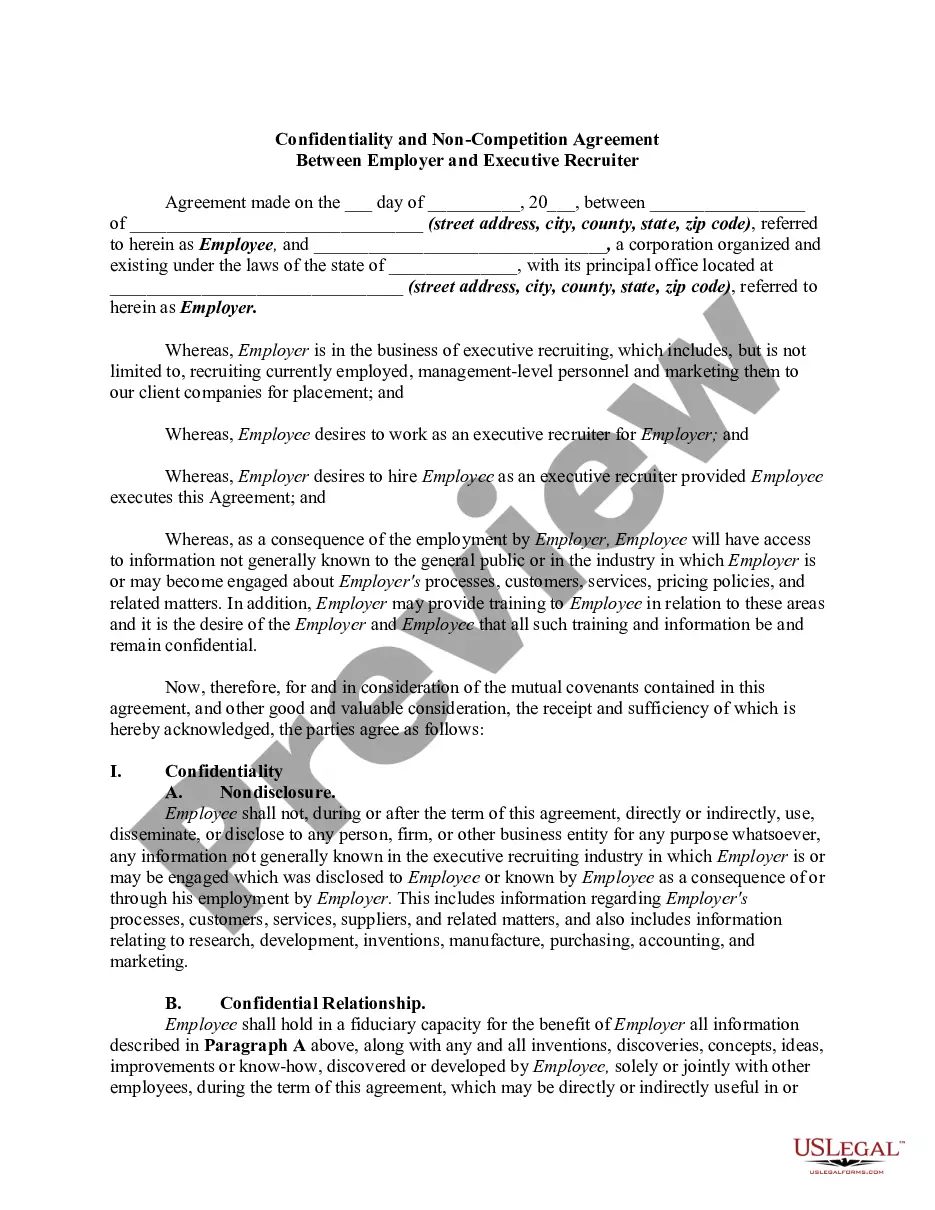

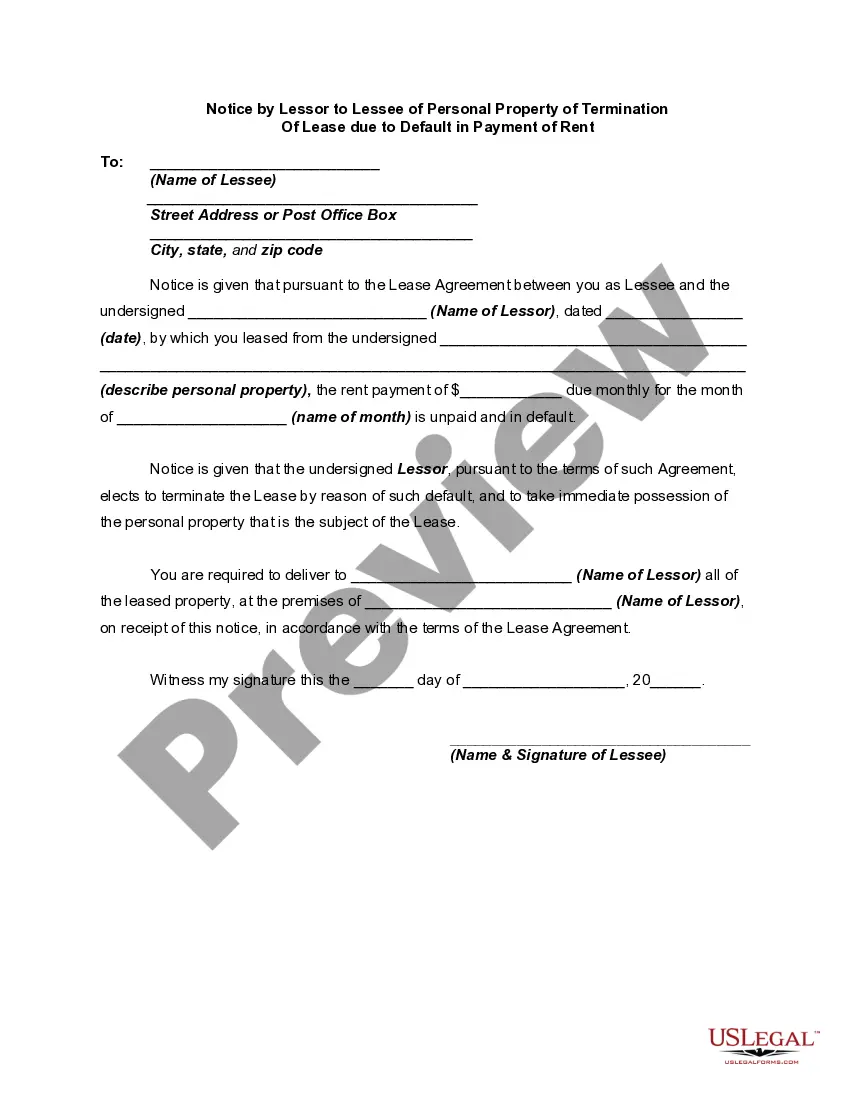

- Review the Preview mode and document description.

- Ensure you’ve selected the right one that aligns with your needs and wholly matches your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you identify any discrepancies, utilize the Search tab above to find the correct document. If it fits your needs, proceed to the next step.

- Complete the transaction.

Form popularity

FAQ

Typically, people use an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife to transfer property ownership without a sale. This may occur during divorce, estate planning, or when adding or removing a spouse from the title. By simplifying the transfer process, it helps maintain clarity on property rights. Uslegalforms makes it easy to draft and execute this crucial document.

Yes, you can complete an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife online. Many platforms, including uslegalforms, offer user-friendly tools that guide you through the process. This option saves time and ensures accuracy, allowing you to focus on other important matters. Simply follow the steps to create and file your deed electronically.

To add your spouse to your deed in California, you can use an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife. Start by correctly filling out the form, ensuring that all parties' names are listed accurately. After signing, you must file the quitclaim deed with your county recorder’s office. For a smoother process, consider using US Legal Forms, which offers templates and guidance for creating and filing your deed.

When you add someone to your deed in California with an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife, it may trigger property tax reassessment, depending on the scenario. California law allows some exclusions, such as transfers between spouses, which can help avoid reassessment. However, it is essential to understand potential income tax implications as well. Consulting a tax professional can provide clarity tailored to your situation.

The primary difference lies in their purpose and legal implications. An Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife simply transfers property interest, whereas an Interspousal transfer deed conveys property between spouses and may provide additional legal protections. This distinction can affect how ownership is treated, especially in the event of divorce. Utilizing US Legal Forms can guide you in choosing the right deed and ensure proper execution.

A quit claim from husband to wife involves one spouse transferring their interest in property to the other. In the context of an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife, this deed helps clarify ownership between spouses without the need for a full sale. It simplifies the process of managing property rights between married couples. Utilizing platforms like US Legal Forms can make this process easier and ensure that all legal requirements are met.

Yes, a quitclaim deed transfers whatever interest the grantor has in a property to the grantee. In California, this means that if a husband and wife execute an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife, they solidify their ownership. However, it's essential to understand that a quitclaim deed does not guarantee clear title. For a valid transfer, ensure that the deed is properly recorded.

You can add your spouse to your deed through an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife without refinancing. This involves drafting the deed to include both spouses' names and signing it in front of a notary public. After signing, file the quitclaim deed with the county recorder’s office to finalize the addition. Utilizing uslegalforms can guide you through this process and ensure proper completion.

Typically, both spouses benefit from an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife during a property transfer. This deed simplifies the process of changing ownership without needing a sale or appraisal. It ensures that both spouses have equal rights to the property, enhancing ownership clarity. Additionally, this method can protect assets in cases of divorce or separation.

When transferring property through an Irvine California Quitclaim Deed from Husband and Wife to Husband and Wife, adding a spouse can be seen as a gift, especially if no compensation is received. This transfer means that one spouse is giving the other an interest in the property. It is essential to understand the tax implications involved, as gifts can affect your tax situation. Consulting with a tax advisor can provide clarity on this matter.

Interesting Questions

More info

When a person dies without leaving a will, most state probate courts will assume that the spouse's assets will be divided between the parents at the time of the spouse's death and the surviving spouse. You would need to have a special court order to change the title and/or the allocation of the estate. If the deceased person had a will, the spouse would have to sign the will and would be protected from a will. Your attorney will review your probate documents to determine whether you may have a claim to ownership of the property. The estate of the deceased could include your spouse's or child's bank accounts, stocks, shares, and other assets. In many cases, the surviving spouse (who is usually the adult) who is likely to benefit, can establish the claim. However, the other spouse might have an irreconcilable difference and can't prove their claim.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.