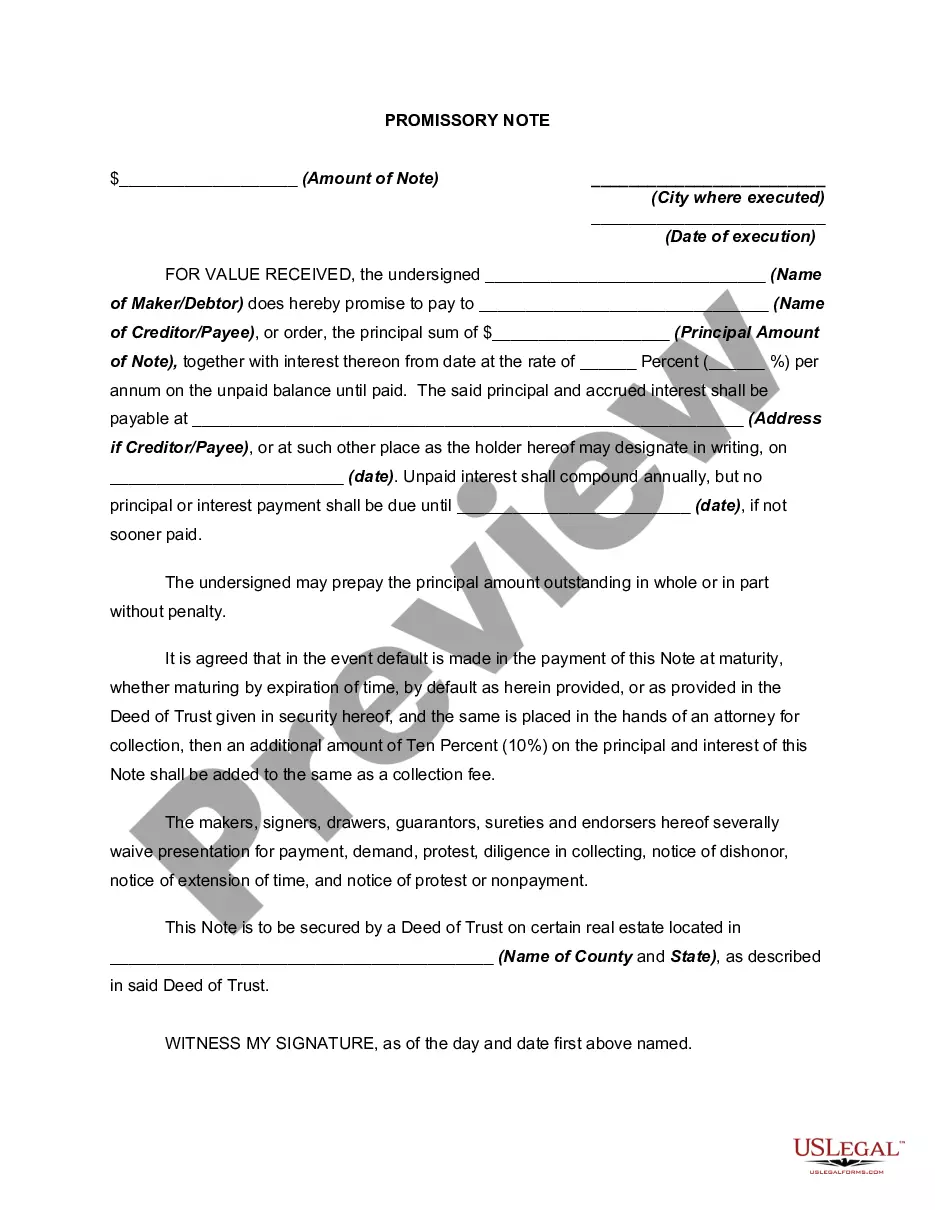

This form is a generic example that may be referred to when preparing such a form.

A Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding contract that outlines the terms and conditions between a borrower and a lender in Stockton, California. This type of promissory note is unique as it allows the borrower to defer any payments until the maturity date, while interest continues to accrue and compound annually. This promissory note is an effective tool for individuals or businesses seeking additional funds but require more flexibility in repaying the borrowed amount. It offers a win-win situation for both parties involved. The borrower gets the much-needed financial support without the immediate burden of making regular payments, while the lender earns interest on the outstanding balance, compounding annually. Considering the different types of Stockton California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually, several variations exist to cater to the specific needs and preferences of parties involved. Let's explore some of these variations: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate, agreed upon by the borrower and the lender, which remains unchanged throughout the loan term. It ensures a consistent annual compounding on the outstanding balance until the maturity date. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, this variation allows the interest rate to adjust periodically based on pre-defined factors, such as market conditions or an index. Here, the compounding of interest would vary annually, reflecting the adjusted interest rate. 3. Secured Promissory Note: In this context, the promissory note is secured with collateral, such as property, vehicles, or other valuable assets owned by the borrower. By providing security, the lender mitigates risk and may offer better terms, such as a lower interest rate or longer maturity period. 4. Unsecured Promissory Note: Unlike the secured promissory note, this variant does not require collateral to back the borrowed amount. Therefore, lenders may impose higher interest rates to compensate for the increased risk associated with lending without security. 5. Installment Promissory Note: While the previously mentioned variations allow for no payments until maturity, an installment promissory note divides the loan amount into regular payment installments, along with compounded interest, until the maturity date. This type of note is suitable for borrowers who prefer a structured repayment plan. Ultimately, the choice of promissory note type depends on the specific needs and preferences of the borrower and lender. It is important to consult legal and financial professionals to ensure the promissory note is drafted accurately, reflecting the agreed terms and abiding by the applicable laws and regulations in Stockton, California.A Stockton California Promissory Note with No Payment Due Until Maturity and Interest to Compound Annually is a legally binding contract that outlines the terms and conditions between a borrower and a lender in Stockton, California. This type of promissory note is unique as it allows the borrower to defer any payments until the maturity date, while interest continues to accrue and compound annually. This promissory note is an effective tool for individuals or businesses seeking additional funds but require more flexibility in repaying the borrowed amount. It offers a win-win situation for both parties involved. The borrower gets the much-needed financial support without the immediate burden of making regular payments, while the lender earns interest on the outstanding balance, compounding annually. Considering the different types of Stockton California Promissory Notes with No Payment Due Until Maturity and Interest to Compound Annually, several variations exist to cater to the specific needs and preferences of parties involved. Let's explore some of these variations: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate, agreed upon by the borrower and the lender, which remains unchanged throughout the loan term. It ensures a consistent annual compounding on the outstanding balance until the maturity date. 2. Adjustable-Rate Promissory Note: Unlike the fixed-rate promissory note, this variation allows the interest rate to adjust periodically based on pre-defined factors, such as market conditions or an index. Here, the compounding of interest would vary annually, reflecting the adjusted interest rate. 3. Secured Promissory Note: In this context, the promissory note is secured with collateral, such as property, vehicles, or other valuable assets owned by the borrower. By providing security, the lender mitigates risk and may offer better terms, such as a lower interest rate or longer maturity period. 4. Unsecured Promissory Note: Unlike the secured promissory note, this variant does not require collateral to back the borrowed amount. Therefore, lenders may impose higher interest rates to compensate for the increased risk associated with lending without security. 5. Installment Promissory Note: While the previously mentioned variations allow for no payments until maturity, an installment promissory note divides the loan amount into regular payment installments, along with compounded interest, until the maturity date. This type of note is suitable for borrowers who prefer a structured repayment plan. Ultimately, the choice of promissory note type depends on the specific needs and preferences of the borrower and lender. It is important to consult legal and financial professionals to ensure the promissory note is drafted accurately, reflecting the agreed terms and abiding by the applicable laws and regulations in Stockton, California.