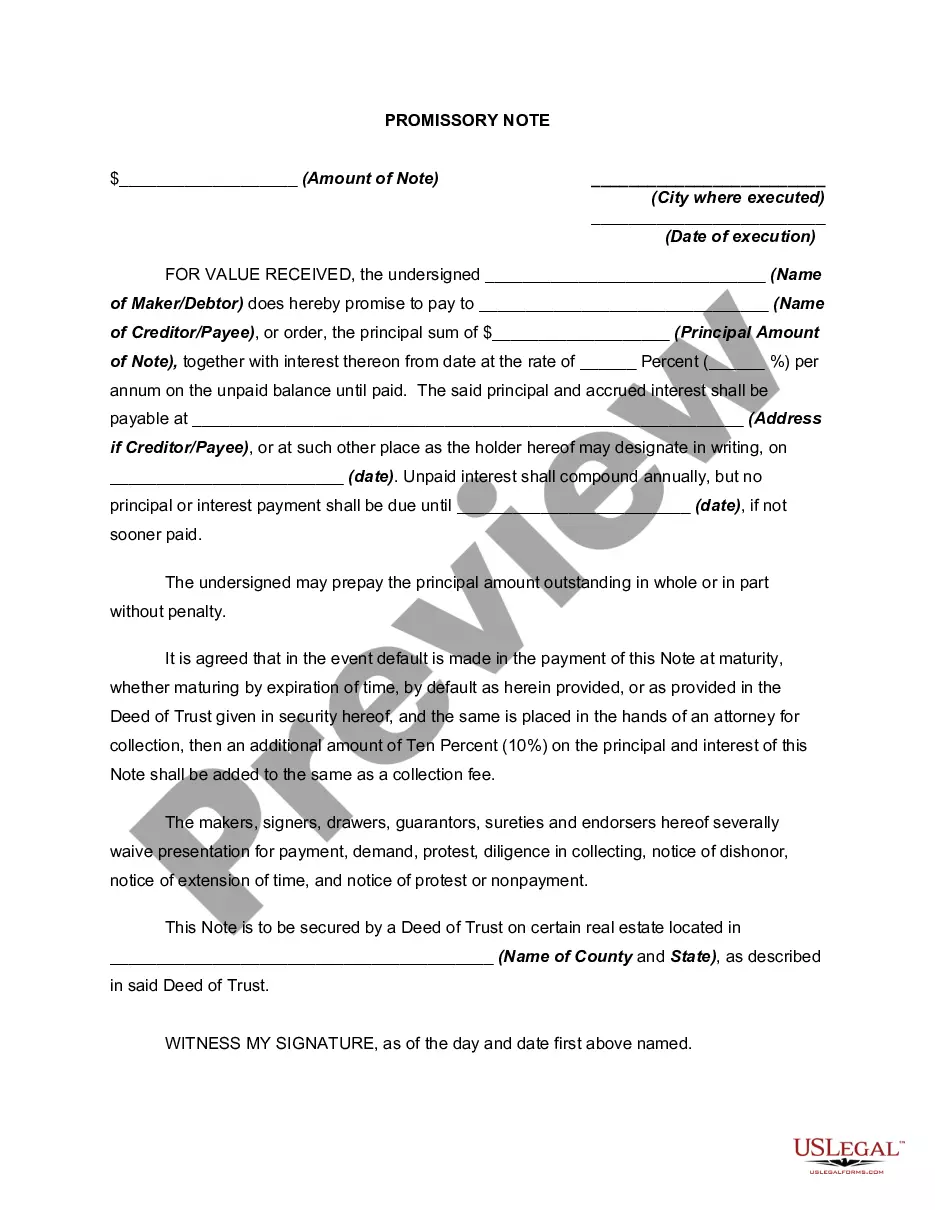

This form is a generic example that may be referred to when preparing such a form.

An Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement that outlines the terms and conditions of a loan between a borrower and a lender in Escondido, California. This type of promissory note is commonly used when the lender agrees to delay the repayment of the loan until its maturity date. Additionally, it specifies that the interest on the loan will compound annually. Keywords: Escondido California Promissory Note, No Payment Due Until Maturity, Interest to Compound Annually, loan agreement, borrower, lender, maturity date, repayment, interest compounding. There are several types of Escondido California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually, depending on the specific circumstances and requirements of the loan. Some of these variations include: 1. Personal Promissory Note: This type of promissory note is used when individuals borrow money from friends or family members. It outlines the terms of the loan, including the loan amount, interest rate, maturity date, and the agreement that no payment will be due until maturity, with interest compounding annually. 2. Business Promissory Note: Businesses often use this type of promissory note when seeking loans from private investors or financial institutions. It lays out the loan terms, such as the loan amount, interest rate, repayment schedule, and the provision that no payment will be due until maturity, with interest accumulating annually. 3. Real Estate Promissory Note: When individuals or businesses borrow money for real estate transactions, such as buying a house or investing in property development, a real estate promissory note can be used. It details the loan specifics including the amount borrowed, interest rate, maturity date, and the agreement that no payment will be due until maturity, with interest compounded annually. 4. Student Loan Promissory Note: Students seeking educational loans may enter into a promissory note with no payment due until maturity. This agreement specifies the terms of the loan, including the loan amount, interest rate, repayment options, and the provision that no payment will be due until maturity, with interest compounding annually. These variations of the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually ensure flexibility in meeting different borrowing needs while adhering to California's legal requirements and regulations. It is essential for borrowers and lenders to carefully review and comprehend the terms and conditions outlined in these promissory notes before entering into any loan agreement.An Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement that outlines the terms and conditions of a loan between a borrower and a lender in Escondido, California. This type of promissory note is commonly used when the lender agrees to delay the repayment of the loan until its maturity date. Additionally, it specifies that the interest on the loan will compound annually. Keywords: Escondido California Promissory Note, No Payment Due Until Maturity, Interest to Compound Annually, loan agreement, borrower, lender, maturity date, repayment, interest compounding. There are several types of Escondido California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually, depending on the specific circumstances and requirements of the loan. Some of these variations include: 1. Personal Promissory Note: This type of promissory note is used when individuals borrow money from friends or family members. It outlines the terms of the loan, including the loan amount, interest rate, maturity date, and the agreement that no payment will be due until maturity, with interest compounding annually. 2. Business Promissory Note: Businesses often use this type of promissory note when seeking loans from private investors or financial institutions. It lays out the loan terms, such as the loan amount, interest rate, repayment schedule, and the provision that no payment will be due until maturity, with interest accumulating annually. 3. Real Estate Promissory Note: When individuals or businesses borrow money for real estate transactions, such as buying a house or investing in property development, a real estate promissory note can be used. It details the loan specifics including the amount borrowed, interest rate, maturity date, and the agreement that no payment will be due until maturity, with interest compounded annually. 4. Student Loan Promissory Note: Students seeking educational loans may enter into a promissory note with no payment due until maturity. This agreement specifies the terms of the loan, including the loan amount, interest rate, repayment options, and the provision that no payment will be due until maturity, with interest compounding annually. These variations of the Escondido California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually ensure flexibility in meeting different borrowing needs while adhering to California's legal requirements and regulations. It is essential for borrowers and lenders to carefully review and comprehend the terms and conditions outlined in these promissory notes before entering into any loan agreement.