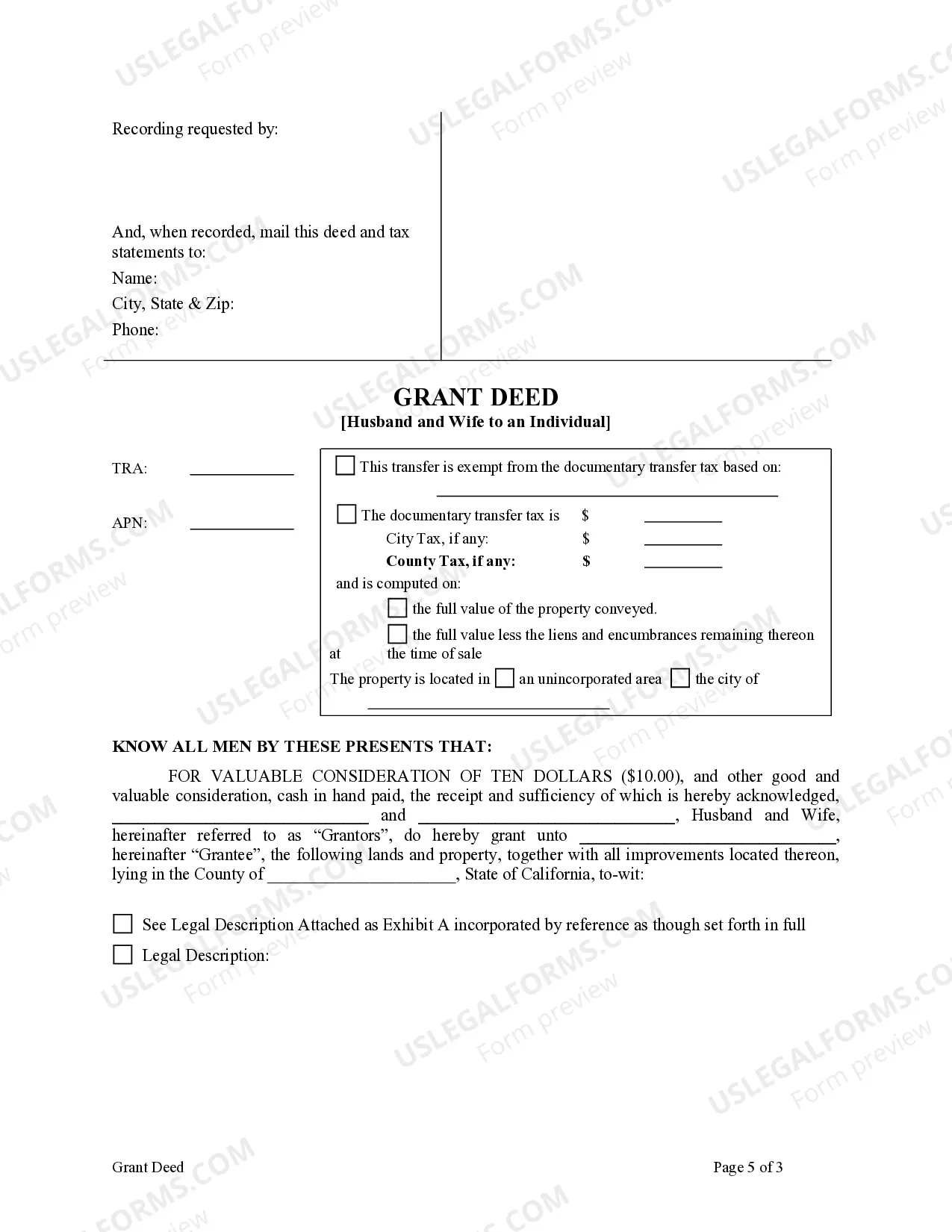

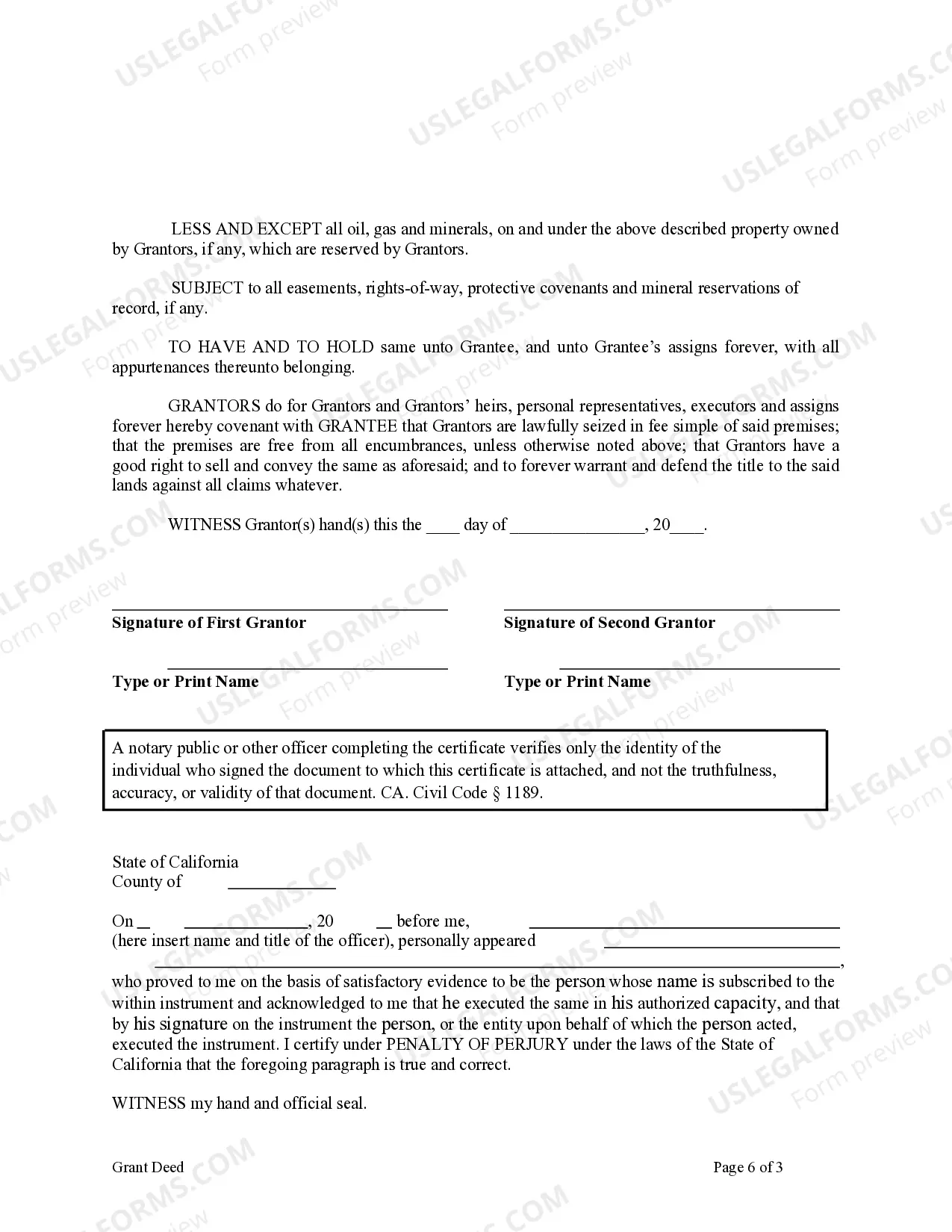

This form is a Warranty Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and warrant the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

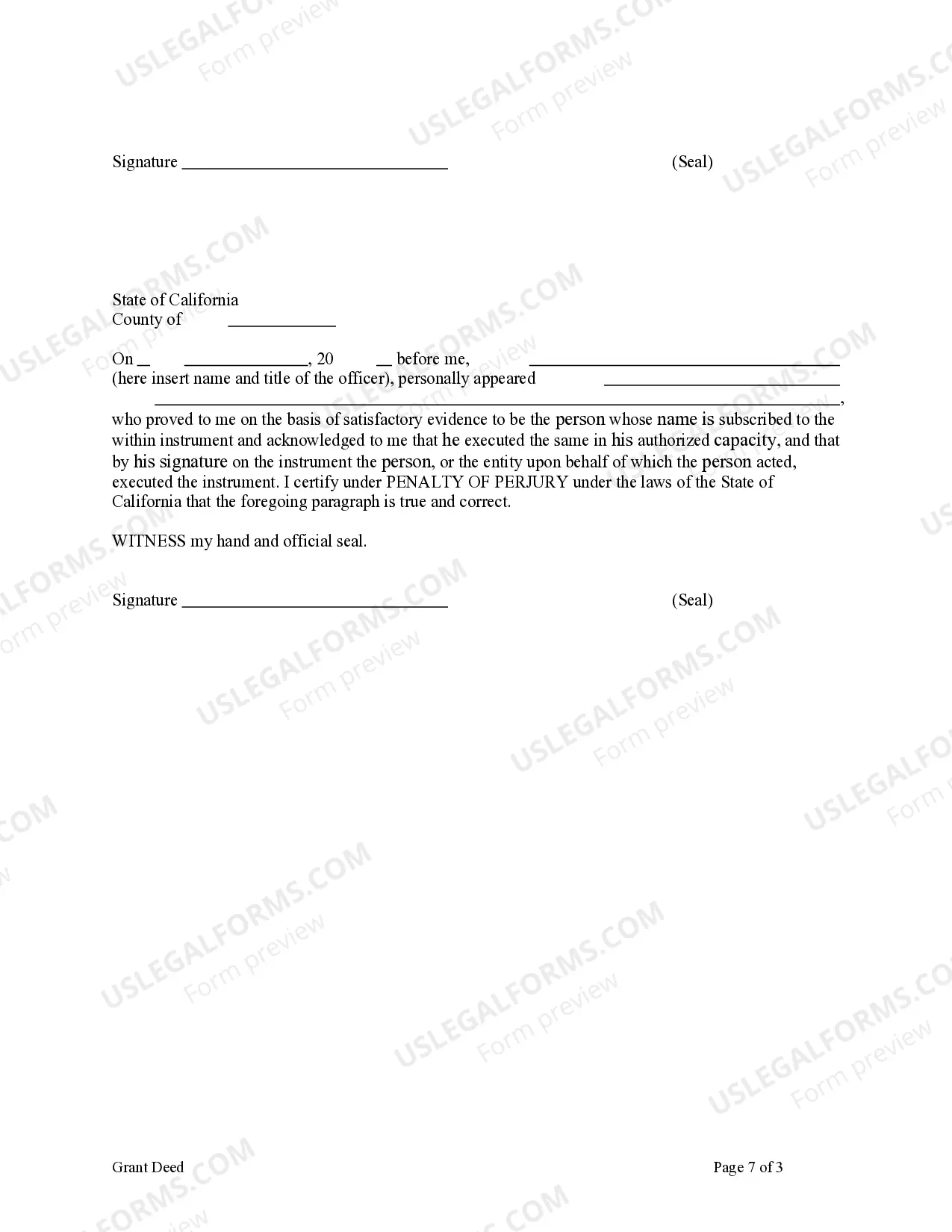

Title: Rialto California Grant Deed from Husband and Wife to an Individual: A Comprehensive Explanation Introduction: In Rialto, California, a Grant Deed is a legal instrument used to transfer real property ownership from one party to another. This article focuses on a specific type of Grant Deed, the Rialto California Grant Deed from Husband and Wife to an Individual. This type of deed holds particular significance as it involves the joint ownership transfer of property by a married couple to a single individual. Let's explore the process, requirements, and variations of this type of Grant Deed. 1. Understanding the Rialto California Grant Deed from Husband and Wife to an Individual: A Rialto California Grant Deed from Husband and Wife to an Individual refers to the legal document used to transfer real estate ownership from a married couple to a single person. In this transaction, both spouses jointly convey their interest in the property to another individual. 2. Process of Executing the Grant Deed: Executing a Rialto California Grant Deed from Husband and Wife to an Individual involves several essential steps, including: a) Preparing the Grant Deed: The couple must draft the Grant Deed with accuracy, including the details of the property, parties involved, legal descriptions, and any encumbrances or restrictions. b) Notarization: The Grant Deed must be notarized by a licensed California notary public to ensure its authenticity and legality. c) Recording the Grant Deed: The completed and notarized Grant Deed must be filed with the San Bernardino County Recorder's Office to establish a public record of the property transfer. 3. Important Considerations: When transferring property through a Rialto California Grant Deed from Husband and Wife to an Individual, it is crucial to take note of the following considerations: a) Consent and Agreement: Both spouses must fully consent to the transfer and sign the Grant Deed willingly and with full understanding. b) Joint Tenancy or Community Property: Understanding the couple's property ownership status is vital as it determines how the property transfer occurs and if any special language or provisions should be included in the deed. c) Potential Tax Implications: It is advisable to consult with a tax professional or attorney to understand any tax consequences associated with this property transfer. 4. Types of Rialto California Grant Deed from Husband and Wife to an Individual: Although the primary purpose of this deed remains consistent across transactions, there may be variations under specific circumstances, such as: a) Grant Deed with Right of Survivorship: This form of Grant Deed ensures that if one spouse passes away, their ownership interest is automatically transferred to the surviving spouse without going through the probate process. b) Grant Deed with Community Property Interest: In California, any property acquired during marriage is presumed to be community property. This type of Grant Deed may be used to transfer this community property interest to an individual. c) Grant Deed Based on Joint Tenancy: Sometimes, spouses may hold property as joint tenants, which grants the right of survivorship. This form of Grant Deed can be used to transfer this interest to an individual. Conclusion: Executing a Rialto California Grant Deed from Husband and Wife to an Individual involves a legal process of transferring property ownership jointly held by a married couple to a single individual. Careful consideration, proper documentation, and adherence to California's legal requirements are essential in ensuring a smooth and valid property transfer. Understanding the various types of Grant Deeds associated with this transaction can provide a clearer path when navigating the complex world of real estate in Rialto, California.Title: Rialto California Grant Deed from Husband and Wife to an Individual: A Comprehensive Explanation Introduction: In Rialto, California, a Grant Deed is a legal instrument used to transfer real property ownership from one party to another. This article focuses on a specific type of Grant Deed, the Rialto California Grant Deed from Husband and Wife to an Individual. This type of deed holds particular significance as it involves the joint ownership transfer of property by a married couple to a single individual. Let's explore the process, requirements, and variations of this type of Grant Deed. 1. Understanding the Rialto California Grant Deed from Husband and Wife to an Individual: A Rialto California Grant Deed from Husband and Wife to an Individual refers to the legal document used to transfer real estate ownership from a married couple to a single person. In this transaction, both spouses jointly convey their interest in the property to another individual. 2. Process of Executing the Grant Deed: Executing a Rialto California Grant Deed from Husband and Wife to an Individual involves several essential steps, including: a) Preparing the Grant Deed: The couple must draft the Grant Deed with accuracy, including the details of the property, parties involved, legal descriptions, and any encumbrances or restrictions. b) Notarization: The Grant Deed must be notarized by a licensed California notary public to ensure its authenticity and legality. c) Recording the Grant Deed: The completed and notarized Grant Deed must be filed with the San Bernardino County Recorder's Office to establish a public record of the property transfer. 3. Important Considerations: When transferring property through a Rialto California Grant Deed from Husband and Wife to an Individual, it is crucial to take note of the following considerations: a) Consent and Agreement: Both spouses must fully consent to the transfer and sign the Grant Deed willingly and with full understanding. b) Joint Tenancy or Community Property: Understanding the couple's property ownership status is vital as it determines how the property transfer occurs and if any special language or provisions should be included in the deed. c) Potential Tax Implications: It is advisable to consult with a tax professional or attorney to understand any tax consequences associated with this property transfer. 4. Types of Rialto California Grant Deed from Husband and Wife to an Individual: Although the primary purpose of this deed remains consistent across transactions, there may be variations under specific circumstances, such as: a) Grant Deed with Right of Survivorship: This form of Grant Deed ensures that if one spouse passes away, their ownership interest is automatically transferred to the surviving spouse without going through the probate process. b) Grant Deed with Community Property Interest: In California, any property acquired during marriage is presumed to be community property. This type of Grant Deed may be used to transfer this community property interest to an individual. c) Grant Deed Based on Joint Tenancy: Sometimes, spouses may hold property as joint tenants, which grants the right of survivorship. This form of Grant Deed can be used to transfer this interest to an individual. Conclusion: Executing a Rialto California Grant Deed from Husband and Wife to an Individual involves a legal process of transferring property ownership jointly held by a married couple to a single individual. Careful consideration, proper documentation, and adherence to California's legal requirements are essential in ensuring a smooth and valid property transfer. Understanding the various types of Grant Deeds associated with this transaction can provide a clearer path when navigating the complex world of real estate in Rialto, California.