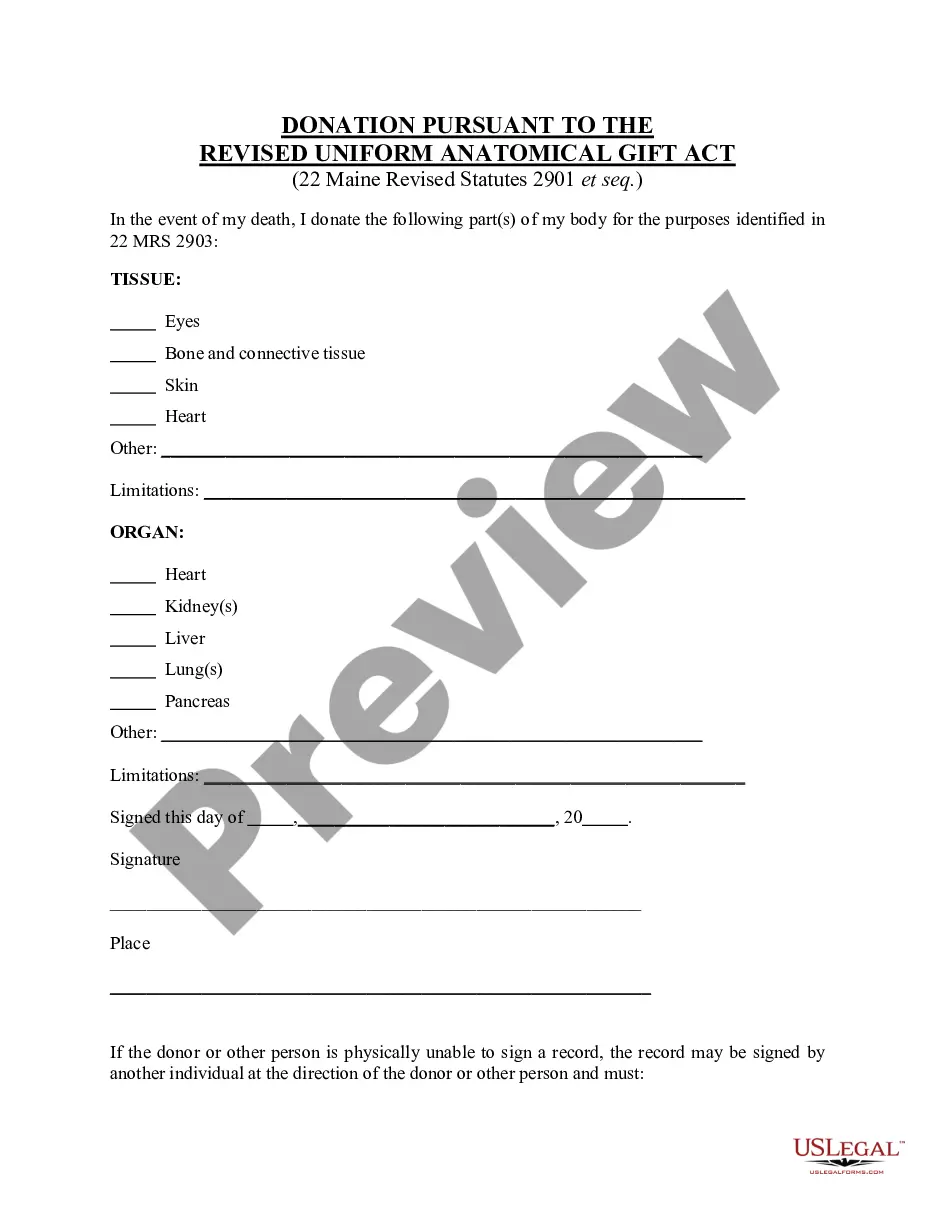

This form is a generic example that may be referred to when preparing such a form.

A Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender in Chico, California. This type of promissory note is distinctive as it only requires the borrower to make the full payment at the end of the designated maturity period, rather than making regular installment payments. The key aspect of this promissory note is that interest is compounded annually, meaning that interest is calculated and added to the principal loan amount each year. This ensures that the lender will receive not only the initially agreed-upon principal amount but also the accumulated interest. Several types of Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may exist, each catering to specific circumstances or needs. These may include: 1. Simple Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This is a basic promissory note that outlines the borrower's promise to repay the principal loan amount and the annual compounding interest. It includes essential terms and conditions such as the loan amount, interest rate, maturity date, and contact information of both parties. 2. Secured Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: In this type of promissory note, the borrower pledges collateral as security for the loan. By providing an asset (such as real estate property or a vehicle) as collateral, the lender gains additional assurance that the loan will be repaid. If the borrower defaults, the lender can seize and sell the collateral to recover their investment. 3. Convertible Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This promissory note includes a provision allowing the lender to convert the outstanding loan amount into equity (ownership) in the borrower's business if certain predefined conditions are met. This offers the lender the potential to benefit from the borrower's future success beyond the principal amount and the agreed interest. 4. Demand Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This promissory note provides the lender with the right to request immediate repayment of the full loan amount (including accrued interest) before the maturity date. While this gives the lender flexibility, it can also create uncertainty for the borrower, who may be required to repay the loan earlier than anticipated. It is important to consult with a legal professional when considering or drafting a Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, as the specific terms and conditions can significantly impact both the lender and borrower's responsibilities and rights.A Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender in Chico, California. This type of promissory note is distinctive as it only requires the borrower to make the full payment at the end of the designated maturity period, rather than making regular installment payments. The key aspect of this promissory note is that interest is compounded annually, meaning that interest is calculated and added to the principal loan amount each year. This ensures that the lender will receive not only the initially agreed-upon principal amount but also the accumulated interest. Several types of Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may exist, each catering to specific circumstances or needs. These may include: 1. Simple Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This is a basic promissory note that outlines the borrower's promise to repay the principal loan amount and the annual compounding interest. It includes essential terms and conditions such as the loan amount, interest rate, maturity date, and contact information of both parties. 2. Secured Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: In this type of promissory note, the borrower pledges collateral as security for the loan. By providing an asset (such as real estate property or a vehicle) as collateral, the lender gains additional assurance that the loan will be repaid. If the borrower defaults, the lender can seize and sell the collateral to recover their investment. 3. Convertible Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This promissory note includes a provision allowing the lender to convert the outstanding loan amount into equity (ownership) in the borrower's business if certain predefined conditions are met. This offers the lender the potential to benefit from the borrower's future success beyond the principal amount and the agreed interest. 4. Demand Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually: This promissory note provides the lender with the right to request immediate repayment of the full loan amount (including accrued interest) before the maturity date. While this gives the lender flexibility, it can also create uncertainty for the borrower, who may be required to repay the loan earlier than anticipated. It is important to consult with a legal professional when considering or drafting a Chico California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, as the specific terms and conditions can significantly impact both the lender and borrower's responsibilities and rights.