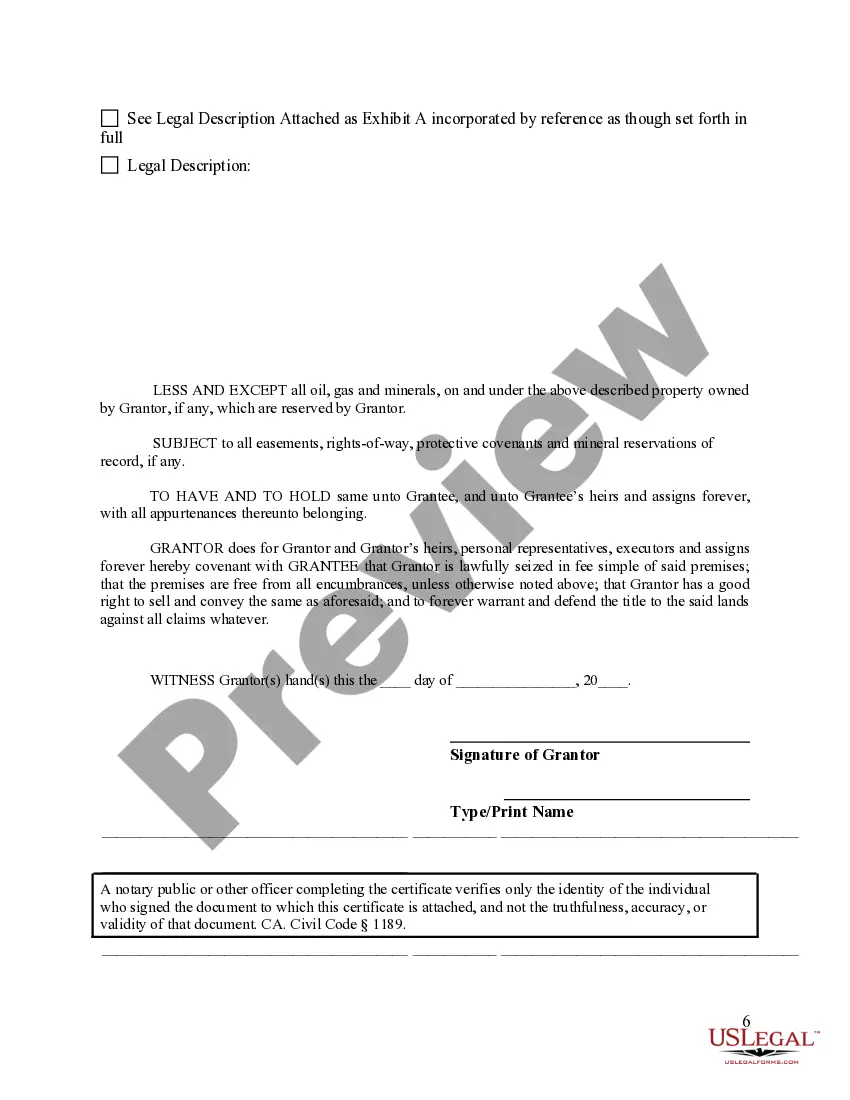

This Warranty Deed from Individual to Individual form is a Warranty Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and warrants the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

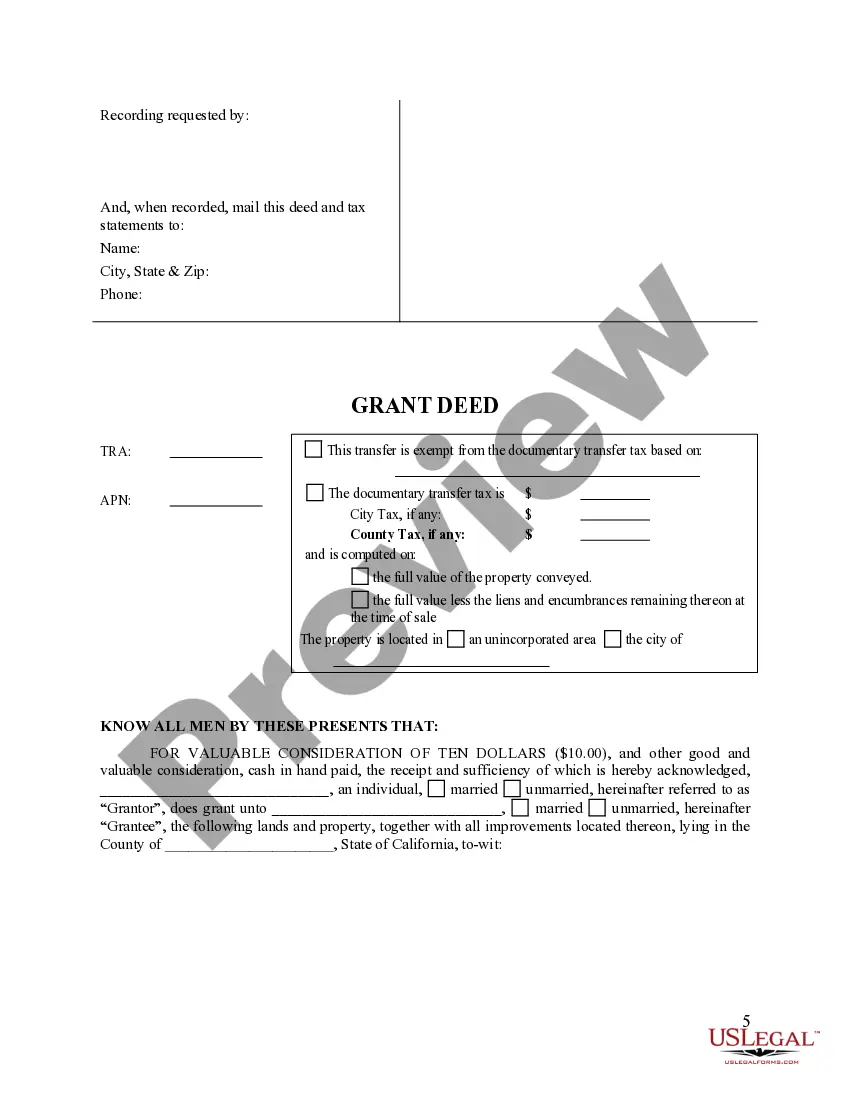

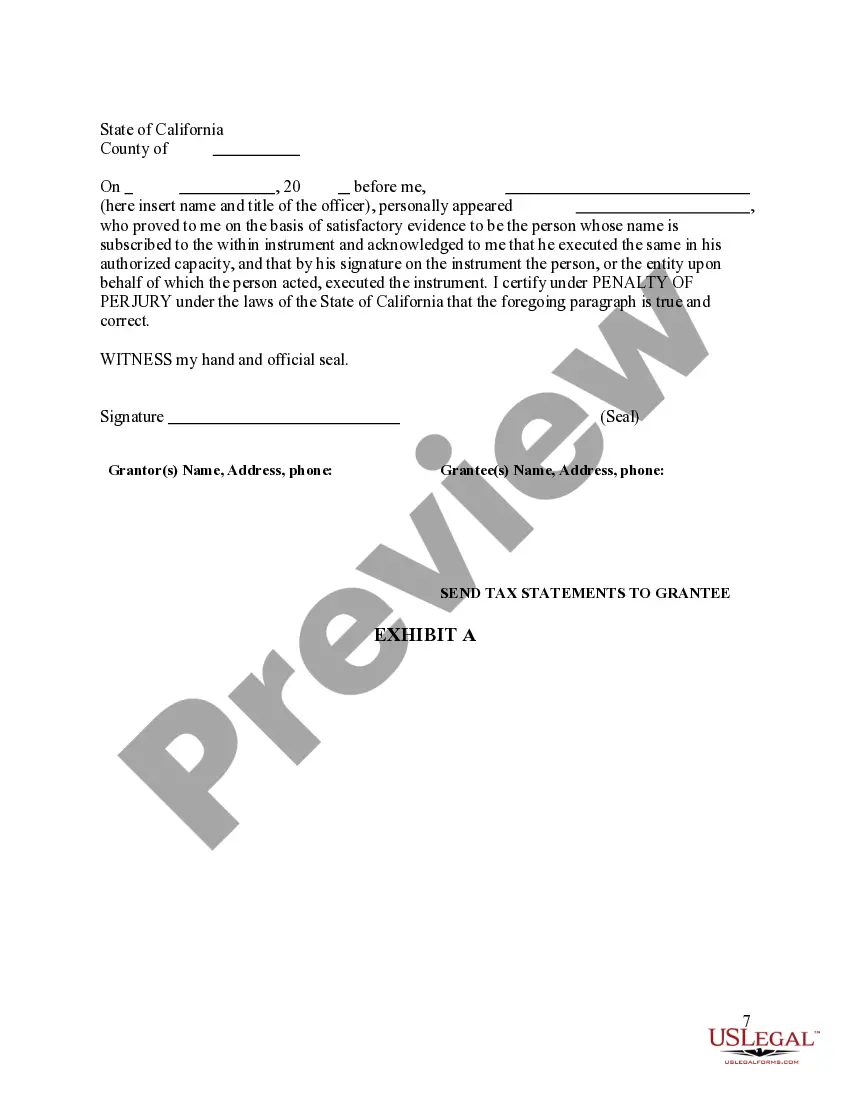

A Los Angeles California grant deed from individual to individual is a legally binding document that transfers ownership of real property from one individual to another in Los Angeles, California. This type of grant deed is commonly used in real estate transactions and is recorded in the county where the property is located. The grant deed includes essential information such as the names and addresses of the granter (the person transferring the property) and the grantee (the person receiving the property), a legal description of the property, and the date of the transfer. One of the key features of a grant deed is that it guarantees that the granter has legal ownership and the right to transfer the property. It also guarantees that the property is free from any encumbrances, except for those specifically mentioned in the deed. This means that the granter is assuring the grantee that no other claims or liens exist on the property, except those disclosed in the deed. In Los Angeles, California, there are no specific types or subcategories of grant deeds from individual to individual. However, it's worth mentioning that grant deeds can vary depending on the specific situation or purpose of the transfer. For example, there may be grant deeds related to gifting property, transferring property between family members, or even transferring property as a result of divorce or inheritance. When executing a Los Angeles California grant deed from individual to individual, it is crucial to follow the specific legal requirements set forth by the state. These requirements may include the form of the deed, signatures of all parties involved, notarization, and proper recording with the county recorder's office. It is important to consult with a qualified real estate attorney or seek professional assistance when dealing with grant deeds to ensure compliance with all legal procedures and to protect your rights as both a granter or grantee. Keywords: Los Angeles, California, grant deed, individual to individual, real property, ownership, transfer, legal description, encumbrances, guarantee, claims, liens, specific types, subcategories, gifting property, transferring property, family members, divorce, inheritance, legal requirements, signatures, notarization, recording, county recorder's office, real estate attorney, professional assistance.