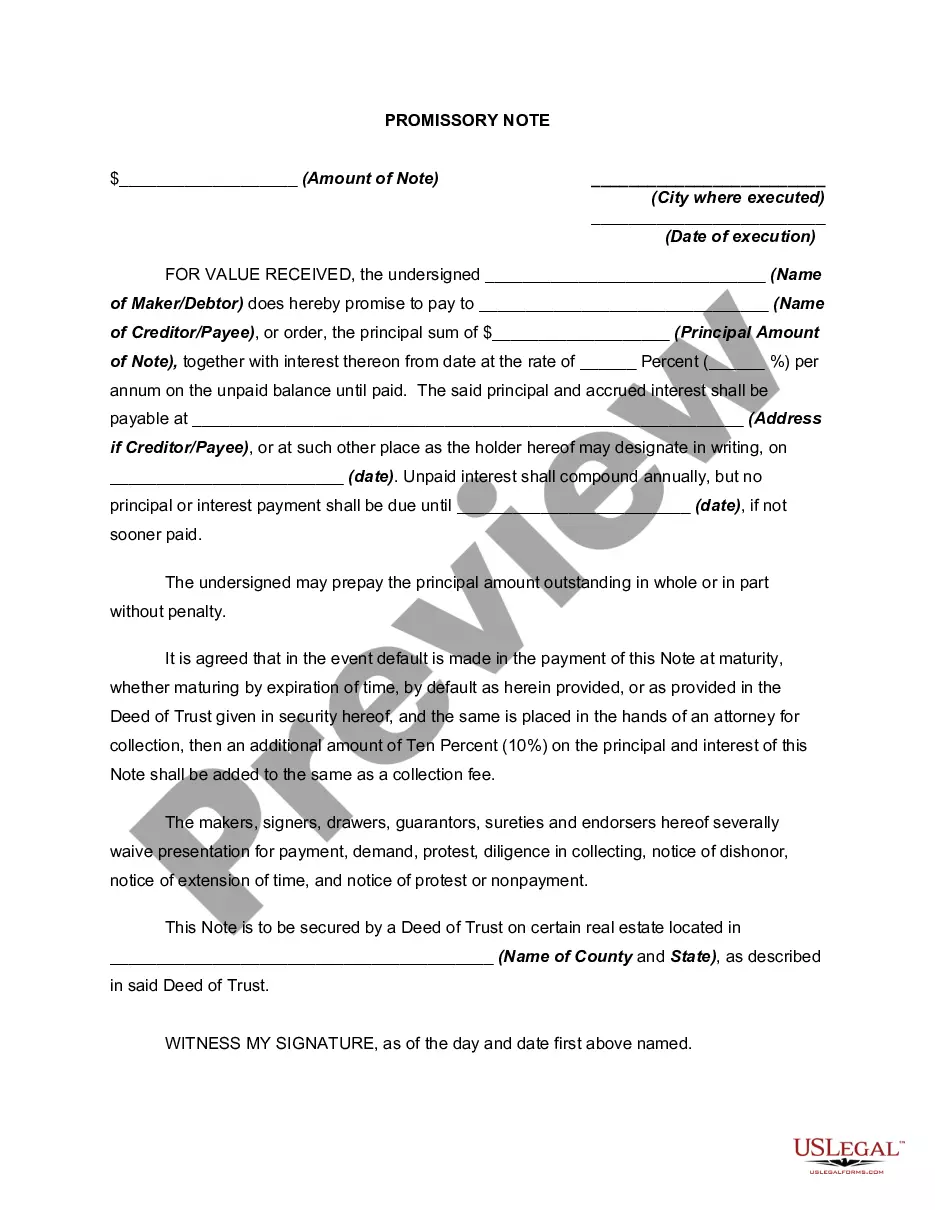

This form is a generic example that may be referred to when preparing such a form.

The Oxnard California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Oxnard, California. This specific type of promissory note offers unique features that make it advantageous for both parties involved. In this promissory note, the borrower is not required to make any payments towards the loan until its maturity date, which is predetermined and specified in the agreement. This flexibility provides the borrower with more financial freedom during the loan term, allowing them to allocate their resources towards other pressing needs. Additionally, the promissory note specifies that the interest on the loan will compound annually. Compound interest is advantageous for lenders as it allows them to earn interest not only on the initial loan amount but also on the accumulated interest over time. This means that the borrower will accrue more interest as time progresses, potentially increasing the overall repayment amount. In Oxnard, California, there may be variations of the Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually based on specific circumstances and requirements. Some possible types of these promissory notes include: 1. Personal Promissory Note: This type of promissory note is used when an individual borrows money from another individual, often for personal reasons such as education, medical expenses, or debt consolidation. 2. Business Promissory Note: This promissory note is utilized when a business entity borrows money from an individual or another business entity. It is commonly used for financing business operations, purchasing assets, or expanding business activities. 3. Real Estate Promissory Note: This promissory note is employed in real estate transactions, where a borrower secures a loan to purchase or refinance property. These notes typically include provisions specific to real estate, such as mortgage or lien details. 4. Secured Promissory Note: In this type of promissory note, the loan is backed by collateral, such as a valuable asset (e.g., a vehicle, property, or equipment). The lender holds the right to seize the collateral if the borrower fails to repay the loan as per the agreed terms. It is essential to consult with a professional or seek legal advice when entering into any promissory note agreement, including the Oxnard California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. This ensures that both parties fully understand their obligations and rights, helping to protect their financial interests.The Oxnard California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Oxnard, California. This specific type of promissory note offers unique features that make it advantageous for both parties involved. In this promissory note, the borrower is not required to make any payments towards the loan until its maturity date, which is predetermined and specified in the agreement. This flexibility provides the borrower with more financial freedom during the loan term, allowing them to allocate their resources towards other pressing needs. Additionally, the promissory note specifies that the interest on the loan will compound annually. Compound interest is advantageous for lenders as it allows them to earn interest not only on the initial loan amount but also on the accumulated interest over time. This means that the borrower will accrue more interest as time progresses, potentially increasing the overall repayment amount. In Oxnard, California, there may be variations of the Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually based on specific circumstances and requirements. Some possible types of these promissory notes include: 1. Personal Promissory Note: This type of promissory note is used when an individual borrows money from another individual, often for personal reasons such as education, medical expenses, or debt consolidation. 2. Business Promissory Note: This promissory note is utilized when a business entity borrows money from an individual or another business entity. It is commonly used for financing business operations, purchasing assets, or expanding business activities. 3. Real Estate Promissory Note: This promissory note is employed in real estate transactions, where a borrower secures a loan to purchase or refinance property. These notes typically include provisions specific to real estate, such as mortgage or lien details. 4. Secured Promissory Note: In this type of promissory note, the loan is backed by collateral, such as a valuable asset (e.g., a vehicle, property, or equipment). The lender holds the right to seize the collateral if the borrower fails to repay the loan as per the agreed terms. It is essential to consult with a professional or seek legal advice when entering into any promissory note agreement, including the Oxnard California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually. This ensures that both parties fully understand their obligations and rights, helping to protect their financial interests.