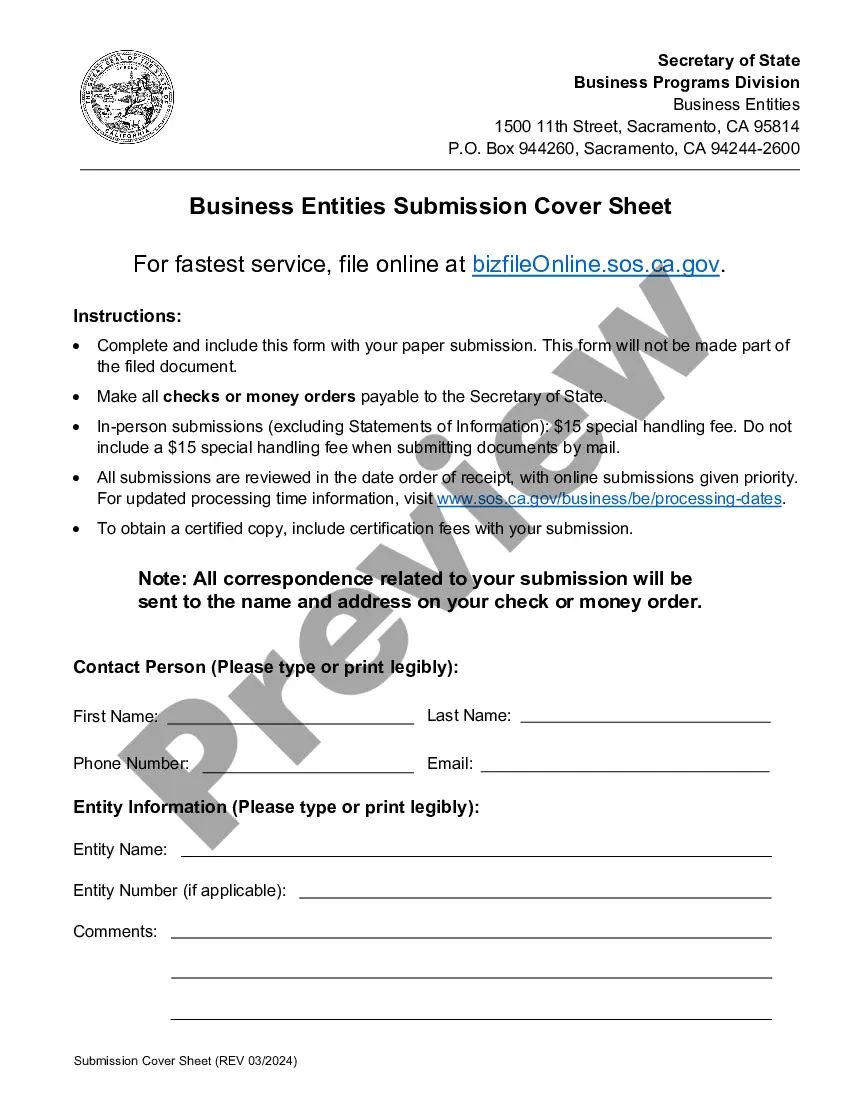

This form is a generic example that may be referred to when preparing such a form.

A Chula Vista California promissory note with no payment due until maturity and interest to compound annually is a legally binding agreement between a lender and a borrower. This type of promissory note is commonly used in financial transactions, such as loans, where the borrower agrees to repay the principal amount borrowed along with accrued interest. However, unlike traditional promissory notes, no payments are required until the maturity date, and the interest compounds annually. In Chula Vista, California, there are several types of promissory notes with no payment due until maturity and interest to compound annually. These include: 1. Fixed-Rate Promissory Note: This type of promissory note features a fixed interest rate, which remains constant throughout the loan term. The borrower agrees to repay the principal amount borrowed, and the interest accrues annually until the maturity date. The fixed-rate promissory note provides predictability in terms of repayment amounts for both the borrower and the lender. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, the adjustable-rate promissory note features an interest rate that can fluctuate over time. The interest rate usually aligns with a specific financial index, such as the prime rate or the Treasury Bill rate. Any changes to the interest rate will affect the annual compounding of interest until the maturity date. Borrowers opting for this type of promissory note should carefully consider the potential fluctuations in interest rates. 3. Demand Promissory Note: This type of promissory note allows the lender to demand repayment at any time. However, in the case of a Chula Vista California promissory note with no payment due until maturity and interest to compound annually, the lender cannot demand any payment until the maturity date. The borrower enjoys the benefit of deferred payments while the interest continues to compound annually until the maturity date. 4. Balloon Promissory Note: A balloon promissory note is characterized by smaller periodic payments throughout the loan term, with a larger payment due at the end, known as the "balloon payment." In the case of a Chula Vista California promissory note with no payment due until maturity and interest to compound annually, the balloon payment would only be due at maturity. This type of promissory note may be suitable for borrowers who anticipate the availability of funds to repay the loan in a lump sum at the maturity date. In summary, a Chula Vista California promissory note with no payment due until maturity and interest to compound annually is a financial agreement that allows borrowers to defer payments until the maturity date while interest compounds annually. Different types of promissory notes available in Chula Vista, California, include fixed-rate, adjustable-rate, demand, and balloon promissory notes.A Chula Vista California promissory note with no payment due until maturity and interest to compound annually is a legally binding agreement between a lender and a borrower. This type of promissory note is commonly used in financial transactions, such as loans, where the borrower agrees to repay the principal amount borrowed along with accrued interest. However, unlike traditional promissory notes, no payments are required until the maturity date, and the interest compounds annually. In Chula Vista, California, there are several types of promissory notes with no payment due until maturity and interest to compound annually. These include: 1. Fixed-Rate Promissory Note: This type of promissory note features a fixed interest rate, which remains constant throughout the loan term. The borrower agrees to repay the principal amount borrowed, and the interest accrues annually until the maturity date. The fixed-rate promissory note provides predictability in terms of repayment amounts for both the borrower and the lender. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, the adjustable-rate promissory note features an interest rate that can fluctuate over time. The interest rate usually aligns with a specific financial index, such as the prime rate or the Treasury Bill rate. Any changes to the interest rate will affect the annual compounding of interest until the maturity date. Borrowers opting for this type of promissory note should carefully consider the potential fluctuations in interest rates. 3. Demand Promissory Note: This type of promissory note allows the lender to demand repayment at any time. However, in the case of a Chula Vista California promissory note with no payment due until maturity and interest to compound annually, the lender cannot demand any payment until the maturity date. The borrower enjoys the benefit of deferred payments while the interest continues to compound annually until the maturity date. 4. Balloon Promissory Note: A balloon promissory note is characterized by smaller periodic payments throughout the loan term, with a larger payment due at the end, known as the "balloon payment." In the case of a Chula Vista California promissory note with no payment due until maturity and interest to compound annually, the balloon payment would only be due at maturity. This type of promissory note may be suitable for borrowers who anticipate the availability of funds to repay the loan in a lump sum at the maturity date. In summary, a Chula Vista California promissory note with no payment due until maturity and interest to compound annually is a financial agreement that allows borrowers to defer payments until the maturity date while interest compounds annually. Different types of promissory notes available in Chula Vista, California, include fixed-rate, adjustable-rate, demand, and balloon promissory notes.