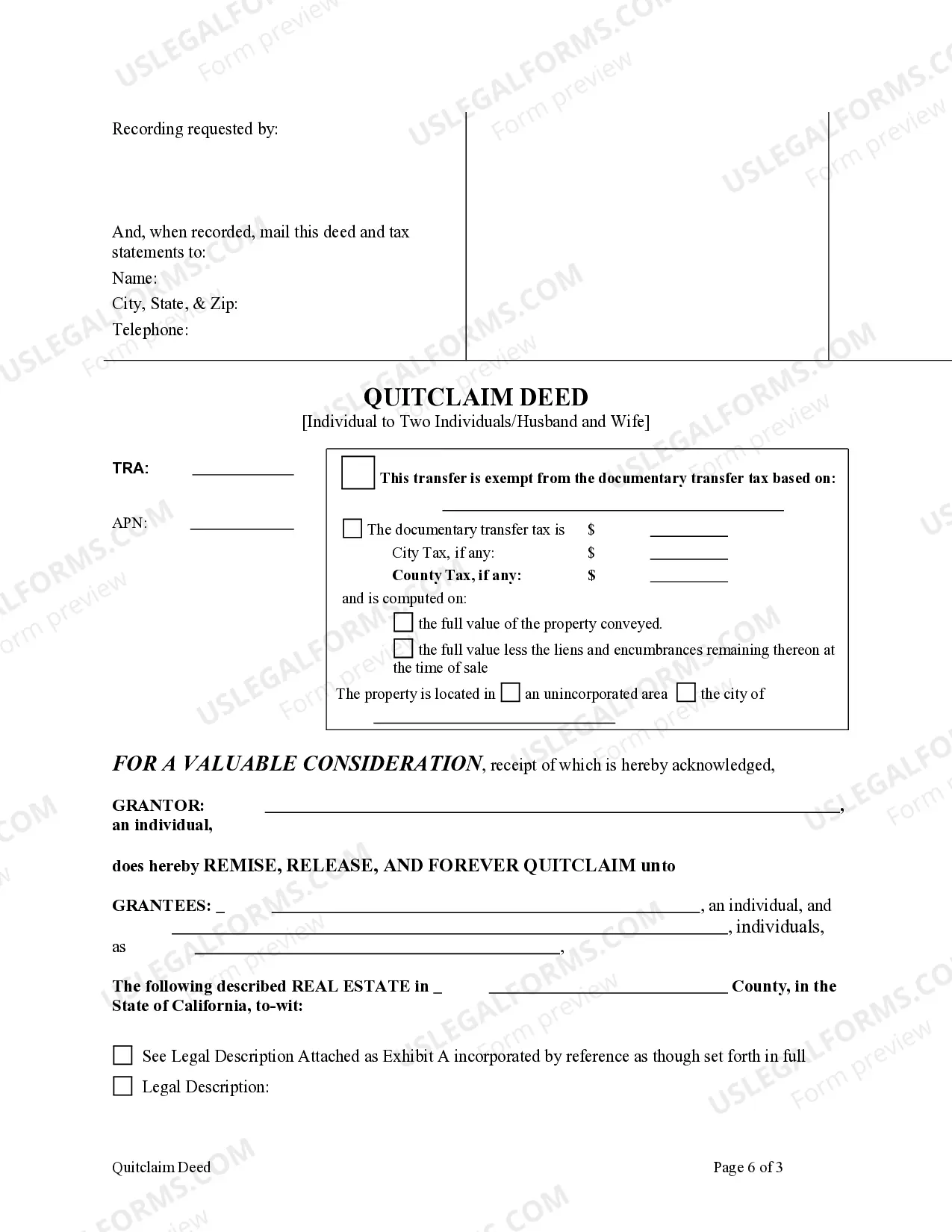

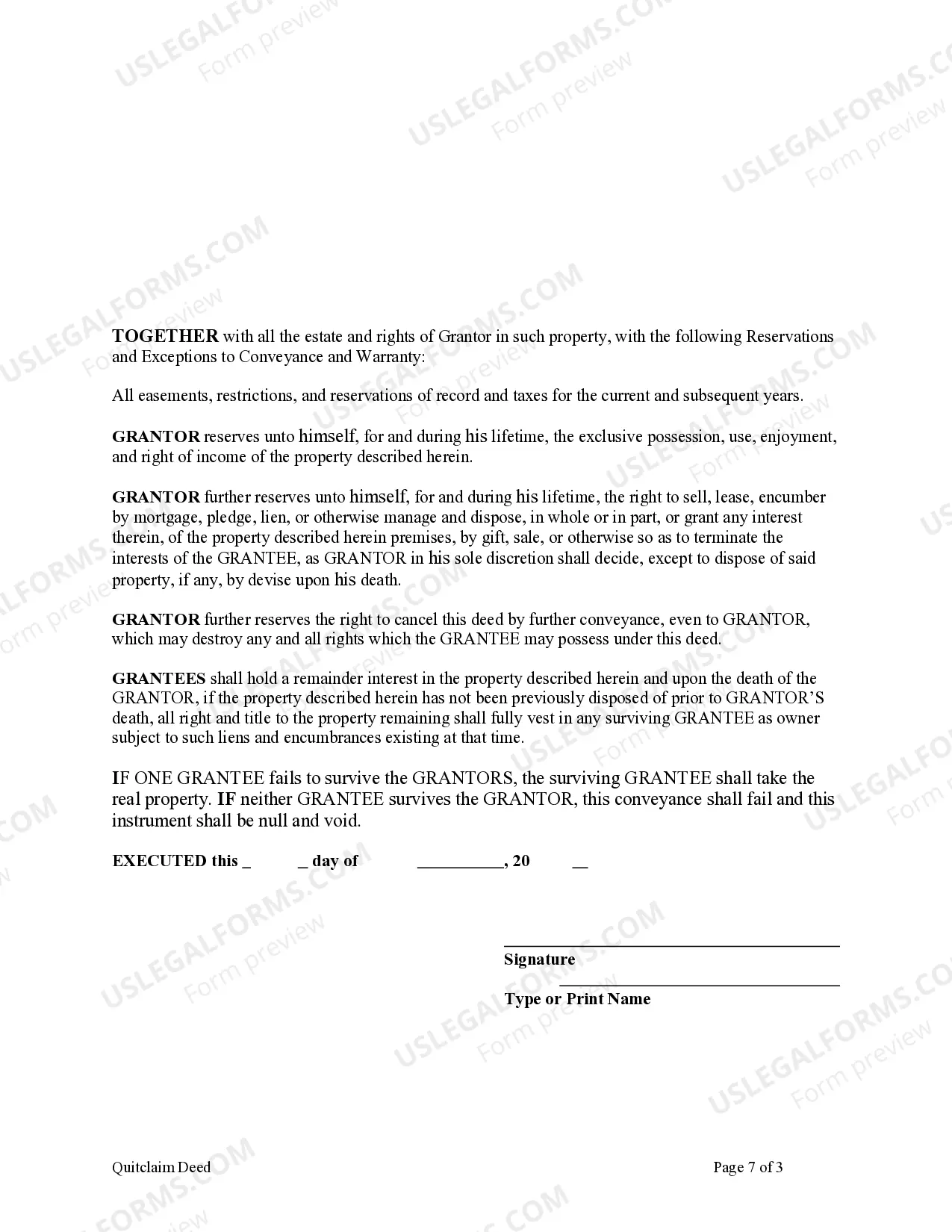

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

In Contra Costa, California, an Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal document that allows individuals to transfer property ownership to two individuals or a husband and wife while retaining control and benefits during their lifetime. This specialized type of deed offers several unique features that make it an attractive option for estate planning and property transfers. The Enhanced Life Estate or Lady Bird Quitclaim Deed provides the granter (the individual transferring the property) with the ability to retain full control and rights over the property, including the right to sell, lease, or mortgage it without any limitations. This means that the granter can continue to live on the property, collect rental income, or utilize it as they wish during their lifetime. This particular type of deed is often referred to as a "life estate with enhanced powers" due to the additional powers it provides to the granter. One key feature of the Enhanced Life Estate or Lady Bird Quitclaim Deed is the unique "remainder interest" that is conveyed to the grantees (the two individuals or husband and wife). This interest allows the grantees to inherit the property automatically, bypassing probate proceedings, upon the granter's death. It is important to note that this interest is not a present ownership interest, as the granter maintains full control and benefits during their lifetime. The Enhanced Life Estate or Lady Bird Quitclaim Deed offers specific advantages in terms of taxes and Medicaid planning. By retaining control over the property, the granter can potentially avoid or minimize gift taxes and may still qualify for certain tax exemptions and deductions. Additionally, since the property is not considered a countable asset for Medicaid eligibility purposes, this type of deed can help protect assets in case long-term care becomes necessary in the future. It is worth mentioning that there may be variations or additional types of Enhanced Life Estate or Lady Bird Quitclaim Deeds specific to Contra Costa County, California. For example, there may be variations depending on the specific use case, such as joint tenancy with enhanced life estate or limited enhanced life estate options. Overall, the Enhanced Life Estate or Lady Bird Quitclaim Deed provides a flexible and powerful tool for individuals or couples in Contra Costa, California who wish to transfer property while maintaining control and benefits during their lifetime. Properly utilizing this type of deed can offer significant advantages in terms of estate planning, tax implications, and asset protection.In Contra Costa, California, an Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal document that allows individuals to transfer property ownership to two individuals or a husband and wife while retaining control and benefits during their lifetime. This specialized type of deed offers several unique features that make it an attractive option for estate planning and property transfers. The Enhanced Life Estate or Lady Bird Quitclaim Deed provides the granter (the individual transferring the property) with the ability to retain full control and rights over the property, including the right to sell, lease, or mortgage it without any limitations. This means that the granter can continue to live on the property, collect rental income, or utilize it as they wish during their lifetime. This particular type of deed is often referred to as a "life estate with enhanced powers" due to the additional powers it provides to the granter. One key feature of the Enhanced Life Estate or Lady Bird Quitclaim Deed is the unique "remainder interest" that is conveyed to the grantees (the two individuals or husband and wife). This interest allows the grantees to inherit the property automatically, bypassing probate proceedings, upon the granter's death. It is important to note that this interest is not a present ownership interest, as the granter maintains full control and benefits during their lifetime. The Enhanced Life Estate or Lady Bird Quitclaim Deed offers specific advantages in terms of taxes and Medicaid planning. By retaining control over the property, the granter can potentially avoid or minimize gift taxes and may still qualify for certain tax exemptions and deductions. Additionally, since the property is not considered a countable asset for Medicaid eligibility purposes, this type of deed can help protect assets in case long-term care becomes necessary in the future. It is worth mentioning that there may be variations or additional types of Enhanced Life Estate or Lady Bird Quitclaim Deeds specific to Contra Costa County, California. For example, there may be variations depending on the specific use case, such as joint tenancy with enhanced life estate or limited enhanced life estate options. Overall, the Enhanced Life Estate or Lady Bird Quitclaim Deed provides a flexible and powerful tool for individuals or couples in Contra Costa, California who wish to transfer property while maintaining control and benefits during their lifetime. Properly utilizing this type of deed can offer significant advantages in terms of estate planning, tax implications, and asset protection.