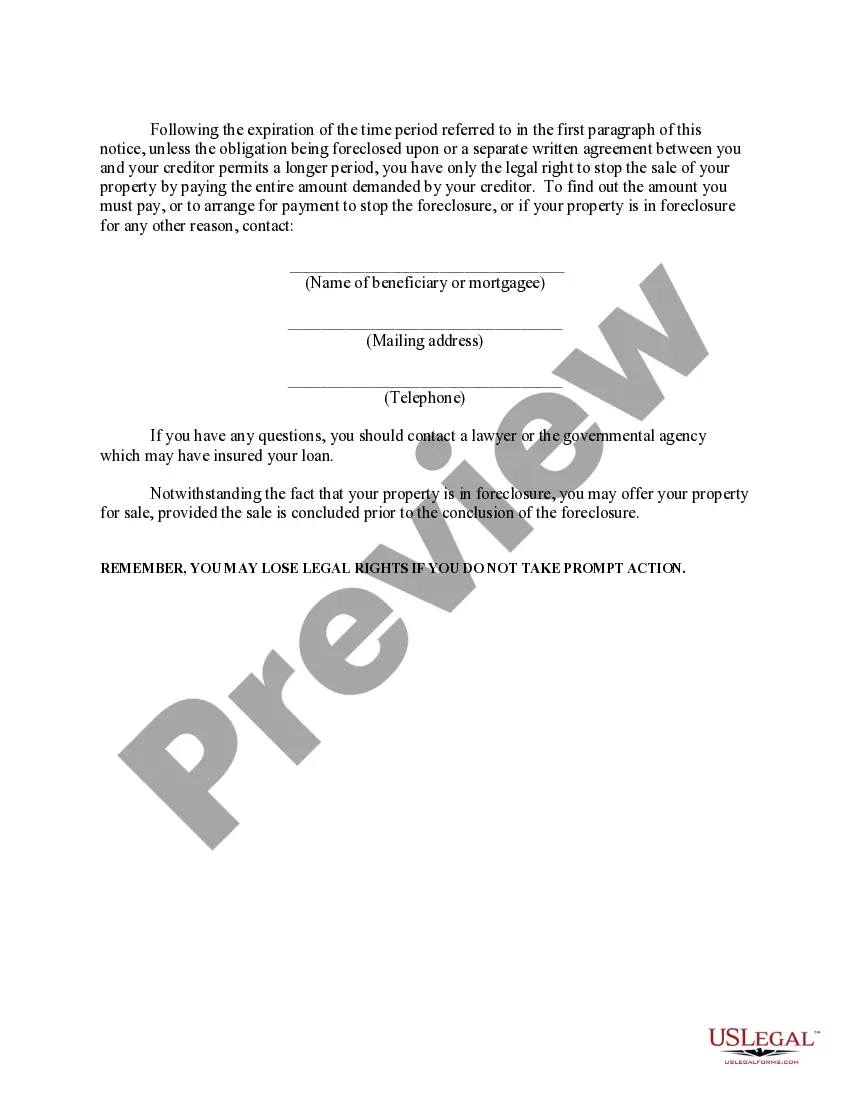

This form serves as a notice of default to the mortgagor for payments that are past due. The default notice states that while the property is in foreclosure, the mortgagor is still responsible for paying other obligations required by the note and the deed of trust. If the mortgagor fails to make future payments on the loan or other financial obligations, the beneficiary or the mortgagee may insist that he/she do so in order to reinstate the account into good standing. The form also emphasizes that the mortgagor could lose his/her rights in the property if prompt action is not taken.

Alameda California Notice of Default And Election to Sell Under Deed of Trust

Description

How to fill out California Notice Of Default And Election To Sell Under Deed Of Trust?

If you are looking for a suitable form template, it’s hard to find a more user-friendly site than the US Legal Forms webpage – likely the most extensive online collections.

With this collection, you can access a vast number of form examples for business and personal use categorized by type and area, or keywords.

With our sophisticated search tool, locating the latest Alameda California Notice of Default And Election to Sell Under Deed of Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal to finalize the registration process.

Receive the document. Specify the file format and save it to your device. Edit. Fill out, modify, print, and sign the obtained Alameda California Notice of Default And Election to Sell Under Deed of Trust.

- Additionally, the validity of each document is confirmed by a team of professional lawyers who routinely assess the templates on our site and refresh them to comply with the latest state and county laws.

- If you are already familiar with our system and have an active account, all you have to do to acquire the Alameda California Notice of Default And Election to Sell Under Deed of Trust is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have selected the form you require. Review its description and utilize the Preview feature to examine its contents. If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the appropriate document.

- Confirm your choice. Click on the Buy now button. After that, choose a suitable subscription plan and enter your details to register for an account.

Form popularity

FAQ

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

How to Foreclose on a Deed of Trust Step 1 ? Notice of Default. Record a Notice of Default with the county recorder.Step 2 ? Notice of Sale.Step 3 ? Auction.Step 4 ? Obtain Possession of Property.

This type of foreclosure, also known as statutory foreclosure, is allowed by many states if the mortgage includes a power of sale clause. After a homeowner has defaulted on mortgage payments, the lender sends out notices demanding payments.

When a buyer fails to make the payments due on the loan (defaults on the loan) the lender can foreclose, which means that the lender can force a sale of the home to pay for the outstanding loan. For more information about foreclosure laws: Foreclosure Process - Civil Code section 2924.

NOTICE OF DEFAULT/SALE If the borrower defaults, the lender can foreclose (force a sale) of the property to get paid. The lender's first step towards a foreclosure is to record and mail the borrower by certified mail a Notice of Default, sometimes titled Notice of Default and Election to Sell.

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.

When you receive a Notice of Default in California, the formal foreclosure process has begun. The document is official notice that you are in default on your mortgage and it will include options for getting your loan out of default.