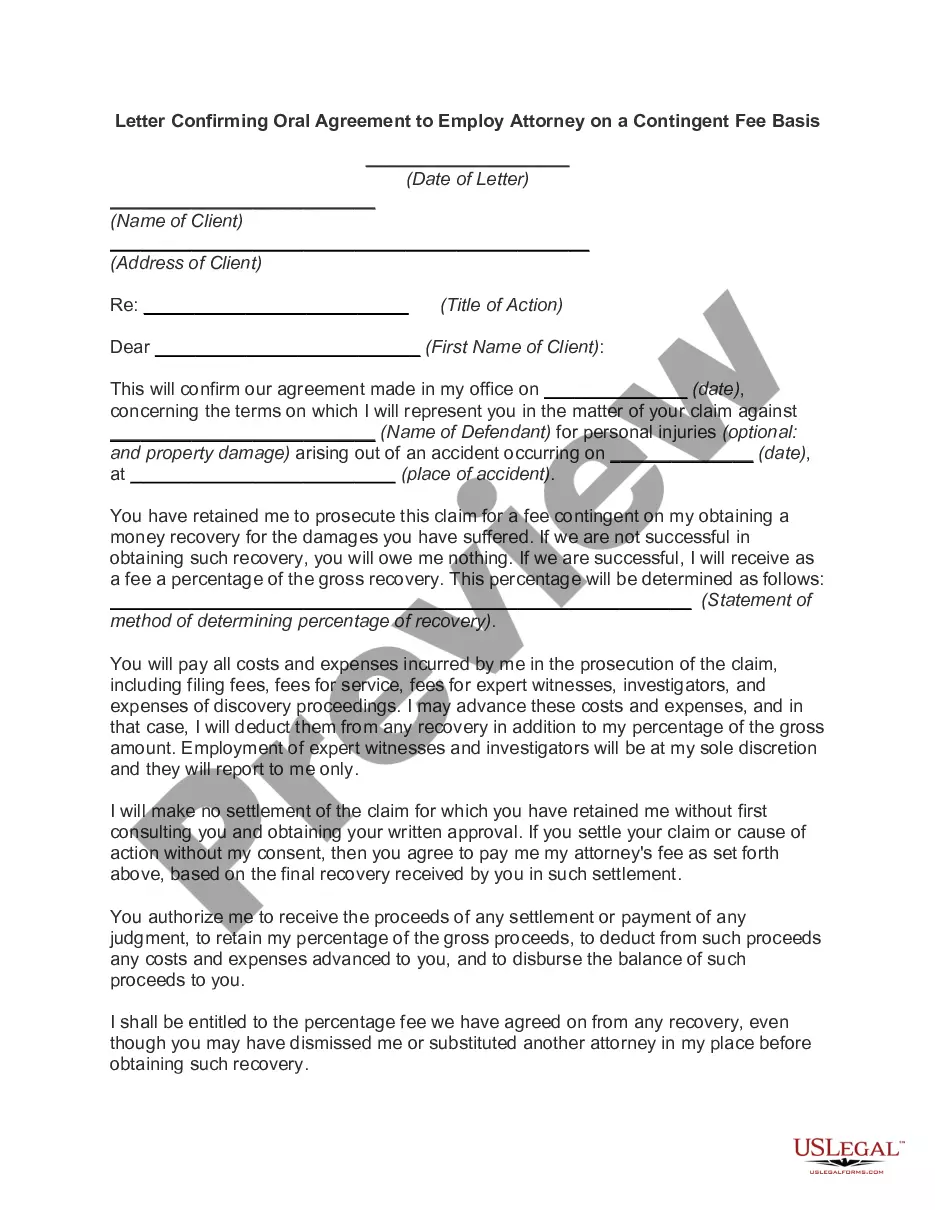

This form is a generic example that may be referred to when preparing such a form.

Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Hayward, California. This specific type of promissory note offers the benefit of deferring all payments until the maturity date, allowing the borrower to focus on other financial obligations in the meantime. In this agreement, the borrower promises to repay the principal amount borrowed on a predetermined maturity date. The promissory note also specifies that interest will compound annually, meaning that interest is calculated on the principal amount along with any accrued interest from previous years. This compounding nature of interest can significantly increase the total repayment amount over time. There are variations of Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, which include: 1. Fixed-Rate Promissory Note: This type of promissory note has a predetermined fixed interest rate that remains constant throughout the loan term. The interest rate is determined at the time of agreement and applied to the principal annually for compounding. 2. Variable-Rate Promissory Note: Unlike the fixed-rate note, this type of promissory note has an interest rate that can fluctuate over time. The interest rate is usually tied to an external benchmark, such as the prime rate or LIBOR, and changes periodically. The variable-rate nature affects the compounding of interest on an annual basis. 3. Balloon Promissory Note: This note structure allows the borrower to make no payments until maturity, similar to the main feature mentioned earlier. However, in addition to deferred payments, the balloon promissory note also includes a large final payment (often referred to as a balloon payment) due at maturity. This final payment includes the remaining principal balance and all accrued interest. The Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal contract that protects both the borrower and the lender's rights. It sets out clear repayment terms, interest rates, default provisions, and any other relevant conditions. It is crucial for both parties to thoroughly review and understand the terms of this promissory note before entering into the loan agreement. Furthermore, it is also advised to seek legal counsel to ensure compliance with state laws and regulations regarding promissory notes in Hayward, California.Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Hayward, California. This specific type of promissory note offers the benefit of deferring all payments until the maturity date, allowing the borrower to focus on other financial obligations in the meantime. In this agreement, the borrower promises to repay the principal amount borrowed on a predetermined maturity date. The promissory note also specifies that interest will compound annually, meaning that interest is calculated on the principal amount along with any accrued interest from previous years. This compounding nature of interest can significantly increase the total repayment amount over time. There are variations of Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, which include: 1. Fixed-Rate Promissory Note: This type of promissory note has a predetermined fixed interest rate that remains constant throughout the loan term. The interest rate is determined at the time of agreement and applied to the principal annually for compounding. 2. Variable-Rate Promissory Note: Unlike the fixed-rate note, this type of promissory note has an interest rate that can fluctuate over time. The interest rate is usually tied to an external benchmark, such as the prime rate or LIBOR, and changes periodically. The variable-rate nature affects the compounding of interest on an annual basis. 3. Balloon Promissory Note: This note structure allows the borrower to make no payments until maturity, similar to the main feature mentioned earlier. However, in addition to deferred payments, the balloon promissory note also includes a large final payment (often referred to as a balloon payment) due at maturity. This final payment includes the remaining principal balance and all accrued interest. The Hayward California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal contract that protects both the borrower and the lender's rights. It sets out clear repayment terms, interest rates, default provisions, and any other relevant conditions. It is crucial for both parties to thoroughly review and understand the terms of this promissory note before entering into the loan agreement. Furthermore, it is also advised to seek legal counsel to ensure compliance with state laws and regulations regarding promissory notes in Hayward, California.