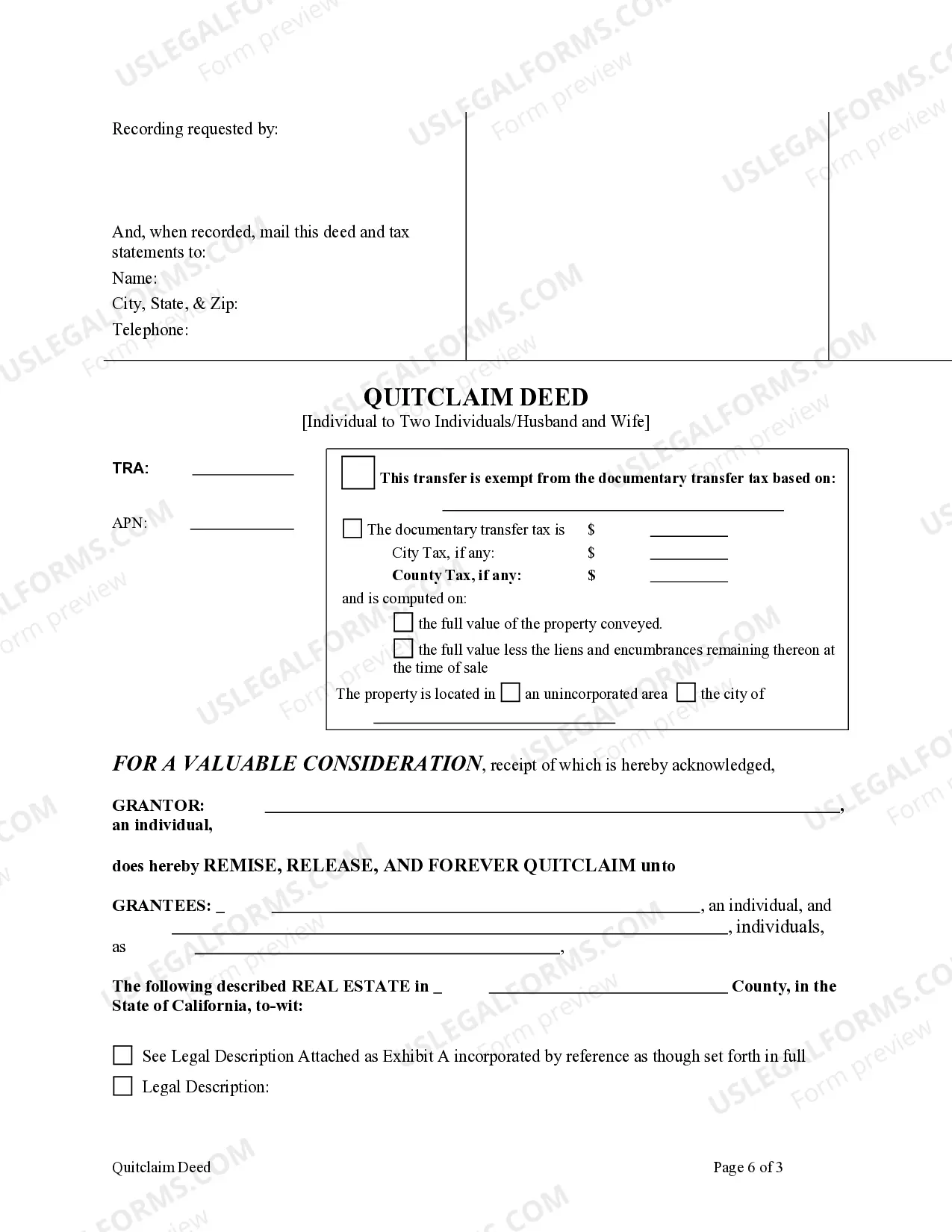

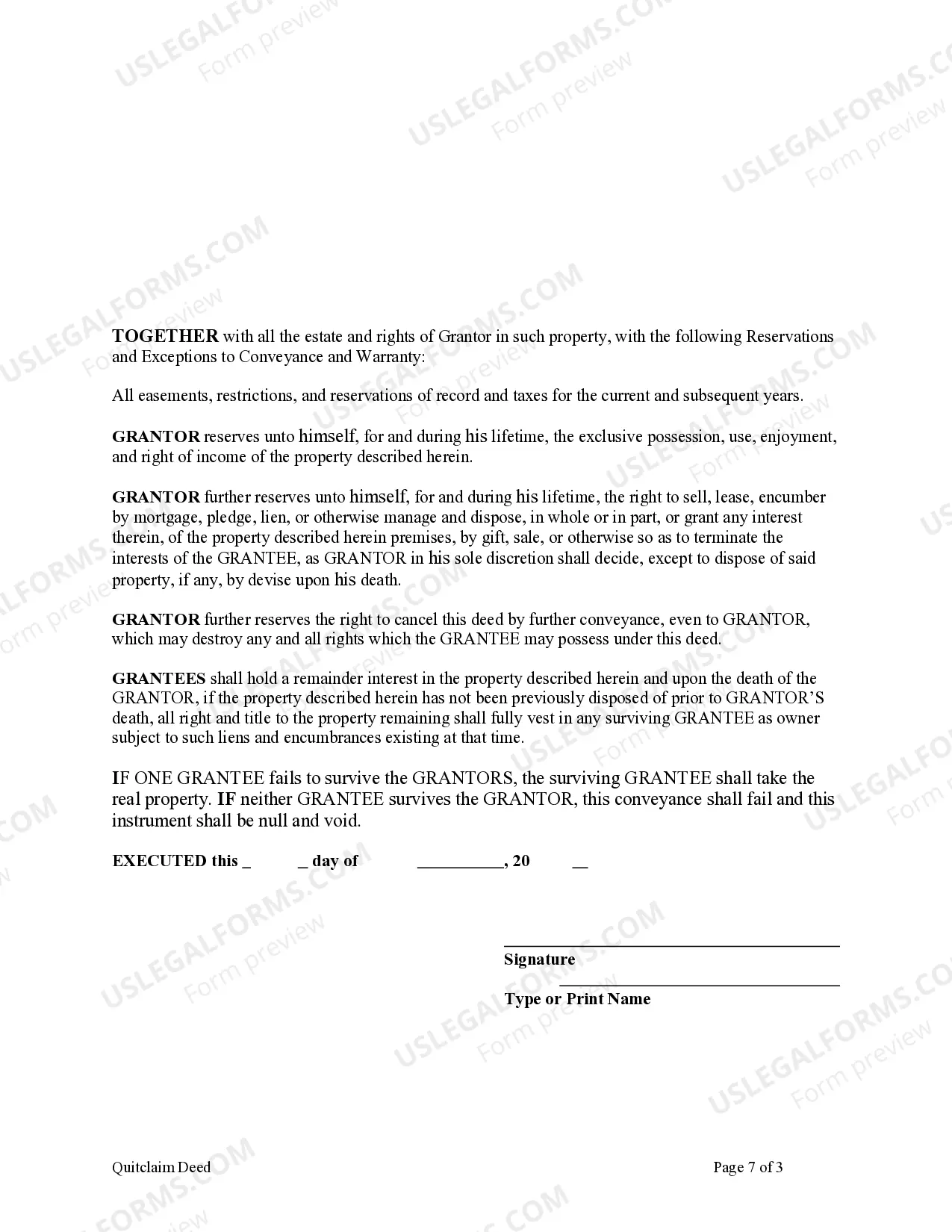

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife is a legal document that allows an individual (the granter) to transfer property ownership to two individuals, specifically to a married couple. This specialized form of a quitclaim deed provides certain benefits and protection, as detailed below. Enhanced Life Estate Deed: This type of transfer provides the granter (typically a parent) the ability to retain control and use of the property during their lifetime while designating the two individuals (often adult children or the spouse) as the remainder beneficiaries. The granter retains the right to live on the property, collect rental income, and make decisions regarding the property's management, maintenance, and sale. Upon the granter's passing, the property automatically transfers to the designated beneficiaries without the need for probate. Lady Bird Quitclaim Deed: Named after former First Lady Bird Johnson, this type of deed builds upon the Enhanced Life Estate Deed. It includes an additional provision allowing the granter to revoke or change the beneficiaries during their lifetime without requiring their consent. The granter maintains full control and flexibility over the property and can transfer ownership to different individuals or even remove beneficiaries altogether. The Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed offers several key advantages for granters and beneficiaries: 1. Avoidance of Probate: By utilizing this type of deed, the property can pass to the designated beneficiaries upon the granter's death, bypassing the lengthy and costly probate process. 2. Asset Protection: The property is protected from potential creditors or claimants during the granter's lifetime. Once the property passes to the designated beneficiaries, it becomes their asset and may be subject to their creditors. 3. Tax Advantages: Transferring property through this deed may offer potential property tax benefits, as it may prevent a reassessment of the property value, resulting in lower property tax obligations for the beneficiaries. 4. Retained Control: The granter can continue to reside on and benefit from the property, maintaining control of decisions related to its use, lease, or sale while alive. When considering a Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed, it is crucial to seek legal advice and consult with an experienced real estate attorney to fully understand the implications, requirements, and potential tax consequences involved.Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife is a legal document that allows an individual (the granter) to transfer property ownership to two individuals, specifically to a married couple. This specialized form of a quitclaim deed provides certain benefits and protection, as detailed below. Enhanced Life Estate Deed: This type of transfer provides the granter (typically a parent) the ability to retain control and use of the property during their lifetime while designating the two individuals (often adult children or the spouse) as the remainder beneficiaries. The granter retains the right to live on the property, collect rental income, and make decisions regarding the property's management, maintenance, and sale. Upon the granter's passing, the property automatically transfers to the designated beneficiaries without the need for probate. Lady Bird Quitclaim Deed: Named after former First Lady Bird Johnson, this type of deed builds upon the Enhanced Life Estate Deed. It includes an additional provision allowing the granter to revoke or change the beneficiaries during their lifetime without requiring their consent. The granter maintains full control and flexibility over the property and can transfer ownership to different individuals or even remove beneficiaries altogether. The Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed offers several key advantages for granters and beneficiaries: 1. Avoidance of Probate: By utilizing this type of deed, the property can pass to the designated beneficiaries upon the granter's death, bypassing the lengthy and costly probate process. 2. Asset Protection: The property is protected from potential creditors or claimants during the granter's lifetime. Once the property passes to the designated beneficiaries, it becomes their asset and may be subject to their creditors. 3. Tax Advantages: Transferring property through this deed may offer potential property tax benefits, as it may prevent a reassessment of the property value, resulting in lower property tax obligations for the beneficiaries. 4. Retained Control: The granter can continue to reside on and benefit from the property, maintaining control of decisions related to its use, lease, or sale while alive. When considering a Concord California Enhanced Life Estate or Lady Bird Quitclaim Deed, it is crucial to seek legal advice and consult with an experienced real estate attorney to fully understand the implications, requirements, and potential tax consequences involved.