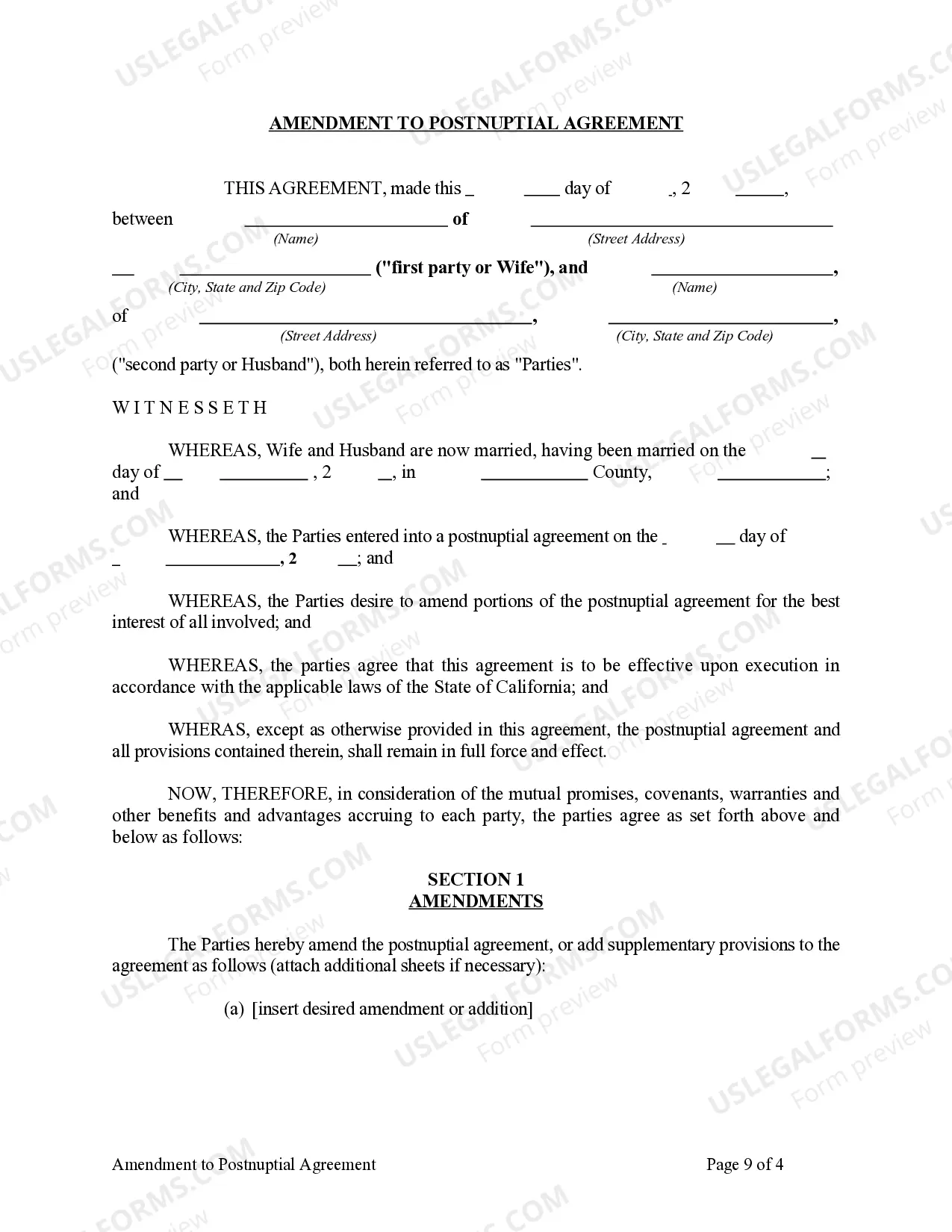

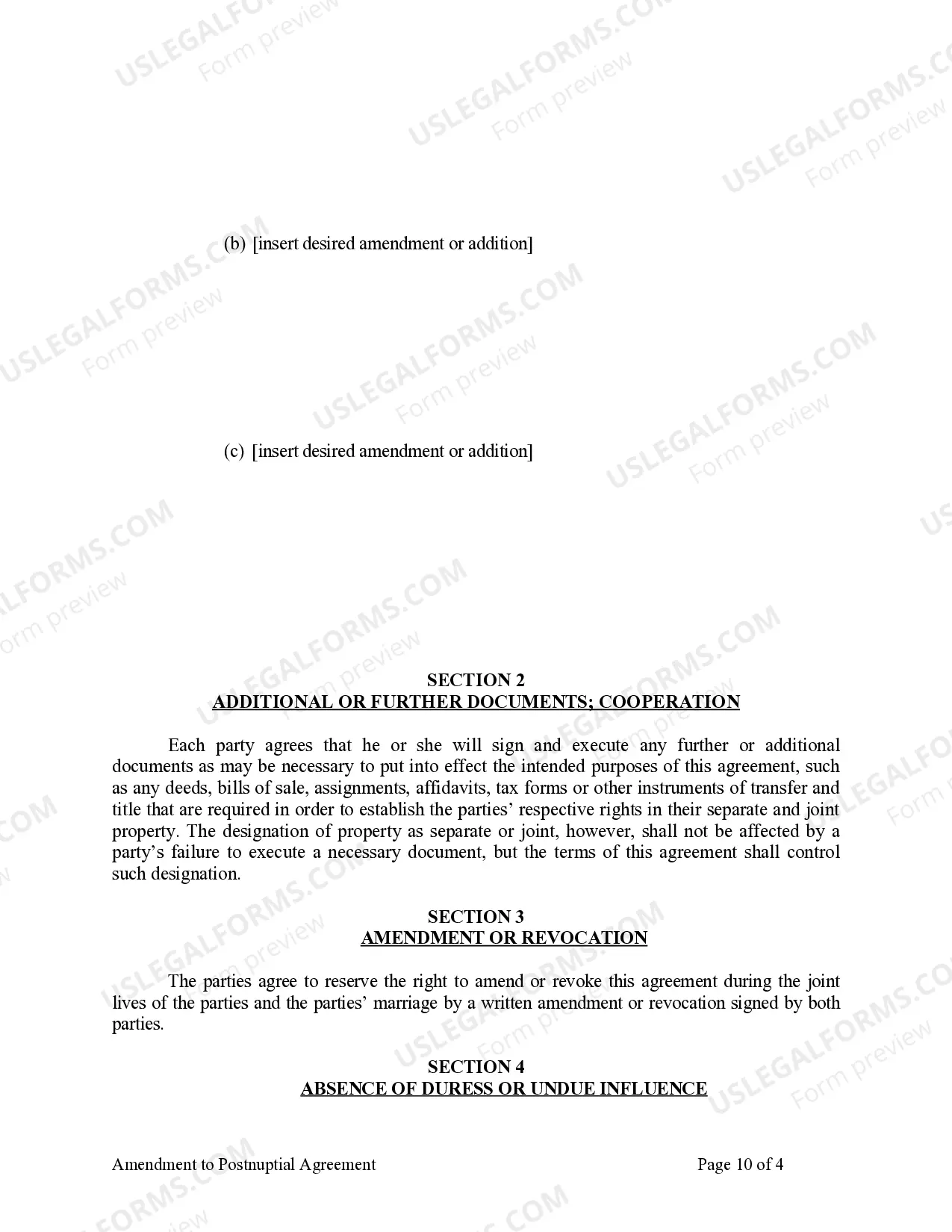

The Pomona Amendment to Postnuptial Property Agreement is an important legal provision in California designed to safeguard the rights and interests of couples in the event of a divorce or separation. In this detailed description, we will explore the purpose, provisions, and various types of the Pomona Amendment, providing a comprehensive understanding of its significance in California family law. The Pomona Amendment serves as an addendum or modification to an existing postnuptial property agreement, also known as a postmarital agreement. This agreement is typically entered into after the couple gets married and outlines the distribution and ownership of assets and debts in the event of a divorce or death. It allows couples to customize their property rights and obligations, providing clarity and preventing disputes during a potentially challenging time. California is a community property state, meaning that in the absence of a prenuptial or postnuptial agreement, assets acquired during the marriage are generally divided equally between the spouses upon divorce. However, the Pomona Amendment offers an opportunity to alter this default rule and develop a more tailored property agreement that aligns with the unique needs and circumstances of the couple. One significant aspect of the Pomona Amendment is that it provides an opportunity for couples to convert community property into separate property or vice versa. This conversion can apply to various types of assets, such as real estate, investments, businesses, or personal belongings. By converting these assets, couples can redefine the ownership and retain control over specific properties, enhancing their financial independence and protecting their individual interests. Moreover, the Pomona Amendment allows couples to include provisions relating to spousal support, commonly referred to as alimony. These provisions can establish the amount, duration, and conditions of support payments, offering financial security and predictability for both parties. It also allows couples to waive or limit their rights to spousal support altogether, placing the decision-making power back in their hands. Different types of Pomona Amendments to Postnuptial Property Agreements in California may include those focusing on: 1. Asset Division: Couples can use the Pomona Amendment to modify the default community property division rules, tailor the distribution of assets, and decide which assets remain separate or community property in case of divorce. 2. Business Interests: If one or both spouses own a business, a Pomona Amendment can outline the treatment of the business during divorce, defining whether it is considered separate or community property and how it will be valued or divided. 3. Inheritance and Estate Planning: The amendment can address concerns regarding future inheritances, specifying whether they will be categorized as separate or community property and how they shall be distributed or managed in the event of a divorce. 4. Retirement Accounts and Investments: Couples may utilize the Pomona Amendment to modify the classification of retirement accounts, pensions, and investments, deciding how they will be treated and divided upon separation. In conclusion, the Pomona Amendment to Postnuptial Property Agreement plays a crucial role in the realm of California family law. It offers couples the flexibility to customize their property arrangements, safeguard their individual interests, and maintain financial security during a divorce or separation. By utilizing this amendment, couples can establish clear guidelines regarding asset division, spousal support, and other pertinent matters, ensuring a smoother transition during challenging times.

Pomona California Amendment to Postnuptial Property Agreement

Description

How to fill out Pomona California Amendment To Postnuptial Property Agreement?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Pomona Amendment to Postnuptial Property Agreement - California or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Pomona Amendment to Postnuptial Property Agreement - California complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Pomona Amendment to Postnuptial Property Agreement - California would work for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!