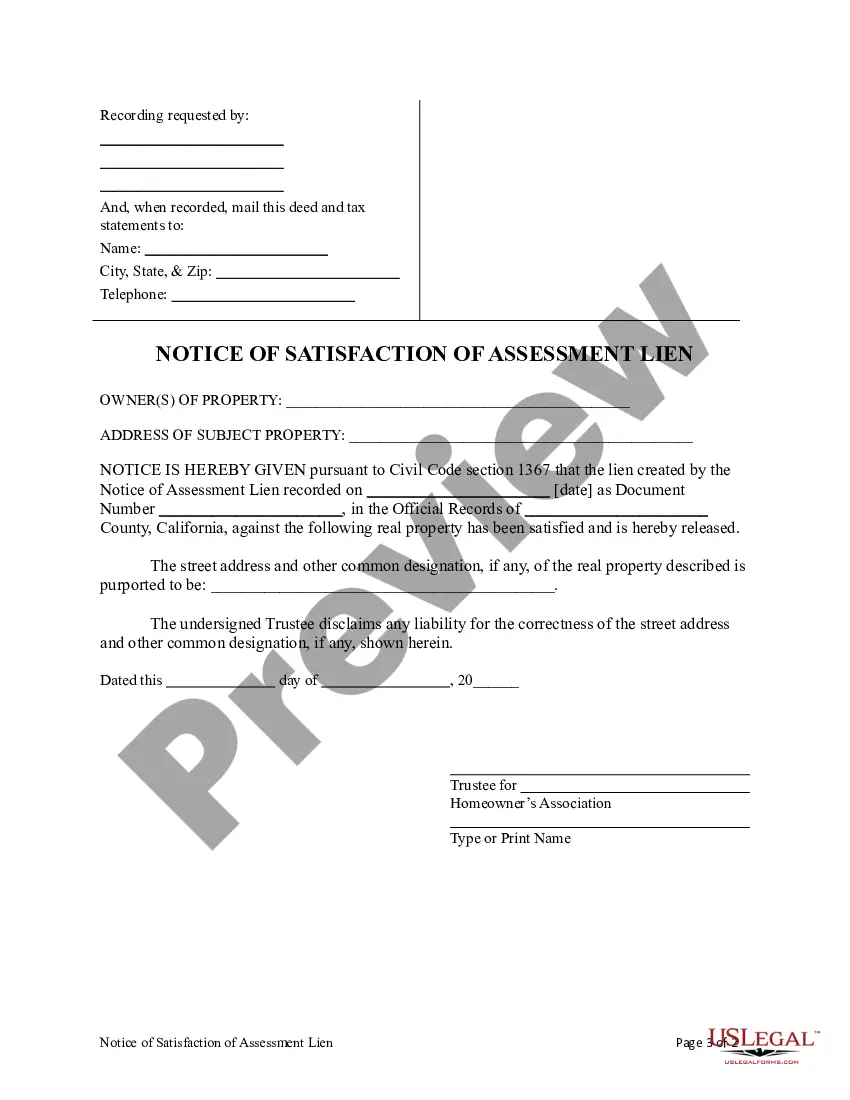

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Satisfaction of Assessment Lien by Home Owners Association, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now. USLF control number CA-01881

A Notice of Satisfaction of Assessment Lien by homeowners Association in Sacramento, California is an important legal document that signifies the resolution or release of a previously filed assessment lien on a property by a homeowners Association (HOA). This notice is typically issued when the outstanding assessments associated with the lien have been fully paid or resolved. In Sacramento, California, there are different types of Notice of Satisfaction of Assessment Lien by homeowners Association that can be encountered depending on specific circumstances. It is essential to understand these scenarios to effectively address any potential lien issues. Some common types include: 1. Full Payment Satisfaction Notice: This type of notice is issued by the HOA when the homeowner has successfully made complete payment of all outstanding assessments, penalties, and interest related to the assessment lien. 2. Partial Payment Satisfaction Notice: In situations where the homeowner has made partial payment towards the outstanding assessments, the HOA may issue a Partial Payment Satisfaction Notice. This notice indicates that the homeowner has resolved a portion of the lien, while a balance may still remain. 3. Settlement Agreement Satisfaction Notice: If the homeowner and the HOA have reached a mutual agreement to settle the outstanding assessments through a negotiated payment plan or other arrangements, a Settlement Agreement Satisfaction Notice is filed. This document represents the satisfaction of the assessment lien as per the agreed-upon terms. 4. Dismissal Satisfaction Notice: In cases where the HOA has wrongfully filed an assessment lien against a homeowner, or if a legal dispute was resolved in favor of the homeowner, a Dismissal Satisfaction Notice is issued. This notice acknowledges that the assessment lien has been dismissed or invalidated. It is crucial for homeowners in Sacramento, California, to promptly address any Notice of Satisfaction of Assessment Lien by homeowners Association they receive. Ensuring that the notice accurately reflects the resolution of the lien will help prevent any potential future disputes or complications regarding property ownership and financial obligations.