This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

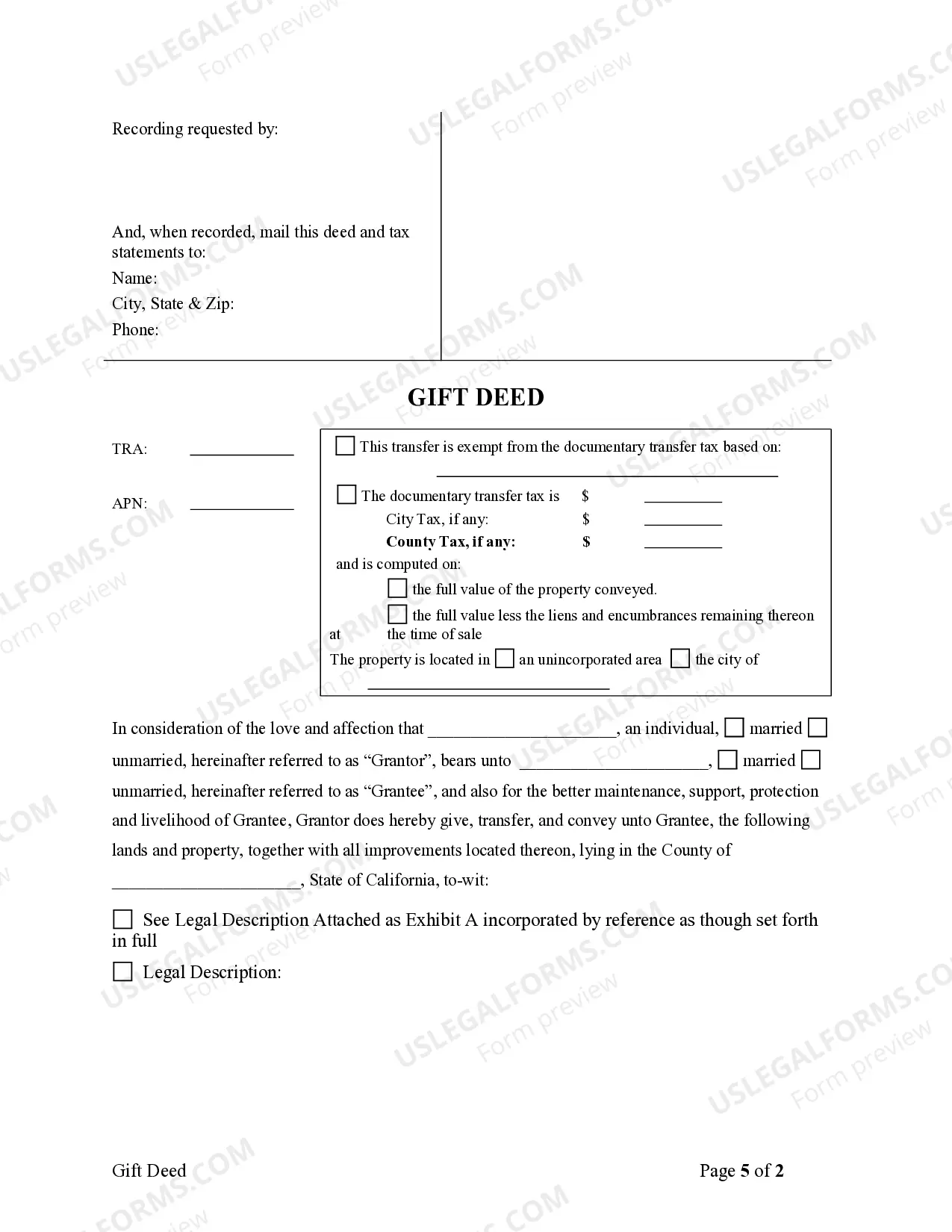

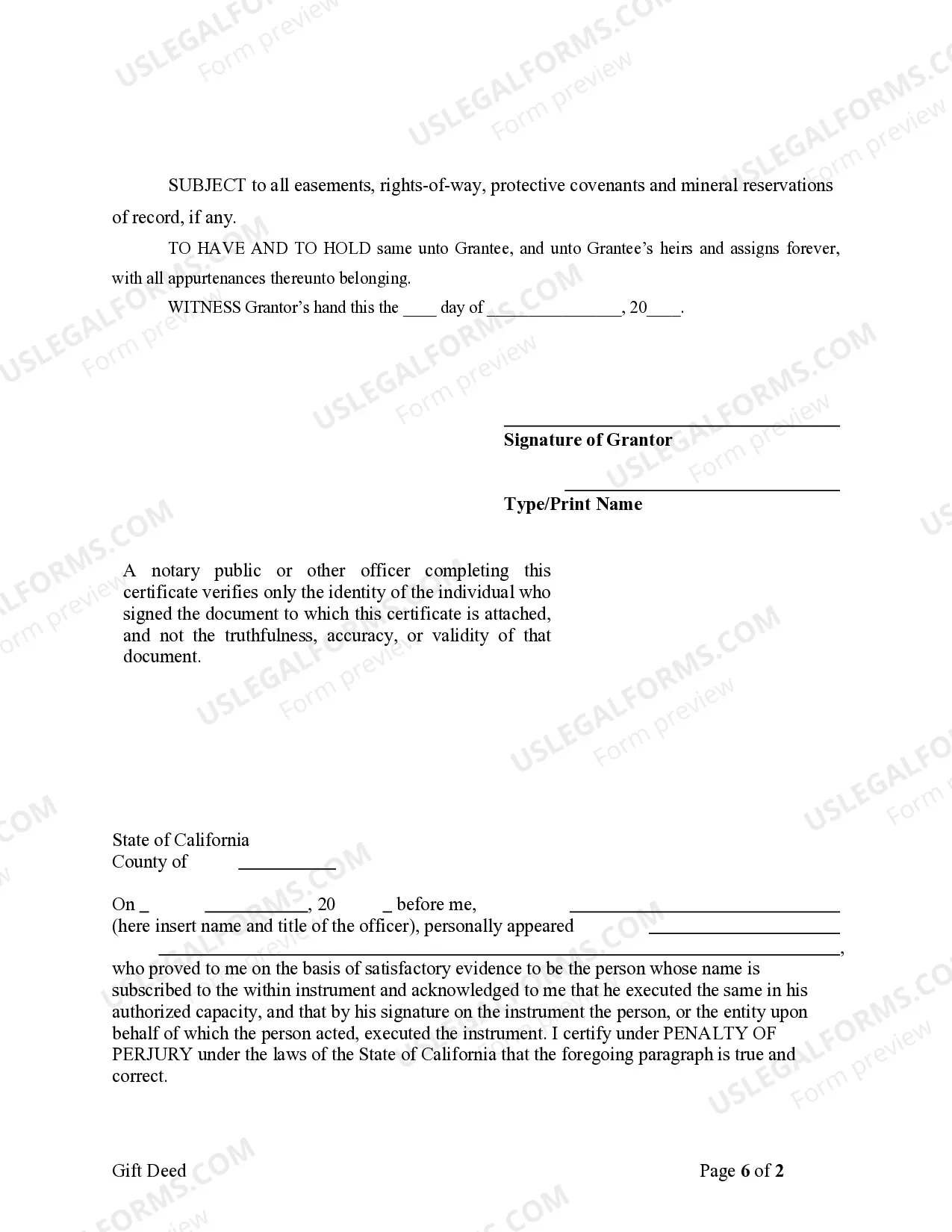

A Fullerton California gift deed for individual to individual is a legal document that allows an individual to transfer ownership of real estate property to another individual without the need for financial compensation. This type of deed is often used in situations where the property owner wishes to gift their property to a family member, friend, or relative, either as a gesture of generosity or as part of an estate planning process. The Fullerton California gift deed includes important details regarding the property, including its legal description, address, and parcel number. It also specifies the granter (the current owner of the property) and the grantee (the recipient of the gifted property). The deed must be signed and notarized by both parties to ensure its validity. The gift deed is a useful method for transferring ownership without the need for a purchase agreement and monetary exchange. It can also help individuals avoid potential estate taxes or probate proceedings. However, it is essential to consult with an experienced real estate attorney or a qualified legal professional to ensure compliance with California state laws and regulations. Different variations of Fullerton California gift deeds may include specific terms and conditions based on the preferences and circumstances of the parties involved. These variations may include: 1. Gift Deed with Reservation: This type of gift deed grants the property to the recipient while reserving specific rights for the granter. For example, the granter may reserve the right to live on the property for a specified period or to retain a portion of the property's income. 2. Gift Deed with Joint Tenancy: In this variation, the property is gifted to the recipient with joint tenancy rights. This means that both the granter and the grantee have an equal share in the property. If one party passes away, their interest automatically transfers to the surviving joint tenant. 3. Gift Deed with Life Estate: This form of gift deed grants ownership of the property to the recipient while reserving a life estate for the granter. A life estate allows the granter to live on the property until their death, after which ownership fully transfers to the recipient. 4. Gift Deed with Conditions: A gift deed may include specific conditions or restrictions imposed by the granter. For example, the granter may require that the property be used for specific purposes or that certain alterations or modifications not be made. 5. Gift Deed with Revocation Clause: This variation includes a clause allowing the granter to revoke the gift deed under certain conditions, providing a level of flexibility and control over the transfer of ownership. It is essential for individuals considering a Fullerton California gift deed to carefully review their specific circumstances and objectives and seek professional advice to ensure compliance with legal requirements and maximize the benefits of the gift deed.A Fullerton California gift deed for individual to individual is a legal document that allows an individual to transfer ownership of real estate property to another individual without the need for financial compensation. This type of deed is often used in situations where the property owner wishes to gift their property to a family member, friend, or relative, either as a gesture of generosity or as part of an estate planning process. The Fullerton California gift deed includes important details regarding the property, including its legal description, address, and parcel number. It also specifies the granter (the current owner of the property) and the grantee (the recipient of the gifted property). The deed must be signed and notarized by both parties to ensure its validity. The gift deed is a useful method for transferring ownership without the need for a purchase agreement and monetary exchange. It can also help individuals avoid potential estate taxes or probate proceedings. However, it is essential to consult with an experienced real estate attorney or a qualified legal professional to ensure compliance with California state laws and regulations. Different variations of Fullerton California gift deeds may include specific terms and conditions based on the preferences and circumstances of the parties involved. These variations may include: 1. Gift Deed with Reservation: This type of gift deed grants the property to the recipient while reserving specific rights for the granter. For example, the granter may reserve the right to live on the property for a specified period or to retain a portion of the property's income. 2. Gift Deed with Joint Tenancy: In this variation, the property is gifted to the recipient with joint tenancy rights. This means that both the granter and the grantee have an equal share in the property. If one party passes away, their interest automatically transfers to the surviving joint tenant. 3. Gift Deed with Life Estate: This form of gift deed grants ownership of the property to the recipient while reserving a life estate for the granter. A life estate allows the granter to live on the property until their death, after which ownership fully transfers to the recipient. 4. Gift Deed with Conditions: A gift deed may include specific conditions or restrictions imposed by the granter. For example, the granter may require that the property be used for specific purposes or that certain alterations or modifications not be made. 5. Gift Deed with Revocation Clause: This variation includes a clause allowing the granter to revoke the gift deed under certain conditions, providing a level of flexibility and control over the transfer of ownership. It is essential for individuals considering a Fullerton California gift deed to carefully review their specific circumstances and objectives and seek professional advice to ensure compliance with legal requirements and maximize the benefits of the gift deed.