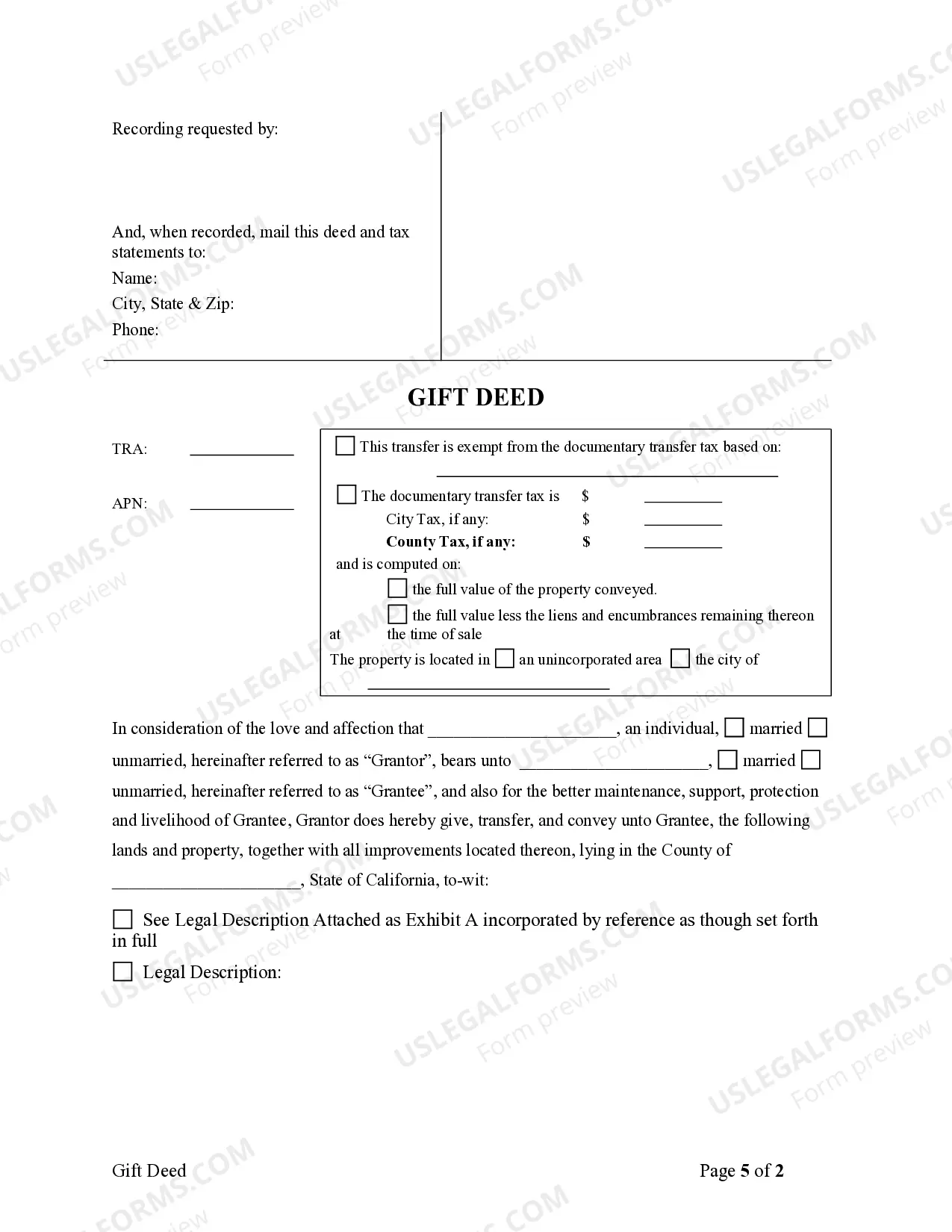

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

A Contra Costa California Gift Deed for Individual to Individual is a legal document that facilitates the transfer of ownership of real estate or properties from one individual to another as a gift, without any exchange of money or consideration. It allows a property owner, referred to as the granter, to transfer their property rights to another individual, known as the grantee, without any monetary transaction involved. This type of gift deed is commonly used for various reasons, including transferring ownership between family members, gifting property to a charitable organization, or simply to fulfill a personal relationship or obligation. The Contra Costa California Gift Deed for Individual to Individual ensures the transfer is legally recognized, providing a clear and valid record of the transaction. Keywords: Contra Costa California, gift deed, individual to individual, transfer of ownership, real estate, properties, granter, grantee, gift, legal document, ownership, family members, charitable organization, personal relationship, obligation, legally recognized, transaction. Types of Contra Costa California Gift Deed for Individual to Individual may include: 1. Interviews Gift Deed: This type of gift deed is used for transferring ownership of property while the granter is still alive. It allows the granter to gift the property to the grantee directly, with an intention to take effect immediately. 2. Conditional Gift Deed: In certain situations, a gift deed may have specific conditions or requirements attached to it. For example, the granter may stipulate that the gift can only be claimed or transferred under certain circumstances or after a specific period of time. 3. Joint Tenancy Gift Deed: This type of gift deed establishes joint ownership of the property between the granter and the grantee. Both parties hold an equal share in the property, and upon the death of one party, the surviving joint tenant automatically receives full ownership rights. 4. Remainder Interest Gift Deed: With this type of gift deed, the granter can transfer their property to the grantee while retaining a life estate. This means the granter still has the right to possess and use the property during their lifetime, and upon their death, full ownership transfers to the grantee. 5. Gift Deed with Reservation of a Life Estate: Similar to a remainder interest gift deed, this type allows the granter to transfer ownership to the grantee while retaining a life estate. However, unlike the remainder interest, the granter can also reserve the right to receive income or financial benefits from the property during their lifetime. Keywords: Interviews gift deed, conditional gift deed, joint tenancy gift deed, remainder interest gift deed, gift deed with reservation of a life estate.A Contra Costa California Gift Deed for Individual to Individual is a legal document that facilitates the transfer of ownership of real estate or properties from one individual to another as a gift, without any exchange of money or consideration. It allows a property owner, referred to as the granter, to transfer their property rights to another individual, known as the grantee, without any monetary transaction involved. This type of gift deed is commonly used for various reasons, including transferring ownership between family members, gifting property to a charitable organization, or simply to fulfill a personal relationship or obligation. The Contra Costa California Gift Deed for Individual to Individual ensures the transfer is legally recognized, providing a clear and valid record of the transaction. Keywords: Contra Costa California, gift deed, individual to individual, transfer of ownership, real estate, properties, granter, grantee, gift, legal document, ownership, family members, charitable organization, personal relationship, obligation, legally recognized, transaction. Types of Contra Costa California Gift Deed for Individual to Individual may include: 1. Interviews Gift Deed: This type of gift deed is used for transferring ownership of property while the granter is still alive. It allows the granter to gift the property to the grantee directly, with an intention to take effect immediately. 2. Conditional Gift Deed: In certain situations, a gift deed may have specific conditions or requirements attached to it. For example, the granter may stipulate that the gift can only be claimed or transferred under certain circumstances or after a specific period of time. 3. Joint Tenancy Gift Deed: This type of gift deed establishes joint ownership of the property between the granter and the grantee. Both parties hold an equal share in the property, and upon the death of one party, the surviving joint tenant automatically receives full ownership rights. 4. Remainder Interest Gift Deed: With this type of gift deed, the granter can transfer their property to the grantee while retaining a life estate. This means the granter still has the right to possess and use the property during their lifetime, and upon their death, full ownership transfers to the grantee. 5. Gift Deed with Reservation of a Life Estate: Similar to a remainder interest gift deed, this type allows the granter to transfer ownership to the grantee while retaining a life estate. However, unlike the remainder interest, the granter can also reserve the right to receive income or financial benefits from the property during their lifetime. Keywords: Interviews gift deed, conditional gift deed, joint tenancy gift deed, remainder interest gift deed, gift deed with reservation of a life estate.