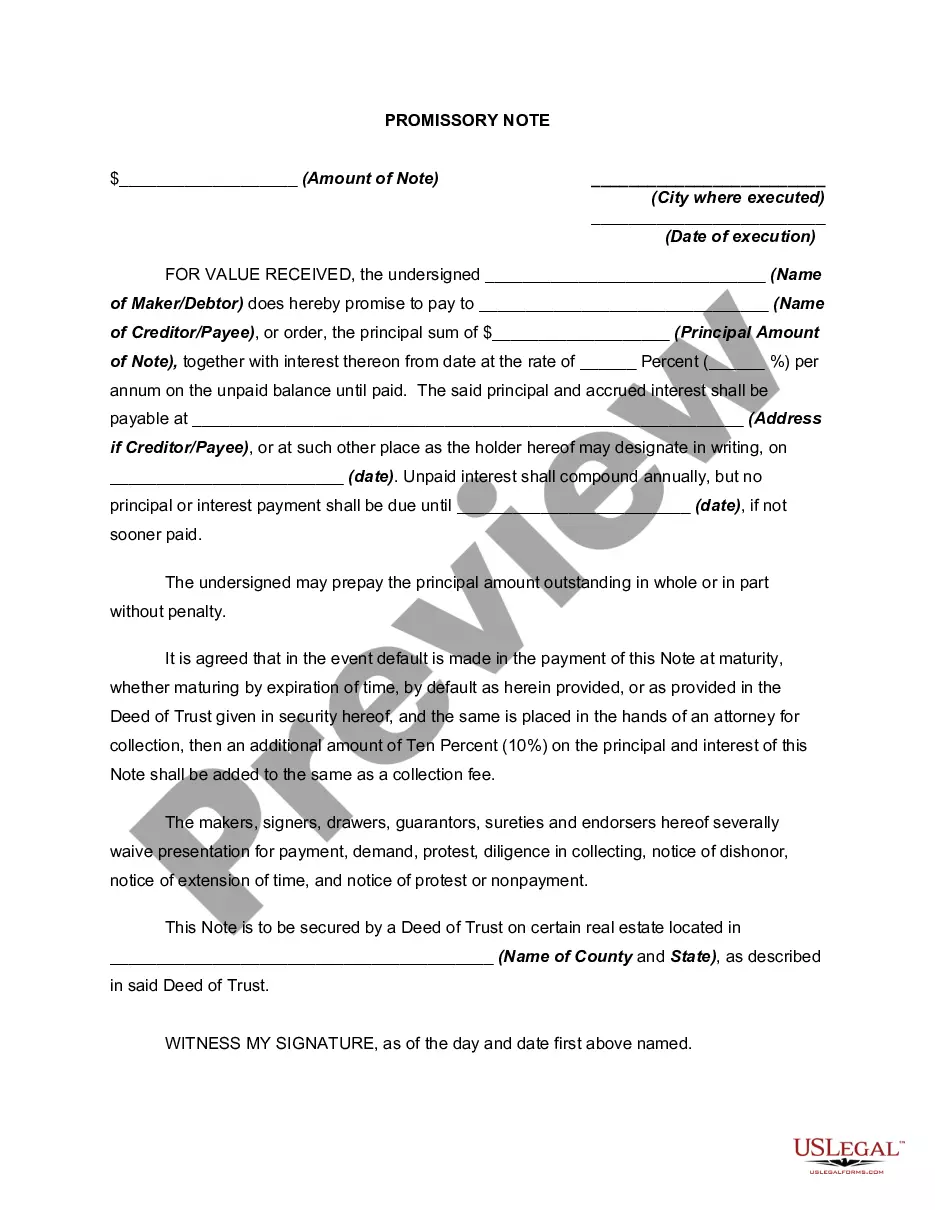

This form is a generic example that may be referred to when preparing such a form.

El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually A El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in El Cajon, California. This specific type of promissory note is characterized by its unique features that allow for deferred payments until the note's maturity date, along with the interest accruing and compounding annually. By choosing a Promissory Note with No Payment Due Until Maturity, borrowers in El Cajon, California can benefit from a flexible repayment structure. Unlike traditional loans requiring monthly or quarterly payments, this arrangement allows borrowers to postpone making any payments until the maturity date of the note. This can be advantageous for those who are experiencing temporary financial constraints or expect a significant influx of funds at a later date. Moreover, the Interest to Compound Annually provision further enhances the borrower's financial planning options. With the interest compounding annually, the overall loan balance increases over time, which means that the borrower will owe more at the end of the note term compared to the initial borrowed amount. This can be appealing for investors or borrowers who are confident in their ability to generate returns that exceed the compound interest rate. Different types of El Cajon California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually may include variations in interest rates, loan amounts, and maturity terms. It is essential for both parties involved to carefully review and agree upon these terms before finalizing the promissory note. Additionally, borrowers should be aware of any potential penalties or fees attached to late or missed payments, as well as any prepayment options available to them. In summary, an El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually provides borrowers in El Cajon with a flexible repayment structure, allowing them to defer payments until the maturity date. With interest compounding annually, this type of promissory note offers potential benefits for borrowers and lenders alike.El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually A El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in El Cajon, California. This specific type of promissory note is characterized by its unique features that allow for deferred payments until the note's maturity date, along with the interest accruing and compounding annually. By choosing a Promissory Note with No Payment Due Until Maturity, borrowers in El Cajon, California can benefit from a flexible repayment structure. Unlike traditional loans requiring monthly or quarterly payments, this arrangement allows borrowers to postpone making any payments until the maturity date of the note. This can be advantageous for those who are experiencing temporary financial constraints or expect a significant influx of funds at a later date. Moreover, the Interest to Compound Annually provision further enhances the borrower's financial planning options. With the interest compounding annually, the overall loan balance increases over time, which means that the borrower will owe more at the end of the note term compared to the initial borrowed amount. This can be appealing for investors or borrowers who are confident in their ability to generate returns that exceed the compound interest rate. Different types of El Cajon California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually may include variations in interest rates, loan amounts, and maturity terms. It is essential for both parties involved to carefully review and agree upon these terms before finalizing the promissory note. Additionally, borrowers should be aware of any potential penalties or fees attached to late or missed payments, as well as any prepayment options available to them. In summary, an El Cajon California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually provides borrowers in El Cajon with a flexible repayment structure, allowing them to defer payments until the maturity date. With interest compounding annually, this type of promissory note offers potential benefits for borrowers and lenders alike.