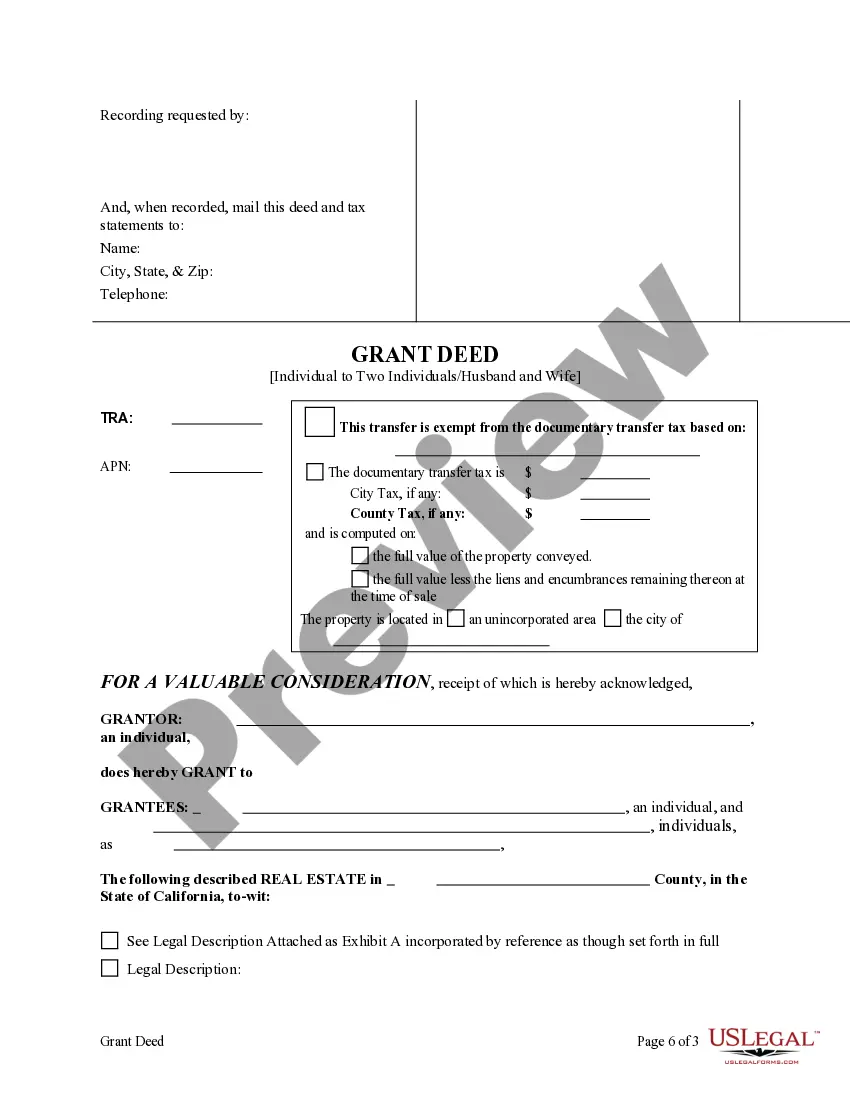

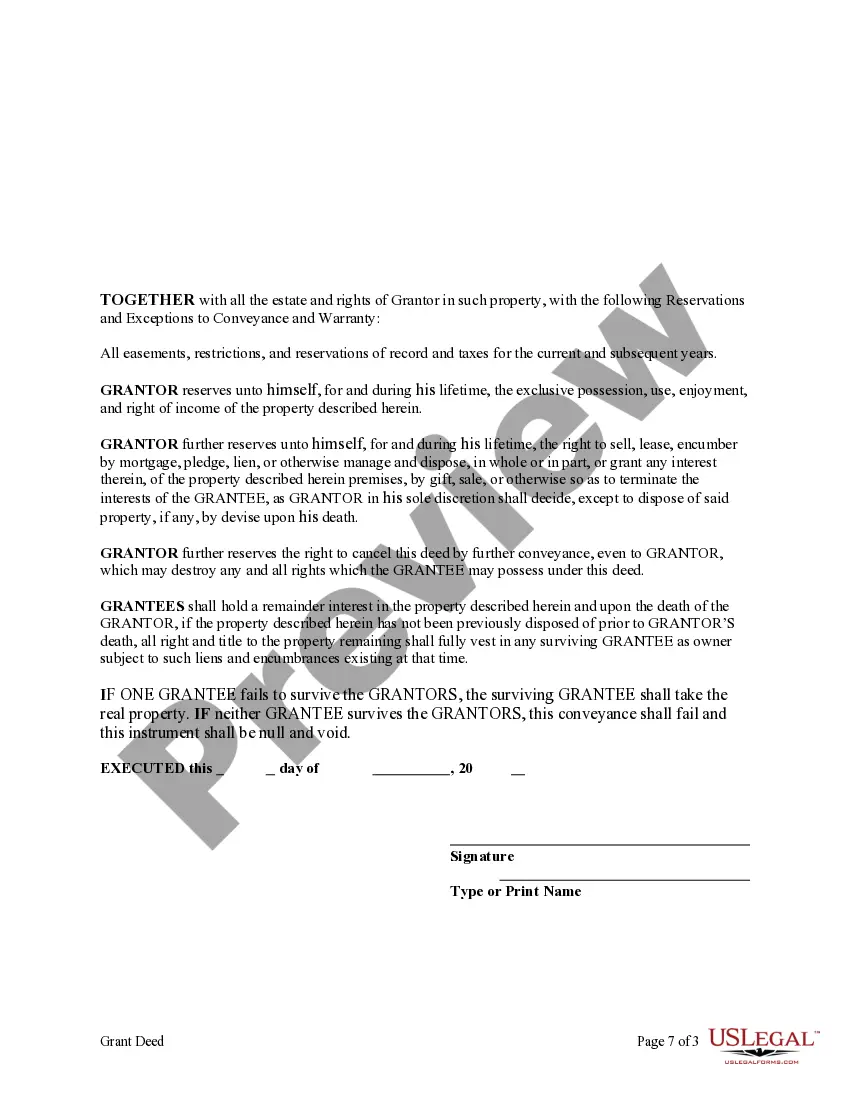

This form is a Grant Deed with a retained Enhanced Life Estate where the Grantor is an individual and the Grantees are two individuals or husband and wife. Grantor conveys the property to Grantees subject to an enhanced retained life estate. The Grantor retains the right to sell, encumber, mortgage or otherwise impair the interest Grantees might receive in the future, without joinder or notice to Grantee, with the exception of the right to transfer the property by will. Grantees are required to survive the Grantor in order to receive an interest in the real property. This deed complies with all state statutory laws.

Inglewood California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife: An Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is a legally binding document that allows an individual (granter) to transfer ownership of real estate to two individuals or a husband and wife (grantees) while retaining certain rights and benefits during their lifetime. This unique type of deed is commonly used in estate planning to ensure a smooth transfer of property and to achieve specific estate goals. Key features of Inglewood California Enhanced Life Estate or Lady Bird Grant Deed include: 1. Enhanced Life Estate: The granter retains an enhanced life estate, which means they have the right to reside on and enjoy the property throughout their lifetime. They can continue to use and control the property, receive any income generated from it, and even sell or mortgage the property without the permission of the grantees. 2. Avoiding Probate: One of the primary advantages of an Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is its ability to bypass the probate process. Upon the granter's death, the property automatically transfers to the grantees without the need for probate court involvement. This allows for a more efficient transfer of ownership and can save time and expenses associated with probate proceedings. 3. Medicaid Planning: Another significant benefit of this type of deed is its usefulness in Medicaid planning. By utilizing the enhanced life estate provision, the granter can transfer the property without it being counted as an asset for Medicaid eligibility purposes. This can be particularly advantageous for individuals who may require long-term care in the future. 4. Homeowner's Tax Exemption: In California, when a principal residence is transferred between spouses, no reassessment of property value for property tax purposes occurs. This means that the grantees can retain the original homeowner's tax exemption, leading to potential tax savings. Different types of Inglewood California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife include: 1. Standard Lady Bird Deed: This is the most common and straightforward form of the Inglewood California Enhanced Life Estate or Lady Bird Grant Deed. It involves the transfer of property from an individual to two individuals or a husband and wife, with the granter retaining an enhanced life estate. 2. Lady Bird Deed with Restrictions: In some cases, certain restrictions or conditions may be included in the deed. For example, the granter may specify that the property can only be used for residential purposes or impose restrictions on the grantees' ability to sell or mortgage the property during the granter's lifetime. In summary, an Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is a powerful estate planning tool that allows for the transfer of property from an individual to two individuals or a husband and wife while providing the granter with an enhanced life estate. It can help avoid probate, facilitate Medicaid planning, and preserve homeowner's tax exemptions. Different variations of this type of deed may exist based on specific restrictions or conditions agreed upon by the parties involved.Inglewood California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife: An Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is a legally binding document that allows an individual (granter) to transfer ownership of real estate to two individuals or a husband and wife (grantees) while retaining certain rights and benefits during their lifetime. This unique type of deed is commonly used in estate planning to ensure a smooth transfer of property and to achieve specific estate goals. Key features of Inglewood California Enhanced Life Estate or Lady Bird Grant Deed include: 1. Enhanced Life Estate: The granter retains an enhanced life estate, which means they have the right to reside on and enjoy the property throughout their lifetime. They can continue to use and control the property, receive any income generated from it, and even sell or mortgage the property without the permission of the grantees. 2. Avoiding Probate: One of the primary advantages of an Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is its ability to bypass the probate process. Upon the granter's death, the property automatically transfers to the grantees without the need for probate court involvement. This allows for a more efficient transfer of ownership and can save time and expenses associated with probate proceedings. 3. Medicaid Planning: Another significant benefit of this type of deed is its usefulness in Medicaid planning. By utilizing the enhanced life estate provision, the granter can transfer the property without it being counted as an asset for Medicaid eligibility purposes. This can be particularly advantageous for individuals who may require long-term care in the future. 4. Homeowner's Tax Exemption: In California, when a principal residence is transferred between spouses, no reassessment of property value for property tax purposes occurs. This means that the grantees can retain the original homeowner's tax exemption, leading to potential tax savings. Different types of Inglewood California Enhanced Life Estate or Lady Bird Grant Deed from Individual to Two Individuals or Husband and Wife include: 1. Standard Lady Bird Deed: This is the most common and straightforward form of the Inglewood California Enhanced Life Estate or Lady Bird Grant Deed. It involves the transfer of property from an individual to two individuals or a husband and wife, with the granter retaining an enhanced life estate. 2. Lady Bird Deed with Restrictions: In some cases, certain restrictions or conditions may be included in the deed. For example, the granter may specify that the property can only be used for residential purposes or impose restrictions on the grantees' ability to sell or mortgage the property during the granter's lifetime. In summary, an Inglewood California Enhanced Life Estate or Lady Bird Grant Deed is a powerful estate planning tool that allows for the transfer of property from an individual to two individuals or a husband and wife while providing the granter with an enhanced life estate. It can help avoid probate, facilitate Medicaid planning, and preserve homeowner's tax exemptions. Different variations of this type of deed may exist based on specific restrictions or conditions agreed upon by the parties involved.