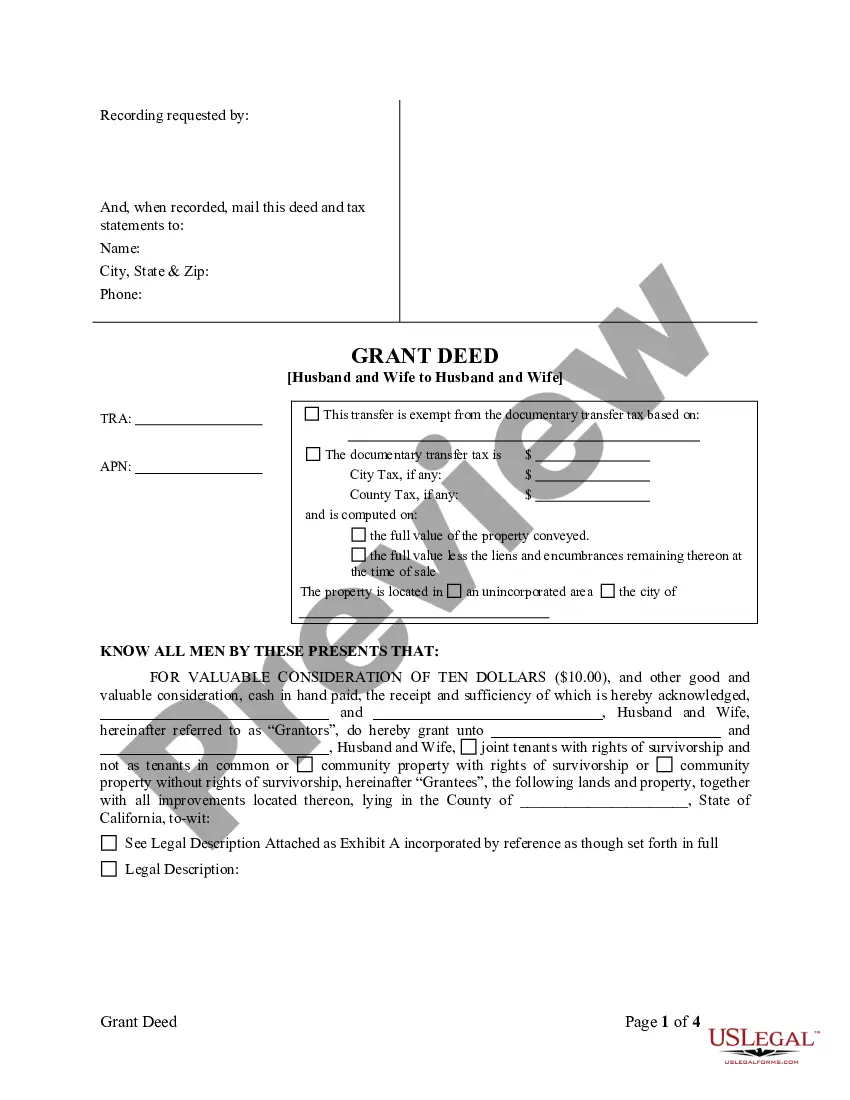

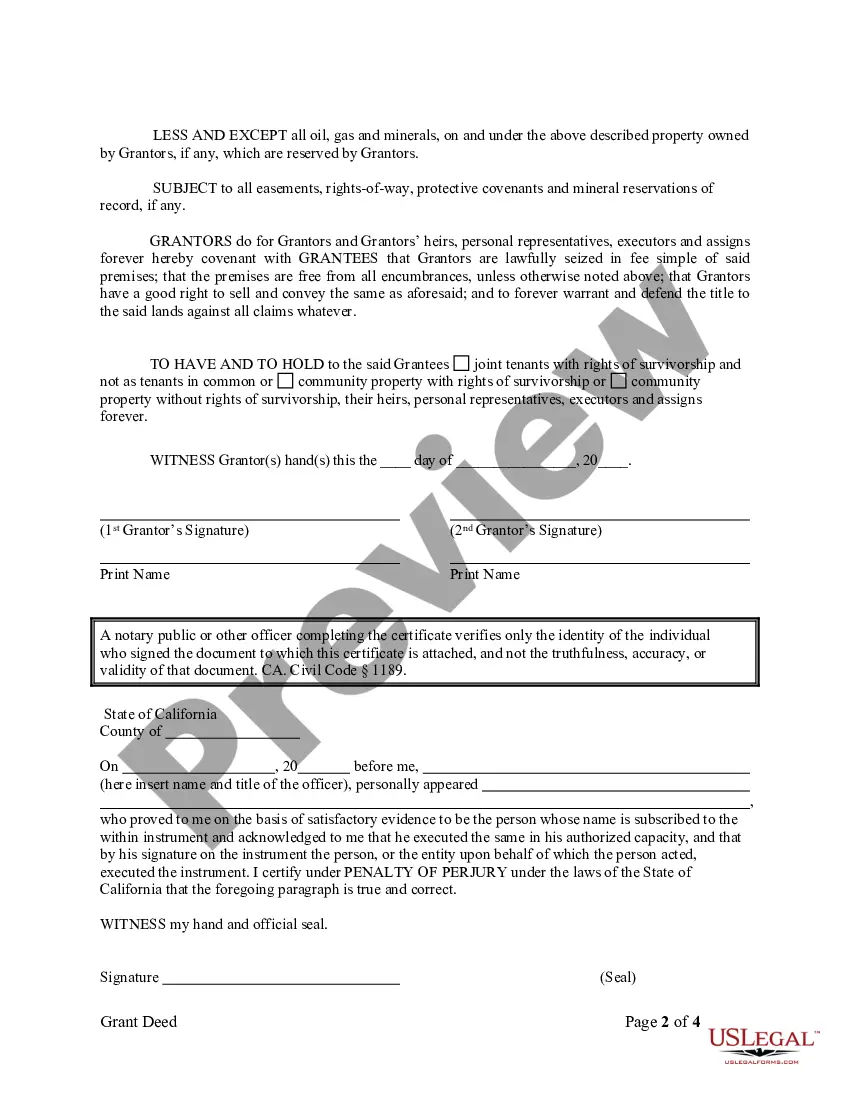

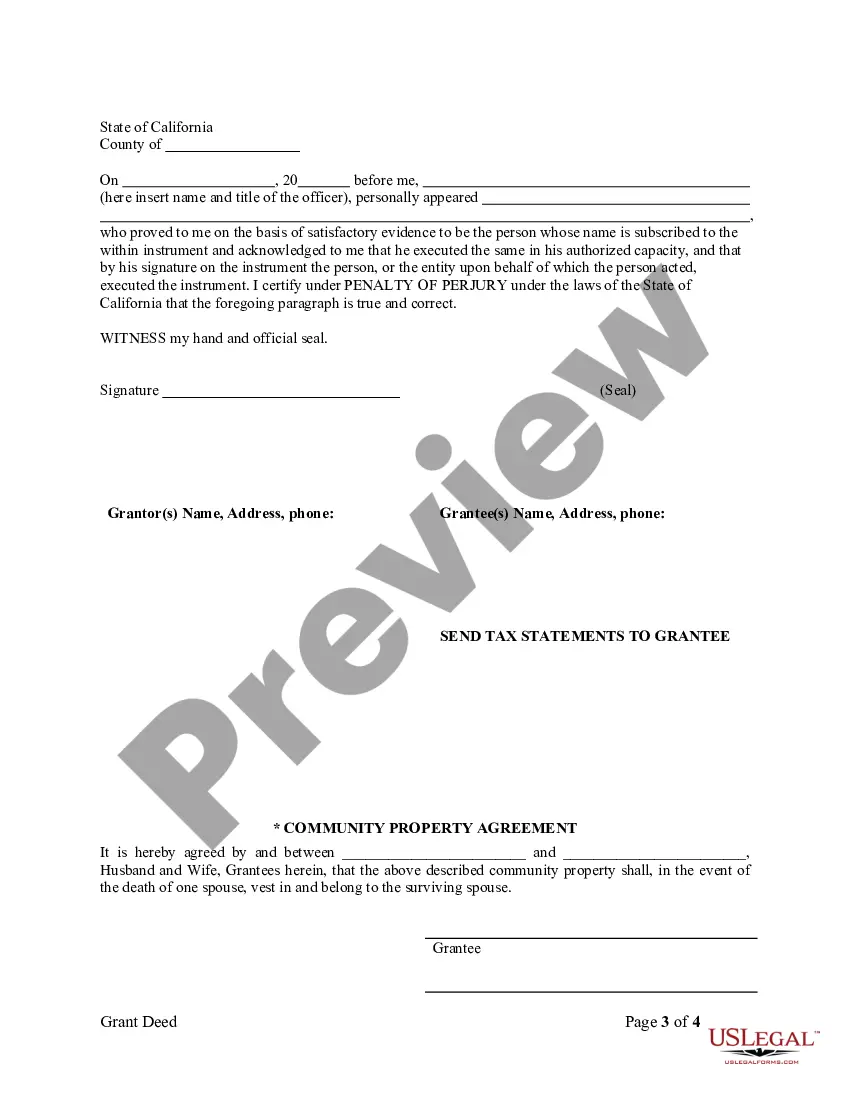

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

Hayward California Grant Deed from Husband and Wife to Husband and Wife

Description

How to fill out California Grant Deed From Husband And Wife To Husband And Wife?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial matters.

To achieve this, we seek attorney services that are typically very costly.

Nevertheless, not all legal matters are equally intricate; many can be managed independently.

US Legal Forms is an online repository of updated DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to the document. If you misplace the form, you can always re-download it in the My documents tab.

- Our library empowers you to manage your affairs without consulting an attorney.

- We offer access to legal document templates that are not always available to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Leverage US Legal Forms whenever you need to quickly and securely obtain and download the Hayward California Grant Deed from Husband and Wife to Husband and Wife or any other document.

Form popularity

FAQ

If your name is not on a deed but you are married in California, you still have rights to the property under community property laws. This means you may have a claim to half of the property, regardless of who holds the title. Understanding your rights can be complex, but using a Hayward California Grant Deed from Husband and Wife to Husband and Wife can provide clarity and peace of mind concerning property ownership in your marriage.

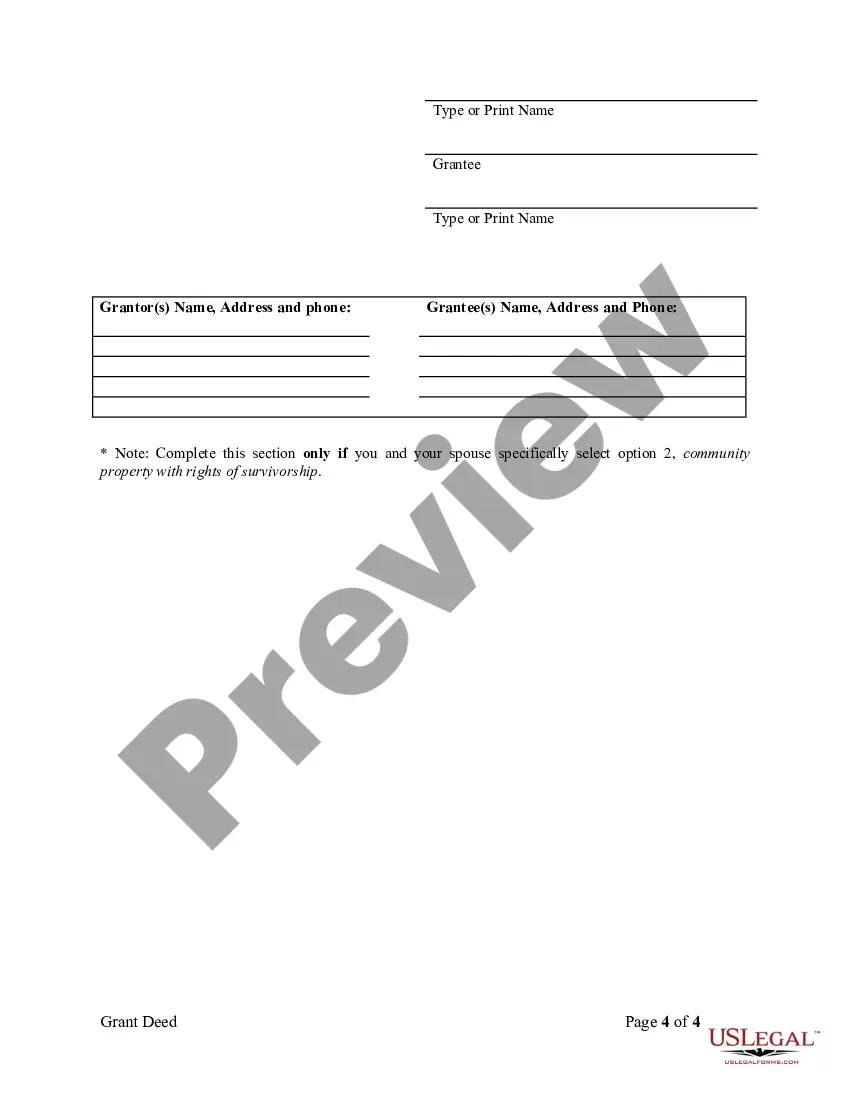

Married couples in California often hold title in one of three ways: Joint Tenancy, Tenancy in Common, or Community Property. Each option has specific legal implications and can affect inheritance and taxation. For a Hayward California Grant Deed from Husband and Wife to Husband and Wife, Joint Tenancy is typically preferred for its simplicity and the automatic transfer of property rights upon death.

Yes, a married person can buy a house alone in California. However, it is essential to understand that the property may still be considered community property, which means both spouses may have rights to it. Using a Hayward California Grant Deed from Husband and Wife to Husband and Wife can help clarify ownership and protect both partners’ interests, even if only one spouse's name appears on the deed.

For married couples, Joint Tenancy is often the best option, as it allows both partners to own the property equally, with rights of survivorship. This means that if one spouse passes away, the other automatically inherits full ownership. When considering a Hayward California Grant Deed from Husband and Wife to Husband and Wife, choosing Joint Tenancy can simplify property transfer and ensure clarity in ownership.

Adding someone to a deed may complicate property decisions in the future, as both parties will need to agree on any changes. Additionally, this can impact your tax liabilities and estate planning. It’s essential to consider potential challenges like disagreement over property use or changes in relationships. Understanding these factors is crucial before proceeding with a Hayward California Grant Deed from Husband and Wife to Husband and Wife.

You can obtain a copy of your grant deed in California by visiting the county recorder’s office where the property is located. You may also request it online or through the mail, depending on the county's services. Ensure you have the property details handy to simplify the request process. This access helps you verify ownership and maintain accurate records.

To add your spouse to a grant deed in California, file a new grant deed with both names listed as owners. This document requires accurate information and signatures from both parties. After completing the grant deed, it must be recorded at the county recorder's office. This process formalizes the addition, making it legally binding.

Adding a spouse to a deed may be viewed as a gift for tax purposes, depending on the property's value. In Hayward, California, when you add your spouse, the IRS considers it a change in ownership, which may trigger gift tax implications. It's advisable to consult a tax professional for clarity. This ensures you understand any financial responsibilities related to the transaction.

Yes, you can add a spouse to a deed without refinancing your mortgage. By completing a grant deed, you can transfer ownership to include both spouses. It’s important to check your lender's guidelines though, as some may have specific requirements. This method provides a straightforward approach to joint ownership.

To transfer ownership from husband to wife in Hayward, use a grant deed. This legal document requires both parties to sign it, detailing the property’s description. Once completed, you must record the grant deed with the county recorder's office. This process solidifies the ownership transfer and ensures legal recognition.