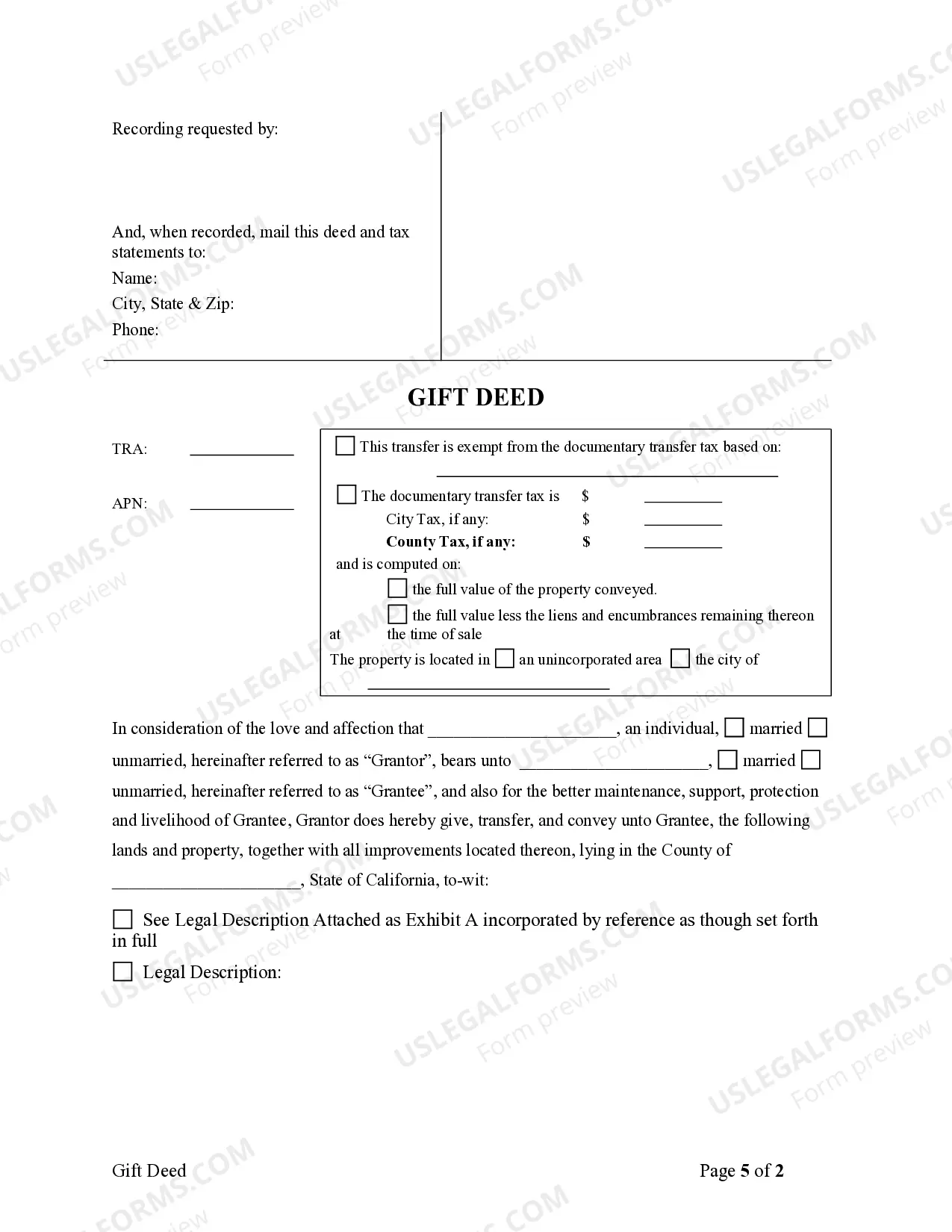

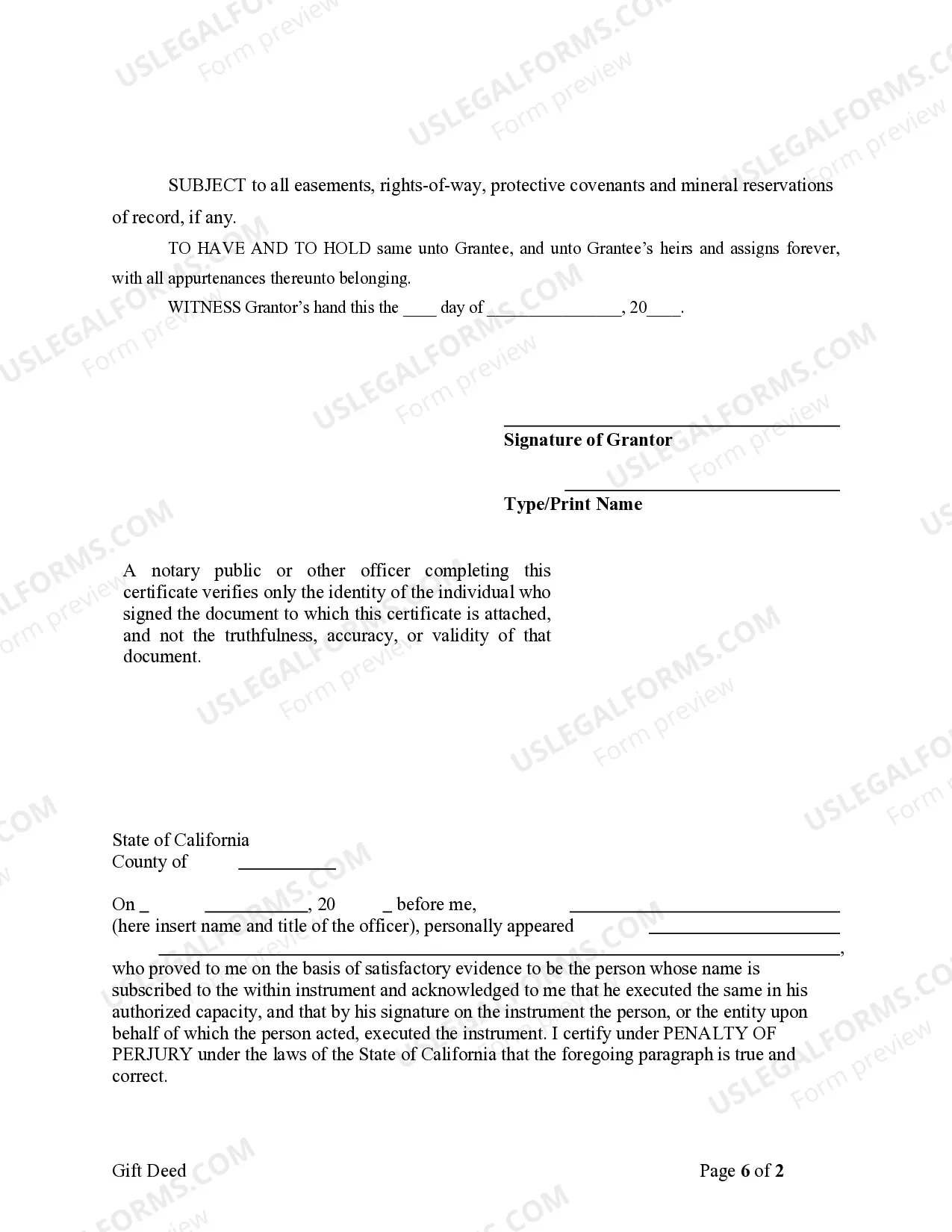

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

Escondido California Gift Deed for Individual to Individual A Gift Deed in Escondido, California refers to a legal document that allows an individual to transfer ownership of real estate as a gift to another individual without any monetary consideration. This type of deed is commonly used when transferring property between family members, friends, or acquaintances. The Escondido California Gift Deed for Individual to Individual is a legally binding agreement that must meet certain requirements to be considered valid. These requirements include: 1. Intention to Gift: The person making the gift (the granter) must have a genuine intent to gift the property without receiving anything in return. This intention should be clearly stated in the deed. 2. Voluntary Transfer: The transfer must be voluntary, meaning there should be no coercion or duress involved. Both parties involved should willingly agree to the transfer. 3. Legal Capacity: Both the granter and the recipient (the grantee) must have the legal capacity to enter into a contract. This means they must be of sound mind, be of legal age (18 years or older), and not be under any legal incapacity. 4. Valid Description of the Property: The gift deed should contain an accurate and detailed description of the property being transferred. This includes the full address, boundaries, and any relevant identifying information. 5. Signatures and Witnesses: The gift deed must be signed by both the granter and the grantee in the presence of at least two witnesses. These witnesses should be impartial individuals who are not directly involved in the transaction. It is important to note that there are different variations of the Escondido California Gift Deed for Individual to Individual, depending on the specific circumstances of the transfer. Some commonly used variations include: 1. Gift Deed with Reservation of Life Estate: This type of gift deed allows the granter to gift the property to the recipient while retaining the right to live on the property for the remainder of their life. Upon the granter's death, the property automatically transfers to the recipient. 2. Joint Tenancy Gift Deed: In this variation, the property is gifted to multiple individuals, usually spouses or partners, as joint tenants. This means that upon the death of one joint tenant, their share automatically transfers to the surviving joint tenant(s) without the need for probate. 3. Gift Deed with Conditions or Restrictions: This type of gift deed may include certain conditions or restrictions that the granter imposes on the use or future transfer of the property. These conditions may include restrictions on building structures, land use, or sale of the property. When considering an Escondido California Gift Deed for Individual to Individual, it is essential to consult with a qualified real estate attorney or legal professional to ensure that all legal requirements are met and to understand the implications of your specific circumstances.Escondido California Gift Deed for Individual to Individual A Gift Deed in Escondido, California refers to a legal document that allows an individual to transfer ownership of real estate as a gift to another individual without any monetary consideration. This type of deed is commonly used when transferring property between family members, friends, or acquaintances. The Escondido California Gift Deed for Individual to Individual is a legally binding agreement that must meet certain requirements to be considered valid. These requirements include: 1. Intention to Gift: The person making the gift (the granter) must have a genuine intent to gift the property without receiving anything in return. This intention should be clearly stated in the deed. 2. Voluntary Transfer: The transfer must be voluntary, meaning there should be no coercion or duress involved. Both parties involved should willingly agree to the transfer. 3. Legal Capacity: Both the granter and the recipient (the grantee) must have the legal capacity to enter into a contract. This means they must be of sound mind, be of legal age (18 years or older), and not be under any legal incapacity. 4. Valid Description of the Property: The gift deed should contain an accurate and detailed description of the property being transferred. This includes the full address, boundaries, and any relevant identifying information. 5. Signatures and Witnesses: The gift deed must be signed by both the granter and the grantee in the presence of at least two witnesses. These witnesses should be impartial individuals who are not directly involved in the transaction. It is important to note that there are different variations of the Escondido California Gift Deed for Individual to Individual, depending on the specific circumstances of the transfer. Some commonly used variations include: 1. Gift Deed with Reservation of Life Estate: This type of gift deed allows the granter to gift the property to the recipient while retaining the right to live on the property for the remainder of their life. Upon the granter's death, the property automatically transfers to the recipient. 2. Joint Tenancy Gift Deed: In this variation, the property is gifted to multiple individuals, usually spouses or partners, as joint tenants. This means that upon the death of one joint tenant, their share automatically transfers to the surviving joint tenant(s) without the need for probate. 3. Gift Deed with Conditions or Restrictions: This type of gift deed may include certain conditions or restrictions that the granter imposes on the use or future transfer of the property. These conditions may include restrictions on building structures, land use, or sale of the property. When considering an Escondido California Gift Deed for Individual to Individual, it is essential to consult with a qualified real estate attorney or legal professional to ensure that all legal requirements are met and to understand the implications of your specific circumstances.