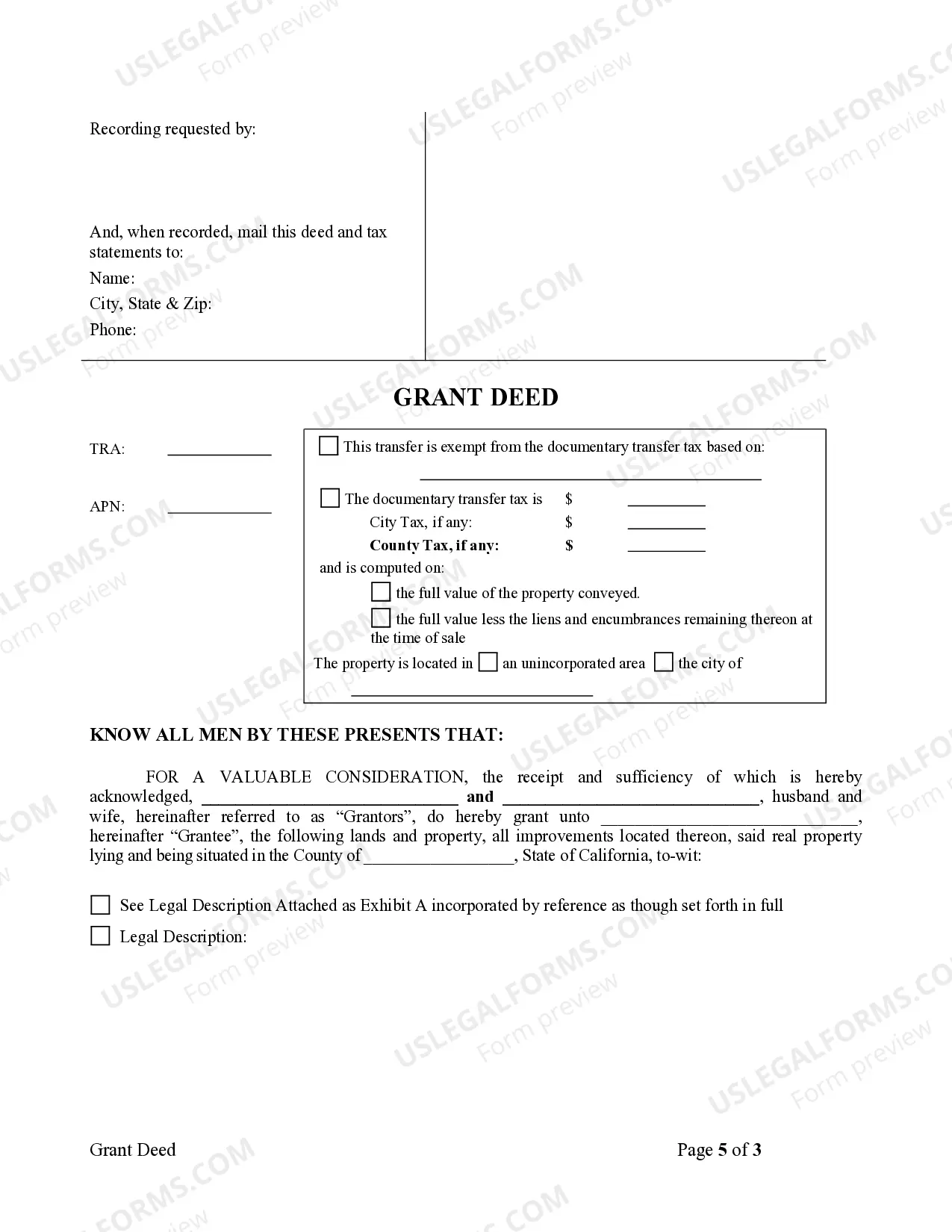

This form is a Grant Deed where the Grantors are Husband and Wife and the Grantee is an Individual. Grantors convey and grant the described property to the Grantee. This deed complies with all state statutory laws.

San Diego California Grant Deed - Husband and Wife to Individual

Description

How to fill out California Grant Deed - Husband And Wife To Individual?

We consistently aim to reduce or avert legal complications when engaging with intricate legal or financial issues.

To achieve this, we enlist attorney services that are generally quite expensive.

However, not all legal concerns are similarly complicated.

The majority can be handled independently.

Take advantage of US Legal Forms whenever you need to obtain and download the San Diego California Grant Deed - Husband and Wife to Individual or any other form promptly and securely.

- US Legal Forms is an online repository of current self-service legal templates addressing everything from wills and powers of attorney to articles of incorporation and petitions for termination.

- Our library enables you to manage your affairs without the need for legal representation.

- We offer access to legal document templates that aren't always readily available in public domains.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

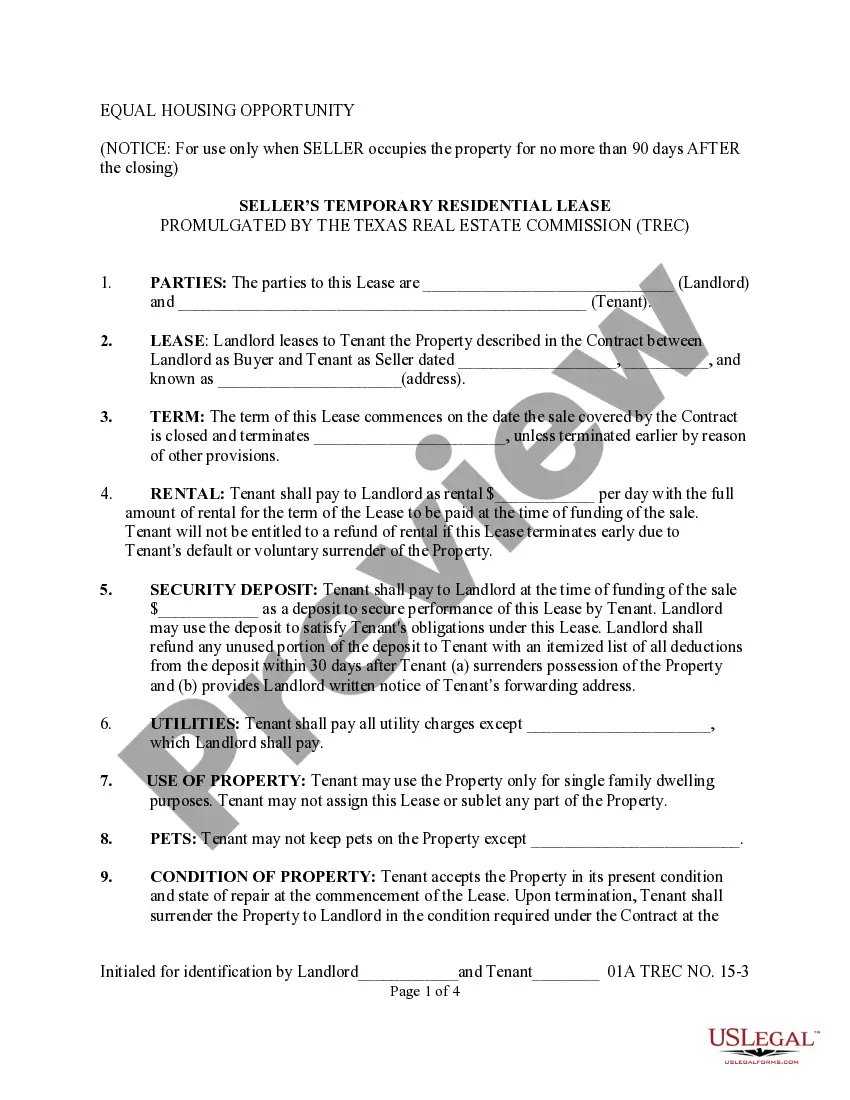

Filling out a California grant deed involves several important steps. First, ensure you have the correct legal description of the property being transferred. Next, provide the names of both the grantor and grantee, followed by specifying the transfer's conditions. Utilizing resources like US Legal Forms can simplify this process, especially when preparing a San Diego California Grant Deed - Husband and Wife to Individual.

To add your spouse to the deed in California, you need to prepare a new grant deed that includes both your and your spouse’s names. This deed must be signed and notarized, then filed with the county recorder. This process helps clarify ownership, especially in cases relating to the San Diego California Grant Deed - Husband and Wife to Individual. If you find the paperwork overwhelming, consider consulting US Legal Forms for assistance.

In California, a grant deed must contain specific elements to be valid. It needs to include the grantor’s and grantee’s names, a legal description of the property, and a declaration that the property is being transferred. Additionally, the document must be signed by the grantor and notarized before it can be recorded. If you're looking for assistance in preparing a San Diego California Grant Deed - Husband and Wife to Individual, US Legal Forms offers valuable resources.

The best way for a husband and wife to hold title in California is typically as community property or joint tenants with rights of survivorship. These options provide legal benefits such as the right to inherit without probate and shared ownership during your lifetime. When considering the San Diego California Grant Deed - Husband and Wife to Individual, discussing your specific situation with a legal professional can help you make the best choice.

A grant deed and title are not the same in California, though they are closely related. The grant deed serves as a document that conveys title, indicating ownership transfer. Meanwhile, the title signifies the legal ownership itself. If you’re navigating the San Diego California Grant Deed - Husband and Wife to Individual, understanding this distinction helps clarify your rights and responsibilities.

Filling out a deed requires careful attention to detail. Start with the names of the grantor and grantee, followed by a clear description of the property. Ensure you accurately include information such as the property’s legal description and any relevant details like the grant deed’s purpose. For further assistance, consider resources like US Legal Forms to guide you through the process of creating a San Diego California Grant Deed - Husband and Wife to Individual.

In California, it is generally advisable for both spouses to be on the house title. This ensures that both partners have legal ownership rights and can protect each other's interests. When considering the San Diego California Grant Deed - Husband and Wife to Individual, joint ownership can simplify estate planning and avoid complications in future transactions. However, always consult with a legal expert to understand the best approach for your situation.

To correct a grant deed in California, start by drafting a new deed that clearly states the necessary corrections. Include a reference to the original grant deed in the new document for clarity. After preparing the new deed, sign it in front of a notary, and then file it with the county recorder's office. This process is essential to ensure the changes are officially recognized, especially in cases of the San Diego California Grant Deed - Husband and Wife to Individual.

Yes, you can add someone to a deed without a lawyer in California. However, it's crucial to follow the correct legal procedures to ensure everything is valid. Completing the necessary paperwork and understanding the implications of the San Diego California Grant Deed - Husband and Wife to Individual will help prevent future complications. Tools and resources available on platforms like USLegalForms can aid in this process.

To add someone to a grant deed in California, you typically need to fill out a deed form and record it with the county recorder's office. Additionally, understanding the implications of your property title is essential when adding an individual. For example, consider how the San Diego California Grant Deed - Husband and Wife to Individual operates in your situation. Utilizing USLegalForms can make this process more straightforward.