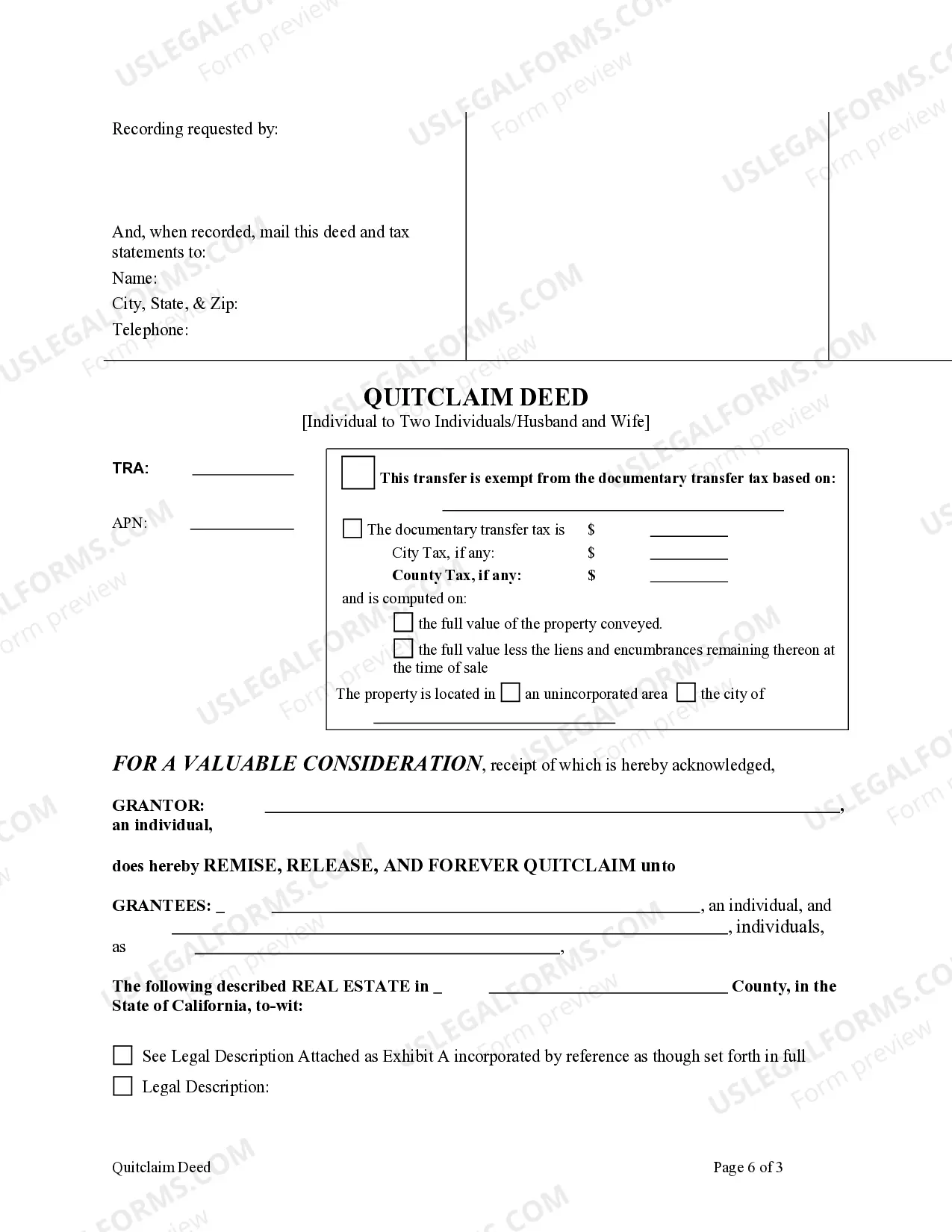

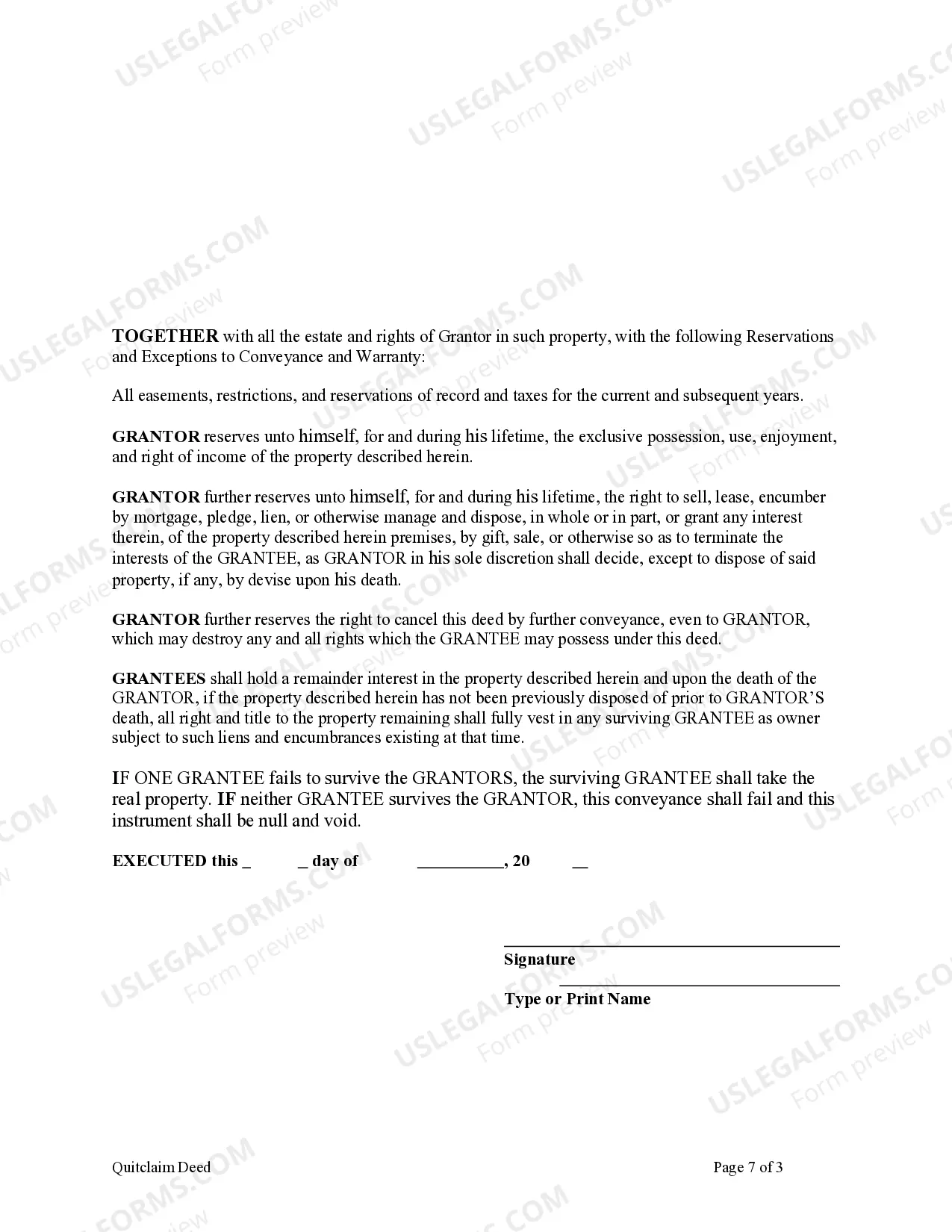

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

Pomona California Enhanced Life Estate or Lady Bird Quitclaim Deed is a legal document used to transfer property ownership from an individual to two individuals, typically a husband and wife. It grants the granters the right to live in and use the property for the remainder of their lives, and upon their passing, the property is automatically transferred to the two individuals without the need for probate. There are different types of Pomona California Enhanced Life Estate or Lady Bird Quitclaim Deeds available, including: 1. Traditional Enhanced Life Estate: This type of deed allows the granters (usually parents) to maintain control and ownership of the property during their lifetime while designating the two individuals (usually children) as the ultimate beneficiaries. The granters have the right to amend, sell, or even revoke the deed if circumstances change. 2. Joint Tenancy with Enhanced Life Estate: In this variation, the granters transfer the property ownership to themselves and the two individuals as joint tenants with the right of survivorship. This means that if one of the granters passes away, their share automatically transfers to the surviving granter(s) without going through probate. 3. Community Property with Right of Survivorship: This type of deed is applicable in cases where the granters are a married couple. It grants equal ownership rights to both spouses, and upon the death of one spouse, the property automatically becomes fully owned by the surviving spouse. The Pomona California Enhanced Life Estate or Lady Bird Quitclaim Deed offers several benefits, such as avoiding probate, potential property tax advantages, and maintaining control and use of the property during the granters' lifetime. It is essential for individuals considering this type of deed to seek legal advice to ensure compliance with relevant laws and regulations.