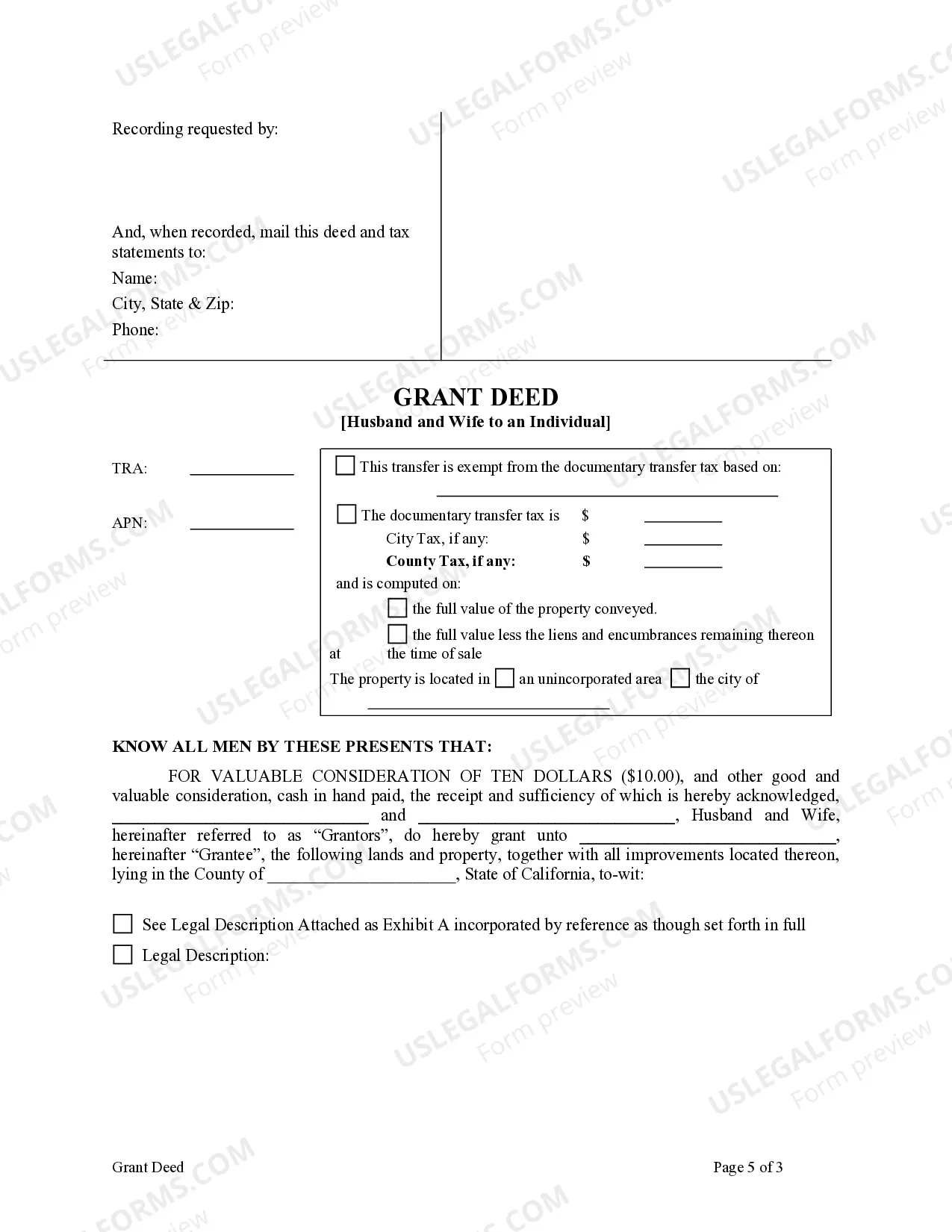

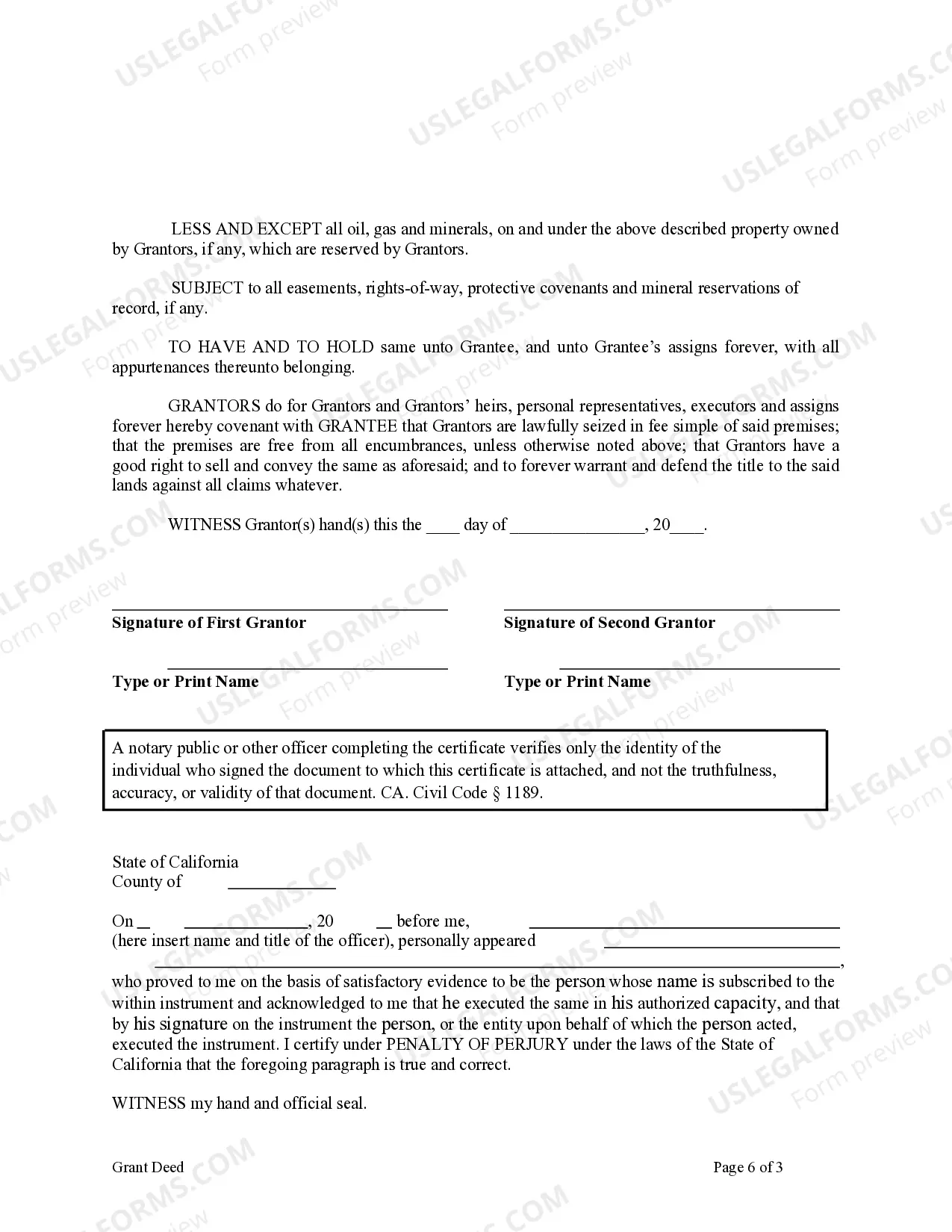

This form is a Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and warrant the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

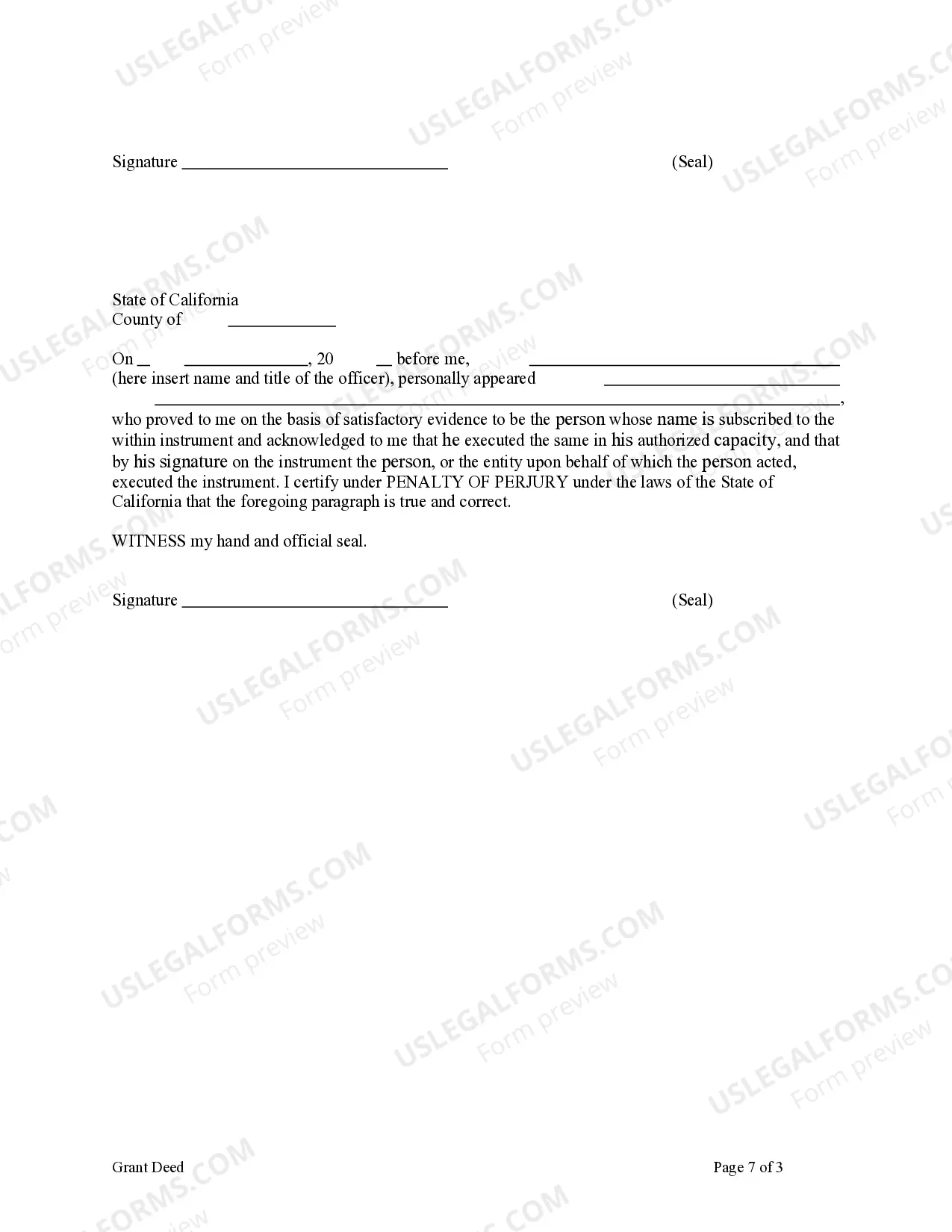

Title: Understanding the Oxnard California Grant Deed from Husband and Wife to an Individual Introduction: In Oxnard, California, the Grant Deed is a legally binding document that facilitates the transfer of real property ownership from a married couple ("Husband and Wife") to an individual. This article aims to provide a detailed explanation of the various aspects and implications of the Oxnard California Grant Deed, highlighting its types and requirements. 1. What is an Oxnard California Grant Deed from Husband and Wife to an Individual? A Grant Deed is a legal instrument used in real estate transactions to convey ownership interest in a property from the granter (Husband and Wife) to the grantee (individual). This particular type of Grant Deed specifically involves married individuals transferring property rights to a single individual. 2. Types of Oxnard California Grant Deed from Husband and Wife to an Individual: a. General Grant Deed: This type of Grant Deed provides a broad guarantee of ownership and implies that the property is free from any undisclosed encumbrances (claims, liens, or other legal issues). b. Special Grant Deed: In contrast to a General Grant Deed, a Special Grant Deed offers limited warranties. While it ensures that the granter has not conveyed the property interest to other parties, it does not guarantee against claims that may have existed before the granter received the property. c. Quitclaim Deed: Although not technically a Grant Deed, it is worth mentioning. In Oxnard, California, a Quitclaim Deed allows a granter (Husband and Wife) to transfer their interest in a property to an individual without providing any warranties or guarantees, essentially relinquishing any claims or rights they may have had. 3. Key Elements and Information in an Oxnard California Grant Deed: a. Granter: The document should clearly identify the married couple transferring the property right as the granter(s). b. Grantee: The individual who will be receiving ownership rights should be named as the grantee. c. Property Description: A detailed and accurate legal description of the property being transferred is crucial. It typically includes the property address, legal parcel number, and boundary information. d. Consideration: The value, consideration, or compensation exchanged between the granter(s) and grantee should be specified. e. Signatures and Acknowledgment: Both the granter(s) and grantee must sign the Grant Deed before a notary public who will verify their identities and execute an acknowledgment. f. Recording: To finalize and make the transfer of ownership legally binding, the Grant Deed must be recorded with the Ventura County Recorder's Office. Conclusion: The Oxnard California Grant Deed from Husband and Wife to an Individual is an essential legal document for real estate transactions involving married couples seeking to transfer property ownership to an individual. Understanding its types, requirements, and crucial elements can help ensure a smooth and legally valid transfer of real estate ownership in the city of Oxnard, California.