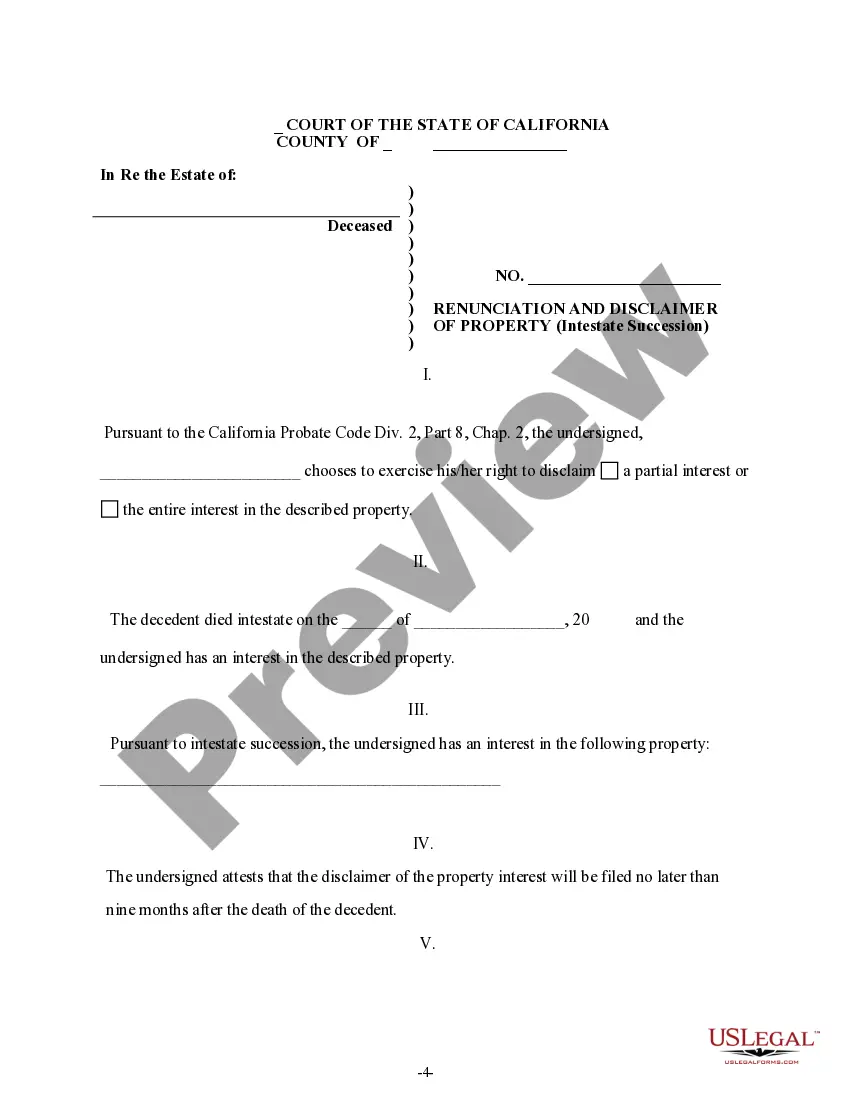

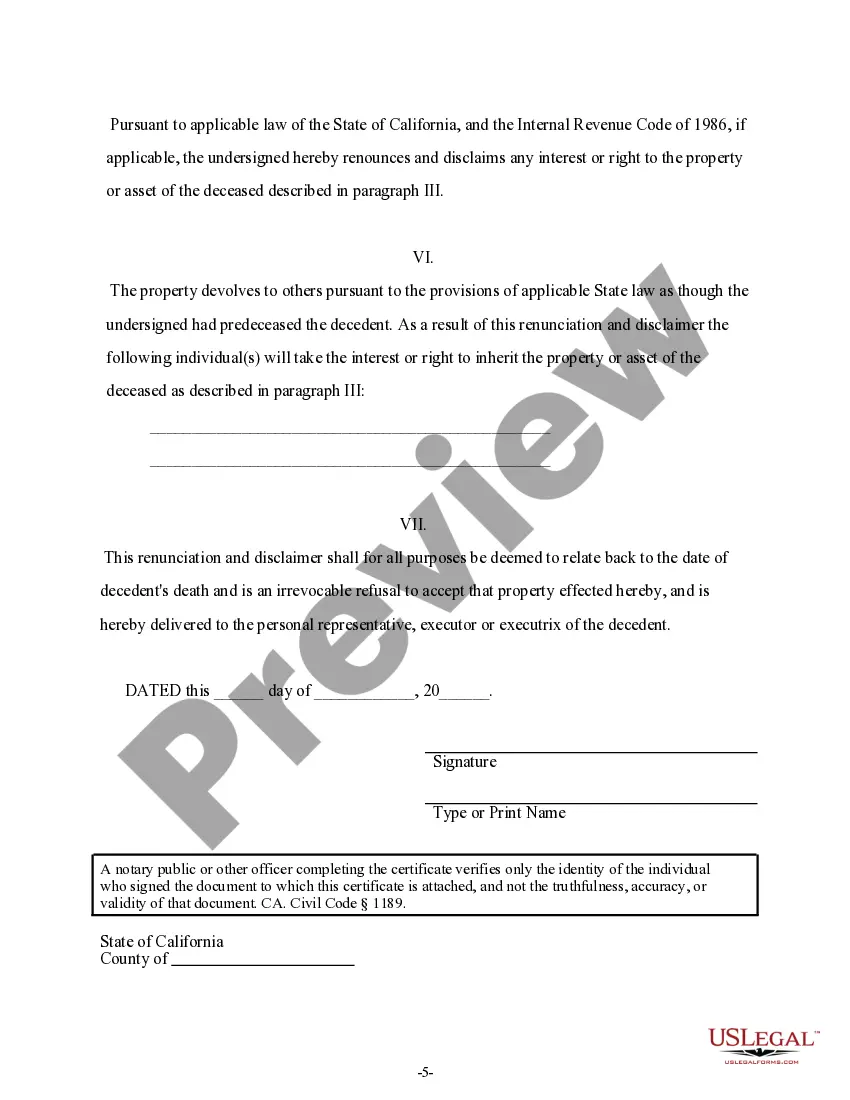

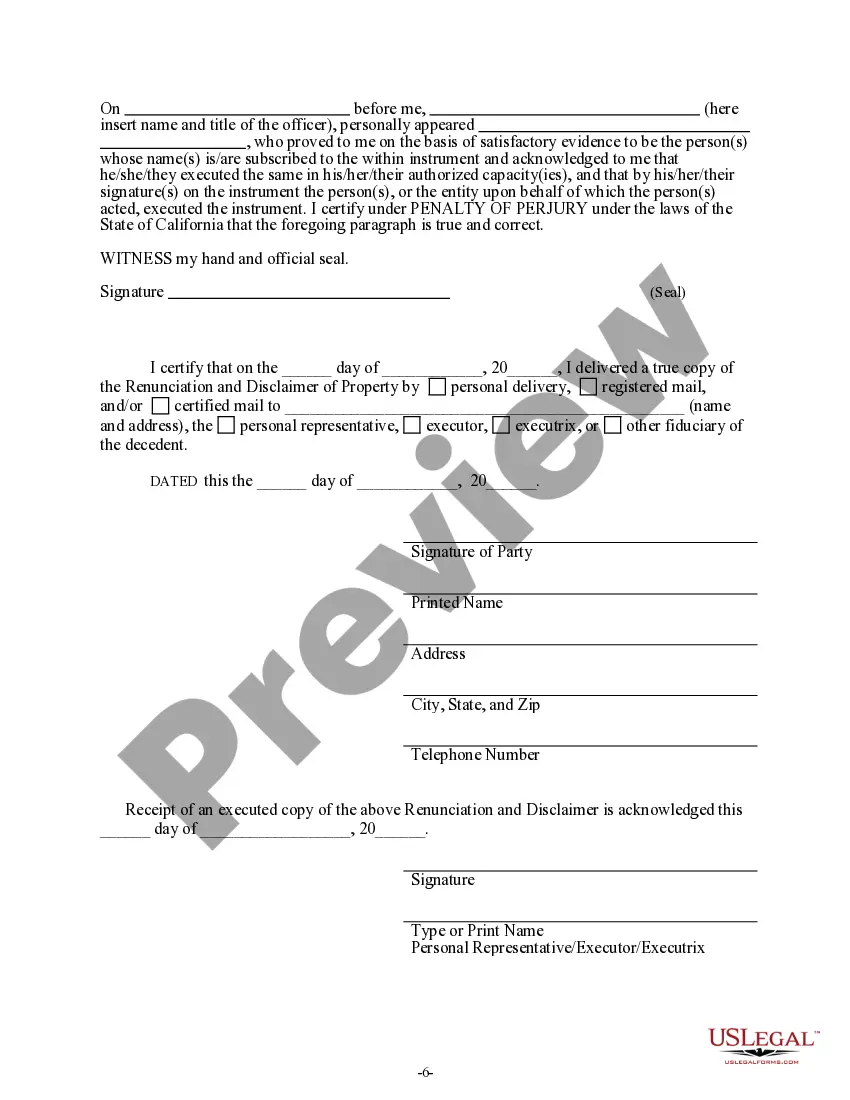

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you have previously utilized our service, Log In to your account and download the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, carry out these straightforward steps to acquire your document.

You have uninterrupted access to every document you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Confirm you’ve found a suitable document. Browse the description and utilize the Preview option, if available, to verify that it meets your needs. If it does not fulfill your needs, use the Search tab above to locate the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Receive your El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession. Choose the file format for your document and store it on your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

A beneficiary may choose to disclaim property to avoid tax liabilities, debt obligations, or emotional burdens tied to the inheritance. By invoking the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession, they can relinquish their rights legally. This decision often leads to a more favorable outcome for both the beneficiary and the estate.

An inheritance disclaimer serves as a formal document where a beneficiary expresses the wish to refuse their inheritance. It should state the specific property being disclaimed and mention the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession to ensure clarity. Consider using resources like USLegalForms to guide you in creating an accurate disclaimer.

An inheritance letter typically includes the details of the deceased and their estate, while clearly outlining your relationship to them. It's essential to express your understanding of the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession when renouncing any property. USLegalForms can provide templates that help you craft this letter effectively.

To write a beneficiary disclaimer letter, start by stating your intent to renounce the inheritance you received under the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession. Clearly identify yourself, the deceased, and the specific property you wish to disclaim. Finally, ensure the letter is signed and dated to provide legal validity.

Intestacy in California is governed by the probate code found in sections 6400 to 6414. These codes provide the framework for distributing a deceased person's assets without a will. For anyone navigating the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession, familiarity with these laws helps clarify inheritance processes and potential outcomes.

Probate Code 6400 establishes the rules regarding intestate succession, defining who inherits when someone dies without a will. This section outlines the priority of heirs, such as spouse, children, and other relatives. For those considering the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession, this code highlights the importance of understanding how property is transferred by law in the absence of a will.

The probate code addressing intestate succession in California is primarily found in sections 6400 to 6414. These sections determine how property is distributed when a person dies without a valid will. For residents interested in the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession, understanding these codes can clarify potential inheritance rights and responsibilities.

Probate Code 4734 outlines how a court in California might interpret a person's will or estate plan. This code plays a significant role in ensuring that the intentions of a decedent are respected, particularly in cases like the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession. It provides legal grounds for individuals to challenge or support claims regarding property distribution.

Probate Code 8482 in California addresses the renunciation of inheritance rights. It allows individuals to formally refuse property that they might receive through intestate succession. This can be particularly relevant in situations involving the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession. Understanding this code helps individuals make informed decisions regarding property distribution.

To disclaim an inheritance in California, you typically need to provide a written disclaimer to the relevant parties, such as the executor of the estate or probate court. It’s also essential to file this disclaimer within the nine-month timeframe after the decedent’s death. If you need clearer guidance or templates for the El Cajon California Renunciation And Disclaimer of Property received by Intestate Succession, consider visiting UsLegalForms for comprehensive resources.