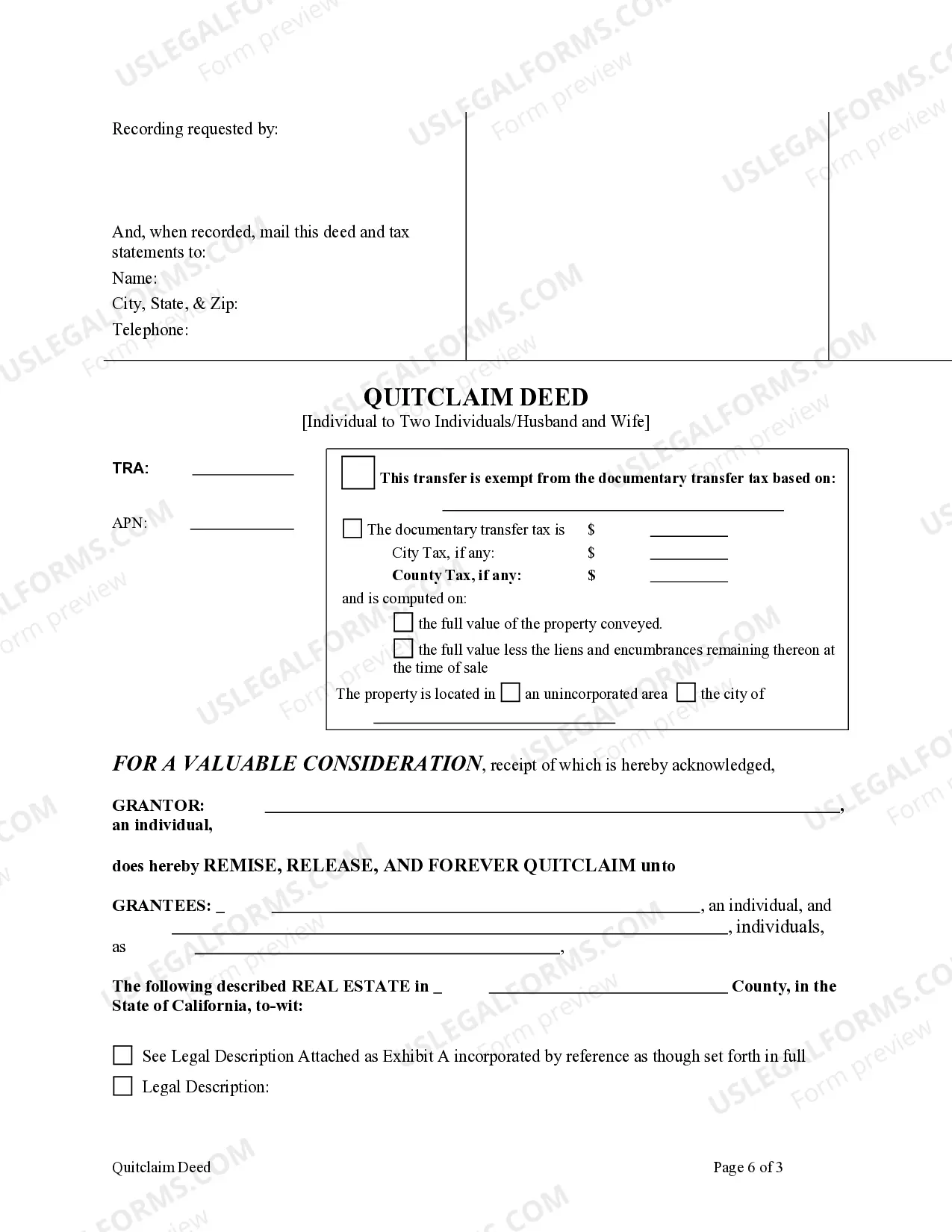

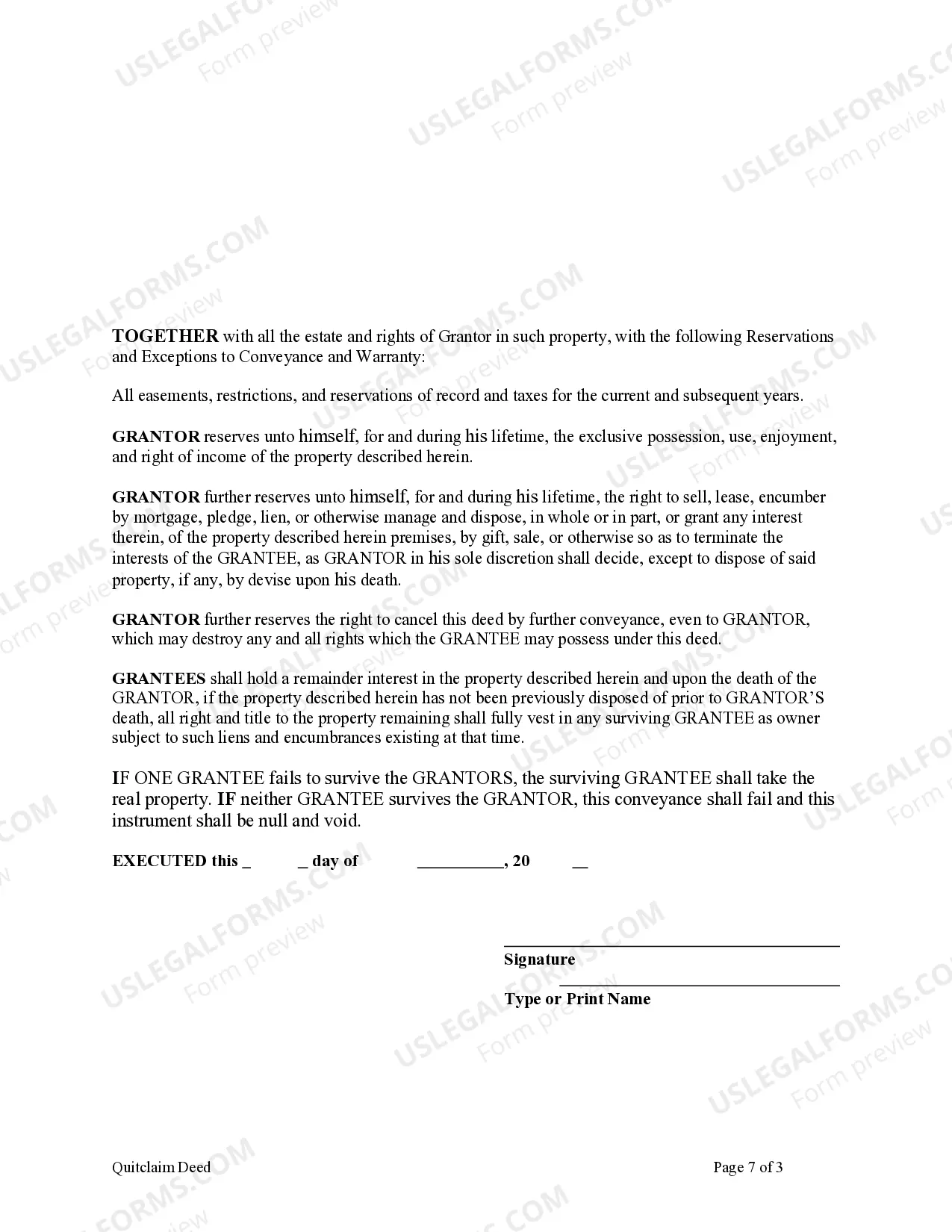

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed: A Comprehensive Overview for Husband and Wife Introduction: When it comes to estate planning, Fullerton, California offers several options for individuals or couples looking to protect their assets and ensure a seamless transfer of properties. The Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is one such option specifically designed for married couples, providing unique benefits and features that distinguish it from other types of deeds. In this detailed description, we will explore the concept of Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed, discuss its various types, and highlight its key features and advantages for husband and wife. What is a Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed? A Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal instrument that allows a property owner, referred to as the granter, to transfer ownership rights to two individuals, often spouses, referred to as grantees, while retaining an enhanced life estate during their lifetime. This means that the granter continues to possess full control and enjoyment of the property until their demise, with the grantees only assuming complete ownership after the granter's death. Types of Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deeds: 1. Full Ownership with Survivorship Rights: This type of deed provides equal ownership rights to both spouses during their lifetime. Upon the death of one spouse, the surviving spouse becomes the sole owner of the property, bypassing the need for probate. 2. Enhanced Life Estate with Right to Sell: This variation grants the granter the ability to sell or mortgage the property without the approval or consent of the grantees during their lifetime. However, it's important to note that any proceeds generated from such transactions belong solely to the granter. 3. Irrevocable Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed: This involves a permanent transfer of property rights and cannot be revoked or undone by the granter once executed. It ensures the grantees' ownership rights are fully protected without any future risks or challenges. Key Features and Advantages: 1. Avoidance of Probate: The primary advantage of this deed is that it enables the seamless transfer of property ownership to the surviving spouse upon the granter's death, bypassing the often time-consuming and costly probate process. 2. Enhanced Control for Granter: Granters benefit from an enhanced life estate, allowing them to retain complete control and possession of the property during their lifetime. This includes the ability to rent, sell, or make changes to the property without the consent of the grantees. 3. Protection of the Grantees: By establishing joint ownership, the Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed protects the surviving spouse's rights, ensuring uninterrupted ownership and preventing potential challenges from other parties. 4. Tax Benefits: This type of deed may offer certain tax advantages, such as property tax reassessment exemption for the surviving spouse or capital gains tax savings upon the subsequent sale of the property. Conclusion: In conclusion, the Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is a valuable estate planning tool for couples in Fullerton, California, aiming to secure their assets and streamline the transfer of property upon the granter's demise. With its various types allowing for tailored customization and its distinct features benefiting both the granter and grantees, this deed remains a popular choice among those seeking a smooth and efficient transition of their assets.Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed: A Comprehensive Overview for Husband and Wife Introduction: When it comes to estate planning, Fullerton, California offers several options for individuals or couples looking to protect their assets and ensure a seamless transfer of properties. The Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is one such option specifically designed for married couples, providing unique benefits and features that distinguish it from other types of deeds. In this detailed description, we will explore the concept of Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed, discuss its various types, and highlight its key features and advantages for husband and wife. What is a Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed? A Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal instrument that allows a property owner, referred to as the granter, to transfer ownership rights to two individuals, often spouses, referred to as grantees, while retaining an enhanced life estate during their lifetime. This means that the granter continues to possess full control and enjoyment of the property until their demise, with the grantees only assuming complete ownership after the granter's death. Types of Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deeds: 1. Full Ownership with Survivorship Rights: This type of deed provides equal ownership rights to both spouses during their lifetime. Upon the death of one spouse, the surviving spouse becomes the sole owner of the property, bypassing the need for probate. 2. Enhanced Life Estate with Right to Sell: This variation grants the granter the ability to sell or mortgage the property without the approval or consent of the grantees during their lifetime. However, it's important to note that any proceeds generated from such transactions belong solely to the granter. 3. Irrevocable Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed: This involves a permanent transfer of property rights and cannot be revoked or undone by the granter once executed. It ensures the grantees' ownership rights are fully protected without any future risks or challenges. Key Features and Advantages: 1. Avoidance of Probate: The primary advantage of this deed is that it enables the seamless transfer of property ownership to the surviving spouse upon the granter's death, bypassing the often time-consuming and costly probate process. 2. Enhanced Control for Granter: Granters benefit from an enhanced life estate, allowing them to retain complete control and possession of the property during their lifetime. This includes the ability to rent, sell, or make changes to the property without the consent of the grantees. 3. Protection of the Grantees: By establishing joint ownership, the Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed protects the surviving spouse's rights, ensuring uninterrupted ownership and preventing potential challenges from other parties. 4. Tax Benefits: This type of deed may offer certain tax advantages, such as property tax reassessment exemption for the surviving spouse or capital gains tax savings upon the subsequent sale of the property. Conclusion: In conclusion, the Fullerton California Enhanced Life Estate or Lady Bird Quitclaim Deed is a valuable estate planning tool for couples in Fullerton, California, aiming to secure their assets and streamline the transfer of property upon the granter's demise. With its various types allowing for tailored customization and its distinct features benefiting both the granter and grantees, this deed remains a popular choice among those seeking a smooth and efficient transition of their assets.