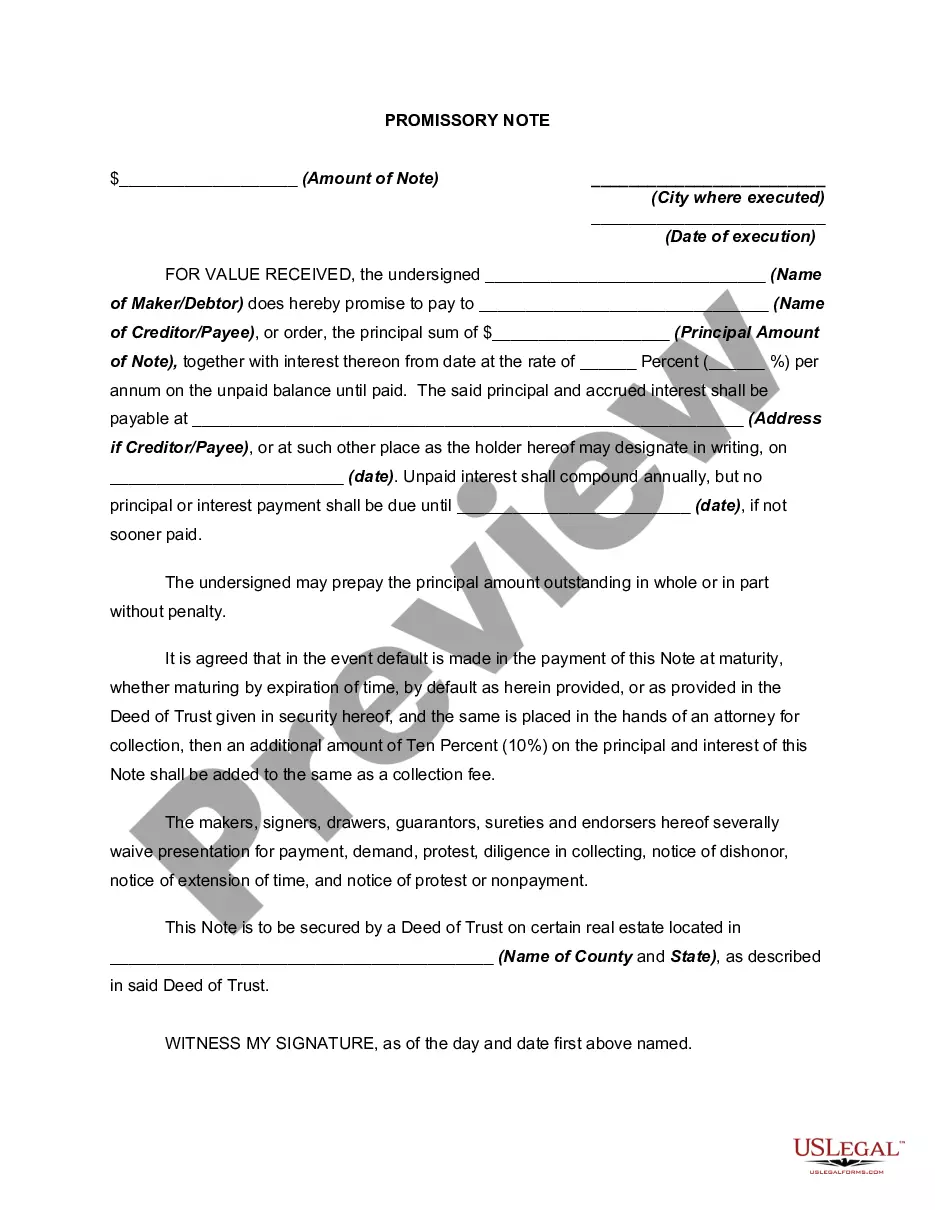

This form is a generic example that may be referred to when preparing such a form.

An Orange California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower within the city of Orange, California. This type of promissory note is characterized by several key features, including the absence of mandatory payments until the loan reaches its maturity date and the accrual of interest compounded annually. In this arrangement, the borrower acknowledges their debt to the lender and promises to repay the principal amount borrowed at a future date specified in the promissory note. Unlike traditional promissory notes that require periodic payments, this specific type allows the borrower to defer all payments until the maturity date, enabling them to channel their resources elsewhere during the loan term. The interest on this Orange California Promissory Note compounds annually, meaning that the interest accrued in each year is added to the principal amount to calculate the interest for the subsequent year. This compounding interest structure can have significant implications for the final repayment amount, potentially increasing the total amount owed as compared to a simple interest structure. While the basic features of this promissory note variant are consistent, there may be various iterations or subtypes available based on the specific preferences of the lender and borrower. It is important to consult a legal professional or seek guidance from a financial institution to fully understand the nuances of each variant and ensure compliance with applicable laws and regulations. Overall, an Orange California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually provides borrowers with flexibility in their payment schedules, allowing them to manage their financial obligations more effectively. However, borrowers must carefully consider the potential impact of annual compounding interest and ensure they have a solid repayment plan in place to honor their obligations when the maturity date arrives.An Orange California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower within the city of Orange, California. This type of promissory note is characterized by several key features, including the absence of mandatory payments until the loan reaches its maturity date and the accrual of interest compounded annually. In this arrangement, the borrower acknowledges their debt to the lender and promises to repay the principal amount borrowed at a future date specified in the promissory note. Unlike traditional promissory notes that require periodic payments, this specific type allows the borrower to defer all payments until the maturity date, enabling them to channel their resources elsewhere during the loan term. The interest on this Orange California Promissory Note compounds annually, meaning that the interest accrued in each year is added to the principal amount to calculate the interest for the subsequent year. This compounding interest structure can have significant implications for the final repayment amount, potentially increasing the total amount owed as compared to a simple interest structure. While the basic features of this promissory note variant are consistent, there may be various iterations or subtypes available based on the specific preferences of the lender and borrower. It is important to consult a legal professional or seek guidance from a financial institution to fully understand the nuances of each variant and ensure compliance with applicable laws and regulations. Overall, an Orange California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually provides borrowers with flexibility in their payment schedules, allowing them to manage their financial obligations more effectively. However, borrowers must carefully consider the potential impact of annual compounding interest and ensure they have a solid repayment plan in place to honor their obligations when the maturity date arrives.