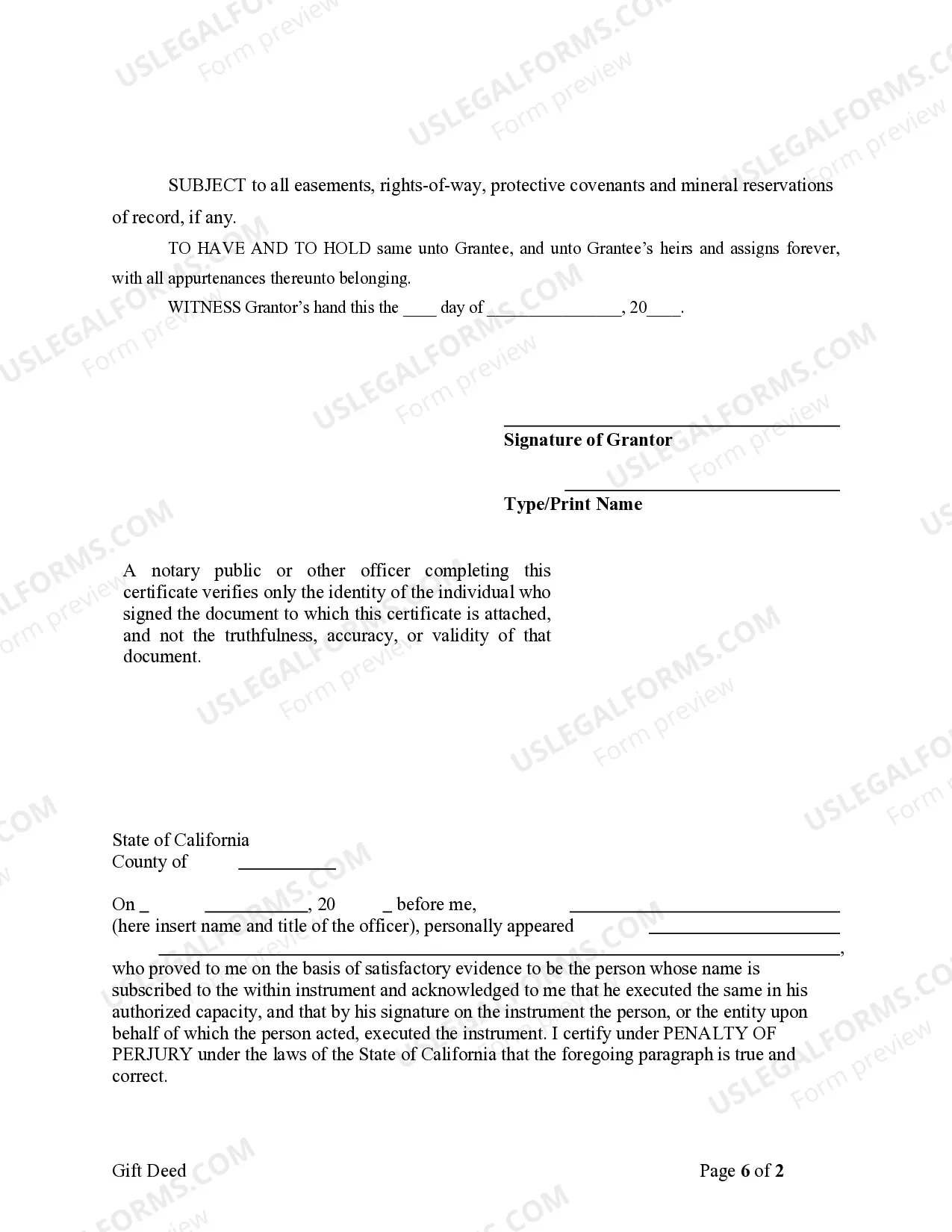

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

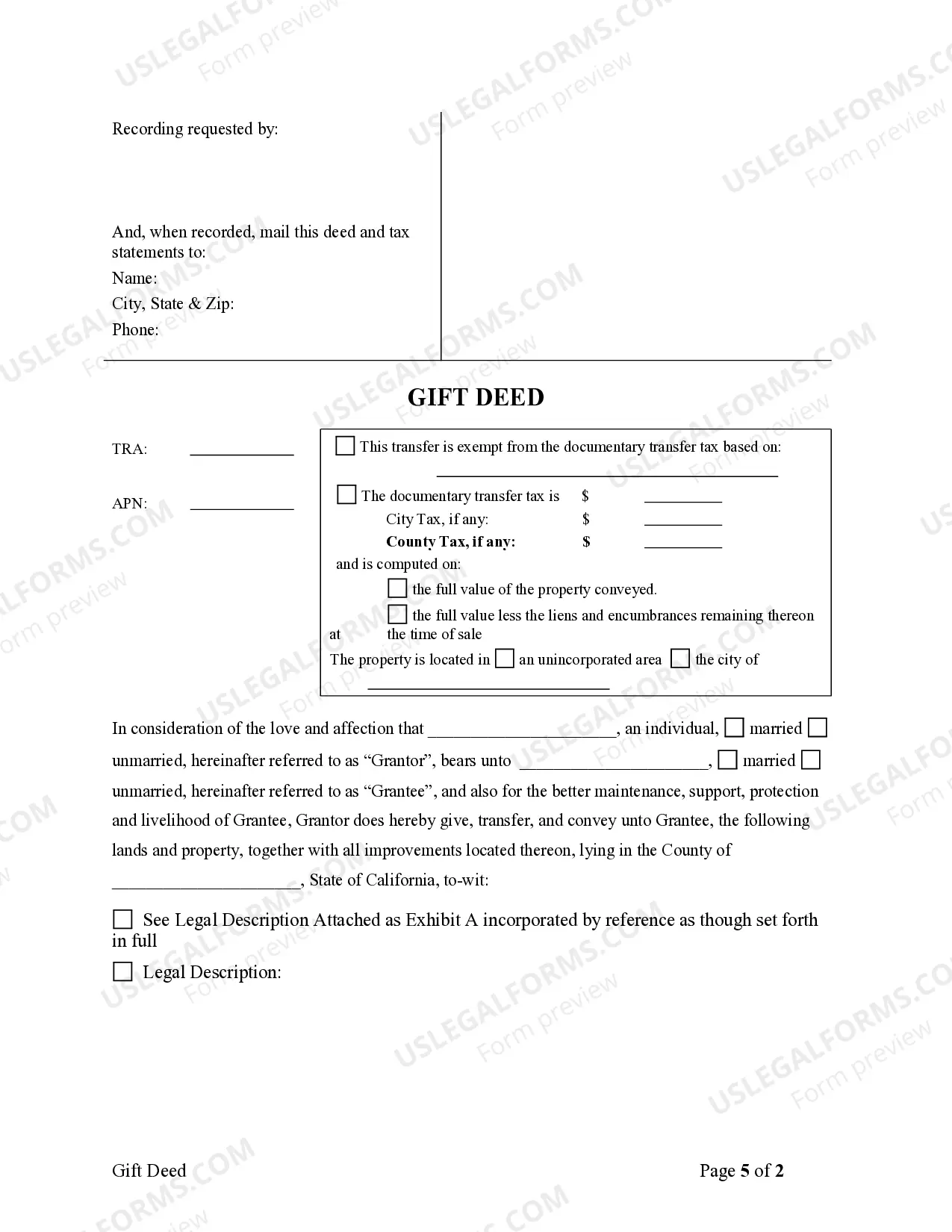

Sacramento California Gift Deed for Individual to Individual is a legally binding document that transfer ownership of real property as a gift from one individual to another within the Sacramento area of California. This deed is commonly used when an individual wishes to transfer ownership of a property to a family member, friend, or loved one. A Sacramento California Gift Deed for Individual to Individual includes details about the property being gifted, such as its legal description, assessor's parcel number (APN), physical address, and any improvements or structures on the property. It also includes the names and addresses of the granter (the person gifting the property) and the grantee (the person receiving the gift). The gift deed should clearly state that the transfer is a gift and that no consideration or payment is required from the grantee. It is important to note that a Sacramento California Gift Deed for Individual to Individual does not involve any monetary exchange and is purely a voluntary transfer of ownership. The granter must have full legal rights and capacity to gift the property, and the grantee must accept the gift willingly. Additionally, both parties should seek legal advice to ensure the gift deed meets all legal requirements and properly documents the transfer of ownership. Different types of Sacramento California Gift Deeds for Individual to Individual include: 1. Traditional Gift Deed: This is the most common form of gift deed, where ownership of the property is transferred from the granter to the grantee without any conditions or restrictions. 2. Gift Deed with Reservation of Life Estate: In this type of gift deed, the granter gifts the property to the grantee but retains the right to live on the property for the remainder of their life. The granter becomes a life tenant and retains all benefits and responsibilities of property ownership until their passing. 3. Gift Deed with Joint Tenancy: This gift deed creates joint ownership between the granter and the grantee. Both parties have equal rights to the property, and in the event of the death of either party, the property automatically transfers to the surviving owner without the need for probate. 4. Gift Deed with Restrictive Covenants: In certain cases, the granter may include specific conditions or restrictions on the use of the gifted property. These restrictions may include limitations on resale, land use, or certain activities on the property. It is crucial to consult with a qualified attorney or legal professional when creating a Sacramento California Gift Deed for Individual to ensure compliance with all relevant laws and to protect the interests of both parties involved.Sacramento California Gift Deed for Individual to Individual is a legally binding document that transfer ownership of real property as a gift from one individual to another within the Sacramento area of California. This deed is commonly used when an individual wishes to transfer ownership of a property to a family member, friend, or loved one. A Sacramento California Gift Deed for Individual to Individual includes details about the property being gifted, such as its legal description, assessor's parcel number (APN), physical address, and any improvements or structures on the property. It also includes the names and addresses of the granter (the person gifting the property) and the grantee (the person receiving the gift). The gift deed should clearly state that the transfer is a gift and that no consideration or payment is required from the grantee. It is important to note that a Sacramento California Gift Deed for Individual to Individual does not involve any monetary exchange and is purely a voluntary transfer of ownership. The granter must have full legal rights and capacity to gift the property, and the grantee must accept the gift willingly. Additionally, both parties should seek legal advice to ensure the gift deed meets all legal requirements and properly documents the transfer of ownership. Different types of Sacramento California Gift Deeds for Individual to Individual include: 1. Traditional Gift Deed: This is the most common form of gift deed, where ownership of the property is transferred from the granter to the grantee without any conditions or restrictions. 2. Gift Deed with Reservation of Life Estate: In this type of gift deed, the granter gifts the property to the grantee but retains the right to live on the property for the remainder of their life. The granter becomes a life tenant and retains all benefits and responsibilities of property ownership until their passing. 3. Gift Deed with Joint Tenancy: This gift deed creates joint ownership between the granter and the grantee. Both parties have equal rights to the property, and in the event of the death of either party, the property automatically transfers to the surviving owner without the need for probate. 4. Gift Deed with Restrictive Covenants: In certain cases, the granter may include specific conditions or restrictions on the use of the gifted property. These restrictions may include limitations on resale, land use, or certain activities on the property. It is crucial to consult with a qualified attorney or legal professional when creating a Sacramento California Gift Deed for Individual to ensure compliance with all relevant laws and to protect the interests of both parties involved.