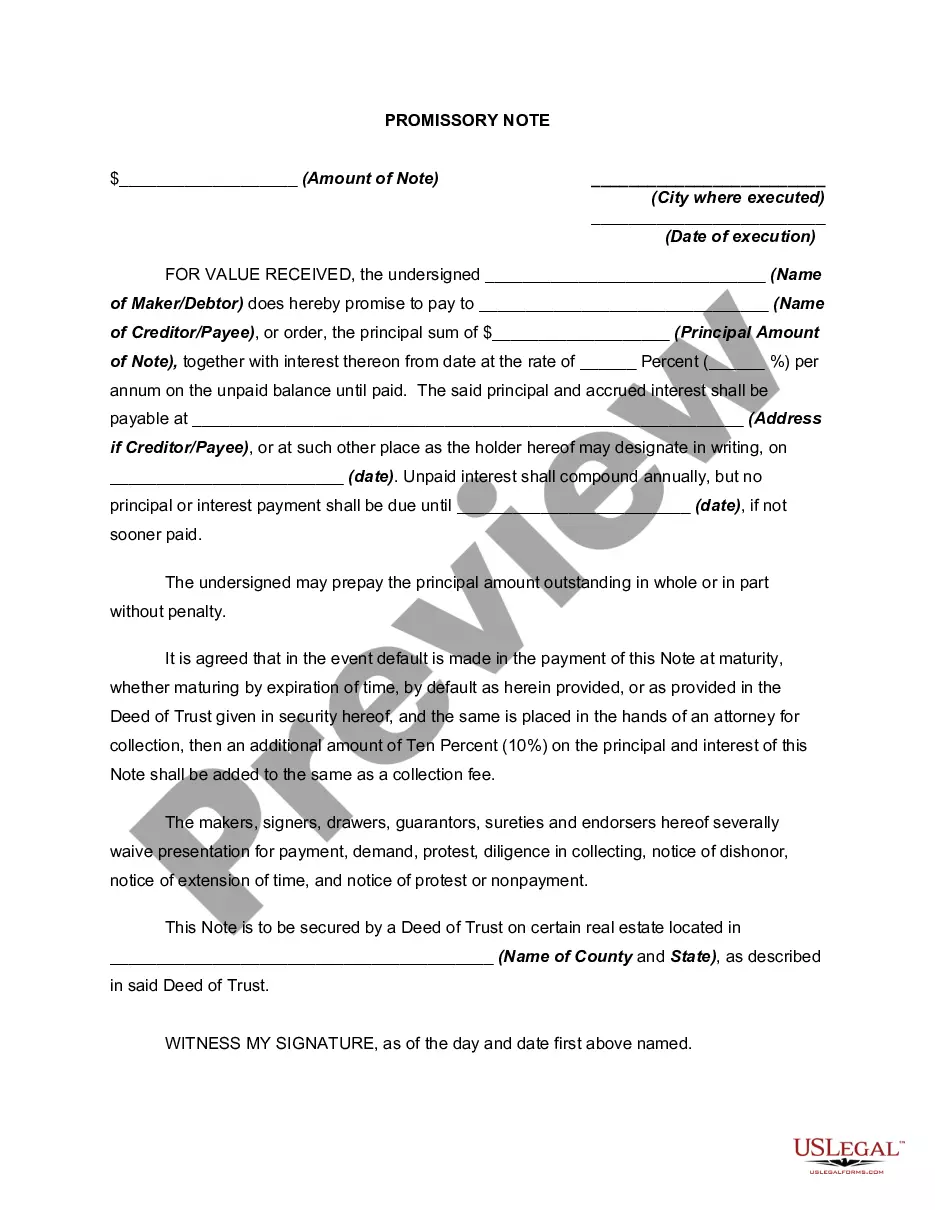

This form is a generic example that may be referred to when preparing such a form.

A Rancho Cucamonga California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding contract between a lender and a borrower in Rancho Cucamonga, California. This type of promissory note allows the borrower to defer any payments until the maturity date, at which point the principal amount and accumulated interest are due in full. The interest on the promissory note is compounded annually, meaning it is added to the principal amount each year, leading to an increased total repayment amount. There are various types of Rancho Cucamonga California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, designed to cater to different borrowing needs and preferences. Some common types include: 1. Fixed-Rate Promissory Note: This type of promissory note offers a fixed interest rate throughout the loan term. Borrowers know exactly how much interest they need to pay annually, allowing for better financial planning. 2. Adjustable-Rate Promissory Note: With an adjustable-rate promissory note, the interest rate is subject to change during the loan term. This can be beneficial if interest rates decrease, as borrowers may end up with lower annual interest payments. 3. Balloon Promissory Note: A balloon promissory note is characterized by a significantly larger final payment (the balloon payment) due at maturity. This type of note allows borrowers to make smaller or no payments until maturity, but they must be prepared to make a substantial lump sum payment at the end. 4. Installment Promissory Note: Unlike the previously mentioned types, an installment promissory note requires regular payments throughout the loan term. However, even with this type, the interest is typically deferred until the maturity date, allowing for smaller payments during the loan period. It is important for both lenders and borrowers in Rancho Cucamonga, California, to carefully consider their financial situation and loan requirements before entering into any type of promissory note agreement. Consulting with a legal professional can provide valuable guidance and ensure compliance with local laws and regulations.A Rancho Cucamonga California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding contract between a lender and a borrower in Rancho Cucamonga, California. This type of promissory note allows the borrower to defer any payments until the maturity date, at which point the principal amount and accumulated interest are due in full. The interest on the promissory note is compounded annually, meaning it is added to the principal amount each year, leading to an increased total repayment amount. There are various types of Rancho Cucamonga California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually, designed to cater to different borrowing needs and preferences. Some common types include: 1. Fixed-Rate Promissory Note: This type of promissory note offers a fixed interest rate throughout the loan term. Borrowers know exactly how much interest they need to pay annually, allowing for better financial planning. 2. Adjustable-Rate Promissory Note: With an adjustable-rate promissory note, the interest rate is subject to change during the loan term. This can be beneficial if interest rates decrease, as borrowers may end up with lower annual interest payments. 3. Balloon Promissory Note: A balloon promissory note is characterized by a significantly larger final payment (the balloon payment) due at maturity. This type of note allows borrowers to make smaller or no payments until maturity, but they must be prepared to make a substantial lump sum payment at the end. 4. Installment Promissory Note: Unlike the previously mentioned types, an installment promissory note requires regular payments throughout the loan term. However, even with this type, the interest is typically deferred until the maturity date, allowing for smaller payments during the loan period. It is important for both lenders and borrowers in Rancho Cucamonga, California, to carefully consider their financial situation and loan requirements before entering into any type of promissory note agreement. Consulting with a legal professional can provide valuable guidance and ensure compliance with local laws and regulations.