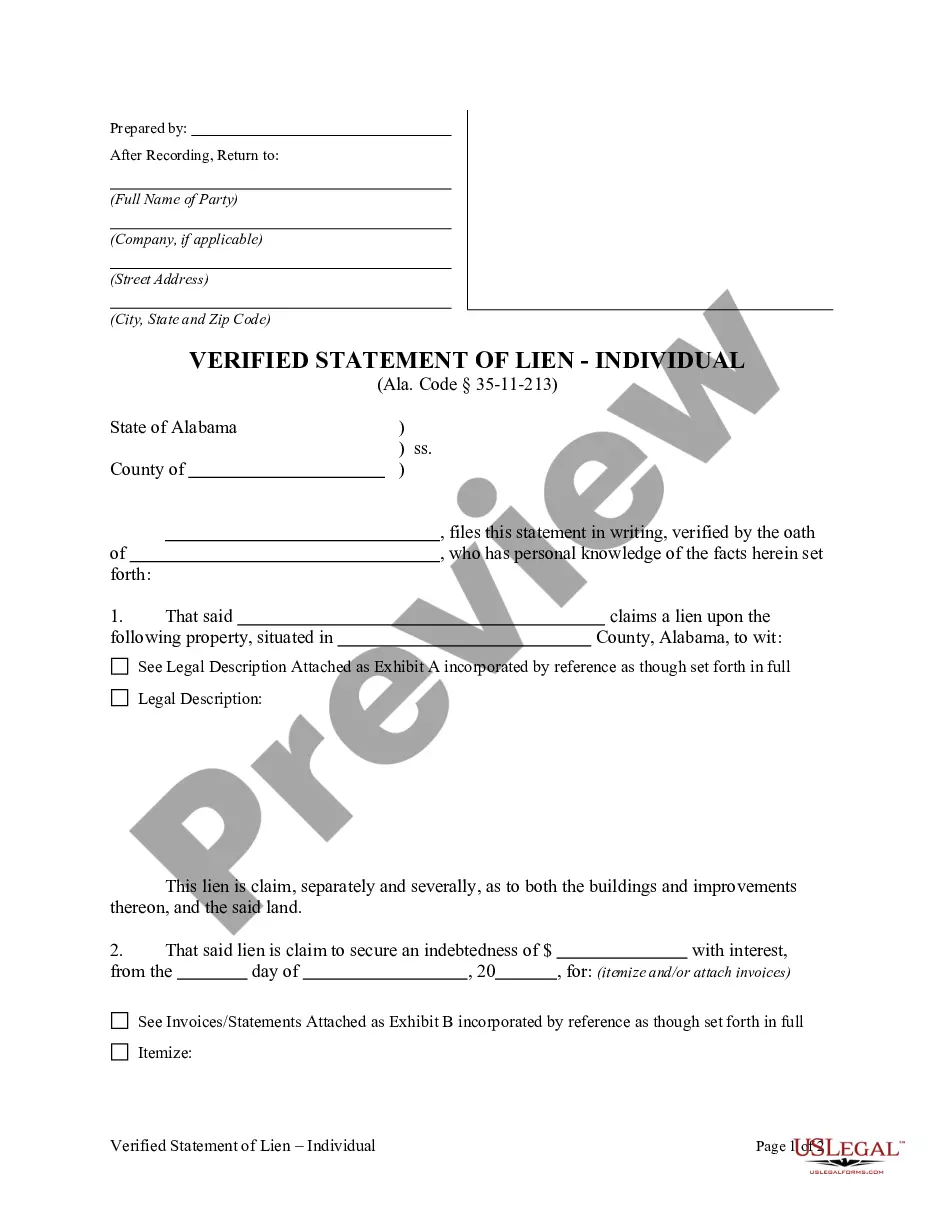

This form is a generic example that may be referred to when preparing such a form.

Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding financial instrument used in financial transactions, specifically for lending purposes. This type of promissory note allows the borrower to defer all payment obligations until the maturity date, providing flexibility and convenience for both the lender and borrower. The note underscores the agreement between the borrower and lender, outlining essential terms and conditions. One significant aspect of this particular promissory note is that the interest is compounded annually. Compound interest means that interest is accrued on the principal loan amount as well as any previously accumulated interest, resulting in a higher total repayment amount. Here's an example of what a detailed description of an Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually might look like: Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document used to record a loan agreement between a lender and borrower within the boundaries of Irvine, California. This promissory note allows the borrower to delay all payment obligations until the preset maturity date, providing them with flexibility in managing their financial resources. In addition to the deferred payments, this promissory note incorporates an annual compounding interest structure. This means that interest is calculated and accumulated on both the principal loan amount and any previously accrued interest. As a result, the borrower will ultimately repay a higher amount than the original principal, reflecting the compounded interest. Different types of Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may include variations such as adjustable interest rates, fixed interest rates, or even balloon payment options. With an adjustable interest rate, the interest percentage may change periodically based on underlying economic factors, while a fixed interest rate remains constant throughout the loan's term. A balloon payment option allows the borrower to defer all payments, including interest, until the maturity date, at which point a substantial final payment is due. In conclusion, an Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a beneficial financial tool for lenders and borrowers alike. It offers the borrower the flexibility to defer any payments until the agreed-upon maturity date while ensuring the lender's interests are safeguarded through the annual compounding of interest. Different variations of this promissory note may exist to accommodate specific loan terms or borrower requirements.Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding financial instrument used in financial transactions, specifically for lending purposes. This type of promissory note allows the borrower to defer all payment obligations until the maturity date, providing flexibility and convenience for both the lender and borrower. The note underscores the agreement between the borrower and lender, outlining essential terms and conditions. One significant aspect of this particular promissory note is that the interest is compounded annually. Compound interest means that interest is accrued on the principal loan amount as well as any previously accumulated interest, resulting in a higher total repayment amount. Here's an example of what a detailed description of an Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually might look like: Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document used to record a loan agreement between a lender and borrower within the boundaries of Irvine, California. This promissory note allows the borrower to delay all payment obligations until the preset maturity date, providing them with flexibility in managing their financial resources. In addition to the deferred payments, this promissory note incorporates an annual compounding interest structure. This means that interest is calculated and accumulated on both the principal loan amount and any previously accrued interest. As a result, the borrower will ultimately repay a higher amount than the original principal, reflecting the compounded interest. Different types of Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually may include variations such as adjustable interest rates, fixed interest rates, or even balloon payment options. With an adjustable interest rate, the interest percentage may change periodically based on underlying economic factors, while a fixed interest rate remains constant throughout the loan's term. A balloon payment option allows the borrower to defer all payments, including interest, until the maturity date, at which point a substantial final payment is due. In conclusion, an Irvine California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a beneficial financial tool for lenders and borrowers alike. It offers the borrower the flexibility to defer any payments until the agreed-upon maturity date while ensuring the lender's interests are safeguarded through the annual compounding of interest. Different variations of this promissory note may exist to accommodate specific loan terms or borrower requirements.