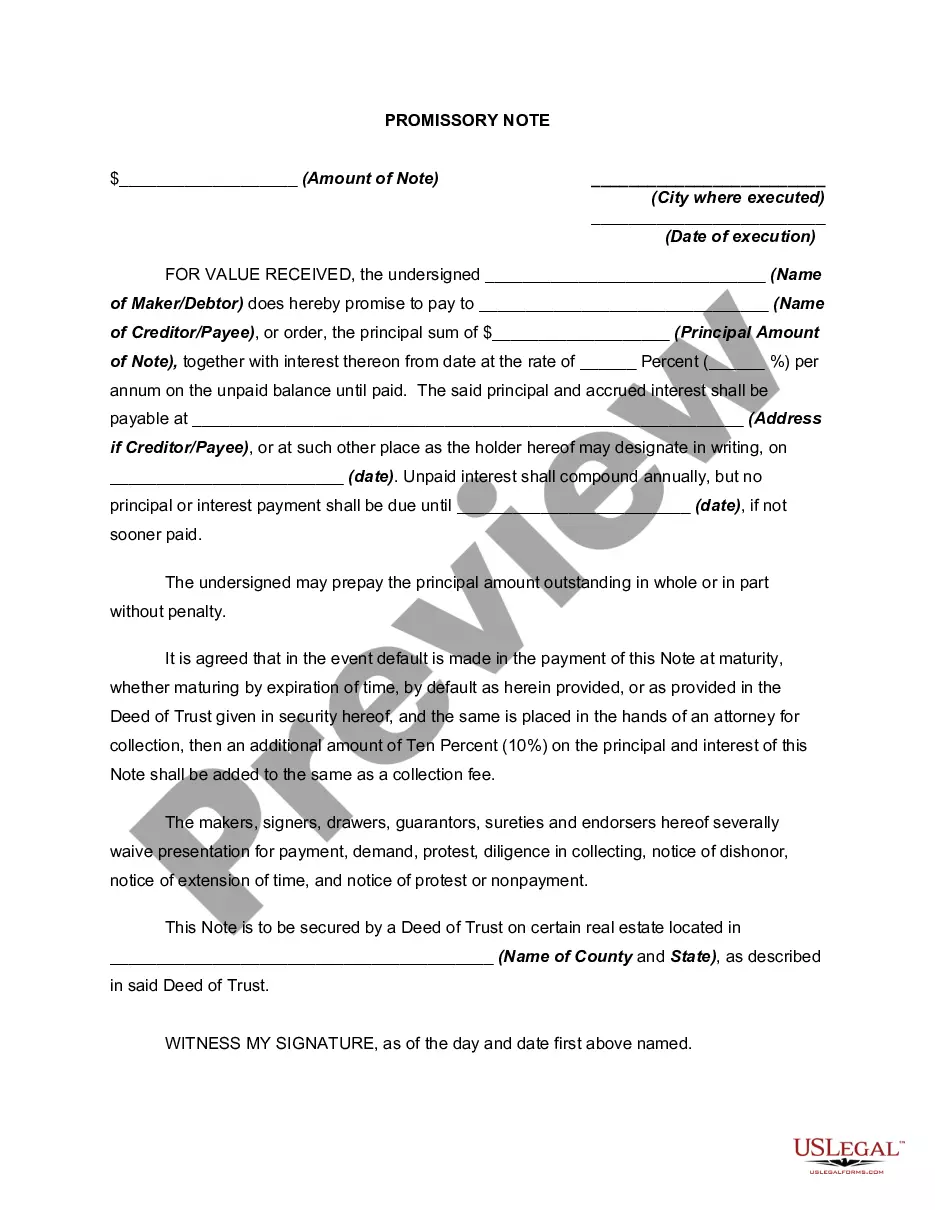

This form is a generic example that may be referred to when preparing such a form.

A Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines an agreement between a lender and a borrower in which the borrower promises to repay a specified amount of money at a future date, known as maturity, while the lender agrees not to require any payment until then. In addition, this type of promissory note includes a provision that states the interest will compound on an annual basis. This promissory note is commonly utilized in Garden Grove, California, as it allows borrowers to postpone repayment obligations until the maturity date while still accruing interest on the loan amount. This can be particularly beneficial for borrowers who are in need of immediate funds but prefer not to make regular payments. One of the main advantages of using a Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is that it provides flexibility for both the lender and borrower. Lenders may opt for this type of promissory note to attract borrowers by offering more favorable repayment terms, while borrowers can benefit from the long-term repayment structure and potential interest savings. It is important to note that there are variations of this promissory note depending on specific terms and conditions agreed upon by the parties involved. Some common types may include: 1. Fixed Interest Rate: This type of promissory note features a predetermined interest rate that remains constant throughout the loan term. The interest compounds annually, increasing the total amount owed by the borrower. 2. Variable Interest Rate: With a variable interest rate promissory note, the interest rate is subject to change based on external factors such as market fluctuations or a predetermined index. The interest still compounds annually, resulting in potential changes to the total repayment amount. 3. Installment Payments: While the primary characteristic of a promissory note with no payment due until maturity is a lack of regular payments, some variations may allow for scheduled payments in specific intervals, typically yearly or bi-annually. These payments typically cover a portion of the principal and accrued interest, reducing the total amount due at maturity. In conclusion, a Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal agreement that enables borrowers to defer payments until the maturity date, while interest continues to compound annually. Different variations of this promissory note may exist, including fixed or variable interest rates, as well as the option for scheduled installment payments.A Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines an agreement between a lender and a borrower in which the borrower promises to repay a specified amount of money at a future date, known as maturity, while the lender agrees not to require any payment until then. In addition, this type of promissory note includes a provision that states the interest will compound on an annual basis. This promissory note is commonly utilized in Garden Grove, California, as it allows borrowers to postpone repayment obligations until the maturity date while still accruing interest on the loan amount. This can be particularly beneficial for borrowers who are in need of immediate funds but prefer not to make regular payments. One of the main advantages of using a Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is that it provides flexibility for both the lender and borrower. Lenders may opt for this type of promissory note to attract borrowers by offering more favorable repayment terms, while borrowers can benefit from the long-term repayment structure and potential interest savings. It is important to note that there are variations of this promissory note depending on specific terms and conditions agreed upon by the parties involved. Some common types may include: 1. Fixed Interest Rate: This type of promissory note features a predetermined interest rate that remains constant throughout the loan term. The interest compounds annually, increasing the total amount owed by the borrower. 2. Variable Interest Rate: With a variable interest rate promissory note, the interest rate is subject to change based on external factors such as market fluctuations or a predetermined index. The interest still compounds annually, resulting in potential changes to the total repayment amount. 3. Installment Payments: While the primary characteristic of a promissory note with no payment due until maturity is a lack of regular payments, some variations may allow for scheduled payments in specific intervals, typically yearly or bi-annually. These payments typically cover a portion of the principal and accrued interest, reducing the total amount due at maturity. In conclusion, a Garden Grove California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal agreement that enables borrowers to defer payments until the maturity date, while interest continues to compound annually. Different variations of this promissory note may exist, including fixed or variable interest rates, as well as the option for scheduled installment payments.