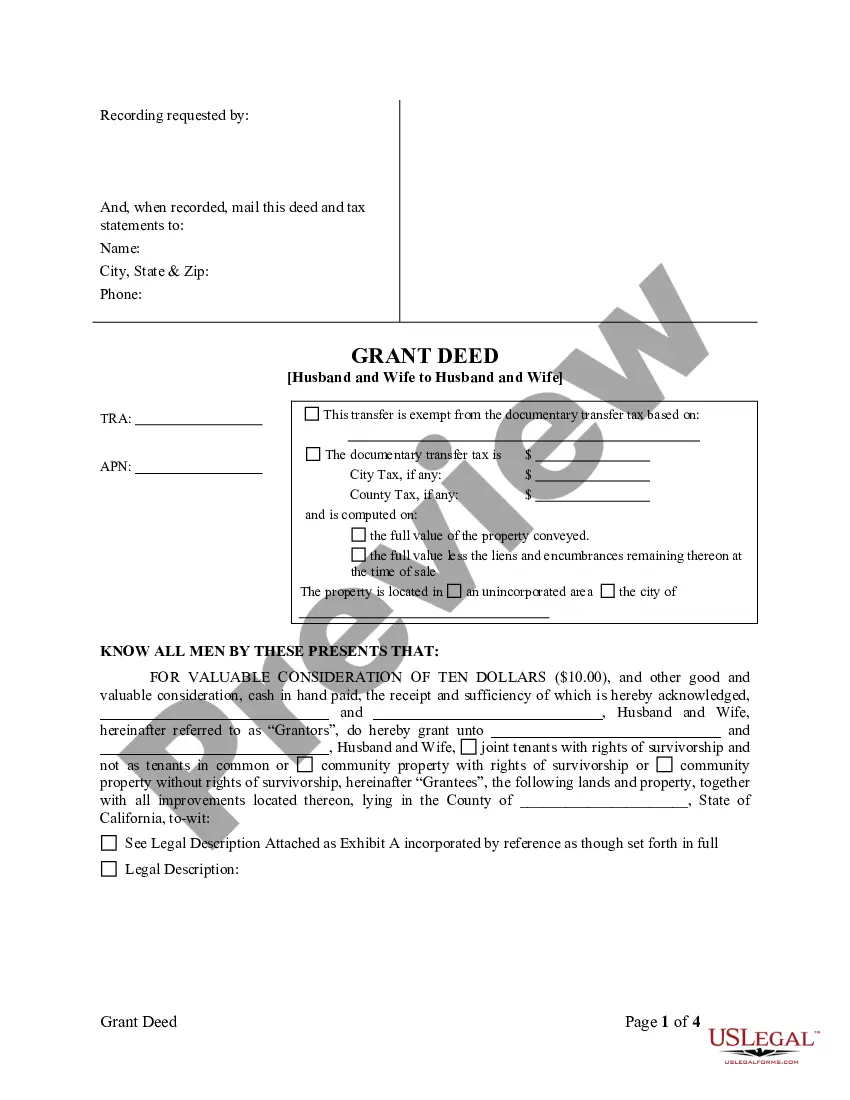

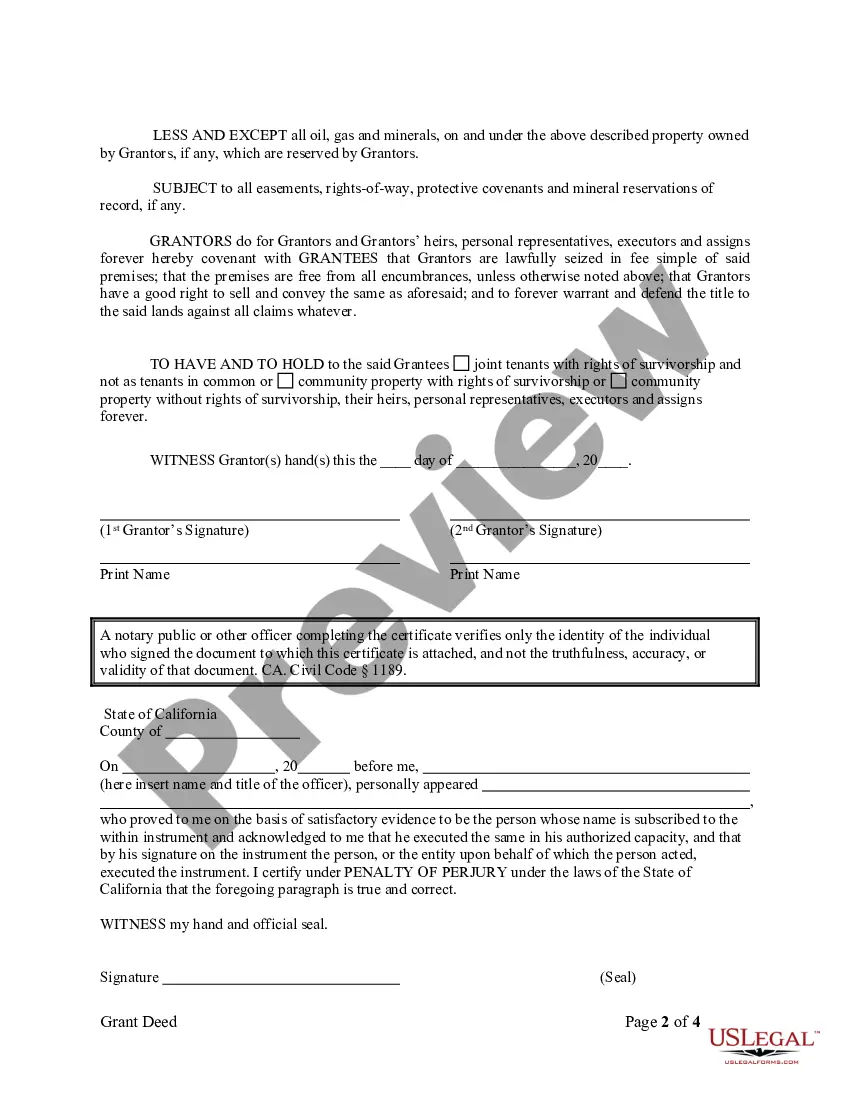

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

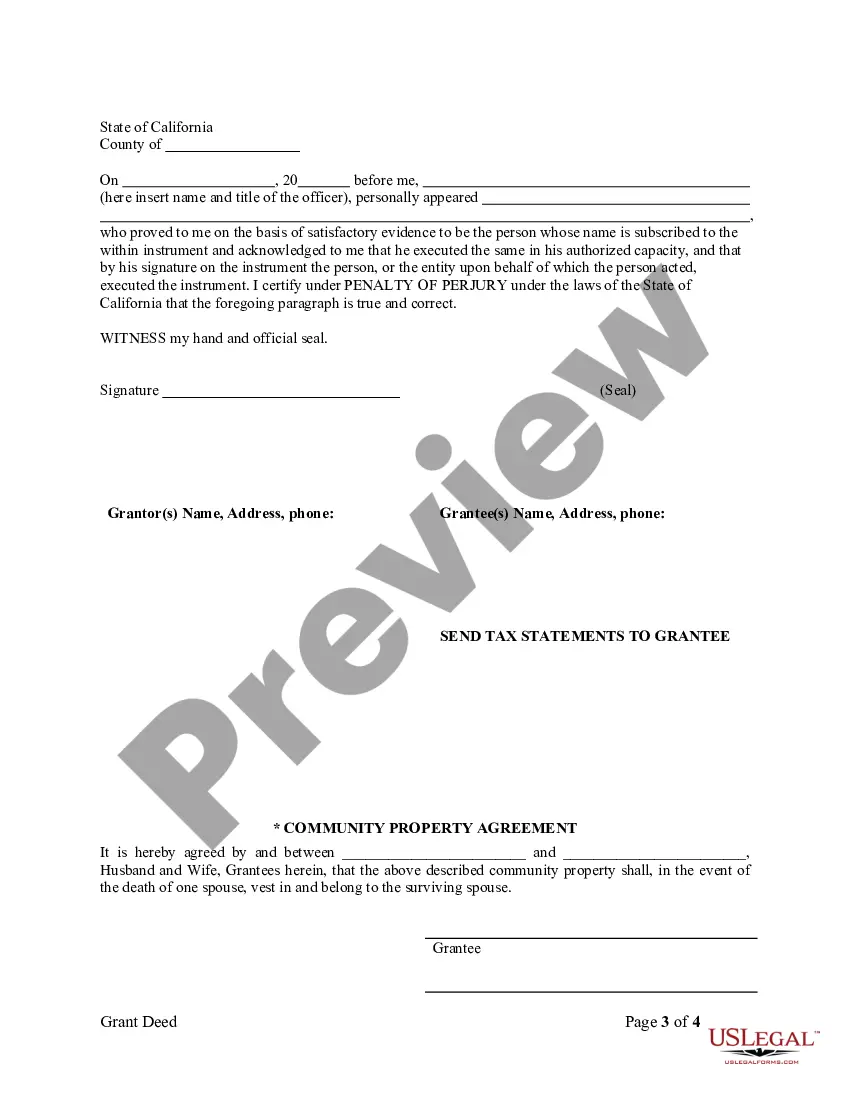

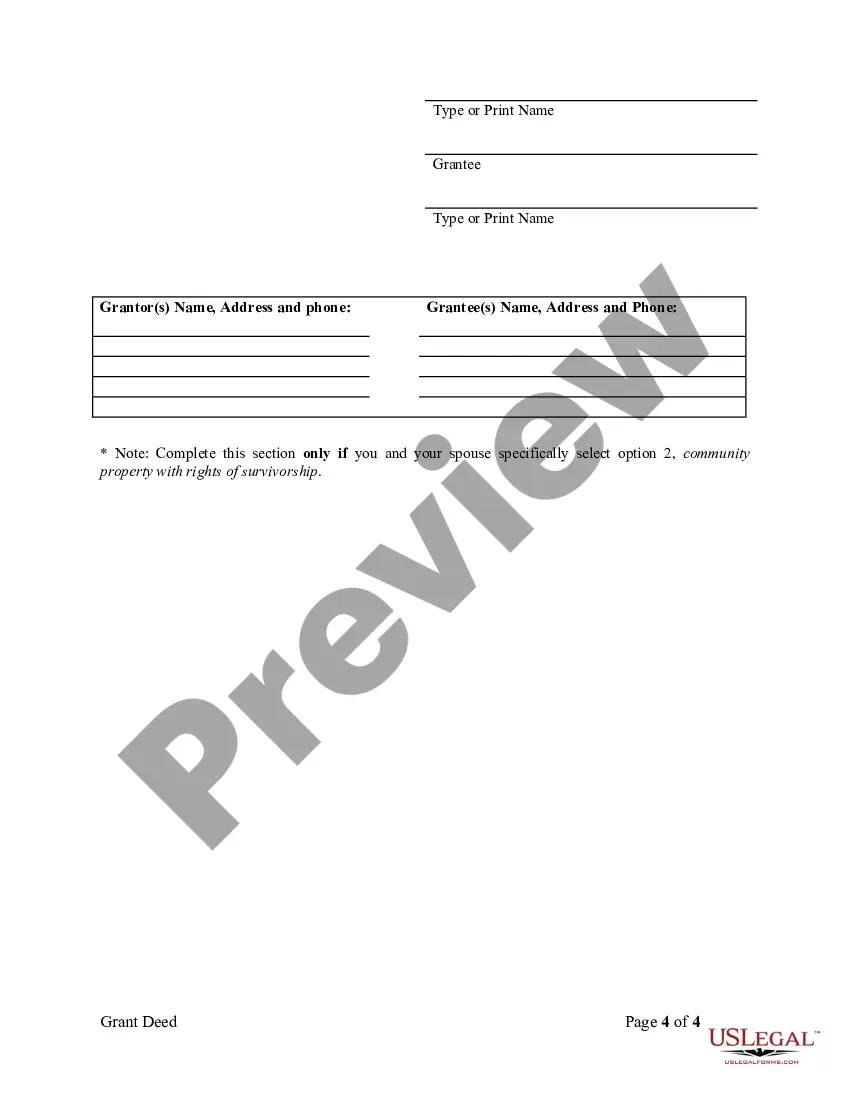

A Daly City California Grant Deed from Husband and Wife to Husband and Wife is a legal document that facilitates the transfer of property ownership from one married couple to another married couple. This type of deed ensures that both spouses have an equal share in the property. The grant deed serves as proof that the property is being transferred without any liens, encumbrances, or claims that could affect the new owners' rights. It also guarantees that the granters (the couple transferring the property) have the legal authority to do so. Keywords: Daly City California, grant deed, husband and wife, property ownership, transfer, married couple, share, proof, liens, encumbrances, claims, legal authority. Different types of Daly City California Grant Deeds from Husband and Wife to Husband and Wife may include: 1. General Grant Deed: This is the most common type of grant deed, transferring property ownership without any warranties or guarantees other than the fact that the granter owns the property and has the right to transfer it. 2. Special Warranty Deed: This grant deed guarantees that the granter has not done anything to diminish the title or create any encumbrances during their ownership, but it does not protect against any issues that may have existed before the granter acquired the property. 3. Quitclaim Deed: This type of grant deed is often used when the transfer of property involves family members or spouses. It transfers whatever interest or rights the granter has in the property, without making any warranties or guarantees. 4. Interspousal Transfer Grant Deed: Specifically designed for married couples, this grant deed allows for the transfer of property between spouses without triggering a reassessment for property tax purposes. It ensures that the property remains under the control and ownership of the couple while accommodating the changes in ownership. 5. Community Property with Right of Survivorship Deed: This grant deed allows for the transfer of a property to a married couple as community property. In case one spouse passes away, the surviving spouse automatically becomes the sole owner without the need for probate. Note: It is important to consult with a qualified real estate attorney or title professional to ensure the appropriate grant deed is used according to the specific circumstances and requirements of the transfer.A Daly City California Grant Deed from Husband and Wife to Husband and Wife is a legal document that facilitates the transfer of property ownership from one married couple to another married couple. This type of deed ensures that both spouses have an equal share in the property. The grant deed serves as proof that the property is being transferred without any liens, encumbrances, or claims that could affect the new owners' rights. It also guarantees that the granters (the couple transferring the property) have the legal authority to do so. Keywords: Daly City California, grant deed, husband and wife, property ownership, transfer, married couple, share, proof, liens, encumbrances, claims, legal authority. Different types of Daly City California Grant Deeds from Husband and Wife to Husband and Wife may include: 1. General Grant Deed: This is the most common type of grant deed, transferring property ownership without any warranties or guarantees other than the fact that the granter owns the property and has the right to transfer it. 2. Special Warranty Deed: This grant deed guarantees that the granter has not done anything to diminish the title or create any encumbrances during their ownership, but it does not protect against any issues that may have existed before the granter acquired the property. 3. Quitclaim Deed: This type of grant deed is often used when the transfer of property involves family members or spouses. It transfers whatever interest or rights the granter has in the property, without making any warranties or guarantees. 4. Interspousal Transfer Grant Deed: Specifically designed for married couples, this grant deed allows for the transfer of property between spouses without triggering a reassessment for property tax purposes. It ensures that the property remains under the control and ownership of the couple while accommodating the changes in ownership. 5. Community Property with Right of Survivorship Deed: This grant deed allows for the transfer of a property to a married couple as community property. In case one spouse passes away, the surviving spouse automatically becomes the sole owner without the need for probate. Note: It is important to consult with a qualified real estate attorney or title professional to ensure the appropriate grant deed is used according to the specific circumstances and requirements of the transfer.