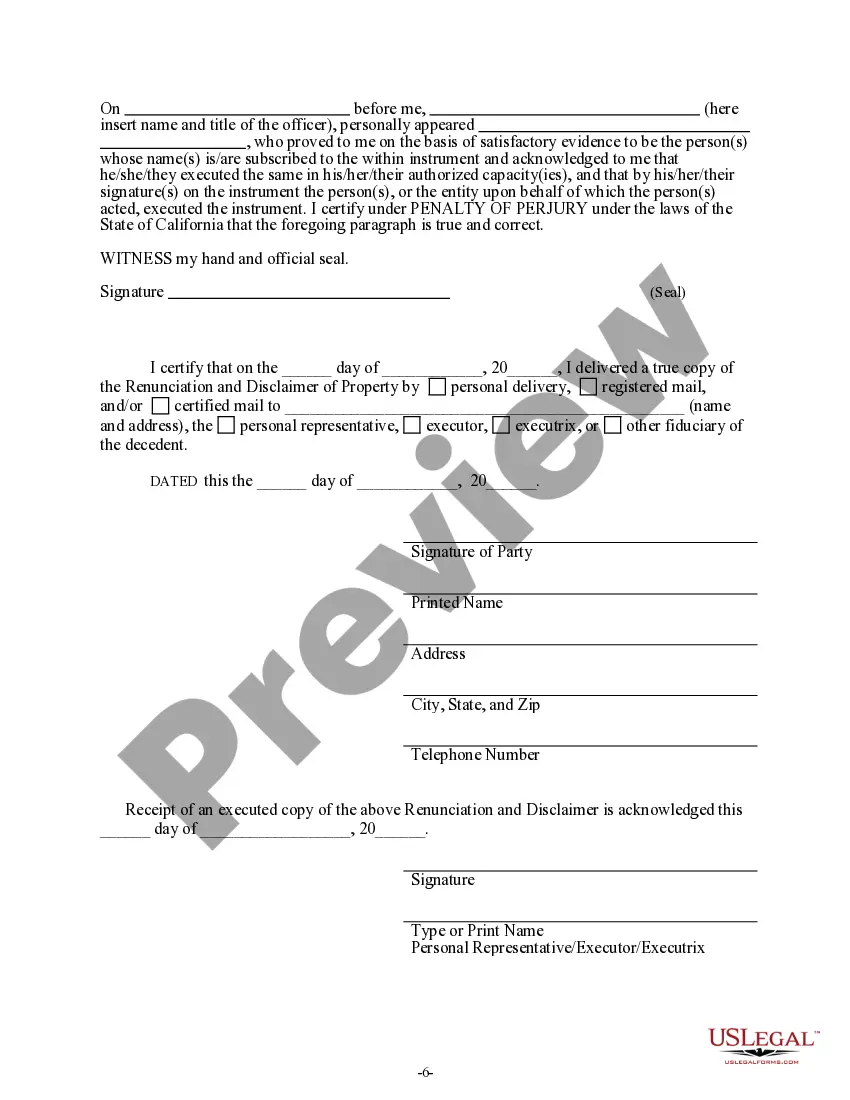

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Victorville California Renunciation and Disclaimer of Property Received by Intestate Succession: A Comprehensive Guide Introduction: The Victorville California Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to formally decline their right to inherit property under intestate succession laws. This detailed description will provide an overview of this process, its purpose, and different types of renunciations and disclaimers applicable in Victorville, California. Overview: When a person passes away without a valid will or estate plan, the state intestate succession laws govern the distribution of their assets. However, certain beneficiaries may find it necessary or beneficial to renounce or disclaim their right to inherit the property. By renouncing or disclaiming their inheritance, beneficiaries can pass their rights onto the next eligible heirs or avoid potential tax obligations or estate debts associated with the inherited property. Types of Renunciations and Disclaimers: 1. Full Renunciation: This type of renunciation involves completely and irrevocably rejecting the entitlement to the inherited property. Once renounced, the renouncing individual has no claim, interest, or stake in the property. This option is often chosen when the beneficiary has no interest or wishes to bypass the complexities of managing the inherited assets. 2. Partial Renunciation: In some cases, beneficiaries may opt to renounce only a portion of their inheritance while retaining another part. This allows them to selectively decline property or assets that pose financial or administrative burdens while accepting others more aligned with their interests or priorities. 3. Conditional Renunciation: With a conditional renunciation, beneficiaries can place specific conditions or requirements on their renunciation. For example, they may agree to renounce their inheritance only if certain debts or taxes associated with the property are cleared first. This allows them to safeguard themselves from potential financial liabilities before definitively giving up their rights. 4. Disclaimer of Property Interest: A disclaimer is a legal instrument used to refuse or reject an inheritance. It can be employed when the beneficiary believes that accepting the inherited property may bring unfavorable consequences such as a depletion of personal funds, exposure to pending lawsuits, or potential creditors' claims. By disclaiming the property, individuals effectively transfer their interest to the next eligible heirs as if they had never been entitled to it initially. Process and Legal Considerations: To renounce or disclaim property received by intestate succession in Victorville, California, beneficiaries must strictly adhere to the state's statutory requirements. Some key considerations include: 1. Timeliness: The renunciation or disclaimer must be made within a specific deadline, usually within a set timeframe from the date of the decedent's passing or the moment the beneficiary becomes aware of their inheritance rights. 2. Proper Documentation: A written renunciation or disclaimer document must be duly executed, signed, and notarized. It should clearly state the beneficiary's intent to renounce or disclaim any interest in the property, specifying the type and extent of the relinquished rights. 3. Notice to Interested Parties: Beneficiaries must provide notice of their renunciation or disclaimer to other interested parties, including the estate's executor or administrator, co-heirs, and any parties with potential claims on the assets. 4. Tax Implications: Renouncing or disclaiming an inheritance may have tax consequences that should be evaluated carefully. Seeking advice from a qualified tax professional or attorney is advisable to understand the potential tax implications of the renunciation or disclaimer. Conclusion: The Victorville California Renunciation and Disclaimer of Property received by Intestate Succession offer beneficiaries options to decline or relinquish their inheritance rights, easing potential burdens or responsibilities associated with the inherited property. Whether through a full renunciation, partial renunciation, conditional renunciation, or disclaimer of property interest, beneficiaries can exercise greater control over their inheritance. Adhering to the appropriate legal requirements and seeking professional advice is crucial when navigating this process to protect one's interests effectively.Victorville California Renunciation and Disclaimer of Property Received by Intestate Succession: A Comprehensive Guide Introduction: The Victorville California Renunciation and Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to formally decline their right to inherit property under intestate succession laws. This detailed description will provide an overview of this process, its purpose, and different types of renunciations and disclaimers applicable in Victorville, California. Overview: When a person passes away without a valid will or estate plan, the state intestate succession laws govern the distribution of their assets. However, certain beneficiaries may find it necessary or beneficial to renounce or disclaim their right to inherit the property. By renouncing or disclaiming their inheritance, beneficiaries can pass their rights onto the next eligible heirs or avoid potential tax obligations or estate debts associated with the inherited property. Types of Renunciations and Disclaimers: 1. Full Renunciation: This type of renunciation involves completely and irrevocably rejecting the entitlement to the inherited property. Once renounced, the renouncing individual has no claim, interest, or stake in the property. This option is often chosen when the beneficiary has no interest or wishes to bypass the complexities of managing the inherited assets. 2. Partial Renunciation: In some cases, beneficiaries may opt to renounce only a portion of their inheritance while retaining another part. This allows them to selectively decline property or assets that pose financial or administrative burdens while accepting others more aligned with their interests or priorities. 3. Conditional Renunciation: With a conditional renunciation, beneficiaries can place specific conditions or requirements on their renunciation. For example, they may agree to renounce their inheritance only if certain debts or taxes associated with the property are cleared first. This allows them to safeguard themselves from potential financial liabilities before definitively giving up their rights. 4. Disclaimer of Property Interest: A disclaimer is a legal instrument used to refuse or reject an inheritance. It can be employed when the beneficiary believes that accepting the inherited property may bring unfavorable consequences such as a depletion of personal funds, exposure to pending lawsuits, or potential creditors' claims. By disclaiming the property, individuals effectively transfer their interest to the next eligible heirs as if they had never been entitled to it initially. Process and Legal Considerations: To renounce or disclaim property received by intestate succession in Victorville, California, beneficiaries must strictly adhere to the state's statutory requirements. Some key considerations include: 1. Timeliness: The renunciation or disclaimer must be made within a specific deadline, usually within a set timeframe from the date of the decedent's passing or the moment the beneficiary becomes aware of their inheritance rights. 2. Proper Documentation: A written renunciation or disclaimer document must be duly executed, signed, and notarized. It should clearly state the beneficiary's intent to renounce or disclaim any interest in the property, specifying the type and extent of the relinquished rights. 3. Notice to Interested Parties: Beneficiaries must provide notice of their renunciation or disclaimer to other interested parties, including the estate's executor or administrator, co-heirs, and any parties with potential claims on the assets. 4. Tax Implications: Renouncing or disclaiming an inheritance may have tax consequences that should be evaluated carefully. Seeking advice from a qualified tax professional or attorney is advisable to understand the potential tax implications of the renunciation or disclaimer. Conclusion: The Victorville California Renunciation and Disclaimer of Property received by Intestate Succession offer beneficiaries options to decline or relinquish their inheritance rights, easing potential burdens or responsibilities associated with the inherited property. Whether through a full renunciation, partial renunciation, conditional renunciation, or disclaimer of property interest, beneficiaries can exercise greater control over their inheritance. Adhering to the appropriate legal requirements and seeking professional advice is crucial when navigating this process to protect one's interests effectively.