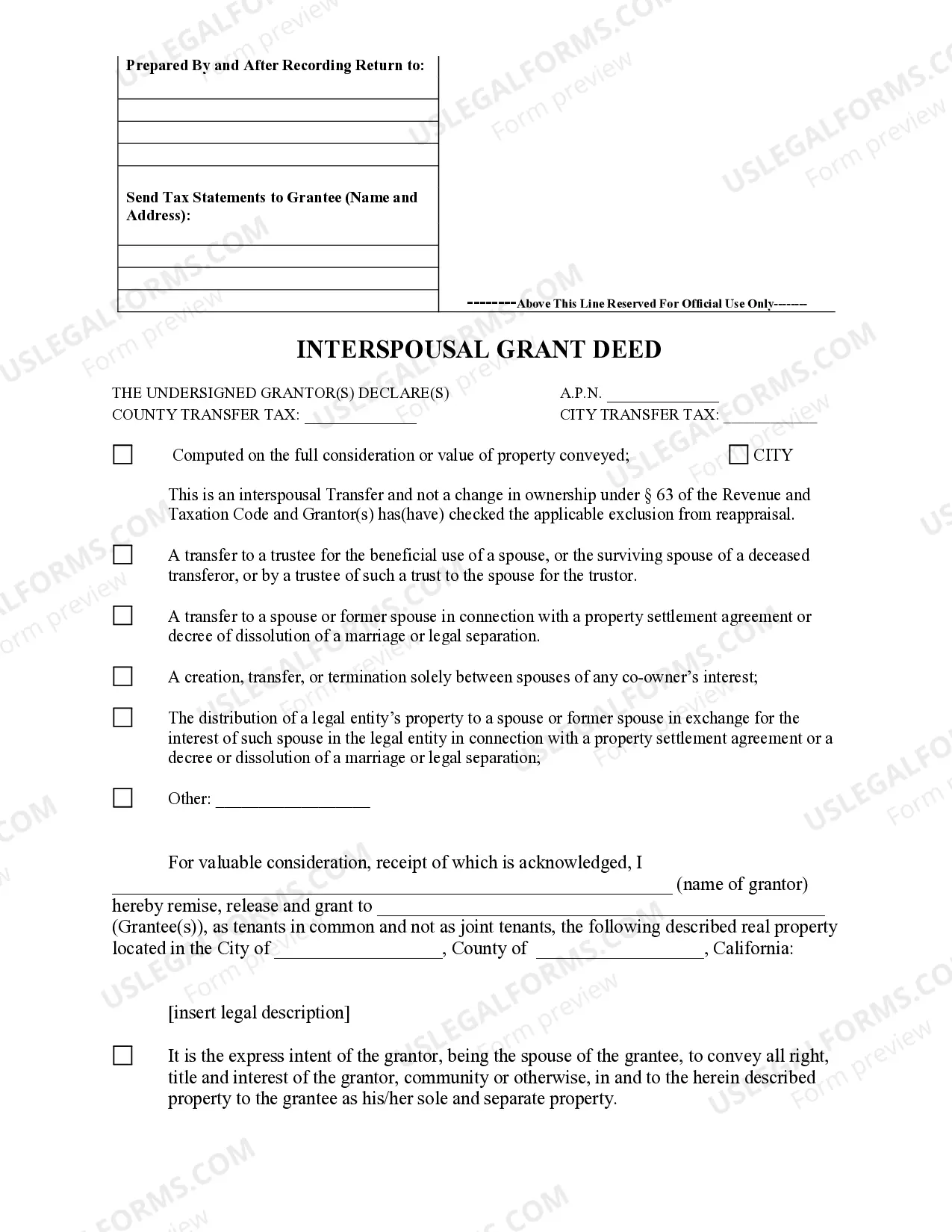

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Interspousal Grant Deed (Individual), can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-01871

San Diego California Interspousal Grant Deed from Individual

Description

How to fill out California Interspousal Grant Deed From Individual?

Are you in search of a trustworthy and cost-effective legal forms supplier to purchase the San Diego California Interspousal Grant Deed from Individual? US Legal Forms is your premier option.

Whether you require a simple agreement to establish guidelines for cohabitation with your partner or a bundle of documents to expedite your divorce process through the court, we have you covered. Our platform provides over 85,000 current legal document templates for personal and commercial use. All templates offered are not universal and are tailored to the regulations of specific states and counties.

To acquire the document, you must sign in to your account, locate the required form, and click the Download button adjacent to it. Please note that you can download your previously acquired form templates anytime from the My documents section.

Are you a newcomer to our site? No problem. You can set up an account in a few minutes, but first, ensure that you do the following.

Now you can create your account. After that, select the subscription plan and proceed to the payment. Once the transaction is completed, download the San Diego California Interspousal Grant Deed from Individual in any available format. You can revisit the website whenever needed and redownload the document at no additional cost.

Searching for current legal documents has never been simpler. Give US Legal Forms a chance now, and stop wasting hours looking for legal paperwork online once and for all.

- Verify if the San Diego California Interspousal Grant Deed from Individual complies with the legislation of your state and local area.

- Review the form’s description (if available) to determine for whom and what the document is designed.

- Restart the search if the form does not suit your specific needs.

Form popularity

FAQ

The best way to transfer property to a family member often involves using a grant deed, which is a straightforward legal document. In areas like San Diego, California, you might want to consider using an Interspousal Grant Deed from Individual for effective property transfers between spouses. This method ensures clarity in ownership and can simplify future transactions. Tools like uslegalforms provide detailed instructions and templates to help you complete this process smoothly.

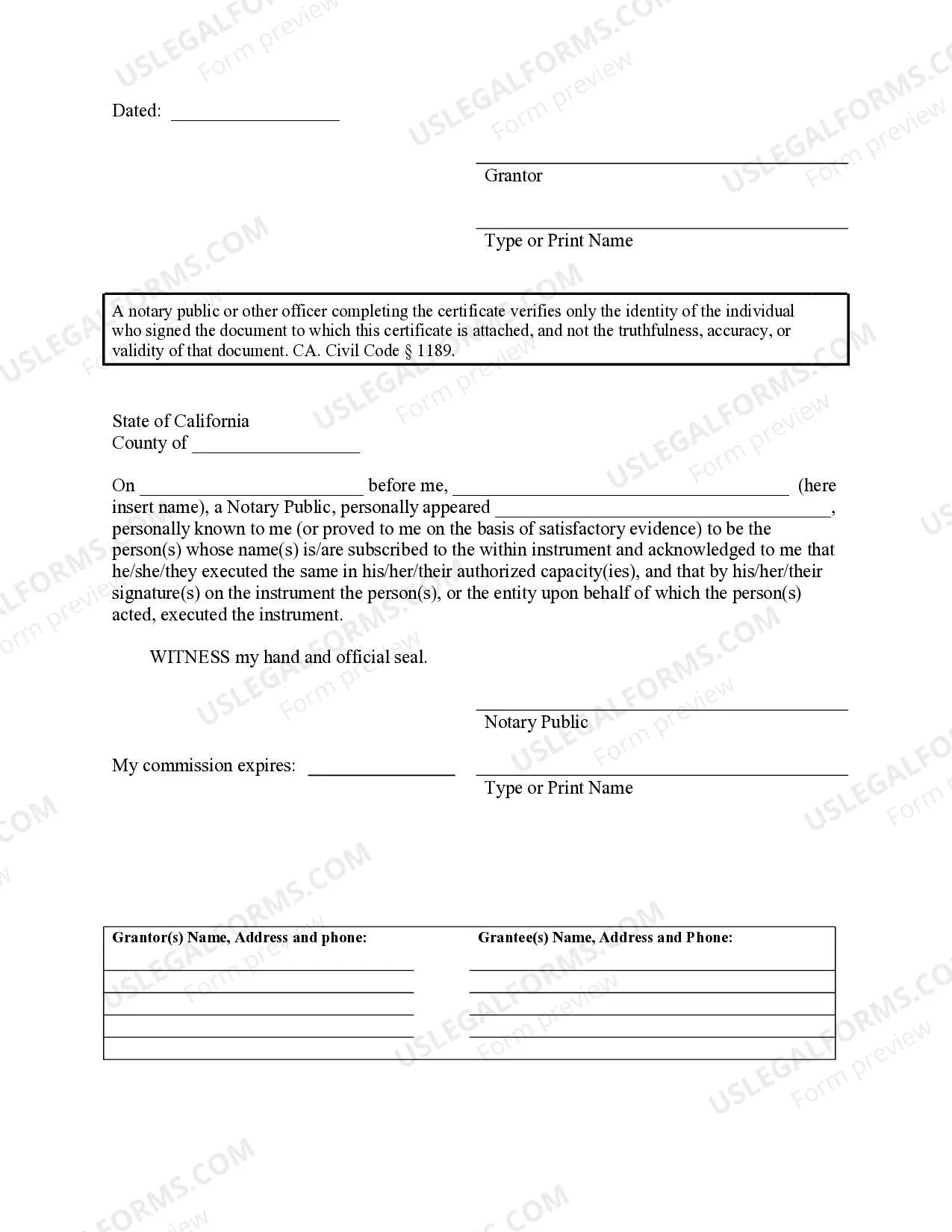

To fill out a California grant deed effectively, start by gathering relevant information about the property and the parties involved. Include the full legal names of both the granter and the grantee, as well as a clear description of the property. Remember, when handling a San Diego California Interspousal Grant Deed from Individual, it is essential to ensure that both spouses agree to the transfer, and that you have the right notary signatures. Utilize platforms like uslegalforms to access templates that can guide you through the process.

A quitclaim deed transfers whatever interest the grantor has in a property, without any warranty of ownership. In contrast, an interspousal transfer deed specifically allows property transfers between spouses and can change the nature of that property. When you use a San Diego California Interspousal Grant Deed from Individual, you are making a more definitive transfer that can offer protections and clarify ownership rights.

Yes, a grant deed is generally regarded as proof of ownership for property in California. When correctly executed and recorded, it indicates the legal owner of the property. Utilizing a San Diego California Interspousal Grant Deed from Individual enhances the clarity of this ownership transfer between spouses.

To prove ownership of property in California, you typically need to present a recorded grant deed reflecting your name as the property owner. Additionally, you may need to provide other documents, such as tax assessments or title documents. If you have a San Diego California Interspousal Grant Deed from Individual, it can significantly strengthen your claim to ownership.

The effect of an interspousal transfer deed in California is the legal transfer of property interest between spouses, which can affect property classification and tax status. For instance, a San Diego California Interspousal Grant Deed from Individual may convert separate property into community property, influencing how marital assets are handled during divorce. Understanding these implications can protect your interests.

The interspousal exclusion in California allows spouses to transfer property between themselves without incurring reassessment for tax purposes. This exclusion is particularly beneficial during property transfers via a San Diego California Interspousal Grant Deed from Individual, as it preserves the existing tax basis. Such provisions promote smoother transitions in property ownership.

To remove someone from a grant deed in California, you typically need to complete a new grant deed that expressly excludes the individual. This process may involve obtaining their consent and signatures. Utilizing a San Diego California Interspousal Grant Deed from Individual can simplify this transfer between spouses, as it is designed specifically for such transactions.

Yes, a grant deed serves as proof of ownership in California, showing who holds legal rights to the property. However, it is crucial to ensure that the deed is properly recorded to establish a public record. In the case of a San Diego California Interspousal Grant Deed from Individual, proper recording provides clarity of ownership during property disputes.

No, a grant deed is not the same as title in California. A grant deed transfers ownership interest in property, while the title represents legal ownership of that property. When dealing with a San Diego California Interspousal Grant Deed from Individual, it's important to understand that the grant deed is the instrument effecting the change of title.