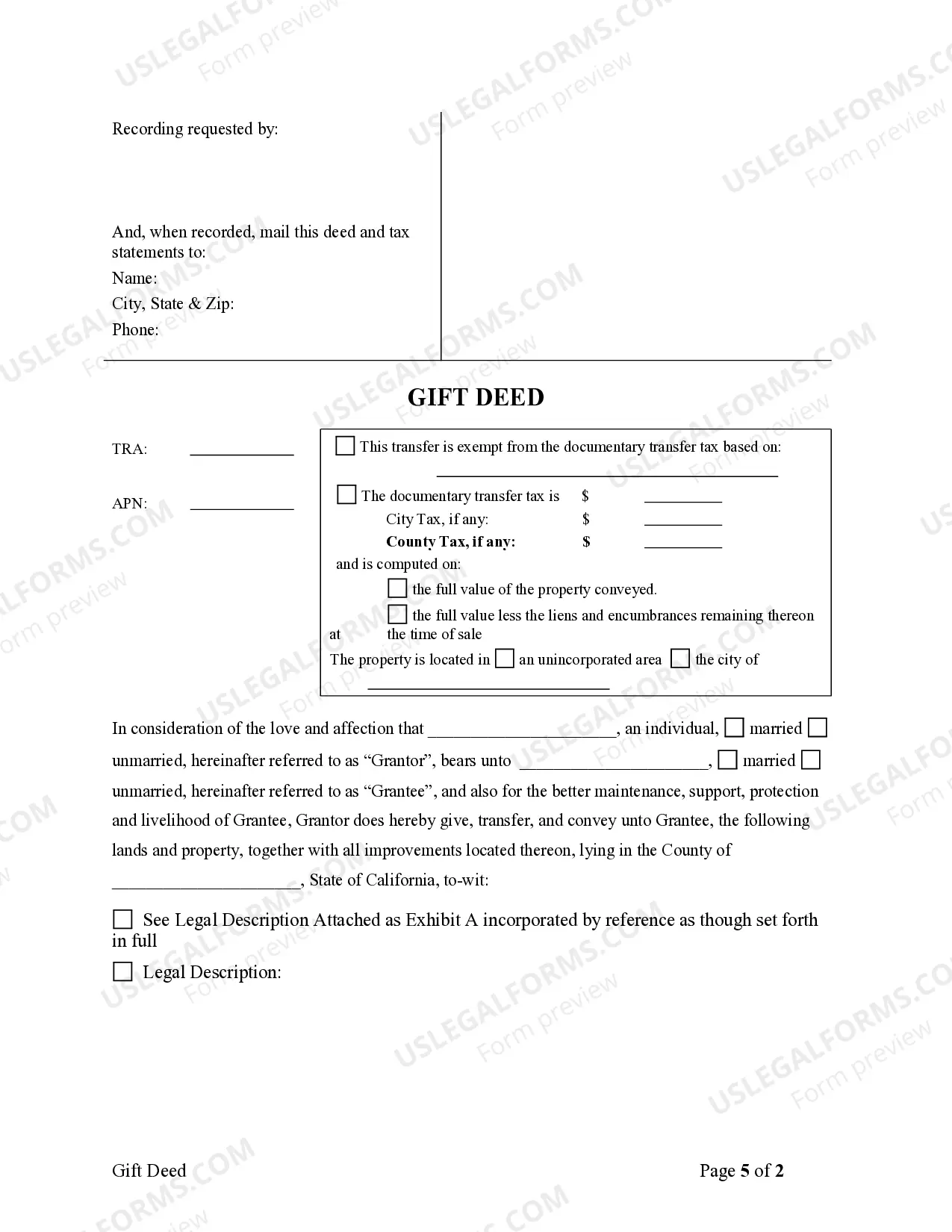

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

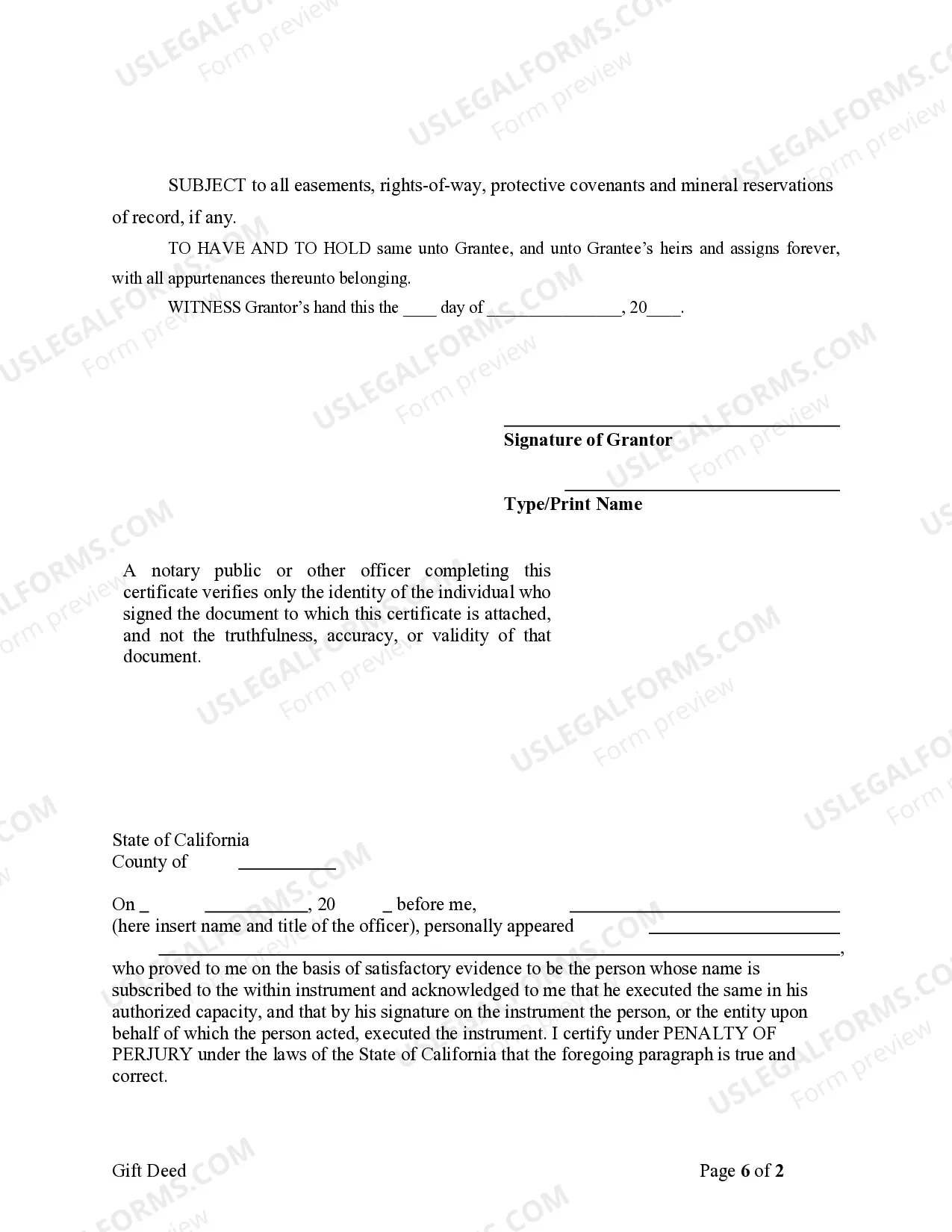

Description: A Hayward California Gift Deed for Individual to Individual is a legally binding document that allows an individual to transfer ownership of real property as a gift to another individual in Hayward, California. This type of deed is used when a person intends to give a property without any financial compensation involved. The Hayward California Gift Deed for Individual to Individual serves as evidence of the gift and ensures a smooth transfer of property rights from the donor (the person giving the gift) to the done (the recipient of the gift). It is a voluntary act of generosity often done between family members, close friends, or for estate planning purposes. There are different types of Hayward California Gift Deeds for Individual to Individual, each serving specific purposes: 1. Immediate Gift: This type of gift deed allows for the immediate transfer of ownership without any conditions or restrictions. 2. Conditional Gift: In this case, the transfer of property ownership is subject to certain conditions stated in the deed. For example, the donor might require the done to use the property for a particular purpose or maintain it in a certain condition. 3. Residual Gift: With a residual gift deed, the donor reserves a life estate, meaning they retain the right to live on the property until they pass away. After the donor's death, the property is gifted to the designated individual. 4. Gift with Reservation: This type of gift deed allows the donor to continue using or benefiting from the property even after the transfer. However, it requires the donor to pay fair market rent to the done for their continued occupancy or use. The Hayward California Gift Deed for Individual to Individual must comply with the legal requirements and guidelines set forth by the state. These may include preparing the deed on appropriate legal forms, ensuring the deed is properly executed and notarized, and recording the deed with the County Recorder's Office to establish its validity and priority in case of future disputes. It is crucial for both the donor and the done to seek professional legal advice before entering into a Hayward California Gift Deed for Individual to ensure compliance with local laws and to understand the implications and potential tax consequences associated with such a transfer. In conclusion, a Hayward California Gift Deed for Individual to Individual is a legal instrument that facilitates the gifting of real property without any financial consideration. Whether it's an immediate, conditional, residual, or gift with reservation deed, this type of transfer allows individuals to pass on ownership of property as a gesture of goodwill, love, or for estate planning purposes.Description: A Hayward California Gift Deed for Individual to Individual is a legally binding document that allows an individual to transfer ownership of real property as a gift to another individual in Hayward, California. This type of deed is used when a person intends to give a property without any financial compensation involved. The Hayward California Gift Deed for Individual to Individual serves as evidence of the gift and ensures a smooth transfer of property rights from the donor (the person giving the gift) to the done (the recipient of the gift). It is a voluntary act of generosity often done between family members, close friends, or for estate planning purposes. There are different types of Hayward California Gift Deeds for Individual to Individual, each serving specific purposes: 1. Immediate Gift: This type of gift deed allows for the immediate transfer of ownership without any conditions or restrictions. 2. Conditional Gift: In this case, the transfer of property ownership is subject to certain conditions stated in the deed. For example, the donor might require the done to use the property for a particular purpose or maintain it in a certain condition. 3. Residual Gift: With a residual gift deed, the donor reserves a life estate, meaning they retain the right to live on the property until they pass away. After the donor's death, the property is gifted to the designated individual. 4. Gift with Reservation: This type of gift deed allows the donor to continue using or benefiting from the property even after the transfer. However, it requires the donor to pay fair market rent to the done for their continued occupancy or use. The Hayward California Gift Deed for Individual to Individual must comply with the legal requirements and guidelines set forth by the state. These may include preparing the deed on appropriate legal forms, ensuring the deed is properly executed and notarized, and recording the deed with the County Recorder's Office to establish its validity and priority in case of future disputes. It is crucial for both the donor and the done to seek professional legal advice before entering into a Hayward California Gift Deed for Individual to ensure compliance with local laws and to understand the implications and potential tax consequences associated with such a transfer. In conclusion, a Hayward California Gift Deed for Individual to Individual is a legal instrument that facilitates the gifting of real property without any financial consideration. Whether it's an immediate, conditional, residual, or gift with reservation deed, this type of transfer allows individuals to pass on ownership of property as a gesture of goodwill, love, or for estate planning purposes.