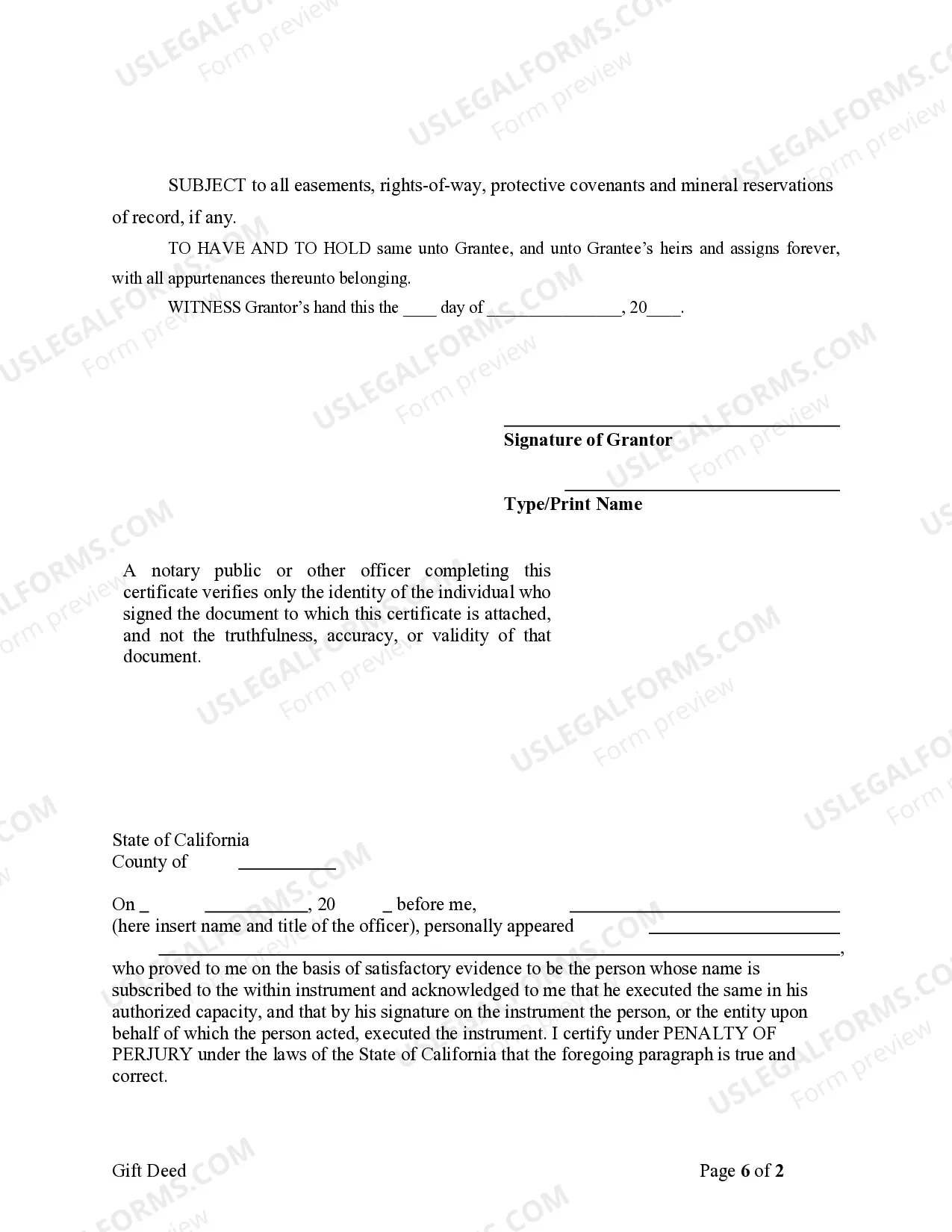

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - California - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CA-020-77

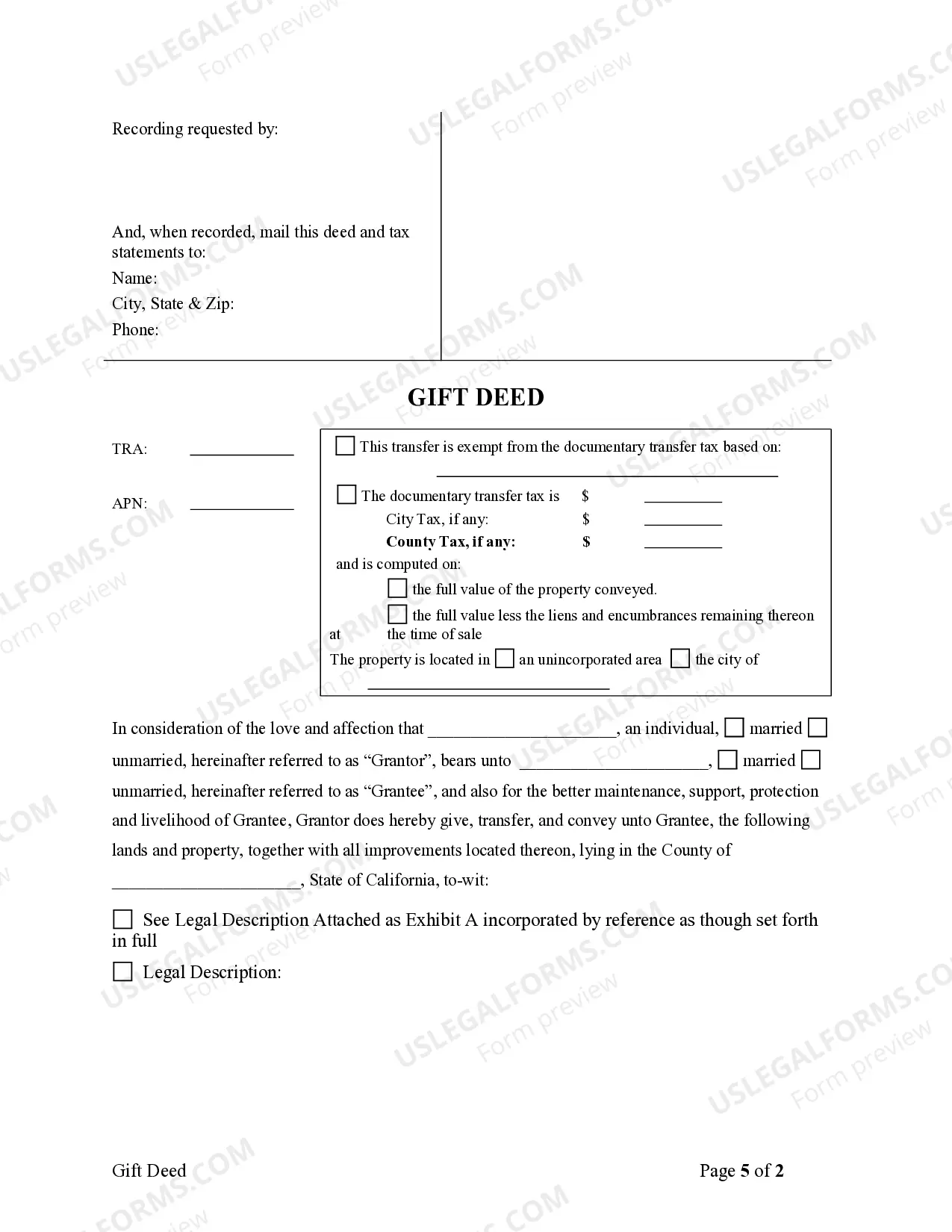

A gift deed is a legal document used to transfer ownership of real estate or property from one individual to another, without any monetary exchange taking place. In San Diego, California, a gift deed specifically refers to the transfer of property or real estate between two private individuals. It is important to note that a gift deed cannot be used for commercial or business property transfers. The San Diego California Gift Deed for Individual to Individual serves as evidence of a voluntary and unconditional transfer of property, without consideration or compensation. This document is often utilized in scenarios such as transferring property to family members, gifting property to friends, or donating property to charitable organizations in the San Diego area. The primary purpose of a gift deed is to legally establish the intent of the donor (the person transferring the property) to voluntarily give up any ownership rights and transfer them to the recipient (the person receiving the property), all without any expectation of payment in return. By executing a gift deed, both parties ensure that the transfer is lawful and can be recognized by the relevant authorities. There are several types of gift deeds that can be used in San Diego, California, depending on the specific circumstances of the property transfer. These include: 1. Inter vivos gift deed: This is the most common type of gift deed, used for transferring property between individuals while both parties are alive. It requires the execution and recording of a legal document, signed by the donor and recipient, which clearly states the intent to transfer ownership. 2. Testamentary gift deed: Unlike an inter vivos gift deed, a testamentary gift deed comes into effect upon the death of the donor. This means that the transfer of ownership only happens after the donor passes away, as specified in their last will and testament. 3. Joint tenancy gift deed: This type of gift deed allows for the transfer of property with the right of survivorship. It is typically used by married couples or individuals who wish to ensure that the surviving party automatically inherits the property in case of death. It is crucial to consult with a qualified attorney or real estate professional when considering a gift deed in San Diego, California, to ensure compliance with local laws and regulations. Properly executed gift deeds can provide a secure and legally binding means for individuals to transfer property ownership without financial transactions.