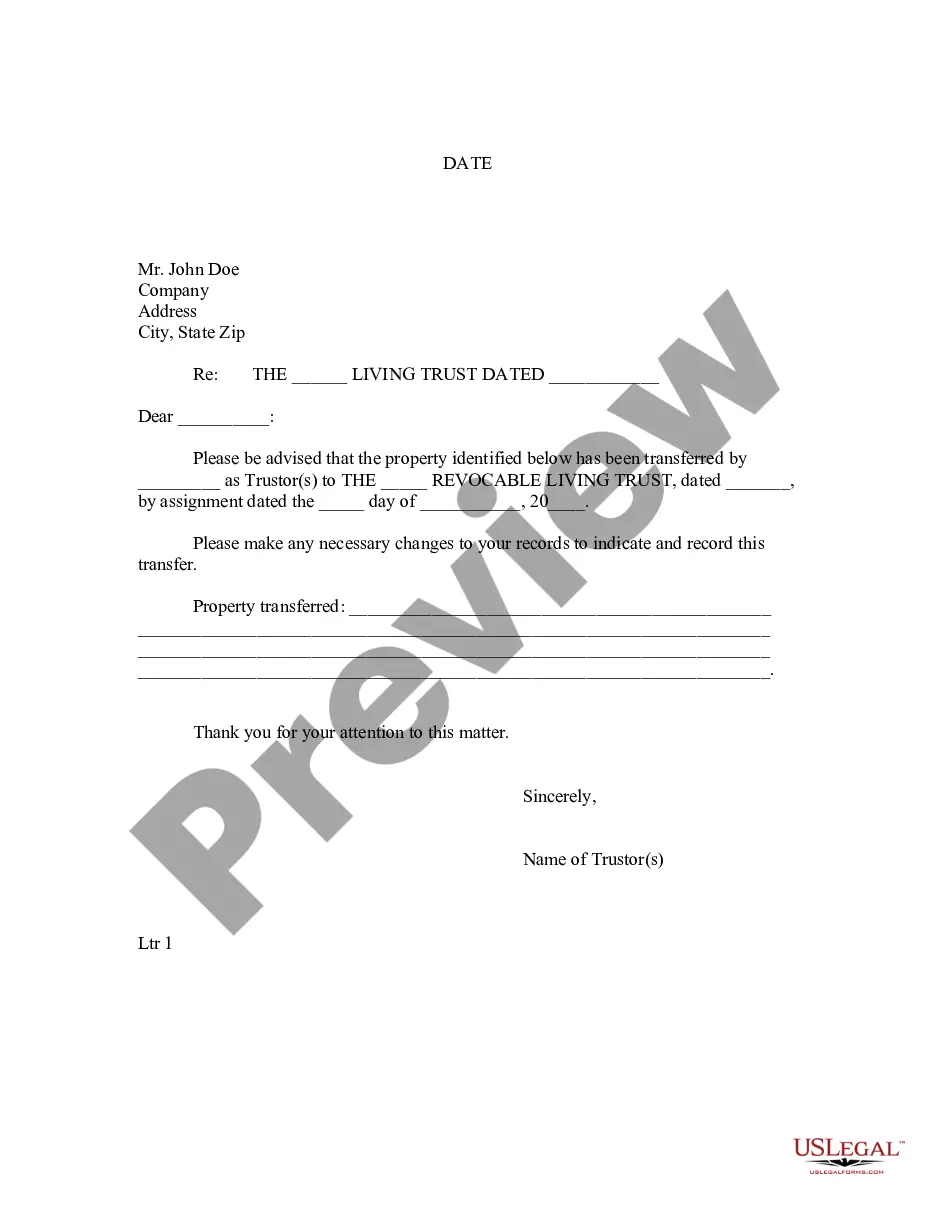

This form is a generic example that may be referred to when preparing such a form.

A Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms of a loan agreement between a lender and a borrower in Santa Ana, California. This type of promissory note enables the borrower to defer making any payments on the loan until the maturity date, at which point the entire loan amount, along with the accrued interest, becomes due. With this Promissory Note, the interest is calculated to compound annually, meaning that the interest earned or charged on the loan is added to the principal amount at the end of each year. This ensures that interest payments accumulate and grow over time until the loan reaches maturity. This type of promissory note can be used for various purposes such as personal loans, business loans, or real estate transactions. It provides flexibility for borrowers who may not have the means to make regular payments during the loan term but are confident in their ability to repay the loan amount in full by the maturity date. Although the Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually mostly adheres to the general structure, it may have some variations to cater to specific circumstances. For instance, there could be variations in regard to the interest rate, repayment schedule, or collateral arrangement. Some other types of Santa Ana California Promissory Notes that share similarities but have slight differences in terms include: 1. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Semi-Annually: In this case, the interest would be calculated and added to the principal twice a year instead of annually. 2. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Quarterly: With quarterly compounding, the interest would be added to the principal every three months. 3. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Monthly: This variation involves monthly compounding, where the interest is added to the principal at the end of each month. These variations allow borrowers and lenders to choose a promissory note that best suits their needs, taking into consideration factors such as loan duration, interest rates, and tax implications. It's important for both parties involved in a Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually to fully understand and agree upon the terms before signing the document. Consulting with a legal professional or financial advisor can provide valuable guidance to ensure the agreement aligns with the borrower's repayment capacity and the lender's expectations.A Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legal document that outlines the terms of a loan agreement between a lender and a borrower in Santa Ana, California. This type of promissory note enables the borrower to defer making any payments on the loan until the maturity date, at which point the entire loan amount, along with the accrued interest, becomes due. With this Promissory Note, the interest is calculated to compound annually, meaning that the interest earned or charged on the loan is added to the principal amount at the end of each year. This ensures that interest payments accumulate and grow over time until the loan reaches maturity. This type of promissory note can be used for various purposes such as personal loans, business loans, or real estate transactions. It provides flexibility for borrowers who may not have the means to make regular payments during the loan term but are confident in their ability to repay the loan amount in full by the maturity date. Although the Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually mostly adheres to the general structure, it may have some variations to cater to specific circumstances. For instance, there could be variations in regard to the interest rate, repayment schedule, or collateral arrangement. Some other types of Santa Ana California Promissory Notes that share similarities but have slight differences in terms include: 1. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Semi-Annually: In this case, the interest would be calculated and added to the principal twice a year instead of annually. 2. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Quarterly: With quarterly compounding, the interest would be added to the principal every three months. 3. Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Monthly: This variation involves monthly compounding, where the interest is added to the principal at the end of each month. These variations allow borrowers and lenders to choose a promissory note that best suits their needs, taking into consideration factors such as loan duration, interest rates, and tax implications. It's important for both parties involved in a Santa Ana California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually to fully understand and agree upon the terms before signing the document. Consulting with a legal professional or financial advisor can provide valuable guidance to ensure the agreement aligns with the borrower's repayment capacity and the lender's expectations.