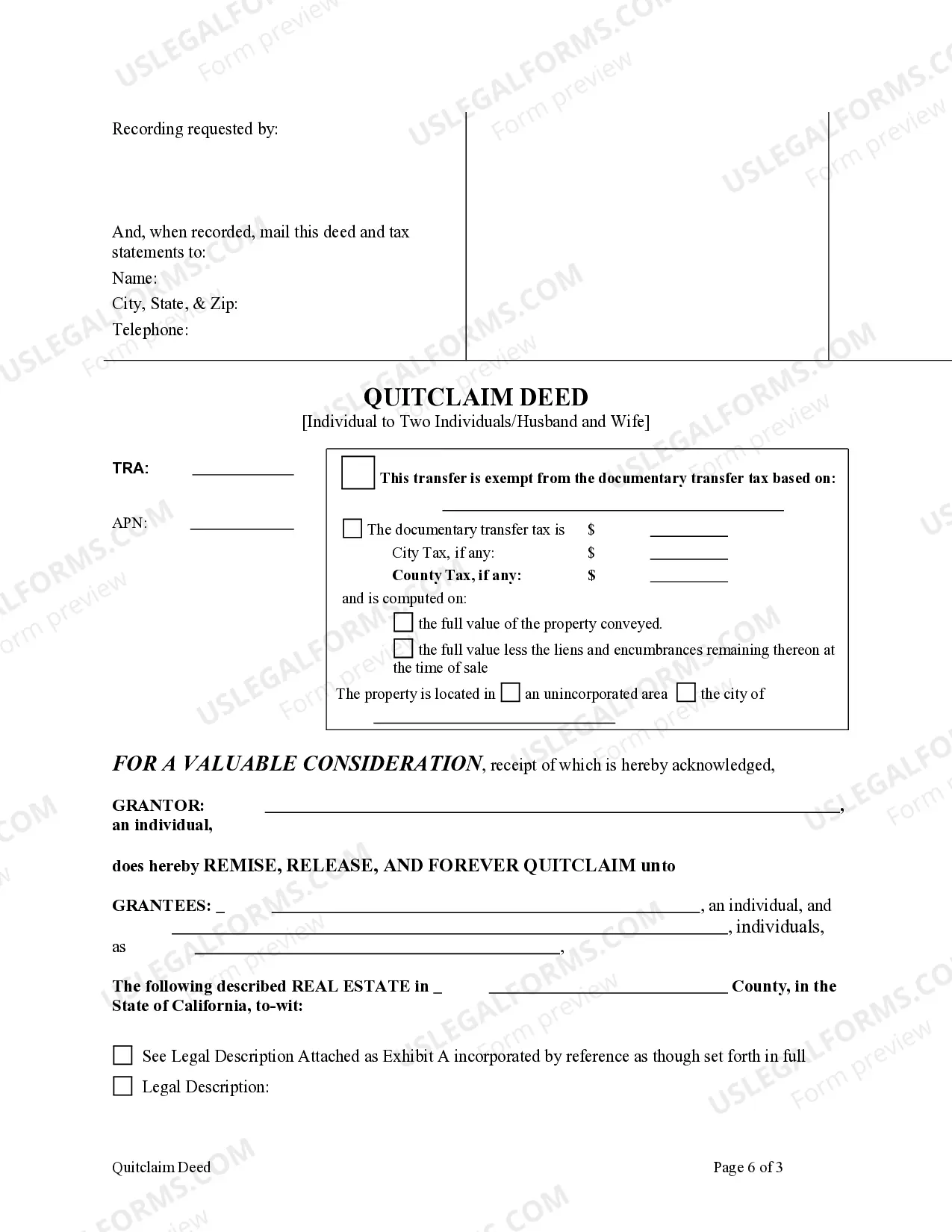

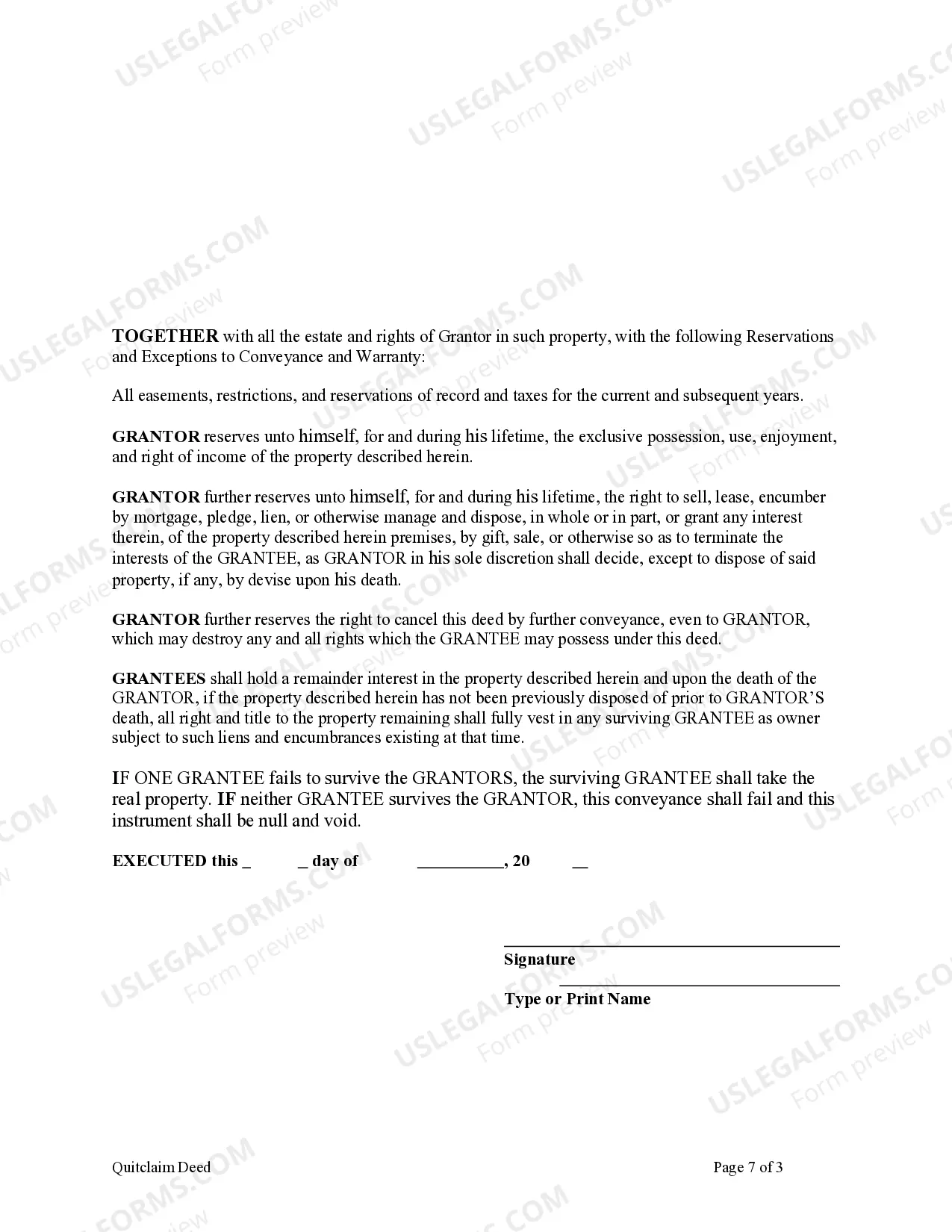

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

Garden Grove, California offers several options for property transfers, including the Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife. This type of deed provides unique benefits and rights for couples or individuals looking to safeguard their property and ensure a smooth transfer of ownership. The Enhanced Life Estate Deed, commonly referred to as a "Lady Bird Deed," is a powerful estate planning tool that allows individuals or couples to retain full control and ownership of their property during their lifetime while simultaneously naming beneficiaries or remainder men. This type of deed is especially advantageous for those who wish to avoid probate and ensure a straightforward transition of their property to their designated beneficiaries upon their death. The Lady Bird Deed provides the original property owner with the ability to sell, mortgage, or lease the property without requiring the consent or involvement of the remainder men. This feature differentiates the Lady Bird Deed from traditional life estates, where the property owner's use or control may be restricted. In Garden Grove, California, there are multiple variations of the Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife, each offering specific provisions and requirements based on the circumstances. Some common variations include: 1. Traditional Enhanced Life Estate or Lady Bird Quitclaim Deed: — Provides for the transfer of the property from an individual property owner to two individuals or a husband and wife. — Grants the individual(s) or couple the right to use, control, and enjoy the property during their lifetime while designating beneficiaries or remainder men. 2. Joint Tenants with Rights of Survivorship Enhanced Life Estate or Lady Bird Quitclaim Deed: — In this variation, the individuals or the husband and wife are designated as joint tenants, holding equal ownership rights and sharing the property. — The surviving joint tenant(s) automatically inherit the deceased joint tenant's interest upon their death, eliminating the need for probate. 3. Tenants in Common Enhanced Life Estate or Lady Bird Quitclaim Deed: — Unlike joint tenancy, tenants in common have separate, distinct shares of the property. — Each individual or the husband and wife can designate their respective remainder man to receive their portion of the property upon their death. By utilizing a Garden Grove, California Enhanced Life Estate or Lady Bird Quitclaim Deed, property owners can establish a clear plan for the transfer of their property while maintaining control and flexibility during their lifetime. It is recommended to consult with a qualified real estate attorney or estate planning professional to ensure compliance with local laws and to customize the deed to your specific needs.Garden Grove, California offers several options for property transfers, including the Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife. This type of deed provides unique benefits and rights for couples or individuals looking to safeguard their property and ensure a smooth transfer of ownership. The Enhanced Life Estate Deed, commonly referred to as a "Lady Bird Deed," is a powerful estate planning tool that allows individuals or couples to retain full control and ownership of their property during their lifetime while simultaneously naming beneficiaries or remainder men. This type of deed is especially advantageous for those who wish to avoid probate and ensure a straightforward transition of their property to their designated beneficiaries upon their death. The Lady Bird Deed provides the original property owner with the ability to sell, mortgage, or lease the property without requiring the consent or involvement of the remainder men. This feature differentiates the Lady Bird Deed from traditional life estates, where the property owner's use or control may be restricted. In Garden Grove, California, there are multiple variations of the Enhanced Life Estate or Lady Bird Quitclaim Deed from Individual to Two Individuals or Husband and Wife, each offering specific provisions and requirements based on the circumstances. Some common variations include: 1. Traditional Enhanced Life Estate or Lady Bird Quitclaim Deed: — Provides for the transfer of the property from an individual property owner to two individuals or a husband and wife. — Grants the individual(s) or couple the right to use, control, and enjoy the property during their lifetime while designating beneficiaries or remainder men. 2. Joint Tenants with Rights of Survivorship Enhanced Life Estate or Lady Bird Quitclaim Deed: — In this variation, the individuals or the husband and wife are designated as joint tenants, holding equal ownership rights and sharing the property. — The surviving joint tenant(s) automatically inherit the deceased joint tenant's interest upon their death, eliminating the need for probate. 3. Tenants in Common Enhanced Life Estate or Lady Bird Quitclaim Deed: — Unlike joint tenancy, tenants in common have separate, distinct shares of the property. — Each individual or the husband and wife can designate their respective remainder man to receive their portion of the property upon their death. By utilizing a Garden Grove, California Enhanced Life Estate or Lady Bird Quitclaim Deed, property owners can establish a clear plan for the transfer of their property while maintaining control and flexibility during their lifetime. It is recommended to consult with a qualified real estate attorney or estate planning professional to ensure compliance with local laws and to customize the deed to your specific needs.