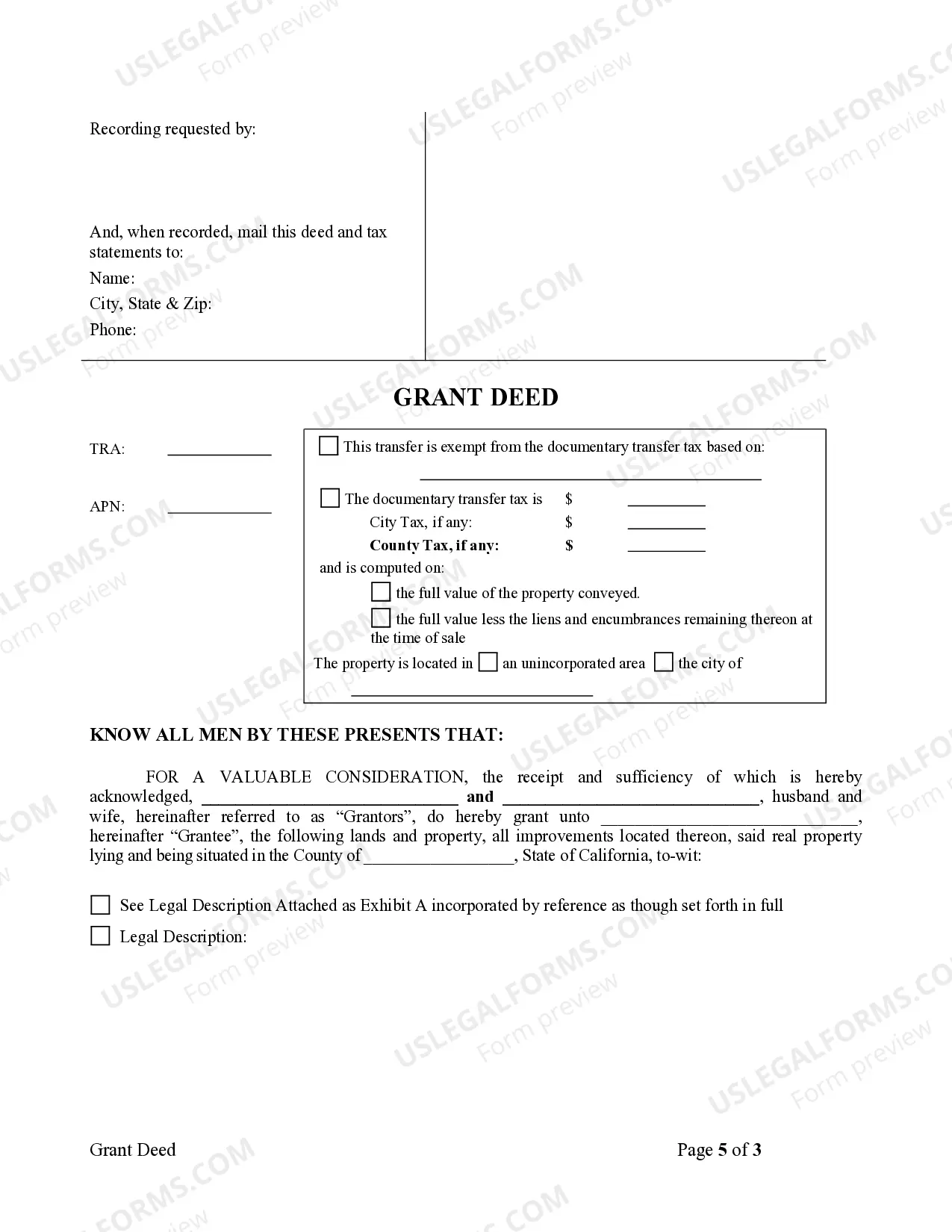

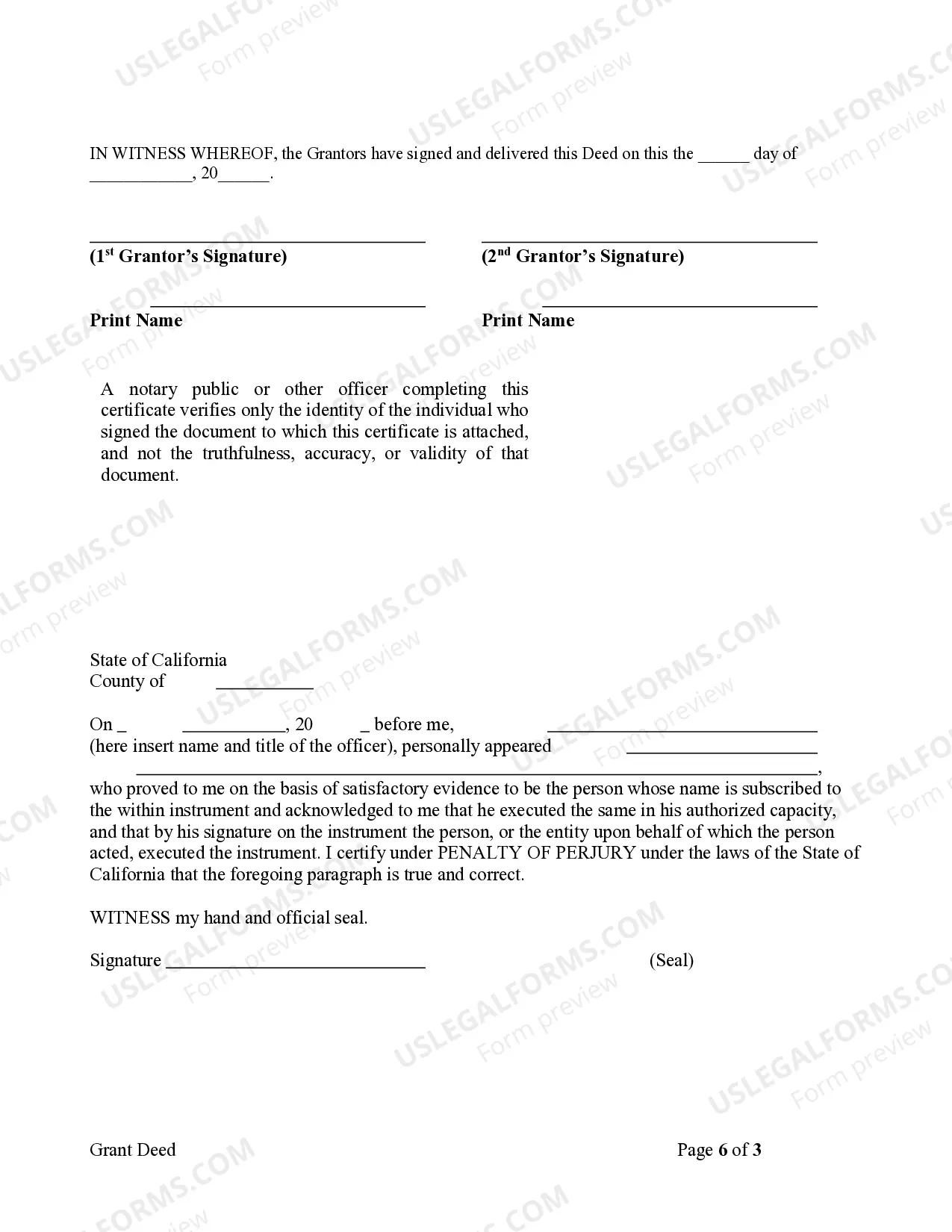

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

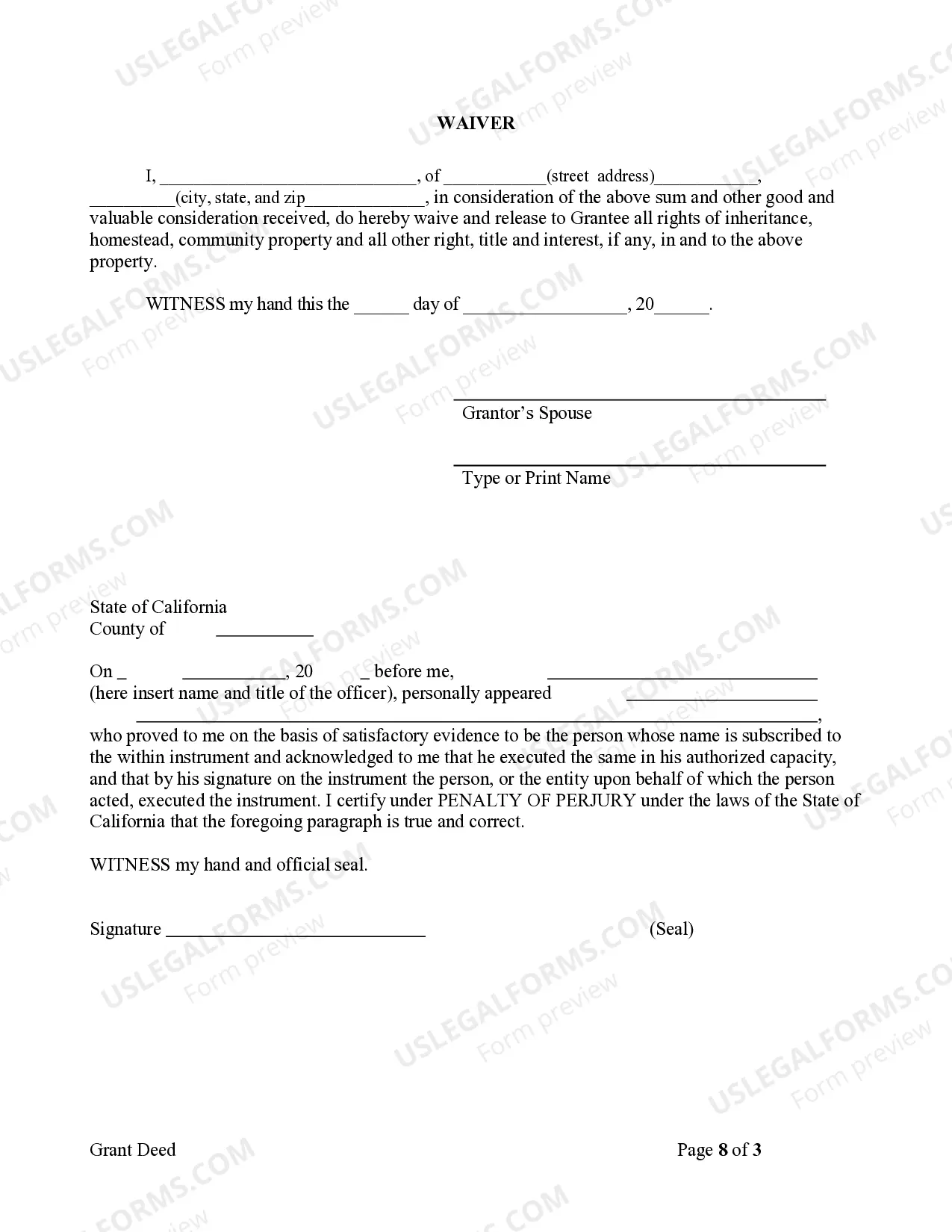

Irvine California Grant Deed — Husband and Wife to Individual: A Comprehensive Overview In Irvine, California, a Grant Deed is a legally binding document that facilitates the transfer of ownership rights from one party to another for any real estate property. Specifically, the Irvine California Grant Deed — Husband and Wife to Individual is a specialized version of this document used when a property is owned jointly by a married couple, and they wish to transfer the property to an individual. A Grant Deed is an essential tool in real estate transactions as it provides a clear record of the property's ownership history. When a husband and wife decide to transfer the property to an individual, this type of Grant Deed safeguards the transaction and ensures that the new owner receives unencumbered ownership rights. Key Elements of an Irvine California Grant Deed — Husband and Wife to Individual: 1. Parties Involved: The Grant Deed identifies the husband and wife, who currently hold joint ownership of the property, as the granters. The individual who will acquire the property is referred to as the grantee. It is crucial to include accurate and complete personal information for all parties involved, such as full names and addresses. 2. Legal Description: The Grant Deed must contain a precise legal description of the property, providing an accurate delineation of its boundaries. This typically includes a full property address, lot and block numbers, and the description of boundaries based on the official survey. 3. Granter's Statement: The granters must declare their intent to transfer the property to the grantee, confirming that they hold full ownership rights to the property and guaranteeing that the property is free from any liens, encumbrances, or claims that might affect the grantee's future ownership. 4. Consideration: The document should state the consideration, typically the purchase price or any other mutually agreed-upon compensation, that the grantee will provide to the granters in exchange for the property transfer. Types of Irvine California Grant Deed — Husband and Wife to Individual: 1. Regular Grant Deed — Husband and Wife to Individual: This is the standard type of Grant Deed used in Irvine, California, for property transfers from spouses to individuals. It ensures a straightforward transfer of ownership rights and provides the necessary legal documentation. 2. Grant Deed with Rights of Survivorship — Husband and Wife to Individual: In this type of Grant Deed, the ownership rights of the property transfer directly to the surviving spouse upon the demise of one spouse. This ensures that the surviving spouse becomes the sole owner of the property without the need for probate. 3. Limited Grant Deed — Husband and Wife to Individual: This unique type of Grant Deed grants restricted rights to the new individual owner, limiting their use of the property or specifying certain conditions for property usage. Such limitations must be clearly stated within the document. In conclusion, an Irvine California Grant Deed — Husband and Wife to Individual enables the transfer of a jointly owned property from a married couple to an individual. It ensures a legally binding and transparent transaction that establishes the new owner's rightful ownership with accurate documentation. It is essential to consult with legal professionals or title companies to prepare and execute this Grant Deed accurately, adhering to all relevant California laws and regulations.