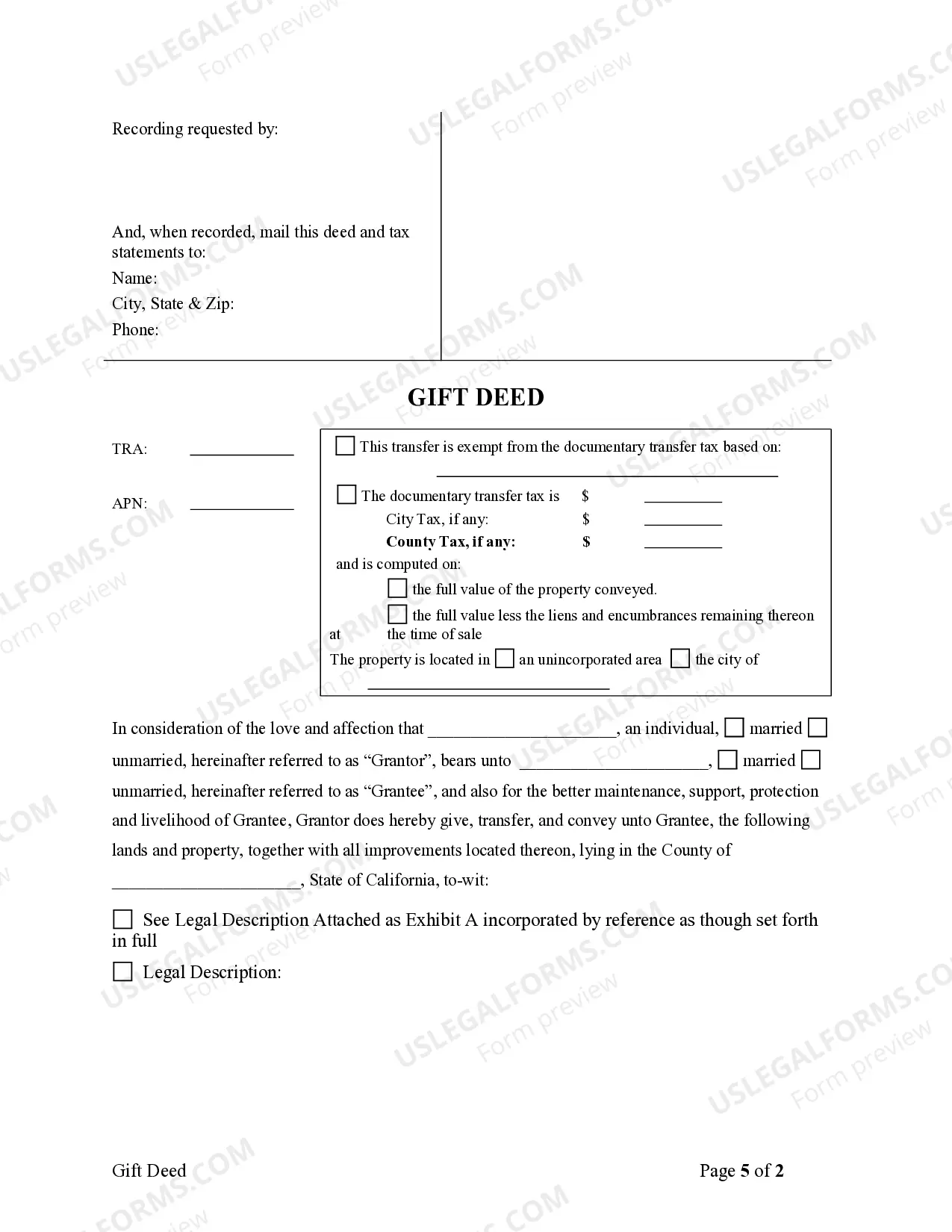

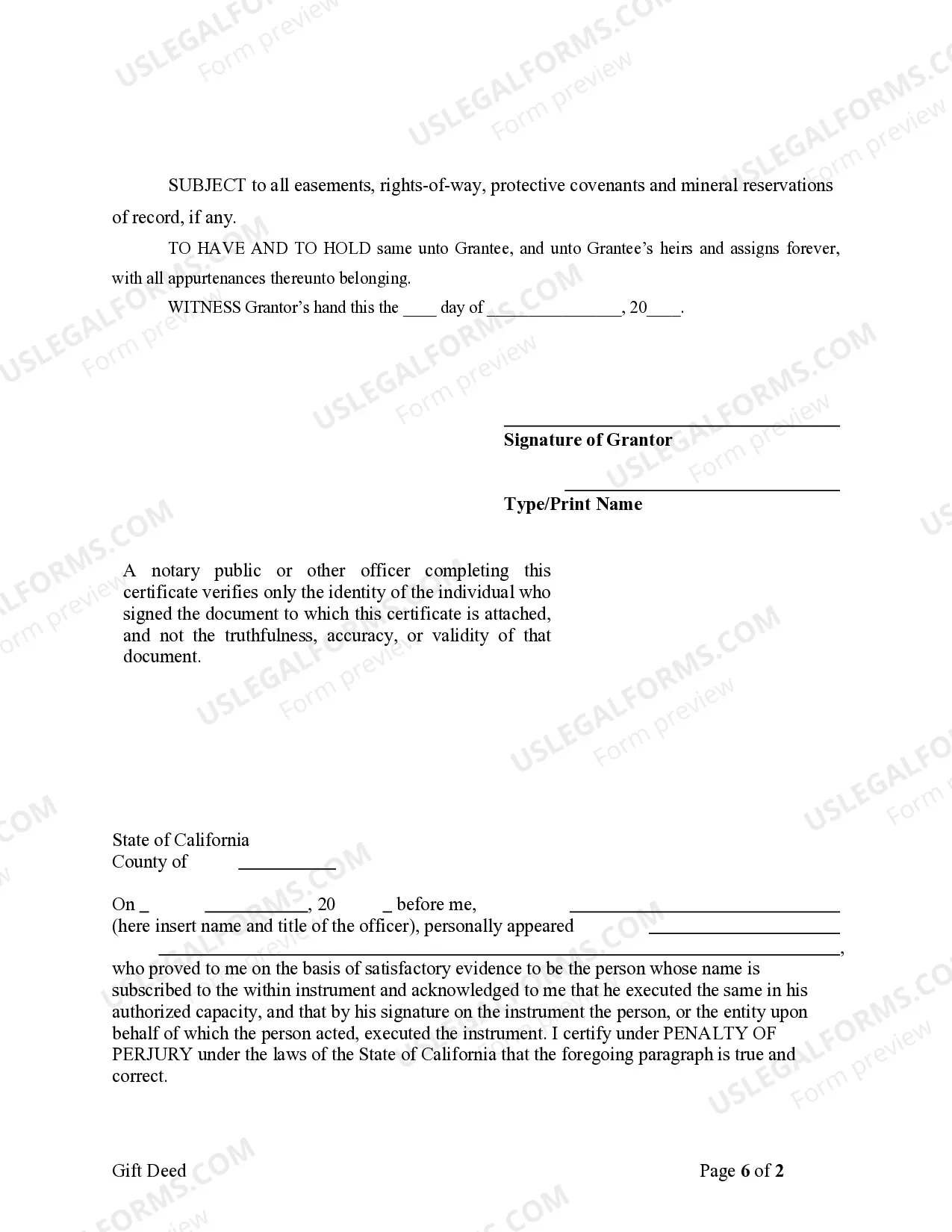

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

Bakersfield California Gift Deed for Individual to Individual is a legal document used to transfer ownership of real property from one person (the donor) to another person (the recipient) as a gift. It is a common method in Bakersfield, California for individuals to transfer property without any exchange of money. A gift deed is a binding agreement that signifies the donor's intention to gift the property to the recipient without any compensation or consideration. This transfer is permanent, and once the gift deed is executed and recorded, the recipient becomes the legal owner of the property. In Bakersfield, California, there are different types of gift deeds, including: 1. Basic Gift Deed: This is the most common type of gift deed, which simply transfers ownership of the property from the donor to the recipient without any conditions or restrictions. 2. Gift Deed with Reservation: In this type of gift deed, the donor retains certain rights or interests in the property even after the transfer. It could include a reserved life estate, where the donor continues to live in the property until their death. 3. Gift Deed with Conditions: Sometimes, a donor may attach certain conditions or obligations to the gift. For example, the recipient may need to use the property for a specific purpose or maintain it in a particular way. It is important to note that a Bakersfield California Gift Deed for Individual to Individual must meet certain legal requirements to be valid. These requirements typically include a written instrument, the donor's intent to gift the property, acceptance of the gift by the recipient, and proper execution and recording of the deed with the county recorder's office. If you are considering gifting a property in Bakersfield, California, it is advisable to consult with a qualified real estate attorney to ensure that the gift deed complies with all legal requirements and to protect your interests throughout the process.Bakersfield California Gift Deed for Individual to Individual is a legal document used to transfer ownership of real property from one person (the donor) to another person (the recipient) as a gift. It is a common method in Bakersfield, California for individuals to transfer property without any exchange of money. A gift deed is a binding agreement that signifies the donor's intention to gift the property to the recipient without any compensation or consideration. This transfer is permanent, and once the gift deed is executed and recorded, the recipient becomes the legal owner of the property. In Bakersfield, California, there are different types of gift deeds, including: 1. Basic Gift Deed: This is the most common type of gift deed, which simply transfers ownership of the property from the donor to the recipient without any conditions or restrictions. 2. Gift Deed with Reservation: In this type of gift deed, the donor retains certain rights or interests in the property even after the transfer. It could include a reserved life estate, where the donor continues to live in the property until their death. 3. Gift Deed with Conditions: Sometimes, a donor may attach certain conditions or obligations to the gift. For example, the recipient may need to use the property for a specific purpose or maintain it in a particular way. It is important to note that a Bakersfield California Gift Deed for Individual to Individual must meet certain legal requirements to be valid. These requirements typically include a written instrument, the donor's intent to gift the property, acceptance of the gift by the recipient, and proper execution and recording of the deed with the county recorder's office. If you are considering gifting a property in Bakersfield, California, it is advisable to consult with a qualified real estate attorney to ensure that the gift deed complies with all legal requirements and to protect your interests throughout the process.