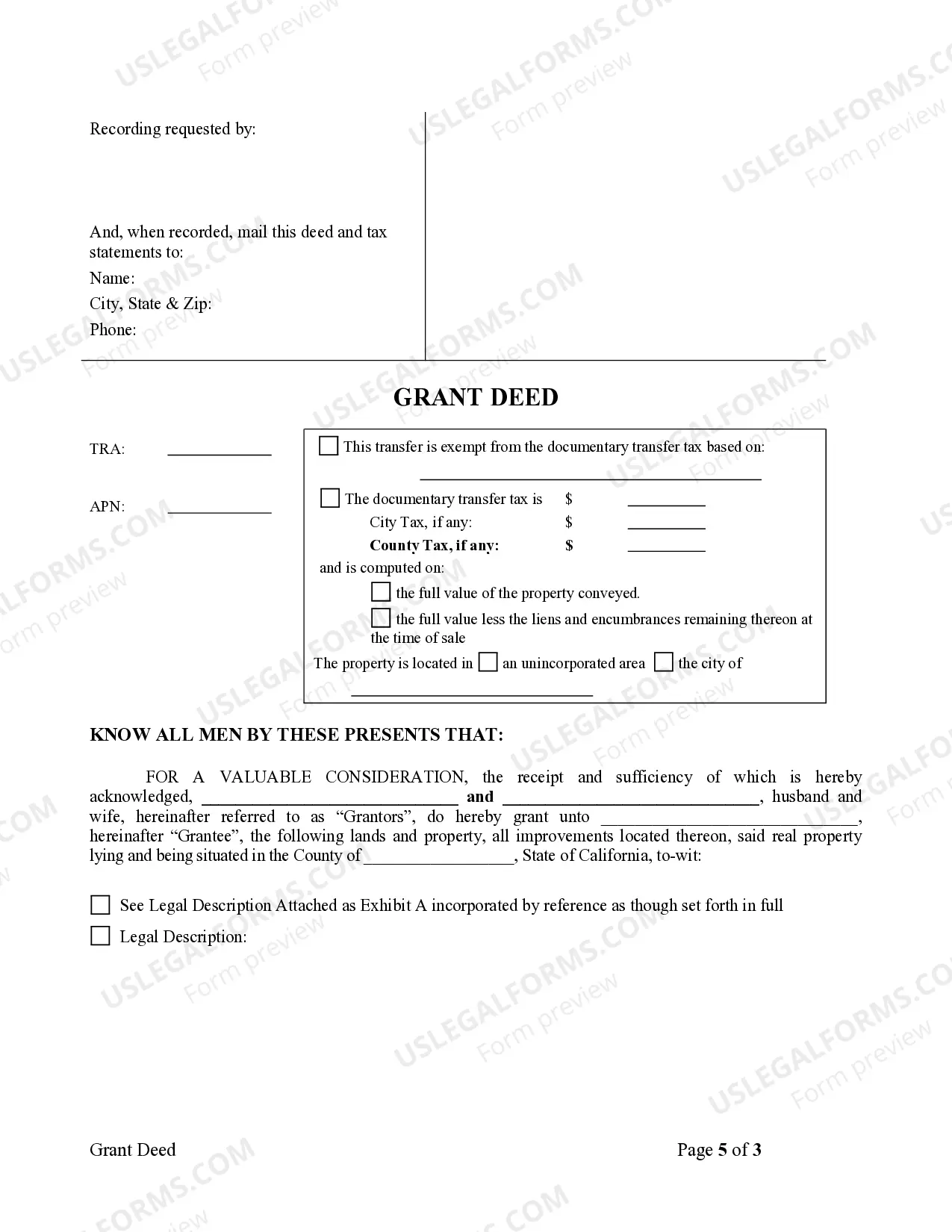

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

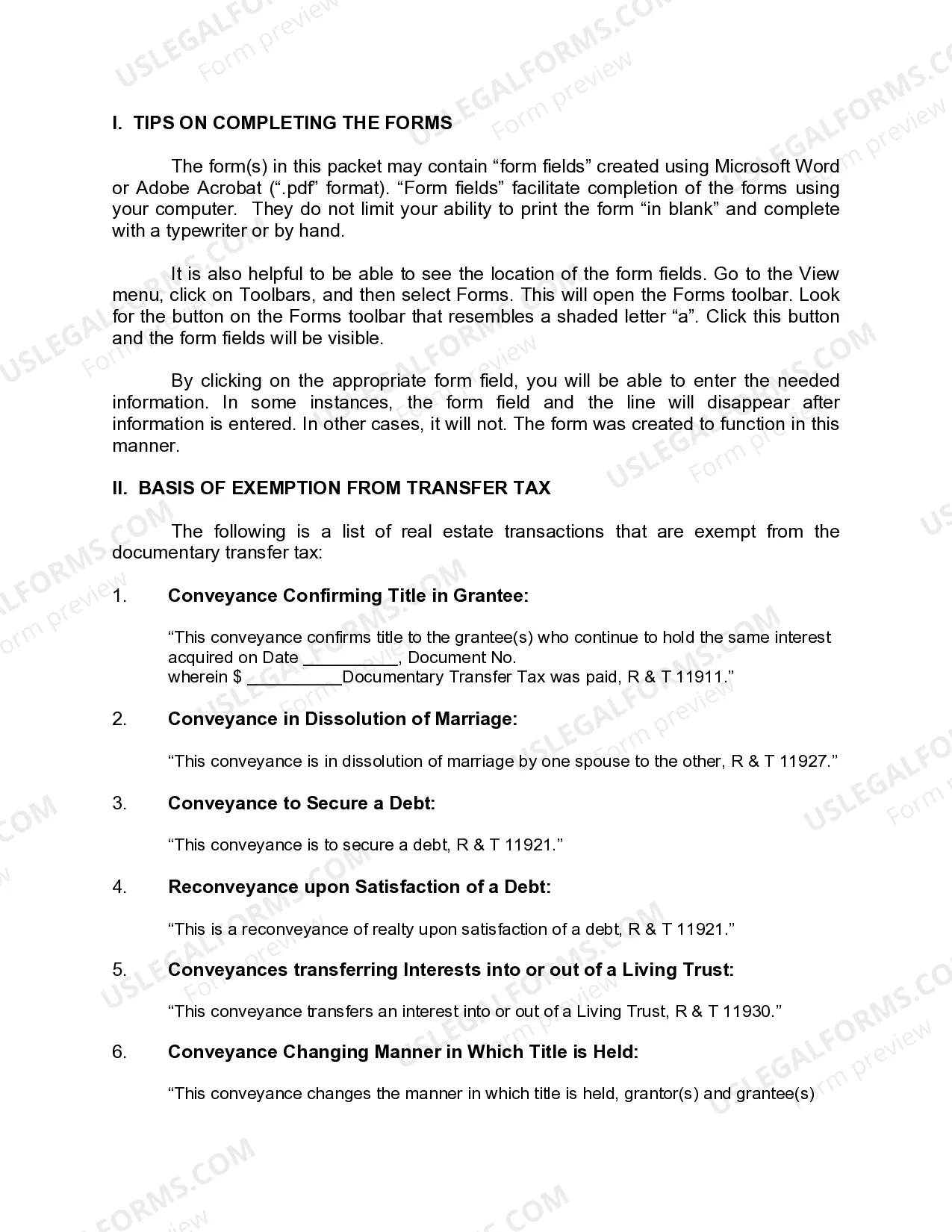

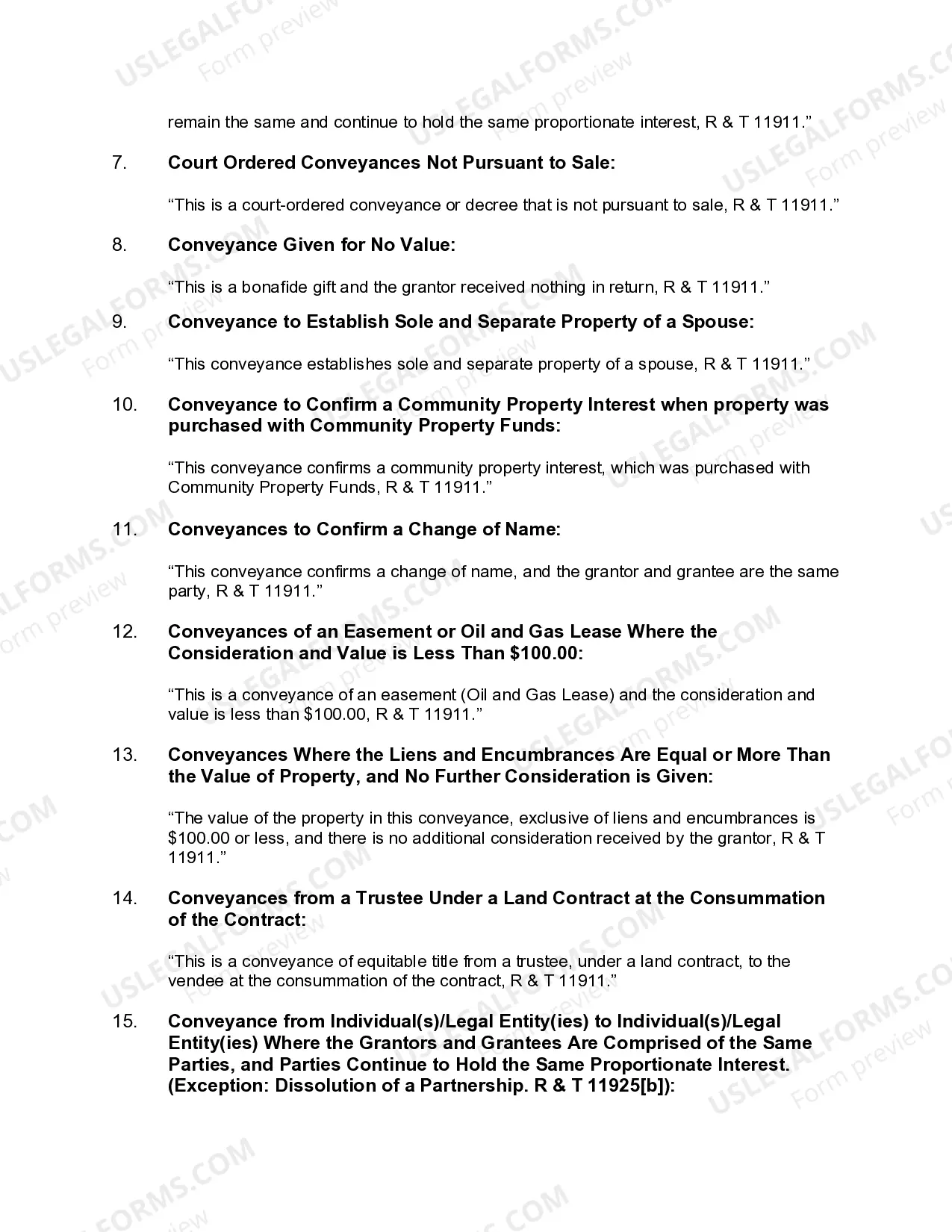

A Hayward California Grant Deed — Husband and Wife to Individual is a legal document used in real estate transactions to transfer the ownership of property from a married couple to an individual buyer. This type of deed ensures that both spouses have equal rights to the property being conveyed. Below are some key details about the Hayward California Grant Deed — Husband and Wife to Individual: Keywords: Hayward California Grant Deed, Husband and Wife to Individual, real estate transactions, property ownership, married couple, individual buyer, legal document, equal rights. 1. Types of Hayward California Grant Deed — Husband and Wife to Individual— - Joint Tenancy Grant Deed: This type of grant deed grants equal ownership and rights to both spouses. If one spouse passes away, the surviving spouse automatically becomes the sole owner. — Tenancy in Common Grant Deed: With this type of grant deed, the property is divided into distinct shares, allowing each spouse to have a separate ownership interest. This means that if one spouse passes away, their share can be inherited by someone else rather than automatically transferring to the surviving spouse. — Community Property Grant Deed: This grant deed is specific to states that follow community property laws, including California. It establishes equal ownership and rights for both spouses, with each partner owning a 50% undivided interest in the property. 2. Purpose and Benefits: The purpose of a Hayward California Grant Deed — Husband and Wife to Individual is to legally transfer the ownership of a property from a married couple to an individual buyer. It ensures that the buyer receives a clear and marketable title, free from any claims or encumbrances. The use of this deed provides protection to both the sellers and the buyer by clarifying the ownership rights and responsibilities of the parties involved. 3. Process: To execute a Hayward California Grant Deed — Husband and Wife to Individual, the couple must draft the deed with the necessary legal language and sign it in the presence of a notary public. The deed should include accurate descriptions of the property being conveyed, details of the husband and wife as granters, and the individual buyer as the grantee. Once the deed is properly signed and notarized, it needs to be recorded with the county recorder's office in the county where the property is located. In conclusion, a Hayward California Grant Deed — Husband and Wife to Individual is a crucial legal document used in real estate transactions. Its various types, including Joint Tenancy Grant Deed, Tenancy in Common Grant Deed, and Community Property Grant Deed, ensure the proper transfer of property ownership between a married couple and an individual buyer. This deed plays a vital role in safeguarding the rights and interests of all parties involved in the transaction.