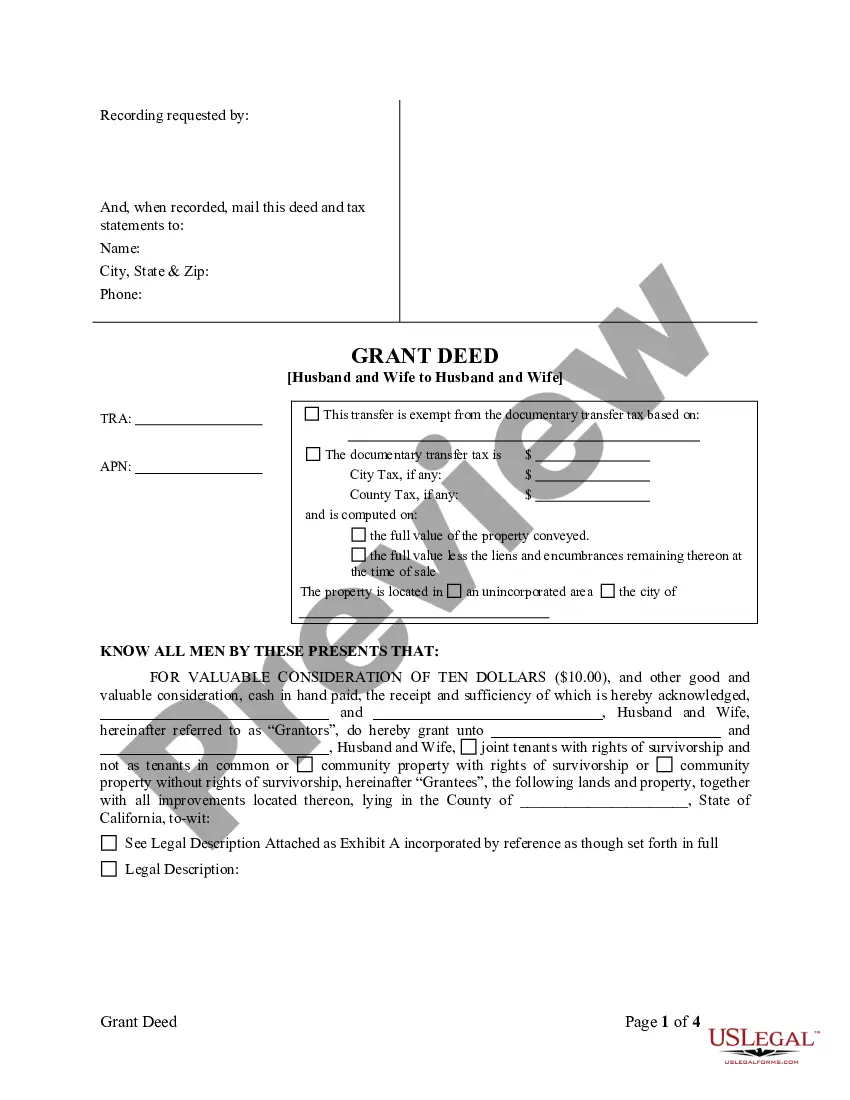

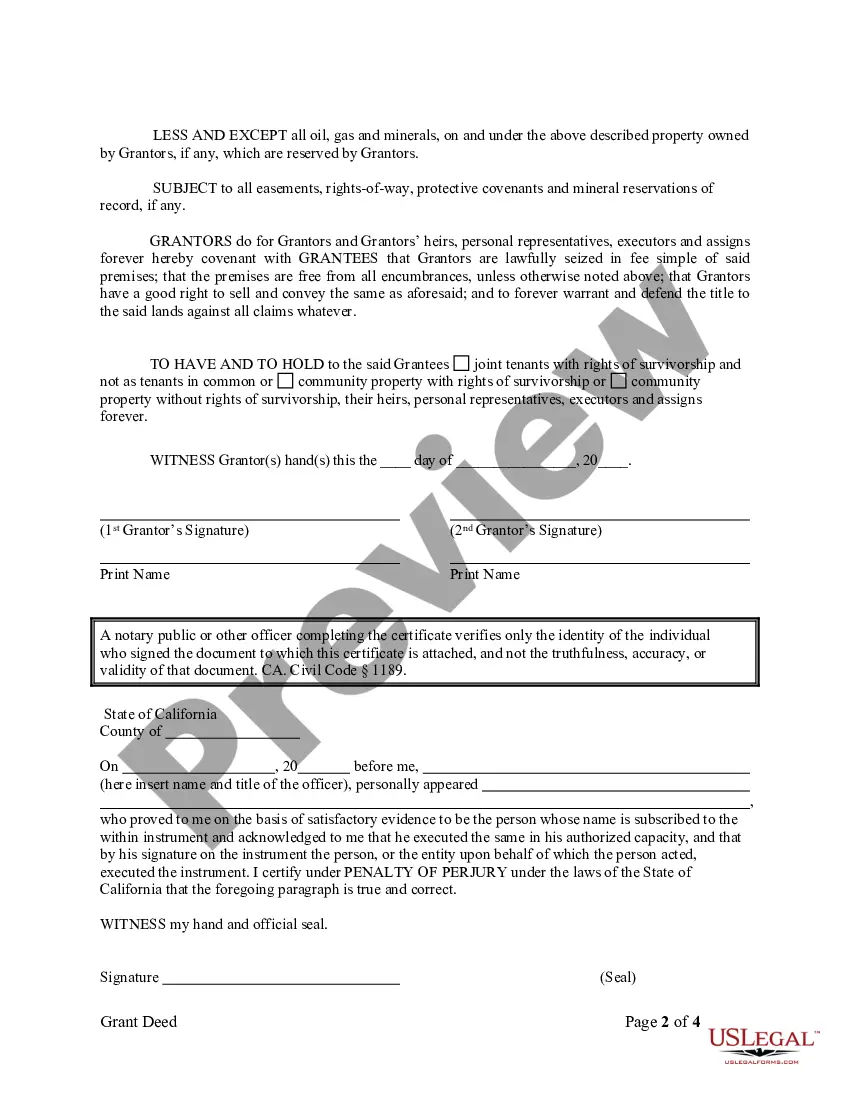

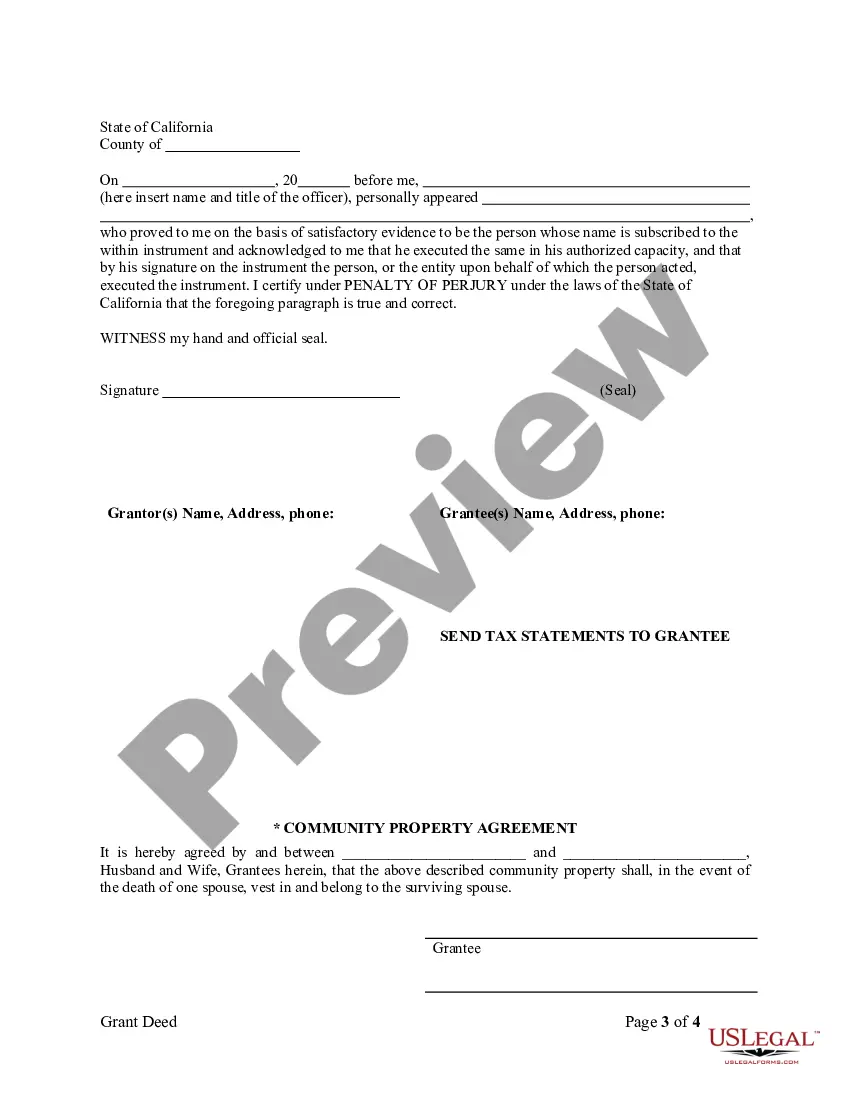

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

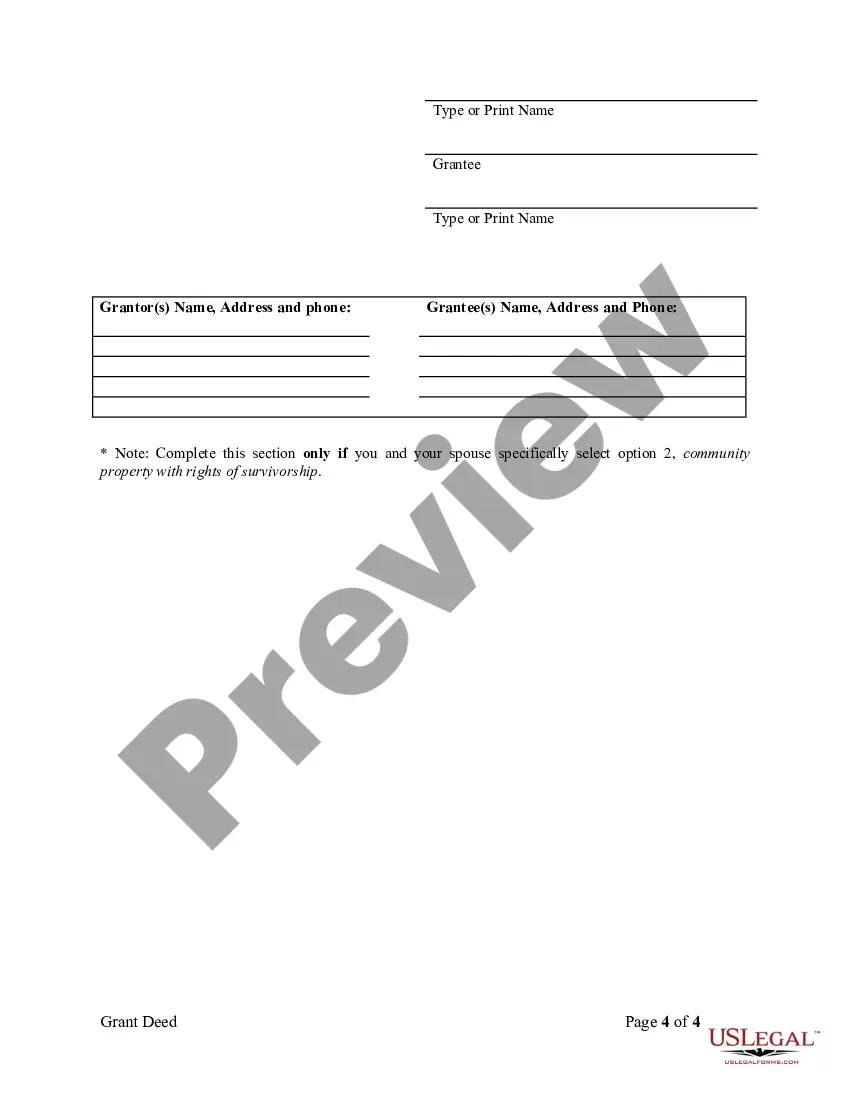

Title: Understanding the Garden Grove California Grant Deed from Husband and Wife to Husband and Wife Description: In Garden Grove, California, a Grant Deed from Husband and Wife to Husband and Wife is a legal document used to transfer property ownership between spouses. This informative content will provide a detailed description of this specific type of Grant Deed, its purpose, and relevant keywords associated with it. Keywords: Garden Grove California, Grant Deed, Husband and Wife, Property Ownership, Spouses, Transfer, Legal Document 1. Purpose and Overview: The Garden Grove California Grant Deed from Husband and Wife to Husband and Wife is a legally recognized document that facilitates the transfer of property ownership between married individuals residing in Garden Grove, California. This deed grants rights and interest in the property from one married couple to another, ensuring a seamless transfer of ownership while preserving their marital rights. 2. Types of Garden Grove California Grant Deed from Husband and Wife to Husband and Wife: a) Joint Tenancy Grant Deed: In this type of Grant Deed, the property is co-owned equally by both spouses. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share of the property. b) Community Property Grant Deed: This Grant Deed establishes joint ownership of the property as community property, with both spouses having an equal 50% interest. Upon the death of one spouse, the surviving spouse retains their own 50% interest while also inheriting the deceased spouse's 50% interest. 3. Process of Transfer: The Garden Grove California Grant Deed from Husband and Wife to Husband and Wife follows a specific process to ensure a valid transfer of property ownership. Here are the fundamental steps involved: a) Creation of the Grant Deed: The Grant Deed must be drafted according to California state law, including all pertinent details about the property and the transferring parties. b) Execution: Both spouses must sign the Grant Deed in the presence of a notary public, acknowledging their consent and understanding of the transfer. c) Recording: The executed Grant Deed needs to be submitted to the Orange County Recorder's Office for official recording. This step guarantees a public record of the ownership transfer. 4. Important Considerations: a) Legal Assistance: It is highly recommended seeking the guidance of a qualified real estate attorney to ensure accuracy and compliance with the legal requirements during the process of transferring property ownership using a Garden Grove California Grant Deed. b) Tax Implications: Transferring property ownership may have tax implications. Seeking advice from a tax professional can help spouses understand any potential tax consequences associated with the transfer. c) Title Insurance: Acquiring title insurance is crucial to protect the new owners from any unforeseen legal claims or disputes regarding the property's ownership. In conclusion, the Garden Grove California Grant Deed from Husband and Wife to Husband and Wife is an essential legal document that enables seamless property ownership transfer between married couples. Understanding the types, process, and essential considerations associated with this Grant Deed is vital for ensuring a smooth and lawful transfer of property ownership in Garden Grove, California.Title: Understanding the Garden Grove California Grant Deed from Husband and Wife to Husband and Wife Description: In Garden Grove, California, a Grant Deed from Husband and Wife to Husband and Wife is a legal document used to transfer property ownership between spouses. This informative content will provide a detailed description of this specific type of Grant Deed, its purpose, and relevant keywords associated with it. Keywords: Garden Grove California, Grant Deed, Husband and Wife, Property Ownership, Spouses, Transfer, Legal Document 1. Purpose and Overview: The Garden Grove California Grant Deed from Husband and Wife to Husband and Wife is a legally recognized document that facilitates the transfer of property ownership between married individuals residing in Garden Grove, California. This deed grants rights and interest in the property from one married couple to another, ensuring a seamless transfer of ownership while preserving their marital rights. 2. Types of Garden Grove California Grant Deed from Husband and Wife to Husband and Wife: a) Joint Tenancy Grant Deed: In this type of Grant Deed, the property is co-owned equally by both spouses. If one spouse passes away, the surviving spouse automatically inherits the deceased spouse's share of the property. b) Community Property Grant Deed: This Grant Deed establishes joint ownership of the property as community property, with both spouses having an equal 50% interest. Upon the death of one spouse, the surviving spouse retains their own 50% interest while also inheriting the deceased spouse's 50% interest. 3. Process of Transfer: The Garden Grove California Grant Deed from Husband and Wife to Husband and Wife follows a specific process to ensure a valid transfer of property ownership. Here are the fundamental steps involved: a) Creation of the Grant Deed: The Grant Deed must be drafted according to California state law, including all pertinent details about the property and the transferring parties. b) Execution: Both spouses must sign the Grant Deed in the presence of a notary public, acknowledging their consent and understanding of the transfer. c) Recording: The executed Grant Deed needs to be submitted to the Orange County Recorder's Office for official recording. This step guarantees a public record of the ownership transfer. 4. Important Considerations: a) Legal Assistance: It is highly recommended seeking the guidance of a qualified real estate attorney to ensure accuracy and compliance with the legal requirements during the process of transferring property ownership using a Garden Grove California Grant Deed. b) Tax Implications: Transferring property ownership may have tax implications. Seeking advice from a tax professional can help spouses understand any potential tax consequences associated with the transfer. c) Title Insurance: Acquiring title insurance is crucial to protect the new owners from any unforeseen legal claims or disputes regarding the property's ownership. In conclusion, the Garden Grove California Grant Deed from Husband and Wife to Husband and Wife is an essential legal document that enables seamless property ownership transfer between married couples. Understanding the types, process, and essential considerations associated with this Grant Deed is vital for ensuring a smooth and lawful transfer of property ownership in Garden Grove, California.