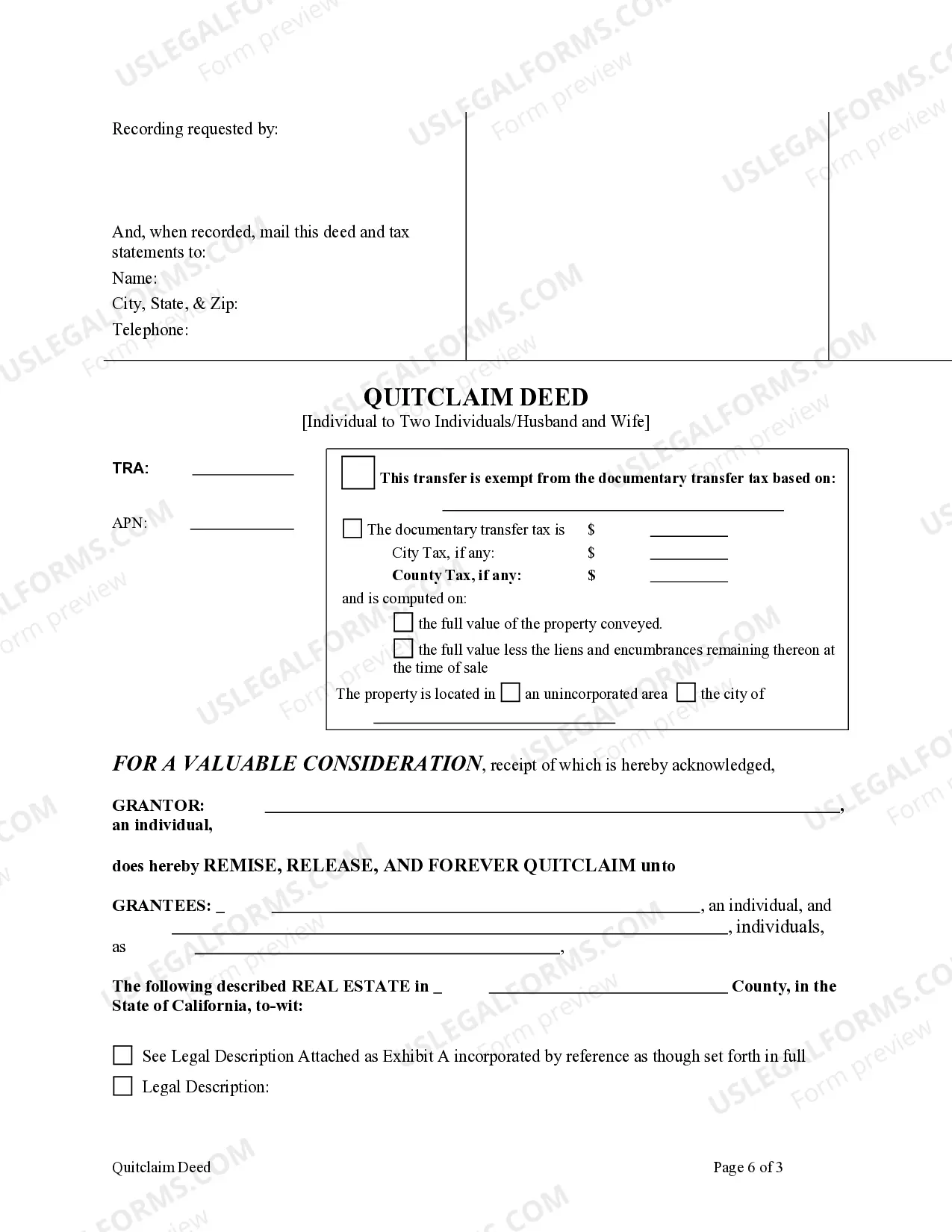

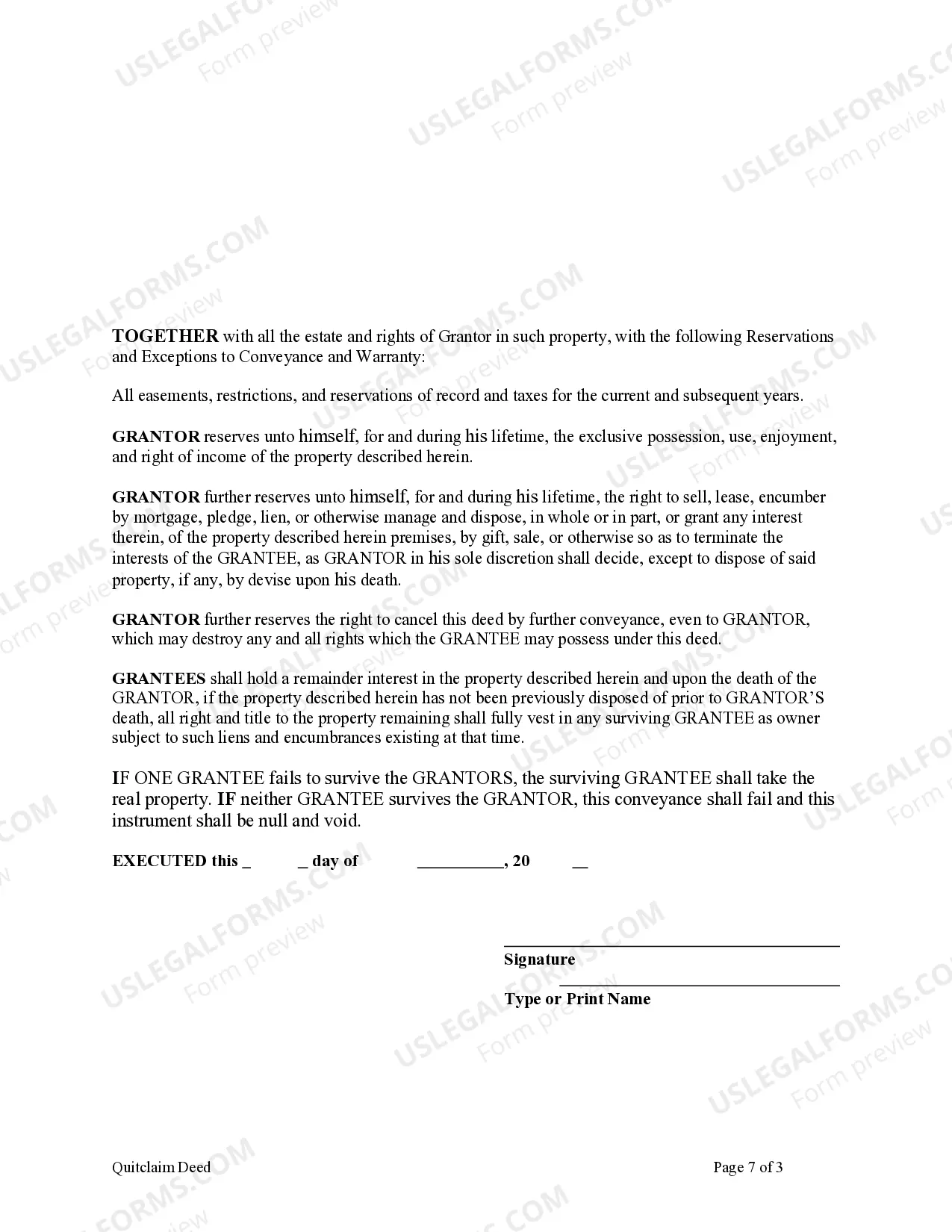

This form is a Quitclaim Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

In San Jose, California, an Enhanced Life Estate Deed, also known as a "Lady Bird Quitclaim Deed," is a legal document used when an individual wishes to transfer ownership of their property to two individuals, typically a husband and wife. This particular type of deed grants the individuals certain unique rights and benefits. The Enhanced Life Estate Deed allows the original property owner (granter) to retain control and possession of the property during their lifetime. They are considered the "life tenant" and can continue living on the property, using it as they see fit, and even selling or mortgaging it without needing the consent of the beneficiaries (grantees). The grantees, usually a husband and wife, become the remainder beneficiaries and will only gain full ownership of the property upon the death of the life tenant. They acquire the property with what is called a "full power of appointment," allowing them complete control of the property's distribution after the life tenant's passing. This means they can decide to leave it to their heirs, sell it, or even transfer it to someone else. The Lady Bird Quitclaim Deed is named after Lady Bird Johnson, wife of President Lyndon B. Johnson, who used this particular type of deed to transfer property in Texas. It gained popularity due to its ability to avoid probate and potential tax issues. It is important to note that while the San Jose California Enhanced Life Estate or Lady Bird Quitclaim Deed is popular, there may be variations or modifications of this deed depending on specific circumstances or estate planning needs. Therefore, it is advisable to consult with a real estate attorney or estate planning professional to ensure the deed is correctly tailored to an individual's situation and goals.In San Jose, California, an Enhanced Life Estate Deed, also known as a "Lady Bird Quitclaim Deed," is a legal document used when an individual wishes to transfer ownership of their property to two individuals, typically a husband and wife. This particular type of deed grants the individuals certain unique rights and benefits. The Enhanced Life Estate Deed allows the original property owner (granter) to retain control and possession of the property during their lifetime. They are considered the "life tenant" and can continue living on the property, using it as they see fit, and even selling or mortgaging it without needing the consent of the beneficiaries (grantees). The grantees, usually a husband and wife, become the remainder beneficiaries and will only gain full ownership of the property upon the death of the life tenant. They acquire the property with what is called a "full power of appointment," allowing them complete control of the property's distribution after the life tenant's passing. This means they can decide to leave it to their heirs, sell it, or even transfer it to someone else. The Lady Bird Quitclaim Deed is named after Lady Bird Johnson, wife of President Lyndon B. Johnson, who used this particular type of deed to transfer property in Texas. It gained popularity due to its ability to avoid probate and potential tax issues. It is important to note that while the San Jose California Enhanced Life Estate or Lady Bird Quitclaim Deed is popular, there may be variations or modifications of this deed depending on specific circumstances or estate planning needs. Therefore, it is advisable to consult with a real estate attorney or estate planning professional to ensure the deed is correctly tailored to an individual's situation and goals.